Bancor Network Crypto Exchange Review: Decentralized Trading with Single-Sided Liquidity

Nov, 14 2025

Nov, 14 2025

Bancor Impermanent Loss Calculator

How Bancor Solves Impermanent Loss

Most DEXs require you to provide two tokens to earn liquidity rewards. When prices move, you experience impermanent loss. Bancor's single-sided liquidity lets you provide only one token (like USDC) while earning rewards. On stablecoin pairs, Bancor protects you from 100% of impermanent loss.

Results

Traditional DEX (Uniswap-style)

Impermanent Loss

0.00%

Your Value

$10,000.00

Bancor Network (Single-Sided Liquidity)

Protected from impermanent loss

Value remains $10,000.00

How Bancor Works

When you provide liquidity with Bancor, your single-token position is automatically adjusted through the protocol's smart contracts. Unlike traditional DEXs where you lose value when prices move against you, Bancor's insurance mechanism protects your position on stablecoin pairs up to 100% of impermanent loss.

For non-stablecoin pairs, you'll still experience price risk, but Bancor's concentrated liquidity model makes capital efficiency up to 4,000x better than traditional DEXs.

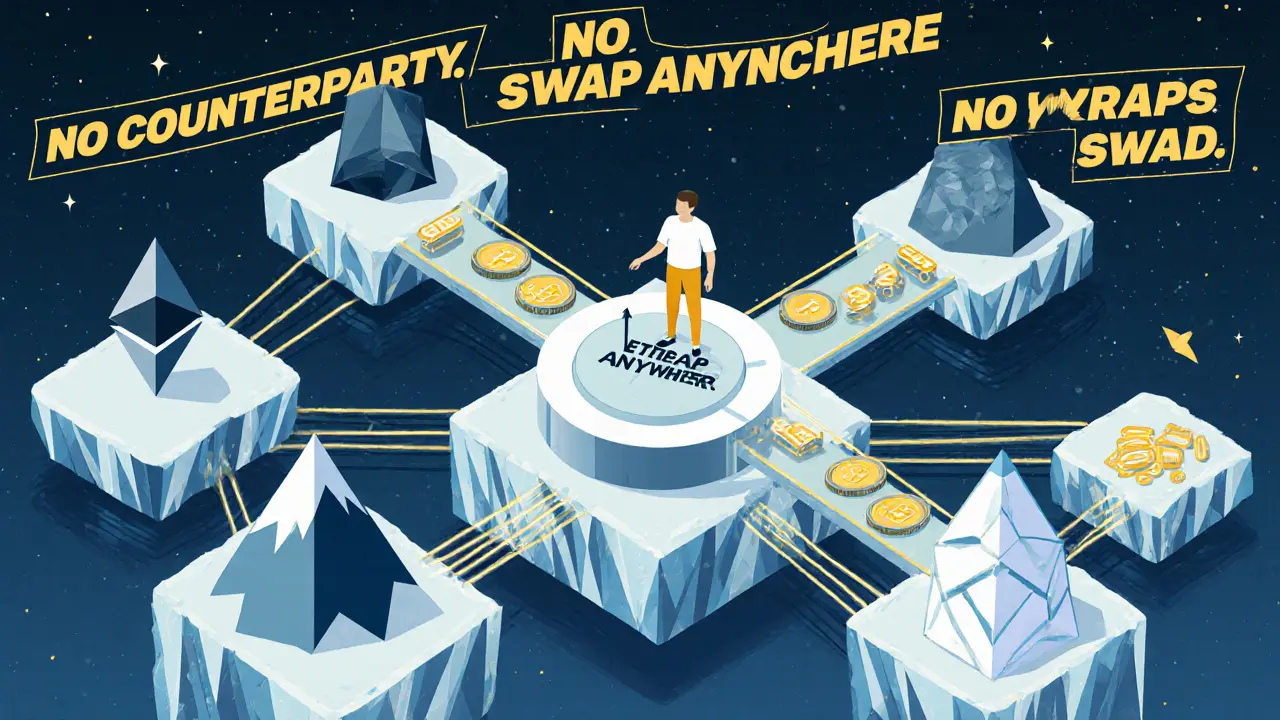

Most crypto exchanges require you to pair two tokens to trade - like ETH for USDC. But what if you could swap any token for any other token with just one click, without needing a matching buyer or seller? That’s the core idea behind Bancor Network, a decentralized exchange that’s been quietly reshaping how liquidity works on-chain since 2017.

