Bangladesh Crypto Adoption Ranks High Despite Complete Ban

Nov, 5 2025

Nov, 5 2025

Remittance Cost Calculator

Send Money to Bangladesh

How It Works

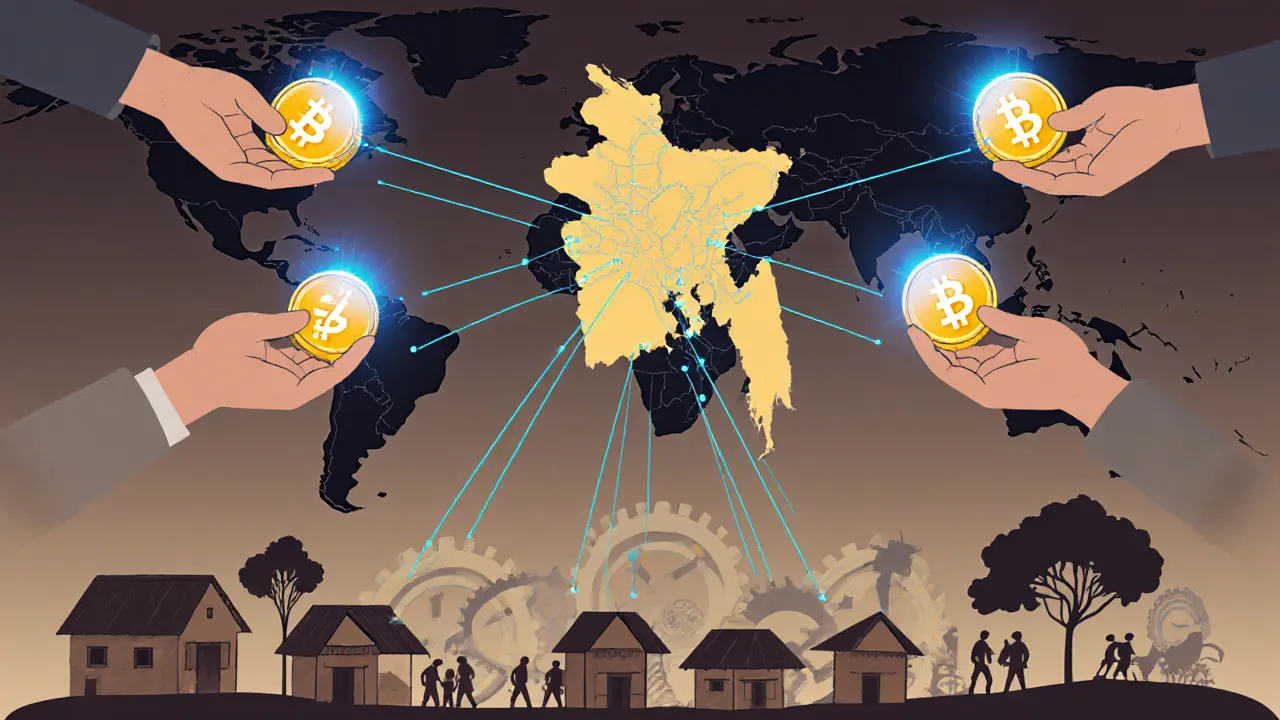

In Bangladesh, 3.1 million users rely on crypto for remittances. Traditional services charge 8-12% fees, while crypto (USDT) typically costs under 2%.

Even though Bangladesh has had a complete legal ban on cryptocurrency since 2021, it still ranks among the top 40 countries in the world for crypto usage. In 2025, over 3.1 million verified users in Bangladesh are actively using digital assets - not for gambling or speculation, but to send money home. This isn’t a glitch. It’s a response to a broken system.

How Can Crypto Be Legal in Bangladesh? It’s Not.

