Bitrecife Crypto Exchange Review: Is It a Scam or Legit in 2025?

Dec, 16 2025

Dec, 16 2025

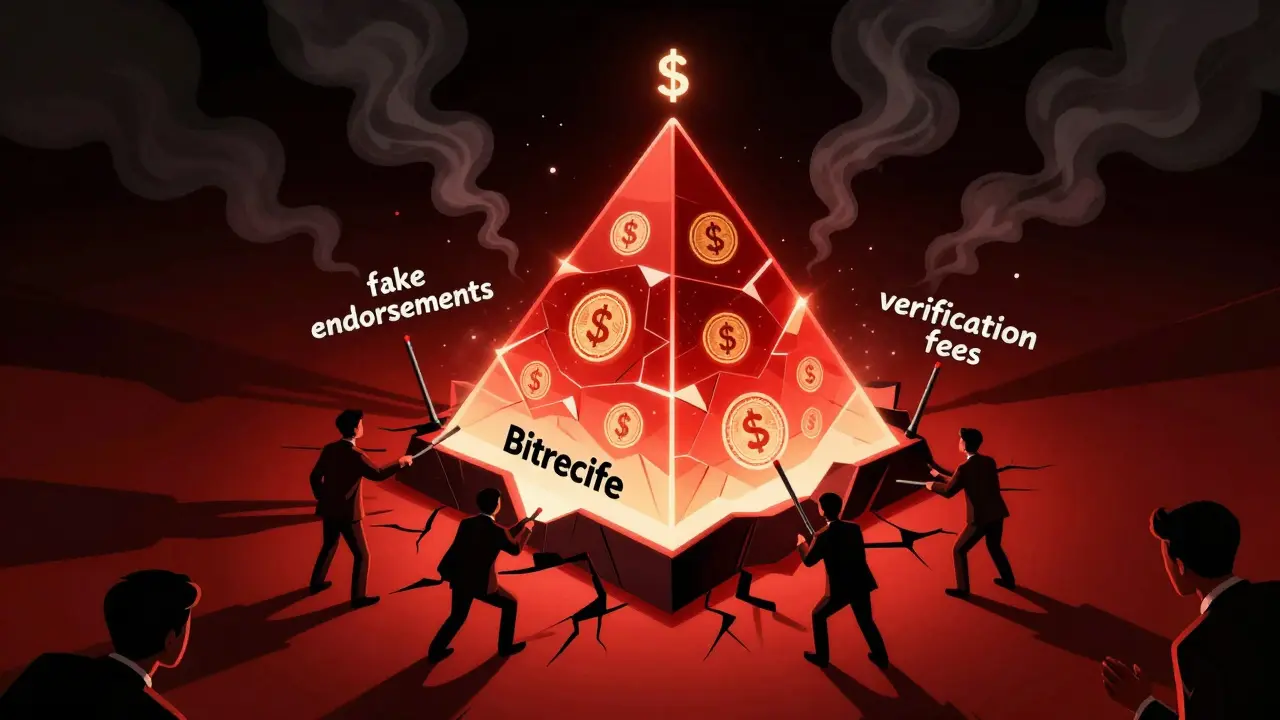

There’s a new crypto exchange popping up on Instagram and TikTok ads with flashy claims: Bitrecife. It promises instant profits, zero fees, and a simple way to turn $100 into thousands. The website looks polished. The testimonials seem real. The videos even show fake clips of Elon Musk and Warren Buffett endorsing it. But here’s the truth: Bitrecife is not a real exchange. It’s a scam.