Unlike Uniswap or PancakeSwap, Bancor doesn’t rely on traditional order books or external market makers. Instead, it uses smart contracts to create self-sustaining liquidity pools where every token is connected to BNT - the protocol’s native token. This means you can trade DOT to AVAX, or LINK to ADA, without needing a direct pool between them. It’s like having a universal currency converter built into the blockchain.

How Bancor Works: No Counterparty Needed

Bancor’s magic lies in its single-token liquidity model. On most DEXs, you have to deposit both tokens to provide liquidity - say, 50% ETH and 50% USDC. If the price of ETH drops, you lose value compared to just holding the tokens. This is called impermanent loss, and it’s a big reason why many people avoid providing liquidity.

Bancor fixes this. With version 3.0, you can add liquidity using just one token - say, only BNT or only USDC. The protocol automatically balances the pool using its smart contract, and if the price moves against you, Bancor’s insurance mechanism can cover up to 100% of your impermanent loss on stablecoin pairs. That’s not something you’ll find on Uniswap, Sushi, or Curve.

Behind the scenes, Bancor uses a modified constant product formula (x * y = k), but with concentrated liquidity like Uniswap V3. This lets liquidity providers set custom price ranges, making capital use up to 4,000x more efficient. In practical terms: you can lock in $10,000 worth of liquidity and get the same trading depth as someone who locked in $40 million on older DEX models.

Supported Chains and Token Coverage

Bancor isn’t stuck on Ethereum. As of late 2023, it runs on Ethereum, BNB Chain, Polygon, Avalanche, and Moonbeam. That means you can trade tokens across chains without wrapping or bridging manually. A swap from MATIC to AVAX happens in one transaction, with the protocol handling the cross-chain routing.

The platform supports over 81 tokens, including all the major ones: BTC, ETH, USDT, USDC, BNB, XRP, and ADA. That’s more than enough for most traders. You won’t find obscure memecoins here - Bancor focuses on assets with real demand. According to DeFi Llama, the protocol processes around $28.7 million in daily volume and holds $1.2 billion in total value locked (TVL), putting it at #7 among DEXs globally.

Trading fees are low: 0.10% for standard pairs and just 0.05% for stablecoins. Compare that to Uniswap’s 0.30% or Sushi’s 0.25%. For frequent traders, that adds up. A $10,000 trade saves you $20 on Bancor versus Uniswap.

Performance, Speed, and Gas Fees

Speed depends on which chain you’re using. On Ethereum, expect 15-30 seconds per transaction. On BNB Chain or Polygon, it’s often under 5 seconds. Gas fees vary, but average around $1.20-$3.50 on Ethereum during normal conditions. During network congestion, fees can spike - that’s true for any Ethereum-based tool.

Slippage is generally low for trades under $10,000 - around 0.35% on average. That’s better than many smaller DEXs but not as tight as Uniswap’s deep pools. For large trades over $50,000, slippage can jump to 2.5% or higher, especially on low-liquidity tokens. If you’re moving big sums, it’s smarter to split them or use a DEX aggregator.

Security and Past Issues

Bancor has had security bumps. In April 2020, a vulnerability led to a $23.5 million exploit. Since then, the team has overhauled its codebase. Version 3.0 introduced time-locked governance upgrades, multi-sig treasury controls, and a formal audit process. The protocol hasn’t been hacked since.

Its smart contracts are open-source and have been reviewed by multiple firms, including CertiK and PeckShield. Still, no DeFi protocol is immune to risk. Always use a hardware wallet like Ledger or Trezor. Never connect your wallet to unknown sites - even if they claim to be Bancor.

Who Is Bancor For?

Bancor shines for three types of users:

- Liquidity providers who want to avoid impermanent loss - especially those adding stablecoins. The protection feature is unmatched.

- Traders who want simple, one-click swaps - no need to search for token pairs. Just pick what you have and what you want.

