Central Bank of Iraq Crypto Restrictions: What You Need to Know in 2025

Dec, 14 2024

Dec, 14 2024

Iraq Crypto Compliance Checker

Check Your Crypto Activity Risk

Based on Central Bank of Iraq regulations (2025) and FATF guidelines

Compliance Assessment

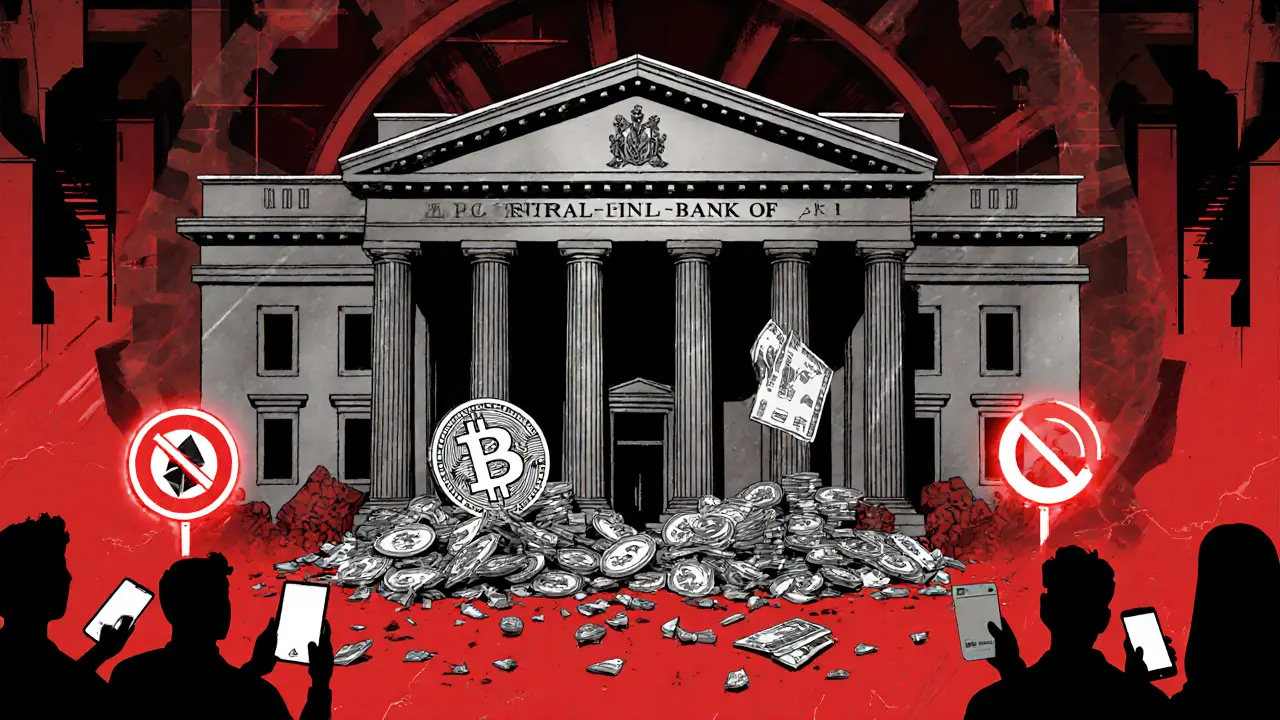

As of 2025, the Central Bank of Iraq enforces one of the strictest cryptocurrency bans in the world. It’s not just a warning - it’s a full legal prohibition. Banks, payment processors, and even e-wallet providers are barred from touching any digital asset. If you’re in Iraq and trying to buy Bitcoin, trade Ethereum, or use a crypto exchange, you’re operating in a legal gray zone - one that could land you under suspicion for money laundering, even if you’re not breaking any specific law.

How the Ban Works - And Who It Targets

The ban didn’t come out of nowhere. It started in 2017, but got teeth in November 2021 with CBI Circular No. (125/5/9). This document made it crystal clear: cryptocurrencies are not legal tender. They can’t be used to pay for goods, settle debts, or be exchanged for Iraqi dinars through any regulated financial channel. That means if you try to deposit Bitcoin into your bank account, the bank is legally required to refuse it - and report you. The restrictions go even further. In March 2022, the Central Bank updated its rules to match international anti-money laundering standards from the Financial Action Task Force (FATF). Now, banks must monitor their customers for any signs of crypto-related activity. If someone uses a debit card to buy crypto on a foreign exchange, or transfers funds to a known crypto wallet, the bank has to flag it. Payment cards, mobile wallets, and online banking systems are all locked down. This isn’t just about stopping banks. It’s about cutting off every possible bridge between Iraq’s formal economy and the crypto world. Even if you’re not a business, your personal transactions can get caught in the net.Why Iraq Banned Crypto - And What They’re Replacing It With

