Airdrop Eligibility Requirements: How to Qualify for Free Crypto Tokens in 2026

Feb, 16 2026

Feb, 16 2026

Getting free crypto through an airdrop sounds simple - until you realize most people never qualify. In 2026, airdrops aren’t random giveaways anymore. They’re carefully designed campaigns that reward real users, not just those who sign up and hope for luck. If you want to actually receive tokens, you need to understand what projects are looking for - and how to prove you’re one of them.

What Exactly Is an Airdrop Eligibility Snapshot?

An airdrop eligibility snapshot is the moment a project freezes your wallet activity to decide who gets tokens. It’s like taking a photo of your blockchain behavior on a specific date. Whatever you were doing at that exact second - holding tokens, swapping on a DEX, voting in a DAO - gets recorded. Afterward, the project uses that data to distribute tokens. The catch? You usually don’t know when the snapshot happens until after it’s over. That’s intentional. It stops people from gaming the system by creating fake activity right before the announcement.

For example, if you held 500 $UNI in your MetaMask wallet on March 12, 2025, and that was the snapshot date for a new Uniswap-related airdrop, you’d qualify. If you bought those tokens the day before, you likely wouldn’t. Projects care about long-term engagement, not last-minute flips.

Three Main Types of Airdrop Eligibility

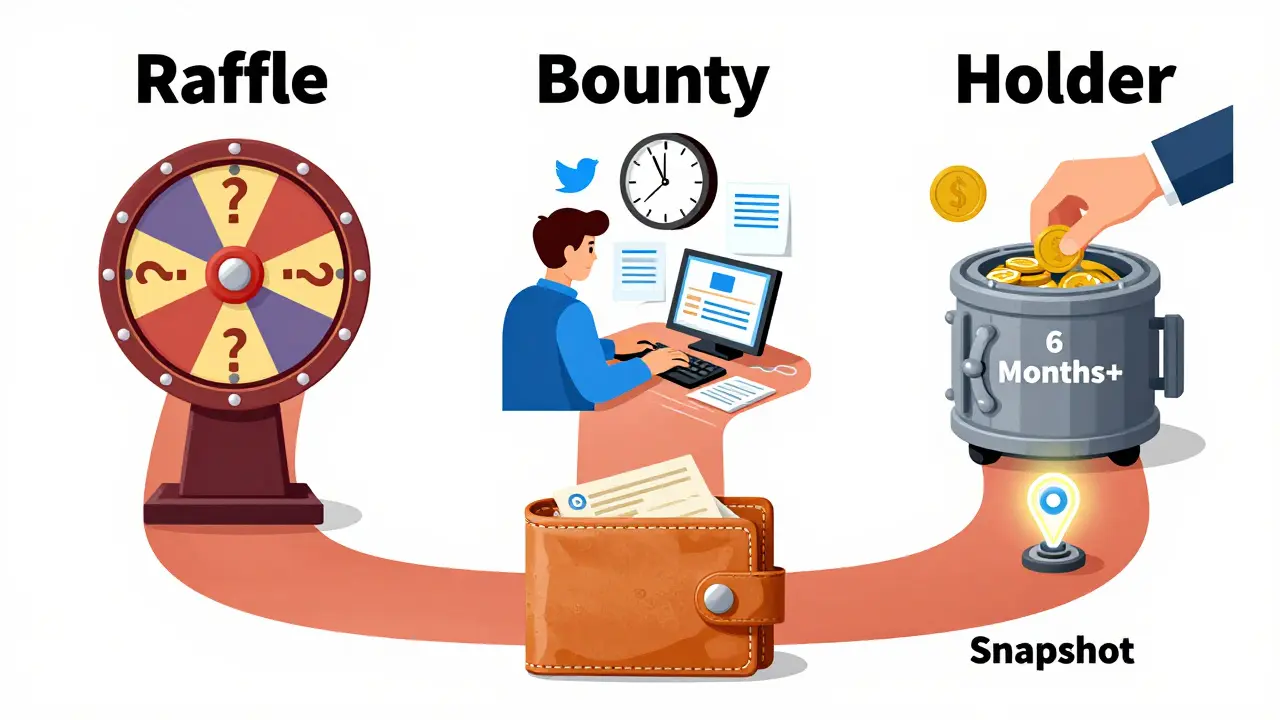

Airdrops fall into three broad categories, each with different rules. Knowing which type you’re dealing with changes how you prepare.

- Standard or Raffle Airdrops - These are the easiest. You sign up with your wallet address, maybe join a Discord, and that’s it. If 10,000 people sign up but only 2,000 get tokens, the project picks randomly. No tasks. No holding. Just luck. These are common for new projects trying to build buzz fast.

- Bounty Airdrops - These require work. You might need to tweet about the project, share a post on Reddit, refer three friends, or translate documentation. Some even ask for coding help or bug reports. Projects use these to build real community momentum. But beware: if the task list looks like a full-time job, the reward might not be worth it. Gas fees and time add up.

- Holder or Exclusive Airdrops - These are the most rewarding for long-term believers. If you held $MKR, $COMP, or $AAVE for six months before the snapshot, you might get a new token for free. No signing up. No tweeting. Just holding. The project assumes you’re a real user because you stuck around through price swings. This is why holding tokens isn’t just speculation - it’s a strategy.

Ecosystem Participation Is Now the Key

In 2026, projects don’t just look at what tokens you hold. They look at how you use them. Are you just sitting on your $ETH? Or are you swapping it on Uniswap, staking it on Lido, lending it on Aave, and voting on governance proposals? That’s the new gold standard.