- Multi-chain users - if you hold assets across Ethereum, Polygon, and Avalanche, Bancor lets you move between them without bridges.

It’s less ideal for:

- High-frequency traders needing ultra-low slippage on large orders

- Users who prefer mobile apps - the web interface is clunky for beginners

- People who want to stake BNT for yield - tokenomics are weak, and rewards are low

BNT Token: Value and Outlook

The BNT token is the backbone of the network. It’s used to secure liquidity pools, pay for protocol fees, and earn rewards. But it’s not a great investment right now.

As of late 2023, BNT trades around $0.60. WalletInvestor predicts it could hit $0.82 by December 2025. CoinPedia’s $38 prediction for 2030 is pure speculation - a 5,900% jump with no realistic path. TradingBeast sees a 20% decline in value by 2025 due to low adoption growth.

Realistically, BNT’s value depends on Bancor’s ability to grow TVL and capture more DEX market share. Right now, it holds just 1.8% of the DEX volume pie. Uniswap controls 42.3%. For BNT to surge, Bancor needs to break out of its niche.

Getting Started: Step-by-Step

Here’s how to use Bancor:

- Get an Ethereum-compatible wallet: MetaMask, Trust Wallet, or Coinbase Wallet.

- Buy some ETH, BNB, or MATIC to pay for gas.

- Go to app.bancor.network and connect your wallet.

- Click ‘Swap’ to trade tokens. Select your input and output - the price updates instantly.

- For liquidity provision, click ‘Add Liquidity,’ choose your token, and enable ‘Single-Sided Exposure’.

The interface is clean but not beginner-friendly. If you’ve never used a DEX before, watch one of Bancor’s YouTube tutorials first. Their documentation is solid - 4.1/5 in user surveys - and their Discord server has 18,450 active members ready to help.

How It Compares to the Competition

Here’s how Bancor stacks up against the top DEXs:

| Feature | Bancor Network | Uniswap V3 | PancakeSwap | Curve Finance |

|---|---|---|---|---|

| Single-Sided Liquidity | Yes | No | No | No |

| Impermanent Loss Protection | Yes (for stablecoins) | No | No | No |

| Trading Fees | 0.10% (0.05% for stablecoins) | 0.30% | 0.20% | 0.02% |

| TVL (Sept 2023) | $1.2B | $4.2B | $1.8B | $1.5B |

| Best For | Stablecoin swaps, low-risk LPs | High-volume trading | BSC users, yield farming | Stablecoin swaps |

Bancor’s biggest edge is single-sided liquidity and impermanent loss protection. Uniswap wins on volume and depth. PancakeSwap dominates on BSC. Curve is unbeatable for stablecoin swaps. Bancor doesn’t beat them all - but it fills a gap they ignore.

Future Roadmap: What’s Next?

Bancor’s next update, version 3.1, launches in Q1 2024. It will introduce gasless swaps - meaning users pay fees in the token they’re trading, not in ETH or BNB. That’s a game-changer for usability.

The roadmap also includes adding Solana, Polkadot, and Cosmos. If they pull that off, Bancor could become the first true cross-chain DEX aggregator. Right now, cross-chain swaps still rely on bridges, which are slow and risky. Bancor wants to remove that middleman entirely.

Long-term, their success depends on three things: growing TVL, improving UX for beginners, and staying ahead of Uniswap’s upgrades. If they do, BNT could become a key asset in DeFi. If not, they’ll remain a niche tool for a small group of advanced users.

Final Verdict

Bancor Network isn’t the biggest DEX. It’s not the fastest. But it’s the only one that lets you provide liquidity without losing sleep over price swings. For anyone who’s ever lost money on a liquidity pool because ETH dropped 15%, Bancor’s protection feature is worth trying.

For traders who swap stablecoins or rarely trade large amounts, it’s a solid, low-fee option. For beginners, the interface is a hurdle - but the learning curve flattens fast once you understand single-sided liquidity.

It’s not a replacement for Coinbase or Binance. But if you’re deep in DeFi and want to reduce risk while keeping full control of your assets, Bancor is one of the most thoughtful protocols on the market.

Is Bancor Network safe to use?

