Malta Blockchain Island Strategy for Crypto Businesses: Regulations, Taxes, and Why It Still Works in 2025

Jun, 7 2025

Jun, 7 2025

Malta Crypto Tax Calculator

Calculate Your Tax Liability

Tax Results

Enter your details to see your tax calculation

When you think of a place where crypto businesses can actually thrive without constant regulatory whiplash, Malta might not be the first name that comes to mind. But since 2018, it’s been quietly building one of the most functional, predictable, and business-friendly environments for blockchain companies in the world. Not because it’s flashy. Not because it’s huge. But because it got the rules right - and stuck to them.

How Malta Became the Blockchain Island

In July 2018, Malta passed three groundbreaking laws: the Virtual Financial Assets Act, the Malta Digital Innovation Authority Act, and the Innovation Technology Arrangements and Services Act. These weren’t vague guidelines. They were full legal frameworks. For the first time anywhere, a government clearly defined what counted as a virtual financial asset, who needed a license to handle crypto, and how platforms had to prove their tech was secure. That clarity pulled in big names - Binance moved its headquarters there in 2019. OKEx followed. Even Coinbase looked seriously at setting up shop. The key wasn’t just letting crypto happen. It was making sure every player had to play by the same rules. The Malta Financial Services Authority (MFSA) became the gatekeeper. If you wanted to run a crypto exchange, custody service, or token sale in Malta, you had to apply for a license. No more guessing. No more shady operators slipping through the cracks. That’s why, even after the 2022 crypto crash, Malta didn’t lose its edge. While other countries panicked and clamped down, Malta doubled down on structure.How Taxes Work for Crypto Businesses in Malta

