IRS Crypto Tax Reporting Requirements: Form 8949 Explained for 2025

Mar, 28 2025

Mar, 28 2025

Crypto Tax Calculator

Calculate Your Crypto Capital Gains or Losses

This calculator helps you determine your capital gain or loss for cryptocurrency transactions to accurately report on Form 8949. Enter your transaction details below.

Results

What You Must Report on Form 8949 for Crypto in 2025

If you bought, sold, traded, or even gave away cryptocurrency in 2025, the IRS expects you to report it - no exceptions. It doesn’t matter if you made a profit, took a loss, or didn’t get a 1099 form. Every single crypto disposal is a taxable event. And the form you need to fill out for that? Form 8949.

This isn’t optional. The IRS isn’t asking. They’re requiring it. And starting January 1, 2025, the rules got tighter. You can’t just average your cost basis across all your wallets anymore. You have to track each coin, each wallet, each trade separately. That’s called wallet-by-wallet accounting, and it’s now the law.

Why Form 8949? Because Crypto Isn’t Cash

The IRS treats cryptocurrency as property, not money. That means every time you sell Bitcoin for USD, trade Ethereum for Solana, or use Dogecoin to buy a laptop, you’re selling an asset. And selling an asset triggers capital gains or losses - just like selling stocks or real estate.

Form 8949 is where you list every one of those sales. It’s the detailed ledger. Schedule D takes those numbers and sums them up for your final tax bill. Without Form 8949, Schedule D is incomplete. And incomplete forms = red flags for the IRS.

What Exactly Goes on Form 8949?

For every crypto transaction, you need six things:

- Description of property: Bitcoin (BTC), Ethereum (ETH), etc.

- Date acquired: When you got the asset - not when you bought it, but when you first received it (via purchase, airdrop, staking, etc.)

- Date sold or disposed: When you traded, sold, or spent it

- Gross proceeds: How much USD (or fair market value in USD) you received

- Cost basis: What you originally paid for it, including fees

- Gain or loss: Proceeds minus cost basis

You also have to split these into two categories: short-term (held one year or less) and long-term (held more than a year). Short-term gains are taxed at your regular income rate. Long-term gets lower rates - but only if you can prove you held it long enough.

The 2025 Game Changer: Form 1099-DA

Before 2025, you mostly got nothing from exchanges. Now, exchanges like Coinbase, Kraken, and Binance have to send you Form 1099-DA. Sounds helpful, right? Not quite.

For 2025, Form 1099-DA only reports gross proceeds - the total amount you sold for. It does NOT include your cost basis. That’s still your job to calculate. So you’re still stuck matching your own records with what the exchange sends you. And if you used DeFi protocols, peer-to-peer trades, or self-custody wallets? Those aren’t reported at all.

Cost basis reporting on 1099-DA won’t start until 2026. That means for the next tax season, you’re still doing 90% of the work yourself.

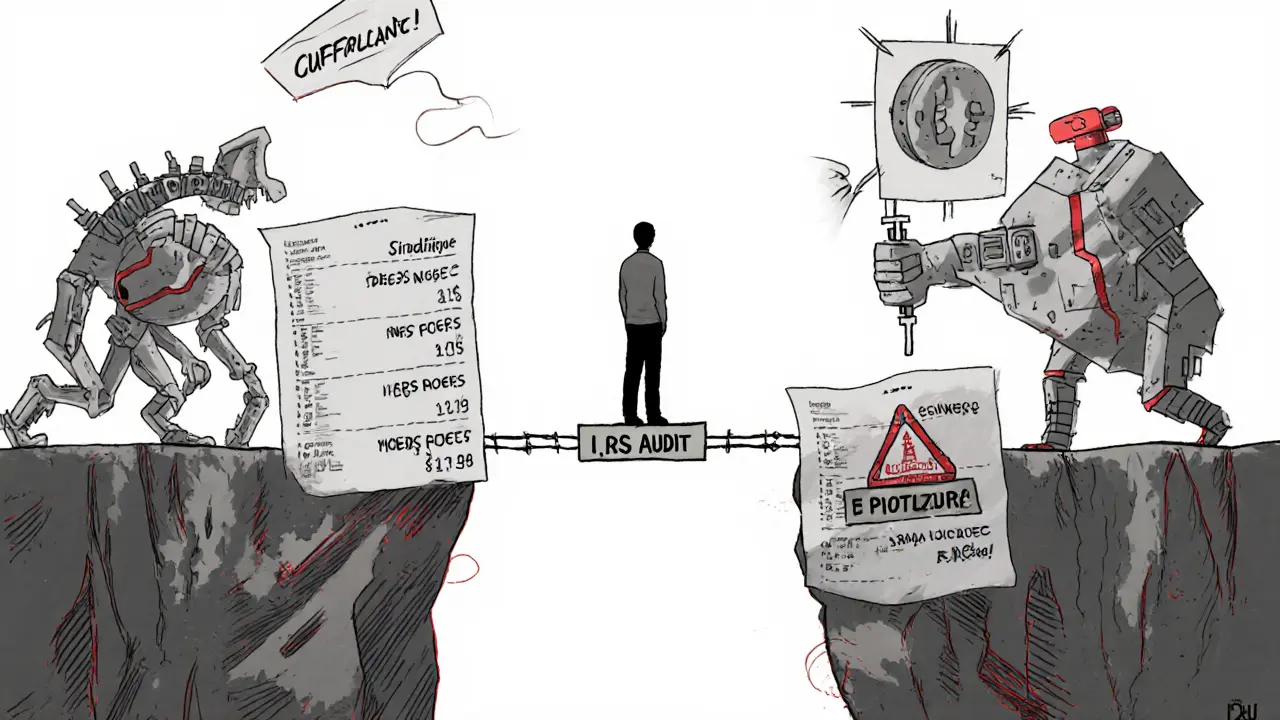

What Happens If You Don’t Report?