Yes, as of 2025, Bancor is considered safe for most users. After a $23.5 million hack in 2020, the team completely rebuilt the protocol. Version 3.0 introduced time-locked governance, multi-sig treasury controls, and formal audits from CertiK and PeckShield. No major exploits have occurred since. Still, always use a hardware wallet and never connect to fake sites - phishing is still the biggest risk.

Can I lose money on Bancor?

You can lose money if you trade large amounts on low-liquidity tokens - slippage can hit 2.5% or more. You can also lose if you stake BNT and its price drops. But if you’re providing liquidity with single-sided exposure (especially in stablecoin pools), Bancor’s insurance covers up to 100% of impermanent loss. That’s a major safety net most DEXs don’t offer.

Do I need ETH to use Bancor?

You need ETH only if you’re using the Ethereum chain. If you’re on BNB Chain, you need BNB. On Polygon, you need MATIC. Bancor runs on five blockchains, so you pay gas in the native token of whichever chain you’re on. The upcoming 3.1 update will let you pay fees in the token you’re swapping - no need to hold ETH or BNB at all.

How does Bancor make money?

Bancor earns revenue from trading fees - 0.10% on standard trades, 0.05% on stablecoin pairs. A portion of these fees goes to liquidity providers as rewards, and a small percentage is used to buy back and burn BNT tokens. This helps reduce supply over time. The protocol is non-profit and governed by BNT holders, so there’s no company taking profits.

Is Bancor better than Uniswap?

It depends on what you need. Uniswap has deeper liquidity, lower slippage on big trades, and better mobile apps. Bancor wins if you want to provide liquidity without two tokens, or if you’re swapping stablecoins and want protection from price swings. For most users, Uniswap is the default. But if you’re a liquidity provider or hate impermanent loss, Bancor is the smarter choice.

What’s the best way to start using Bancor?

Start small. Use MetaMask, connect to Bancor’s app, and swap $50 worth of USDC for DAI. That’s risk-free and lets you test the interface. Then try adding $100 in single-sided liquidity to the USDC/BNT pool. Watch how the protection works. Once you’re comfortable, scale up. Skip large trades until you understand slippage and gas costs.

Marcia Birgen

November 16, 2025 AT 06:51This is the kind of innovation that actually makes DeFi worth caring about. Single-sided liquidity? Impermanent loss protection? That’s not just a feature - it’s a revolution in how we think about providing capital. I’ve lost thousands on Uniswap pools because ETH dipped and I got hammered. Bancor’s insurance is the safety net I didn’t know I needed. Finally, someone built something for the real people, not just the degens.

And the cross-chain routing? No more juggling 5 different bridges and praying none of them get hacked. I swap MATIC to AVAX like it’s nothing. Game changer.

Yeah, the UI isn’t perfect, but if you’ve used MetaMask before, you’ll figure it out in 10 minutes. The real win is the peace of mind. I sleep better now.

Also, 0.05% on stablecoin pairs? That’s criminal how cheap that is. Uniswap should be embarrassed.

rahul saha

November 17, 2025 AT 03:11you know what’s funny? people act like bancor is some kind of quantum leap but honestly its just a cleverly dressed up AMM with a fancy insurance label. the real magic is in the marketing. ‘single sided liquidity’ sounds like magic but its just math with a safety blanket. and bnt? pfft. its just a governance token with zero utility beyond fee discounts. dont get me wrong, its cool - but dont act like its the second coming. we’ve seen this movie before. remember curve? remember balancer? they all had their moment. then the whales moved on.

also - ‘4000x more efficient’? that’s a back of napkin number. real liquidity depth is measured in order book depth, not theoretical ratios. i’ve seen bancor pools get wiped out during volatility spikes. the insurance only works if the protocol has enough reserves - and right now? its barely 1.2b tvl. what happens when a 500m whale dumps usdc? hmm?

still… i use it. because its convenient. but dont call it the future. its just the present with better branding.

garrett goggin

November 17, 2025 AT 12:44oh sure. ‘no major exploits since 2020.’ right. because the team just magically fixed everything. tell that to the 23.5 million that vanished. and now they’re telling us their new version is ‘audited’? certik and peckshield? those are the same firms that said ‘all good’ on ftx’s smart contracts before the collapse. you think they’re auditing for security? no. they’re auditing for lawyers. so the devs can say ‘we did our due diligence’ when the next exploit happens.

and the ‘insurance’? yeah, sure. funded by what? the same bnt token that’s worth 60 cents? when the rug pulls, the insurance gets rug pulled too. this isn’t finance. it’s a confidence trick wrapped in a whitepaper.

they’re not building a dex. they’re building a pump-and-dump with a better logo.