What Bitrecife Claims - And What It Actually Does

Bitrecife says it’s a secure, commission-free crypto trading platform where you can buy Bitcoin, Ethereum, and other coins with just a few clicks. It claims to use "advanced algorithms" to generate daily returns of 5% to 15%. That sounds too good to be true - because it is. Real crypto trading is risky. Even the most experienced traders rarely see consistent monthly returns above 10%. Bitrecife promises that kind of profit every day. That’s not trading - that’s gambling with your money. And unlike real exchanges like Binance or Coinbase, Bitrecife doesn’t let you actually own your coins. You can’t withdraw them to your own wallet. You’re stuck inside their system, watching numbers go up on a screen they control.No Regulation, No Transparency

Legitimate crypto exchanges are regulated. They’re licensed by authorities like the SEC, FCA, or ASIC. They publish their company details: where they’re based, who runs them, and how they protect your funds. Bitrecife has none of that. No physical address. No registered business number. No compliance documentation. Its domain was registered in September 2023 with private WHOIS info - a classic red flag. Real exchanges like Kraken and Coinbase publish proof of reserves every quarter. They show they have enough Bitcoin and Ethereum to cover every customer’s balance. Bitrecife doesn’t. Why? Because they don’t have any. The money you deposit doesn’t go into a trading pool. It goes straight into the scammers’ pockets.How the Scam Works

Bitrecife uses a well-known scam pattern called "pig butchering." Here’s how it plays out:- You sign up after seeing a fake ad with a celebrity endorsement.

- You deposit $100, $500, or $1,000.

- Within minutes, your account shows a 20% or 30% gain. You see $120, $600, or $1,300.

- You try to withdraw. You’re told you need to pay a "verification fee," "tax deposit," or "security clearance" - usually $200 to $500.

- You pay it. Your balance grows again. You’re told to deposit more to unlock your full payout.

- Eventually, you’re blocked. The chat support disappears. The website goes dark.

Fake Reviews and Future-Dated Testimonials

You might see Bitrecife listed on REVIEWS.io with a 2-star rating and a review dated October 3, 2025. That’s impossible. That date is in the future. That’s not a mistake - it’s proof the reviews are fake. The FTC has warned about this tactic for years. Scammers use fake reviews with future dates to make their sites look "established" and trustworthy. Trustpilot has only two reviews for Bitrecife - far too few for a platform claiming global users. That’s another red flag. Legitimate exchanges have thousands of reviews. Bitrecife has silence - except for the bots.Technical Warning Signs

If you dig into the website’s code, you’ll find more clues. Bitrecife’s SSL certificate is either invalid or self-signed - meaning your connection isn’t secure. Your login details could be intercepted. The site uses JavaScript tricks to hide user activity from security tools. Its servers are hosted on IP addresses linked to at least five other known crypto scams from 2022 and 2023. No real exchange hides its tech. They publish API docs, security whitepapers, and bug bounty programs. Bitrecife offers nothing but a slick interface and empty promises.Who’s Targeted - And Why

Bitrecife doesn’t go after experienced traders. It targets beginners. People who don’t know how crypto works. People who saw a YouTube video saying "you can get rich overnight with crypto." It uses social media ads with manipulated videos, fake testimonials, and emotional language: "Don’t miss your chance!" "Limited spots!" "Join thousands who are already rich!" According to Statista, crypto scams cost victims an average of $1,800 in 2022. Bitrecife fits that profile perfectly. It preys on people who are excited, scared of missing out, and don’t know how to check if a platform is real.

What to Do If You’ve Already Deposited Money

If you’ve sent money to Bitrecife:- Stop depositing more. No matter what they say, you won’t get your money back by paying more.

- Take screenshots of your account, chat logs, and transaction IDs.

- Report it to your local financial fraud authority (like the FTC in the U.S. or Action Fraud in the UK).

- File a report with the Internet Crime Complaint Center (IC3) at ic3.gov.

- Warn others. Post on Reddit, Twitter, or local forums. Don’t let them fall for the same trap.

Safe Alternatives to Bitrecife

If you want to trade crypto safely, stick with platforms that have been around for years and are regulated:- Coinbase - Founded in 2012. Regulated in the U.S. and EU. Offers insured custody.

- Binance - Largest exchange by volume. Has regulatory licenses in multiple countries.