Projects like Arbitrum, Optimism, and Base now reward users who interact across their entire ecosystem. For example, if you swapped tokens on Base’s DEX, deposited funds into a Base-native lending protocol, and voted on a Base DAO proposal - all within 90 days before the snapshot - you’re far more likely to qualify than someone who just held $BASE in their exchange wallet.

This shift means airdrop eligibility is no longer about owning one token. It’s about being an active participant in a network. The more ways you use a project’s tools, the higher your chances.

Wallet Choice Matters - A Lot

You can’t get an airdrop if your tokens are sitting on Coinbase, Binance, or Kraken. Most projects exclude centralized exchange wallets entirely. Why? Because exchanges hold thousands of wallets under one address. The project can’t tell who the real user is.

You need a non-custodial wallet - one where you control the private keys. MetaMask, Trust Wallet, and Best Wallet are the most common. But compatibility matters too. If the airdrop is on Solana, your MetaMask won’t work. You’ll need Phantom or Solflare. If it’s on Ethereum or Polygon, you need an ERC-20 or POLYGON-compatible wallet.

Smart users set up a dedicated airdrop wallet. Not their main one. Not the one with their life savings. Just a clean wallet used only for airdrops. That way, if a scammer tries to trick you into signing a malicious transaction, your real funds stay safe.

Claiming Isn’t Automatic - And It Has Deadlines

Even if you qualify, you might not get your tokens unless you claim them. Many airdrops have a claim window - sometimes just 30 days. Miss it, and the tokens go back to the project’s treasury. Some projects even reassign them to other users who met the criteria but didn’t get picked the first time.

And claiming isn’t always one click. Some require you to sign a message, connect your wallet to a specific website, and confirm your identity. Others ask for proof of social media activity. If you didn’t save screenshots of your tweets or Discord posts, you might be out of luck.

Always check the official project page after the snapshot. If they say “claim by April 15,” don’t wait. Set a reminder. Treat it like a tax deadline - because missing it means free money vanishes.

How to Find Legitimate Airdrop Info (And Avoid Scams)

Scammers love airdrops. Fake Twitter accounts, cloned websites, and phishing links are everywhere. The rule is simple: no real airdrop will ever ask for your seed phrase, private key, or password. Ever. If they do, close the tab. Immediately.

Legit airdrop info comes from three places:

- The project’s official website (check the URL - is it

projectname.ioorprojectname-official.xyz?) - Their verified Twitter/X or Mastodon account (look for the blue check)

- Their official Discord or Telegram channel (join via the link on their website, not a random Google result)

Use aggregator sites like AirdropAlert or CoinMarketCap Airdrops to track new opportunities - but always cross-check with the project’s own channels. If the announcement is vague - “Just send $10 to get tokens!” - it’s a scam.

Why Most People Never Get Airdrops

Here’s the truth: 90% of people who try for airdrops fail. Why?

- They use exchange wallets.

- They only sign up after the airdrop is announced - too late.

- They don’t hold tokens long enough.

- They skip governance voting or DeFi interactions.

- They fall for scams and lose their wallet.

The winners? They don’t chase airdrops. They build presence. They hold tokens. They swap. They vote. They join communities. They act like users, not hunters. And when the snapshot hits, they’re already in.

What to Do Now - A Simple Strategy

You don’t need to be a crypto expert. Here’s what to do in 2026:

- Set up a dedicated wallet (MetaMask or Trust Wallet).

- Buy and hold one or two established tokens from projects with a history of airdrops (like Uniswap, Arbitrum, or Optimism).

- Use them. Swap on their DEX. Stake on their platform. Vote on their DAO. Even once a month.

- Follow their official social media. Don’t just like posts - comment, share, engage.

- Never connect your wallet to a site unless you’re 100% sure it’s official.

That’s it. No complex tasks. No botting. Just consistent, real behavior. If you do this for six months, you’ll be ahead of 95% of people trying to get free tokens.

Do I need to pay gas fees to qualify for an airdrop?

Yes, sometimes. If you need to swap tokens, stake, or interact with a smart contract to qualify, you’ll pay gas fees on Ethereum, Polygon, or other networks. These aren’t optional - they’re part of proving real activity. But don’t pay gas just to sign up for a raffle airdrop. That’s usually not worth it unless the project has strong potential.

Can I use the same wallet for multiple airdrops?

Technically yes, but it’s risky. If you use your main wallet for everything, you expose all your funds to potential scams. Smart users create one wallet for airdrop hunting and keep their savings elsewhere. That way, even if a claim page is fake, your real crypto stays safe.

Are airdrops taxable?

In most countries, including the UK, receiving airdropped tokens is considered taxable income at the time you receive them. The value is based on the market price when the tokens hit your wallet. Keep records of all airdrops you claim - including dates and values - for tax reporting. Don’t assume they’re free money - they come with paperwork.

What if I didn’t hold the token before the snapshot - can I still qualify?

Maybe, but it’s harder. Some airdrops reward new users who complete tasks after the snapshot, like joining a community or using a new feature. But the biggest payouts go to those who held before. If you missed the snapshot, focus on the next project. Don’t waste time trying to catch up on one that’s already passed.

Do all airdrops have a claim period?

No. Some airdrops auto-distribute tokens directly to qualifying wallets. But many require you to claim them manually. Always check the project’s official announcement. If they don’t mention a claim process, assume you’ll need to do something. Never assume it’s automatic.