The official reasons are familiar: money laundering, fraud, volatility, and consumer protection. But the real story is deeper. Iraq’s economy is fragile. In 2020, the government devalued the dinar from 1,182 to 1,450 per dollar overnight. Prices for food and fuel spiked. People lost savings. Trust in the banking system dropped to historic lows. That’s when crypto started creeping in - not as a speculative asset, but as a lifeline. People turned to Bitcoin and USDT to protect their money from inflation and to send remittances without going through broken banking channels. The Central Bank saw this as a threat to its control over the currency. So instead of adapting, it doubled down on control. And in March 2025, the government made its next move official: Iraq is developing its own Central Bank Digital Currency (CBDC). Financial advisor Mazhar Mohammed Saleh said the goal is to reduce cash printing, track spending, and stop money laundering. But experts warn this isn’t about freedom - it’s about surveillance. Unlike Bitcoin, where transactions are pseudonymous, Iraq’s CBDC will be fully traceable. Every dollar spent, every transfer made, every purchase - recorded by the state. Given Iraq’s low civil liberties score (4.38/10), this raises serious concerns. If you criticize the government online, your salary could be docked. If you protest, you could be arrested. Now imagine the government can see every financial move you make - and block your transactions before you even spend.What’s Different About Iraq’s Ban Compared to Other Countries

Most countries don’t ban crypto outright. China restricts exchanges but allows private ownership. The U.S. regulates it. The EU creates licensing systems. Even Saudi Arabia and the UAE are building crypto hubs. Iraq is one of only ten countries in the world with a total ban. That puts it in the same league as Egypt, Algeria, and Nepal - not the U.S., China, or Germany. What makes Iraq unique is how comprehensive the ban is. It’s not just about institutions. It’s about people. Other countries focus on stopping exchanges and mining. Iraq bans payment cards from being used for crypto purchases. It bans e-wallets from holding digital assets. It even pressures religious authorities to issue fatwas against crypto. The Supreme Fatwa Authority of the Kurdistan Region banned OneCoin in 2018 - a scam that turned out to be a pyramid scheme. But the fatwa didn’t just target fraud. It painted all crypto as religiously forbidden, adding moral weight to the legal ban. This blend of financial, legal, and religious pressure makes Iraq’s approach unusually aggressive.

But People Are Still Using Crypto - Quietly

Here’s the irony: despite the ban, crypto is still circulating in Iraq. It’s not on exchanges. It’s not in banks. It’s in WhatsApp groups, peer-to-peer trades, and cash-for-Bitcoin meetups in Baghdad and Erbil. People use cash to buy USDT from traders who hold it on their phones. They send it to family abroad. They use it to buy goods from Turkish or Iranian vendors who accept crypto. Enforcement against individuals is rare. There are no known cases of someone being jailed just for owning Bitcoin. But that doesn’t mean it’s safe. If you’re flagged for suspicious transfers - say, you suddenly send 5 million dinars to a foreign wallet - the Anti-Money Laundering unit can investigate. You might be asked to prove your income. Your bank account could be frozen. Your phone could be seized. The system is inconsistent. It’s not designed to catch every user. It’s designed to scare them away from using the formal system. And it’s working - for now.The Legal Vacuum and the Risk It Creates

There’s no law in Iraq that says “owning cryptocurrency is illegal.” There’s no law that says “using crypto is a crime.” The ban applies only to financial institutions. That creates a dangerous gray zone. You can’t legally buy crypto from a bank. But if you buy it from a stranger in a café? The law doesn’t say that’s a crime. Yet if you’re caught with crypto, you can still be accused of violating AML rules. That’s not legal clarity - it’s legal chaos. Legal analysts from Al Nesoor Law Firm warn this vacuum makes Iraq more vulnerable to fraud, not less. Criminals don’t care about banking rules. They’ll use unregulated crypto trades to move stolen money. Meanwhile, ordinary people who just want to protect their savings are left with no safe options. And the government isn’t helping. No parliament has passed a law on crypto. No court has ruled on its status. The Central Bank acts like a regulator, but it’s operating without legislative backing. That’s not regulation - it’s administrative overreach.

