Are Crypto Payments Allowed in China? The Full 2025 Ban Explained

Jun, 20 2025

Jun, 20 2025

China Crypto Penalty Calculator

Calculate Your Legal Risk

Based on China's 2025 crypto ban regulations, estimate potential fines and consequences for crypto activities within mainland China.

Legal Risk Assessment

Based on China's 2025 crypto regulations

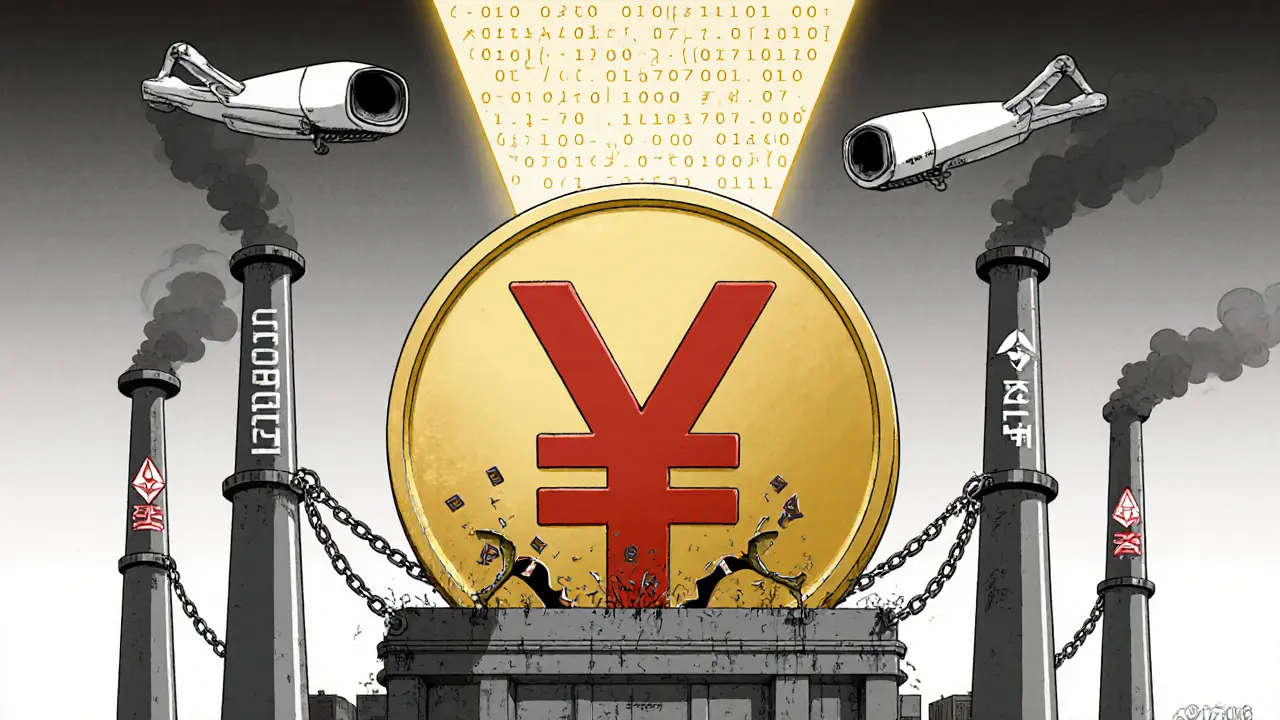

As of June 1, 2025, crypto payments are completely illegal in mainland China. Not just discouraged. Not just unregulated. Illegal. If you try to pay for coffee with Bitcoin, send Ethereum to a friend, or use a crypto debit card in Beijing, you’re breaking the law. This isn’t a gray area. It’s a hard line drawn by the People’s Bank of China (PBOC) - and enforcement is real.