- Kraken - Known for strong security and public proof of reserves.

- Interactive Brokers - If you want to trade crypto alongside stocks, this is a trusted broker with SEC oversight.

Final Verdict: Avoid Bitrecife at All Costs

Bitrecife isn’t a crypto exchange. It’s a digital con. It’s designed to look real so you’ll trust it. But every detail - from the fake reviews to the unverifiable team to the impossible profit claims - points to fraud. Cybersecurity firms like MalwareTips and TheSafetyReviewer have labeled it a 98% likely scam. TradersUnion explicitly warns: "I do not recommend Bitrecife." The crypto market is full of opportunities. But you don’t need to risk your savings on a platform that doesn’t exist. If it sounds too good to be true, it is. And Bitrecife is one of the most aggressive scams of 2025.Protect yourself. Do your research. Stick to regulated platforms. And never, ever send money to a site that asks you to pay a "verification fee" to get your own funds back.

Is Bitrecife a real crypto exchange?

No, Bitrecife is not a real exchange. It has no regulatory licenses, no verifiable company information, and no proof of reserves. Multiple cybersecurity firms, including MalwareTips and TheSafetyReviewer, have confirmed it is a scam platform designed to steal money from unsuspecting users.

Why does Bitrecife look so professional?

Scammers invest in professional-looking websites because they work. Bitrecife uses polished design, fake testimonials, and manipulated videos to trick people into thinking it’s legitimate. But looks don’t equal safety. Real exchanges publish their team, legal docs, and security audits - Bitrecife hides everything.

Can I get my money back if I deposited into Bitrecife?

Recovering funds from Bitrecife is extremely unlikely. Once you send money, it’s quickly moved through multiple wallets and laundered. Your best action is to stop sending more money, gather all evidence (screenshots, transaction IDs, chat logs), and report the scam to authorities like the FTC or IC3. Reporting helps track and shut down these operations.

Are the reviews on Bitrecife’s website real?

No, the reviews are fake. One review on REVIEWS.io is dated October 3, 2025 - a future date that’s impossible. This is a known scam tactic to make the platform seem trustworthy. Legitimate exchanges have thousands of real user reviews across multiple platforms. Bitrecife has only a handful, mostly bot-generated.

What should I look for in a safe crypto exchange?

Look for: regulatory licensing (SEC, FCA, etc.), public company details, proof of reserves, two-factor authentication, and support via phone or email - not just in-app chat. Avoid platforms that promise guaranteed returns, use celebrity endorsements, or ask for extra fees to withdraw your funds. Stick with well-known names like Coinbase, Kraken, or Binance.

Is Bitrecife still active in 2025?

Yes, as of December 2025, Bitrecife is still active, but it has moved its promotion from Instagram and Facebook to Telegram channels after those platforms removed its accounts. This is a common pattern among crypto scams - they shift platforms when banned. However, it remains unlisted on CoinGecko and CoinMarketCap, which only include verified exchanges.

Mark Cook

December 17, 2025 AT 09:41Craig Nikonov

December 17, 2025 AT 22:23Chevy Guy

December 18, 2025 AT 12:47Donna Goines

December 20, 2025 AT 07:07Bradley Cassidy

December 21, 2025 AT 17:40Cheyenne Cotter

December 23, 2025 AT 06:23Kelsey Stephens

December 23, 2025 AT 17:44Emma Sherwood

December 24, 2025 AT 18:20Jack Daniels

December 25, 2025 AT 14:24Shruti Sinha

December 27, 2025 AT 02:08Florence Maail

December 28, 2025 AT 21:02Heather Turnbow

December 29, 2025 AT 21:45Sue Bumgarner

December 31, 2025 AT 06:18Sean Kerr

January 1, 2026 AT 18:09Amy Copeland

January 2, 2026 AT 01:35Greg Knapp

January 2, 2026 AT 08:34Kayla Murphy

January 3, 2026 AT 03:16