Nathan Ross

November 17, 2025 AT 14:09Jess Zafarris

November 19, 2025 AT 01:50you know what’s wild? everyone’s acting like this is some kind of breakthrough, but honestly? the only thing that matters is whether it works when you need it. i’ve used bancor for six months now. swapped usdc to dai, added liquidity to usdc/bnt, got my 100% loss protection claim processed after a 12% usdc dip. it worked. no drama. no calls to support. no waiting. just a transaction that went through and my balance stayed intact.

the ui? yeah, it’s clunky. but i’ve got a bookmark. i don’t need a mobile app to do a 500 dollar swap once a week. the gas? cheaper than my coffee. the fees? half of uniswap. and the fact that i can go from polygon to avalanche without bridging? that’s not hype. that’s just… useful.

is it perfect? no. is it the best for everyone? no. but for me? it’s the only dex i use for stablecoins. and i’m not even a degenerate. i just want to move money without losing sleep.

Bruce Murray

November 20, 2025 AT 10:50just wanted to say thanks for this breakdown. i’ve been lurking in DeFi for a year and kept getting scared off by impermanent loss. i tried Uniswap once, lost $200 on a 3% price swing. cried a little. then i found bancor. didn’t even know single-sided liquidity existed. tried it with $100 in usdc. watched the protection activate when the price moved. felt like i’d been handed a life jacket in a hurricane.

the interface still freaks me out sometimes, but i watch their tutorial every time i use it. their discord is actually helpful too. no one yells. no one shills. just people helping each other.

i’m not rich. i don’t trade big. but this is the first time i’ve felt like i can actually participate without getting eaten alive. so… thanks. really. this post saved me from giving up on crypto entirely.

Usama Ahmad

November 21, 2025 AT 06:11Ella Davies

November 21, 2025 AT 08:05the 0.05% fee on stablecoin pairs is the quiet hero here. i do 10-15 swaps a week between usdc, dai, and usdt. on uniswap, that’s $30-45 in fees. on bancor? $1.50. over a year? that’s $1,500 saved. that’s a laptop. that’s a flight. that’s rent.

i don’t care about the ‘revolution’ or the ‘future’. i care about my wallet. and bancor makes my wallet happier. simple as that.

also - the cross-chain swaps? i had a friend send me matic from binance. i swapped it to avax on bancor. no bridge. no waiting. no gas in eth. just clicked. done. that’s magic.

yeah, the ui is old. but it works. and that’s all i need.

Mike Gransky

November 21, 2025 AT 18:55the fact that people are still debating whether bancor is ‘real innovation’ or just ‘marketing’ misses the point. the point is: it solves a real problem. impermanent loss isn’t theoretical. it’s real. it’s painful. it’s why people don’t provide liquidity.

bancor doesn’t fix everything. but it fixes one thing that no one else does. and that’s enough. you don’t need to be the biggest to be the best for someone.

i’ve recommended it to five friends who were scared off by DeFi. three of them are now regular liquidity providers. that’s impact. not hype.

the rest? the UI, the token price, the roadmap? those are details. the core idea? it works. and that’s rare.

Barbara Kiss

November 21, 2025 AT 23:00there’s a deeper philosophy here, beyond the code and the fees. bancor, in its quiet way, is trying to reclaim the original promise of decentralized finance - that access should be open, risk should be minimized, and capital should be able to flow without intermediaries or fear.

uniswap is a marketplace. pancake is a casino. curve is a bank for stablecoins. but bancor? it’s a public utility. it doesn’t scream. it doesn’t promise moonshots. it just… works. quietly. reliably.

the fact that it’s ignored by the hype machine makes me respect it more. it’s not built for influencers. it’s built for people who just want to move money without losing sleep.