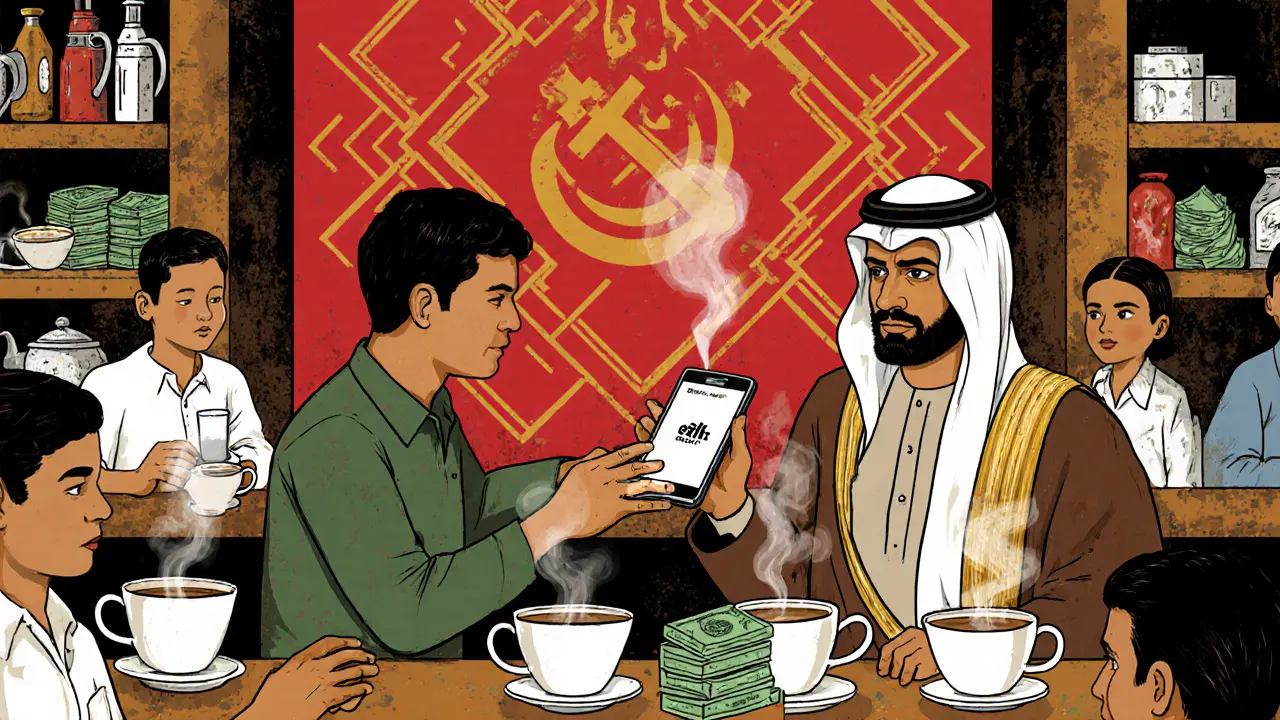

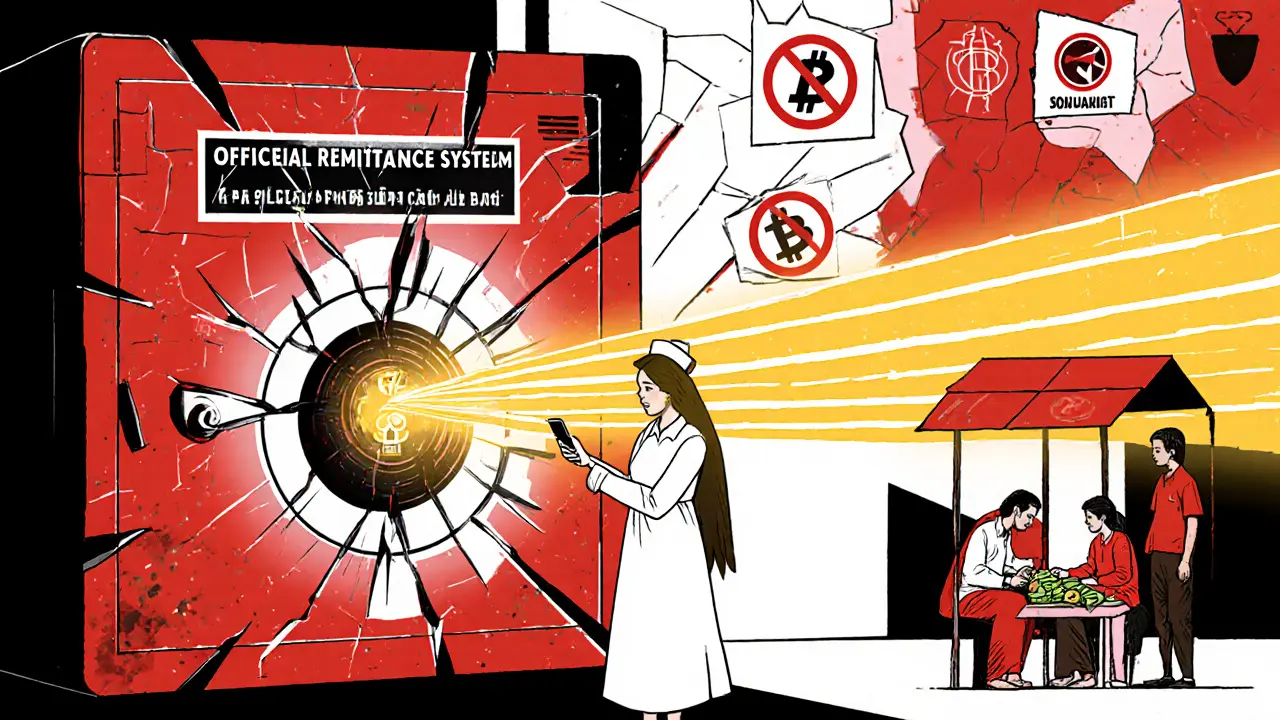

The Bangladesh Bank issued a formal ban in 2021, warning banks and financial institutions not to process any transactions related to Bitcoin, Ethereum, or any other cryptocurrency. Violators faced criminal charges. Banks froze accounts. Exchanges pulled out. The government made it clear: crypto is illegal. But people kept using it. Why? Because the alternatives were worse. Millions of Bangladeshis work overseas - in the Middle East, Malaysia, and elsewhere - sending money back to families. Traditional remittance channels like Western Union or MoneyGram charge 8-12% in fees. Banks take days. Sometimes, they refuse entirely. That’s where crypto stepped in. Stablecoins like USDT became the unofficial solution. Users buy USDT on international platforms, send it via peer-to-peer networks, and cash out through local traders who accept BDT in exchange. No bank account needed. No paperwork. No delays. And fees? Often under 2%.Ranking 35th in Global Crypto Adoption

According to CoinLaw’s 2025 report, Bangladesh sits at number 35 on the global crypto adoption index - ahead of countries like Germany, France, and Japan. Chainalysis and Coinpedia both confirm this isn’t a one-year anomaly. Bangladesh has held this position for three years straight, even as its government doubled down on enforcement. Compare that to India, which leads the world with over 100 million crypto users. Or Pakistan, which added 5.4 million new users in 2025. Bangladesh doesn’t have the population size of those countries, but its adoption rate per capita is shockingly high. For every 50 people in Bangladesh, one is using crypto. That’s not a trend. That’s a necessity.The Real Reason: Remittances, Not Trading