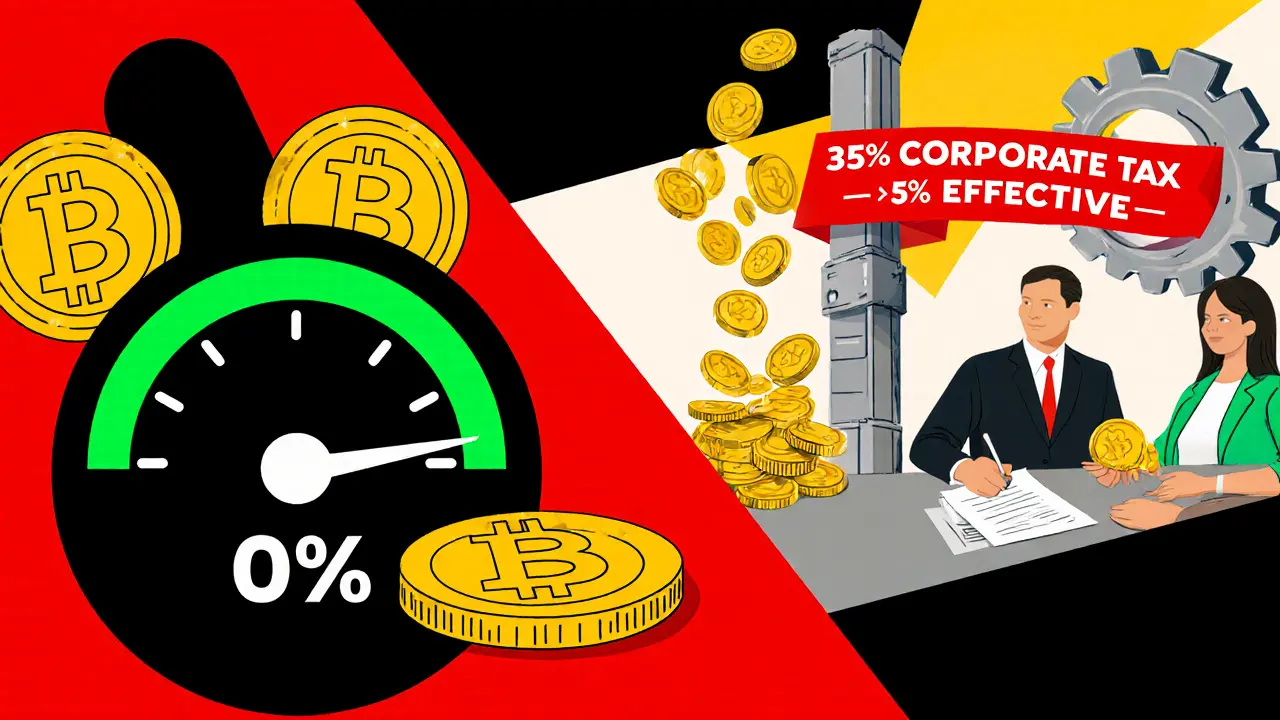

Taxes are where Malta really separates itself from the pack. Most countries treat crypto like a stock - you pay capital gains when you sell. But Malta doesn’t tax long-term crypto holdings at all. If you buy Bitcoin and hold it for years, then sell it as an investment, you pay zero capital gains tax. That’s rare. Even Switzerland taxes it. But here’s the catch: if you’re actively trading - buying and selling crypto every week, making profits like a day trader - the government treats that as a business. Then you pay income tax, between 15% and 35%, depending on how much you earn. It’s fair. It’s clear. No gray zone. For companies, it gets even better. The corporate tax rate is 35%, but Malta’s imputation system lets you get most of it back. If your company earns profits and pays dividends to shareholders who are residents, you can end up paying as little as 0% to 5% effective tax. That’s not a loophole. It’s the law. And it’s been used successfully by dozens of crypto firms to keep more of their revenue. There’s also the Global Residence Programme. If you’re a crypto investor and you spend 183 days a year in Malta, you can pay just 15% tax on foreign income you bring into the country. Minimum tax? €15,000 a year. For someone with crypto gains from global trading, that’s a steal.What’s Changed Since MiCA Rolled Out in 2025

The EU’s Markets in Crypto-Assets (MiCA) regulation finally went live in June 2024, and by April 2025, the MFSA issued new guidance to all licensed crypto asset service providers (CASPs). This wasn’t a surprise. Malta had been preparing for it since 2021. MiCA didn’t break Malta’s model - it upgraded it. The rules on transparency, reserve audits, and client fund protection now match EU standards. But Malta kept its tax perks and faster licensing process. Other EU countries had to build systems from scratch. Malta already had them. The MFSA now focuses on four things: protecting consumers, keeping markets clean, ensuring financial stability, and making sure CASPs report accurately. No more vague terms. If you’re running a DeFi protocol or an NFT marketplace in Malta, you know exactly what you need to disclose, how often, and to whom. One big win in 2025? Clarity on crypto-to-crypto trades. Before MiCA, swapping ETH for SOL was a regulatory gray area. Now, it’s clearly defined as a taxable event only if you’re trading for profit. For long-term holders, it’s just a transfer - no tax hit.

Why Malta Beats Estonia, Switzerland, and the U.S.

Estonia tried to be the crypto hub of Europe. But its 20% corporate tax and high capital requirements scared off startups. Switzerland has great banking, but its rules vary by canton - messy for scaling. The U.S.? Regulatory chaos. The SEC sues companies for things that aren’t even illegal anywhere else. Malta doesn’t have that problem. Its Virtual Financial Assets (VFA) framework includes a Financial Instrument Test - a three-step checklist to determine if your token is a security, utility token, or virtual asset. No guesswork. You run the test, you get the answer. That’s why even early-stage blockchain teams feel safe launching here. Plus, Malta’s location matters. It’s in the Mediterranean, part of the EU, with English as an official language. No language barrier. No time zone nightmare. Easy access to London, Frankfurt, and Dubai. And because it’s a small island, the government listens. If a company has a problem, they can get a meeting with a regulator - not a 6-month waiting list.Residency and Citizenship for Crypto Investors

If you’re serious about crypto and want to live where your money works best, Malta offers two solid paths: residency and citizenship. The Malta Permanent Residence Programme (MPRP) lets you get indefinite residence if you buy or rent property, pay annual fees, and prove your crypto wealth is clean. You don’t need to give up your original passport. You just need to show your Bitcoin came from a regulated exchange, not a darknet market. For those ready to go all-in, the Citizenship by Naturalisation program allows you to apply for a Maltese passport after 12-36 months of residency, depending on your investment. You’ll need to donate €600,000 to the national development fund, buy property worth €700,000, or rent for €16,000/year, and pass strict due diligence. But the payoff? A passport that gives you visa-free access to 180+ countries, including the Schengen Area, Canada, and Singapore. For crypto founders who travel constantly, that’s worth more than any tax break.

What’s Next for Malta’s Blockchain Strategy?