The IRS knows you’re out there. They’ve been auditing crypto tax returns since 2021. In 2024 alone, they recovered over $1.2 billion in unreported crypto gains. They cross-check 1099-DA data with your tax return. If you report $50,000 in sales but only list $10,000 on Form 8949? You’ll get a letter.

Penalties start at $500 for failure to file, but can climb to 25% of the unpaid tax if it’s deemed negligence. If they think you’re hiding income on purpose? That’s tax fraud - and that’s a federal crime.

Where Do You Even Get This Data?

Most people don’t realize how messy crypto record-keeping is. If you traded on five different exchanges, used MetaMask for DeFi, got airdrops from three projects, and staked on two platforms, you’re looking at hundreds of transactions.

Manually tracking each one? That’s 20 to 40 hours of work for someone with moderate activity. You need:

- Transaction history from every exchange and wallet

- Exchange rates for every trade (USD value at exact time of transaction)

- Proof of acquisition cost (receipts, screenshots, blockchain explorers)

- Records of airdrops, forks, and staking rewards (these have cost basis too)

Many people use tools like CoinTracker, Koinly, or TaxBit. These sync with your wallets and exchanges, auto-calculate cost basis, and generate Form 8949. But they’re not perfect. If you moved crypto between wallets, or used a DEX like Uniswap, you might still get errors. Always double-check their output.

Common Mistakes That Trigger Audits

- Ignoring crypto-to-crypto trades: Trading BTC for ETH? That’s two taxable events - selling BTC and buying ETH. Both need reporting.

- Forgetting airdrops and forks: When you get free tokens, their fair market value on the day you received them becomes your cost basis. If you later sell them, you owe tax on the gain.

- Using the wrong cost basis method: FIFO (first in, first out) is the default if you don’t specify. But if you’re trying to minimize tax, you might need to pick specific lots. You have to document your choice.

- Not reporting losses: People think losses don’t matter. But they do. You can deduct up to $3,000 in capital losses against ordinary income. Any excess carries forward.

- Using universal accounting: The IRS killed this in 2025. You can’t average your BTC cost across all wallets anymore. Each wallet’s holdings must be tracked separately.

How to Stay Compliant Without Losing Your Mind

- Log every transaction weekly. Don’t wait until December. Use a spreadsheet or app to record date, asset, amount, action (buy/sell/trade), and USD value.

- Use crypto tax software. Pick one that supports your wallets and DeFi protocols. Sync it early and often.

- Keep screenshots of wallet addresses and transaction IDs. If the IRS asks for proof, you need it.

- Don’t assume exchanges did the work. 1099-DA is incomplete. You still need your own records.

- Consult a crypto-savvy CPA. If you’ve done more than 50 trades or have DeFi income, get help. One mistake can cost thousands.

What’s Next After 2025?

2026 will bring full cost basis reporting on 1099-DA. That’ll help - but only for centralized exchanges. DeFi, NFTs, and peer-to-peer trades? Still your responsibility.

There’s talk of Congress changing how crypto gains are taxed - maybe giving long-term rates to more assets, or creating a new category for DeFi. But for now, the rules are clear: you own the records, you own the tax, and you own the consequences.

The IRS isn’t going away. They’ve spent over $100 million building crypto tracking tools. They’re watching. And they’re counting every transaction you’ve ever made.

Do I have to report crypto if I didn’t sell it?

No, you only report when you dispose of crypto - meaning you sell it, trade it for another crypto, spend it on goods/services, or give it away. Just holding crypto, even if its value went up, isn’t a taxable event.

What if I lost money on crypto? Do I still report?

Yes. You report losses just like gains. In fact, reporting losses can help reduce your tax bill. You can deduct up to $3,000 in net capital losses against your ordinary income each year. Any extra losses carry forward to future years.

Do I need to report crypto staking rewards?

Yes. Staking rewards are treated as ordinary income. Report the USD value of the rewards on the day you received them. You’ll report this on Schedule 1, not Form 8949. But if you later sell those rewards, you’ll need to report the gain or loss on Form 8949.

Can I use FIFO for my crypto cost basis?

FIFO (first in, first out) is the IRS default if you don’t choose another method. But you can pick specific identification - meaning you choose which coins you’re selling based on their purchase price. You must document this choice clearly. The IRS doesn’t allow averaging anymore, so FIFO or specific lot selection are your only two options.

What if I used multiple wallets or exchanges?

Starting in 2025, you must track cost basis by wallet, not across all your holdings. If you bought BTC on Coinbase and later transferred it to MetaMask, you can’t average the cost. Each wallet’s holdings must be accounted for separately. This makes tracking harder but is now required by law.

Do I need to report crypto received as payment for work?

Yes. If you got paid in crypto for services, that’s ordinary income. Report the fair market value in USD on the day you received it on Schedule 1. If you later sell that crypto, you’ll report any gain or loss on Form 8949 based on that initial value as your cost basis.