Most people think crypto users are day traders chasing Bitcoin spikes. That’s not happening here. In Bangladesh, over 90% of crypto activity is tied to remittances. Users don’t care about NFTs, DeFi, or metaverse land. They care about getting money to their mothers in Dhaka, their sisters in Sylhet, their kids in Khulna. Stablecoins are the tool. They’re digital dollars. They don’t swing wildly like Bitcoin. They hold value. They move fast. And they bypass the entire banking bureaucracy. A 2025 survey by a Dhaka-based fintech NGO found that 68% of crypto users in Bangladesh had used it to receive money from abroad in the past year. Only 12% had ever bought crypto to sell later for profit. The rest? They used it like cash - just digital, borderless cash.

How Do People Even Access It?

The government banned crypto. But it didn’t ban the internet. Users access international exchanges like Binance, Bybit, or OKX through VPNs. Peer-to-peer platforms like Paxful and LocalBitcoins are still active. Local traders - often shop owners, mobile phone sellers, or small business operators - act as liquidity hubs. You send USDT to their wallet. They hand you cash in BDT. No bank involved. No ID required. No trace. Some users even use WhatsApp groups to find buyers and sellers. A simple message: “Need 500 USDT for BDT. Rate?” That’s it. Transactions happen in parking lots, tea stalls, or even inside mosques after Friday prayers. It’s not perfect. Scams happen. People get ripped off. But when your only other option is a 10% fee and a two-week wait, you take the risk.Why Doesn’t the Government Shut It Down?