Malta isn’t resting. In 2025, the government is working on new tax incentives for long-term crypto holders - possibly extending the zero capital gains rule to assets held over five years. They’re also exploring blockchain for public services: land registries, voting systems, and even school records. The Malta Gaming Authority, already a global leader in online gaming regulation, is testing blockchain for game fairness. Imagine a slot machine where every spin is recorded on a public ledger - no one can cheat. That’s the kind of innovation Malta is encouraging. Universities like the University of Malta now offer blockchain degrees. Graduates are being hired by local crypto firms before they even finish their thesis. This isn’t a bubble. It’s a pipeline.Is Malta Still the Best Place for Crypto in 2025?

Yes - if you want clarity, not chaos. If you’re a crypto exchange, a DeFi protocol, a token issuer, or even a high-net-worth investor with crypto assets, Malta gives you something most places don’t: predictability. You know what the rules are. You know how much tax you’ll pay. You know who to talk to if something goes wrong. It’s not perfect. Banking is still a challenge - not every bank wants to touch crypto, even in Malta. But the ones that do? They’re used to it. The MFSA has vetted them. And unlike places like Singapore or the UAE, which are tightening rules as global pressure mounts, Malta’s government is still pro-innovation. They know their economy depends on it. The Blockchain Island isn’t just a nickname anymore. It’s a working model - and right now, it’s the only one that actually delivers on its promise.Is it still legal to run a crypto business in Malta in 2025?

Yes, absolutely. Malta remains one of the few jurisdictions with a fully operational, EU-aligned regulatory framework for crypto businesses. All operators must hold a license from the Malta Financial Services Authority (MFSA), but the process is clear, structured, and actively supported by the government. MiCA compliance has only strengthened this system, not weakened it.

Do I pay capital gains tax on crypto in Malta?

No, if you’re holding crypto as a long-term investment. Malta does not impose capital gains tax on digital assets held for investment purposes. However, if you’re actively trading crypto - buying and selling frequently with profit intent - the profits are treated as business income and taxed between 15% and 35% as personal income tax.

Can I use Bitcoin to qualify for Maltese residency or citizenship?

Yes, but with strict documentation. The Maltese government accepts crypto as proof of funds for residency (MPRP) and citizenship programs, provided you can show clear provenance - such as transaction history from regulated exchanges, KYC records, and proof the assets were legally acquired. Anonymous or untraceable crypto sources will be rejected.

How does Malta’s tax system compare to Switzerland’s for crypto?

Switzerland taxes capital gains on crypto for private investors in most cantons, and corporate tax rates vary widely. Malta offers zero capital gains on long-term holdings and can reduce effective corporate tax to near zero via its imputation system. Switzerland has better banking access, but Malta offers more predictable, centralized tax rules that are easier to plan around.

What happens if my crypto business fails in Malta?

Malta has clear insolvency procedures for licensed CASPs. If a company goes under, client assets must be held separately in segregated accounts, so they’re protected from the company’s debts. The MFSA oversees the wind-down process, ensuring customers get their crypto back before creditors. This level of investor protection is rare globally.

Do I need to be physically present in Malta to run a crypto business there?

No, but you need a local presence. All licensed crypto businesses must have a registered office in Malta, a local compliance officer, and at least one director who is a resident. Remote teams are allowed, but the legal and regulatory backbone must be physically located on the island.

Are NFTs regulated differently in Malta?

No. NFTs are treated under the same Virtual Financial Assets Act as other digital assets. If an NFT represents ownership, access, or financial rights, it may be classified as a virtual financial asset and require licensing. Pure collectible NFTs with no utility or financial function are generally unregulated, similar to physical art.

How long does it take to get a crypto license in Malta?

Typically 6 to 9 months. The process includes submitting detailed documentation on technology, security, compliance, and financials. The MFSA reviews applications thoroughly, but the timeline is predictable. There’s no rush, and no shortcuts - which is exactly why businesses trust the outcome.

Masechaba Setona

November 2, 2025 AT 08:35Jessica Hulst

November 2, 2025 AT 12:01alvin Bachtiar

November 4, 2025 AT 00:55DeeDee Kallam

November 4, 2025 AT 17:31Bhavna Suri

November 6, 2025 AT 06:50Elizabeth Melendez

November 7, 2025 AT 04:41Phil Higgins

November 7, 2025 AT 07:49Eli PINEDA

November 7, 2025 AT 23:25Debby Ananda

November 8, 2025 AT 03:47Vicki Fletcher

November 9, 2025 AT 14:38Jeremy Jaramillo

November 11, 2025 AT 10:02