How China Got to a Total Crypto Ban

China didn’t wake up one day and decide to ban crypto. It was a decade-long tightening. The first crack came in 2013, when banks were told not to touch Bitcoin transactions. Then in 2017, initial coin offerings (ICOs) were shut down. Exchanges like Binance and Huobi were forced to leave the mainland. Mining got banned in 2021 - thousands of data centers shut down overnight. By 2025, the rules got even stricter. The PBOC’s May 30 decree didn’t just ban trading or mining. It made owning cryptocurrency a legal risk. Authorities can now seize digital assets. Individuals can face fines or criminal charges for holding crypto. The Cyberspace Administration and Ministry of Industry are actively monitoring bank transfers and digital wallets for signs of crypto activity. This isn’t about stopping innovation. It’s about control. China wants to know every yuan that moves. Private cryptocurrencies, with their anonymity and decentralization, threaten that. The government can’t track them. Can’t tax them. Can’t stop capital from leaving the country. And that’s unacceptable.What’s Actually Illegal Now?

The 2025 ban covers everything:- Buying, selling, or trading any cryptocurrency on domestic or offshore platforms while in China

- Mining Bitcoin, Ethereum, or any other coin - even with a home rig

- Holding crypto in personal wallets, whether on a phone, hardware device, or exchange

- Using crypto as payment for goods or services - online or in-store

- Operating or promoting crypto payment gateways within mainland China

- Using OTC (over-the-counter) traders to convert yuan to crypto

But What About Blockchain? Isn’t China Into That?

Yes - but only the kind they control. China doesn’t hate blockchain. It loves it - as long as it’s centralized. That’s why the e-CNY, or digital yuan, is being rolled out across 200+ cities. It’s not Bitcoin. It’s not decentralized. It’s a government-issued digital cash system. Every transaction is tracked. Every user is verified. Every payment goes through the PBOC’s servers. The e-CNY is the centerpiece of China’s financial future. It’s faster than Alipay. More secure than WeChat Pay. And most importantly - it gives the state full visibility into spending patterns, savings, and capital flows. No hidden wallets. No offshore transfers. No anonymous transactions. China even runs the mBridge project - a cross-border CBDC pilot with Hong Kong, Thailand, and the UAE. Millions in settlements have already been processed using digital versions of their currencies. But here’s the catch: crypto payments are still banned inside China. mBridge only works between central bank digital currencies - not Bitcoin, not USDT, not anything private.

How This Compares to Hong Kong and Singapore

Just across the border, Hong Kong lets you trade crypto legally. You can buy Bitcoin on licensed exchanges like HashKey or OSL. You can even use crypto to pay for services. The Securities and Futures Commission (SFC) regulates it all. Singapore is even more open. The Monetary Authority of Singapore (MAS) licenses stablecoin issuers and crypto platforms. Businesses can accept crypto payments without fear of prosecution. China is the outlier. While its neighbors embrace regulated crypto markets, China has chosen total exclusion. Why? Because Hong Kong and Singapore don’t have the same goals. They’re financial hubs trying to attract global capital. China is a state-run economy trying to lock it down.What Happens If You Get Caught?

In 2024, over 200 people were arrested for crypto-related offenses - mostly OTC traders and small-scale miners. In 2025, penalties got harsher. Fines can reach up to 500,000 RMB (about $70,000 USD). In cases involving large sums or cross-border transfers, individuals face criminal charges under China’s anti-money laundering laws. Companies aren’t safe either. If your business accepts crypto - even accidentally - regulators can shut you down, freeze your assets, and blacklist your directors. Foreign crypto firms that tried to serve Chinese customers have been blocked from operating in the country. There’s no warning. No grace period. If your bank account shows a pattern of payments to known crypto exchanges, you’ll be flagged. The system doesn’t ask questions. It just freezes.

Sara Lindsey

November 14, 2025 AT 21:09David Cameron

November 16, 2025 AT 10:38Liz Watson

November 18, 2025 AT 06:13Rachel Anderson

November 19, 2025 AT 04:22Hamish Britton

November 20, 2025 AT 10:44Gavin Jones

November 22, 2025 AT 00:29alex piner

November 22, 2025 AT 04:50Mauricio Picirillo

November 22, 2025 AT 22:14Robert Astel

November 24, 2025 AT 16:06Andrew Parker

November 25, 2025 AT 14:48