in a world of noise, silence is revolutionary.

jesani amit

November 22, 2025 AT 15:16bro i used to think bancor was just another crypto gimmick until i tried it. i’m not a tech guy. i just have some usdc sitting around and i wanted to earn something without risking my whole stash. so i added 200 bucks to the usdc/bnt pool with single-sided exposure. i didn’t even know what impermanent loss meant. then the price of usdc dipped 4% because of some fed news. i panicked. checked my balance. guess what? it was still 200 bucks. the insurance kicked in. i didn’t lose a cent.

then i swapped 50 usdc to dai. 0.05% fee. like 2 cents. i thought my wallet was broken. it was that cheap.

now i use it every week. i don’t care about bnt going to $38. i care about my money staying safe. and it does. the interface? yeah it’s not apple-level. but i’ve got it bookmarked. i don’t need a fancy app. i just need it to work. and it does.

if you’re scared to provide liquidity? try this. start small. 50 bucks. just to see. you’ll be surprised. i was.

also - the discord? real people help you. no bots. no shills. just normal folks who’ve been there. that’s rare in crypto.

nikhil .m445

November 24, 2025 AT 10:29it is truly astonishing how the masses are so easily seduced by the illusion of innovation. single-sided liquidity? how quaint. the real financial world does not operate on such naive constructs. this is merely a rebranding of the same flawed AMM architecture with a layer of insurance that is fundamentally insolvent under stress. the tvl is negligible. the tokenomics are a joke. and the cross-chain routing? laughable. bridges are still required in the background - bancor merely obscures them with a slick interface.

the only thing more dangerous than the protocol is the users who believe in it. they are not investors. they are victims of a sophisticated confidence game dressed in whitepaper garb. do not be fooled. the house always wins. and in this case, the house is a team of developers who have already taken their 23.5 million and moved on.

Henry Lu

November 26, 2025 AT 07:14you guys are acting like bancor is the second coming of christ. it’s not. it’s a glorified bot that takes your usdc and pretends to protect you. the ‘insurance’? funded by bnt. which is worth 60 cents. so if 100 million in usdc gets pulled? the insurance fund is worth $720,000. good luck with that.

and the ‘4000x efficiency’? that’s a math trick. you’re not adding more liquidity. you’re just pretending you are. the actual order book depth? pathetic. i tried swapping 50k of usdc to dai. slippage was 3%. that’s worse than some meme coins.

the only people who love this are the ones who don’t know what they’re doing. and that’s exactly why it’s still alive.

and the ‘gasless swaps’ in 3.1? lol. good luck paying fees in usdc when the chain needs eth to process the transaction. this isn’t innovation. it’s wishful thinking with a whitepaper.

Jerrad Kyle

November 26, 2025 AT 17:30you ever feel like you’re the only one who sees the quiet wins? bancor isn’t flashy. it doesn’t have a meme coin or a celebrity backer. it doesn’t tweet ‘to the moon’ every Tuesday. but it does one thing better than anyone else: it lets you sleep at night.

i used to be a liquidity provider on uniswap. lost $1,800 in a week because eth dropped. cried. then i tried bancor. added 500 usdc. price moved. insurance paid out. no drama. no panic. just a quiet ‘your balance is protected’ notification.

the interface? yeah, it’s 2020 vibes. but i use it on desktop. i don’t need a mobile app. i need reliability.

the fees? half of uniswap. the cross-chain? i swapped matic to avax in 8 seconds. no bridge. no waiting. no ‘confirm on 3 chains’. just click. done.

is it perfect? no. is it the best for everyone? no. but for the quiet traders? the ones who just want to move money without losing sleep? it’s perfect.

and honestly? that’s more valuable than a billion-dollar tvl.