Because they can’t. The state can shut down banks. It can jail people who run crypto exchanges. But it can’t shut down every phone, every VPN, every WhatsApp group, every local trader with a pocket full of cash. The system is too decentralized. Too widespread. Too embedded in daily life. Plus, there’s political pressure. Bangladesh receives over $20 billion in remittances every year - the third-largest source of foreign currency after garments and textiles. If the government cracks down too hard, it risks cutting off a lifeline for 15 million families. That’s not just an economic problem. It’s a social crisis waiting to happen.What’s Happening in Neighboring Countries?

India has a complicated stance - crypto isn’t illegal, but taxes are high and banks block crypto transactions. Pakistan has no ban, and crypto use is exploding thanks to freelancers and offshore earnings. Nepal banned crypto in 2023, but usage is still growing underground. Bangladesh is caught in the middle. It’s not as strict as Nepal. Not as open as Pakistan. But the people? They’re doing what people always do when institutions fail: they build their own system.

The Bigger Picture: Crypto as a Safety Net

This isn’t just about money. It’s about dignity. A Bangladeshi nurse working in Saudi Arabia can’t rely on her employer’s payroll system. Sometimes, she’s paid late. Sometimes, she’s paid in local currency she can’t convert. With crypto, she sends her earnings home instantly. Her family gets cash the same day. No one has to beg. No one has to wait. In countries where banks are unreliable, inflation is rising, and wages are stagnant, crypto isn’t a luxury. It’s insurance. It’s a backup plan. And in Bangladesh, it’s working - even if the government says it shouldn’t.What’s Next?

The government may keep banning. The banks may keep freezing accounts. But the demand won’t disappear. If Bangladesh ever lifts the ban - and many experts believe it will within the next five years - it could become one of the most sophisticated crypto markets in Asia. Not because of speculation. But because its people already know how to use crypto the right way: for survival, not speculation. Until then, 3.1 million people will keep using it. Quietly. Carefully. And without permission.Why This Matters for the Rest of the World

Bangladesh isn’t an outlier. It’s a preview. Countries across Africa, Latin America, and Southeast Asia are facing the same problem: outdated financial systems that don’t serve the people. Crypto isn’t replacing banks - it’s replacing broken promises. When governments fail to deliver, people build their own infrastructure. That’s not rebellion. That’s resilience. Bangladesh proves that you can’t ban what people need.Is cryptocurrency completely illegal in Bangladesh?

Yes, cryptocurrency trading and exchange are officially banned by the Bangladesh Bank since 2021. Banks are prohibited from processing crypto transactions, and financial institutions face penalties for compliance violations. However, there is no specific law that criminalizes individual users holding or sending crypto, which creates a legal gray area that many exploit through peer-to-peer networks.

How do people in Bangladesh buy and sell crypto if it’s banned?

Most users access international crypto exchanges like Binance or OKX using VPNs. They buy stablecoins like USDT and trade them directly with local sellers via WhatsApp, Telegram, or in-person meetups. These sellers - often small shop owners or mobile phone dealers - exchange USDT for Bangladeshi Taka (BDT) in cash. No bank is involved, making the transactions hard to track or stop.

Why do Bangladeshis prefer stablecoins over Bitcoin?

Stablecoins like USDT are pegged to the U.S. dollar, so their value stays steady. This makes them ideal for remittances - users don’t want to risk losing money because Bitcoin’s price dropped while the transfer was processing. Bitcoin is too volatile for sending family money. USDT is digital cash. Simple. Reliable. Practical.

How many people in Bangladesh use cryptocurrency?

As of 2025, there are an estimated 3.1 million verified crypto users in Bangladesh, according to CoinLaw and Chainalysis. This number doesn’t include unverified users or those who use crypto occasionally, so the real number could be closer to 4 million. With a population of 170 million, that means roughly 1 in 50 people uses crypto regularly.

Why isn’t the government cracking down harder on crypto users?

Cracking down on millions of ordinary users would cause massive social unrest. Bangladesh relies on over $20 billion in annual remittances - money sent home by workers abroad. Crypto is now the most efficient way to get that money to families. Shutting it down could hurt the economy and destabilize households. The government is caught between enforcing an unpopular ban and risking economic damage.

Could Bangladesh legalize crypto in the future?

Yes, and many analysts believe it’s inevitable. With 3.1 million active users and growing remittance needs, the ban is unsustainable. Countries like Nigeria and Vietnam have moved from banning to regulating crypto. Bangladesh may follow suit, especially if neighboring India or Pakistan introduce clearer frameworks. The real question isn’t if - but when.