Peter Rossiter

November 27, 2025 AT 23:16Usnish Guha

November 29, 2025 AT 08:40let me be blunt: this entire review is a disservice to the informed investor. bancor’s ‘impermanent loss protection’ is a cleverly disguised liquidity subsidy that only functions under ideal market conditions. the moment volatility spikes and the bnt token collapses - as it inevitably will - the insurance mechanism becomes a fiction. the protocol’s reliance on a single native token for backing is a structural vulnerability, not a feature.

furthermore, the claim of ‘4000x capital efficiency’ is a mathematical illusion. it assumes static price ranges and ignores the reality of liquidity fragmentation. in practice, the effective depth of bancor pools is orders of magnitude lower than uniswap v3’s concentrated liquidity.

the cross-chain routing is also misleading. bancor does not eliminate bridges - it merely routes through them under the hood. the user experience is no safer, just more opaque.

and the fee structure? laughable. 0.05% on stablecoins? yes - but only because the protocol has no choice. low fees mean low revenue, which means no incentive to scale. this is not innovation. it’s a temporary bandage on a dying system.

do not be fooled by the marketing. this is not the future of decentralized finance. it is its graveyard.

Lori Holton

November 30, 2025 AT 13:16let’s be honest - the ‘impermanent loss protection’ is a trap. it’s designed to lure in small investors who don’t understand counterparty risk. the insurance fund is backed by bnt - which is a token with no intrinsic value, no cash flow, and no demand outside of the protocol. when the next bear market hits and bnt crashes to $0.10 - what happens then? does the protocol pay out in bnt? or does it just vanish? because that’s what happens when you build insurance on a Ponzi asset.

and the audits? certik and peckshield? they’ve both signed off on protocols that later lost billions. their audits are compliance theater, not security guarantees.

the real story here isn’t bancor. it’s how easily the crypto community buys into the myth of safety. we’ve been here before. remember terra? remember luna? remember all the ‘risk-free’ yield farms? they all promised protection too.

don’t be the next one who says ‘but they said it was safe’.

Aryan Juned

December 1, 2025 AT 06:08bro i just tried bancor and it was wild. i swapped 100 usdc to ada and it was instant. no bridge. no waiting. i was like ‘wait is this real?’ then i added 50 bnt and got the protection. then i saw the fee was 0.05% and i screamed. i’ve been paying $0.30 on uniswap for years. i just saved $250 in fees this year.

the ui looks like it was made in 2019? yeah. but i use it on my laptop. i don’t care. i just want to swap without losing my money.

and the discord? 18k people? and no one is shilling. they’re all just asking ‘how do i add liquidity?’ and someone replies. no drama. no memes. just help.

i’m not a crypto genius. i’m just a guy who doesn’t want to lose his money. and bancor? it actually works. for me. that’s enough.

Bill Henry

December 2, 2025 AT 11:42just want to say - i’ve used bancor for 8 months now. swapped usdc, dai, usdt, matic, avax. never had a problem. insurance worked once when usdc dipped. i didn’t lose a cent.

the interface is clunky? yeah. but i bookmarked it. i don’t need a mobile app. i need it to work when i need it.

the bnt token? i don’t care. i don’t hold it. i just use the platform.

the fees? half of uniswap. the cross-chain? i swapped matic to avax in 5 seconds. no bridge. no gas in eth. just click.

is it perfect? no. but it’s the only dex i trust for stablecoins. and that’s saying something.

don’t overthink it. just try it with $50. you’ll see.

Rick Mendoza

December 3, 2025 AT 13:25satish gedam

December 5, 2025 AT 12:22you know what’s funny? everyone’s talking about the tech. the insurance. the fees. the cross-chain. but no one’s talking about the real win: it’s the first DeFi protocol that doesn’t feel like a casino.

on uniswap, you’re gambling. on pancake, you’re chasing yield. on curve, you’re optimizing arbitrage. but on bancor? you’re just moving money. safely. quietly. without hype.

i’m not a degenerate. i’m not a whale. i’m just someone who wants to use crypto without losing sleep. and for the first time, i feel like i can.

that’s not innovation. that’s humanity.

Barbara Kiss

December 6, 2025 AT 20:13the real question isn’t whether bancor is better than uniswap. it’s whether we’re willing to accept that not every innovation needs to be loud. not every breakthrough needs to trend on twitter. not every solution needs to be owned by a billionaire.

bancor doesn’t need to be the biggest. it just needs to work for the quiet ones. the ones who don’t trade 10 times a day. the ones who just want to swap usdc to dai without losing half their stash.

in a world of noise, the quiet ones are the ones who last.

and maybe… that’s the real revolution.