DeeDee Kallam

November 2, 2025 AT 05:31lol why are yall even surprised? the gov wants control not freedom

Phyllis Nordquist

November 4, 2025 AT 04:04The Central Bank of Iraq's approach reflects a broader global tension between financial sovereignty and technological innovation. While the legal framework is predicated on anti-money laundering protocols aligned with FATF guidelines, the absence of legislative codification creates a dangerous precedent of administrative overreach. The potential for human rights abuses through a fully traceable CBDC cannot be overstated, particularly in contexts with weak rule of law and documented histories of political repression.

Kaela Coren

November 5, 2025 AT 15:44It's fascinating how the ban targets institutions while leaving individuals in legal limbo. The government's strategy seems less about preventing crime and more about maintaining control. The fact that people are still trading crypto via WhatsApp and cash meetups suggests the policy is fundamentally unenforceable - and possibly counterproductive.

Genevieve Rachal

November 5, 2025 AT 18:35Oh please. You're acting like this is some unique tyranny. Every country controls its currency. The U.S. freezes bank accounts for less. Iraq’s just being proactive. People who use crypto are either criminals or fools. Don’t romanticize it.

naveen kumar

November 6, 2025 AT 18:19CBDCs are the final step in the surveillance state. They're not about efficiency - they're about obedience. Iraq is just the first domino. Next up: India, Brazil, maybe even Canada. The crypto resistance is just getting started.

alvin Bachtiar

November 7, 2025 AT 18:50Let’s be real - this isn’t about money laundering. It’s about power. The CBI is terrified of a parallel financial system that can’t be manipulated, taxed, or silenced. Meanwhile, the average Iraqi is using USDT to buy groceries because the dinar’s worth less than your last Starbucks receipt. This isn’t a ban - it’s a cry for help from a crumbling regime. 🤡

Kymberley Sant

November 8, 2025 AT 00:50why do people think crypto is safe? like uhhh the blockchain is a magic fairy dust that stops govs from tracking u? lol no. even bitcoin is traceable. this is why i hate crypto bros

Bruce Bynum

November 9, 2025 AT 08:13People are finding ways to survive. That’s not rebellion - it’s basic human instinct. The state can ban tech, but it can’t ban need.

ISAH Isah

November 10, 2025 AT 03:02Chris Strife

November 11, 2025 AT 13:15Stop crying about Iraq. They’re not the U.S. They don’t owe you freedom. If you can’t handle your currency collapsing, that’s your problem. CBDCs are the future. Get used to it.

Elizabeth Melendez

November 12, 2025 AT 05:05I just want to say how brave these everyday Iraqis are. They’re risking everything just to protect their families from inflation. Imagine having to meet strangers in a café just to buy food. That’s not crypto - that’s survival. And honestly? The fact that they’re using WhatsApp and cash instead of exchanges? That’s grassroots innovation at its purest. We should be supporting them, not judging them. I’m so moved by their resilience. 💛

Phil Higgins

November 13, 2025 AT 14:13There is a profound irony here. The state seeks to eliminate decentralized money to enforce centralized control - yet in doing so, it accelerates the very decentralization it fears. The underground networks are not merely evading regulation; they are building new social contracts outside the state’s reach. This is not an act of defiance - it is the emergence of a new civic infrastructure, forged in necessity. The question is not whether the state can win - but whether it can survive the collapse of its own legitimacy.

Eliane Karp Toledo

November 13, 2025 AT 18:34CBDC? More like CBDC - Controlled By Dictators Corporation. You think this is about inflation? Nah. This is the deep state prepping for the Great Reset. They’re building the digital leash. The moment your CBDC goes live, your phone will beep if you buy too much bread. Or worse - if you buy too much *freedom*. The Illuminati are just using Iraqi bureaucrats as their puppets. Wake up. They’re already watching.

Jeremy Jaramillo

November 14, 2025 AT 02:29I’ve lived in three countries where the government tried to control money. They all failed. People adapt. They always do. The real tragedy isn’t the ban - it’s that the state sees its own citizens as threats instead of people who just want to feed their kids.

Wesley Grimm

November 15, 2025 AT 23:48There is no legal basis for this ban. No statute. No judicial precedent. Just a circular. That’s not governance. That’s authoritarianism dressed in financial jargon. The CBI is not regulating - it’s terrorizing.

Eric Redman

November 16, 2025 AT 02:18Y’all are acting like Iraq is the only country that hates crypto. Bro, I saw a guy get arrested in Nigeria for holding Bitcoin last week. The whole world’s scared of decentralized money. The CBI just has the guts to say it out loud. Meanwhile, the U.S. is just slapping on taxes and pretending it’s ‘regulation.’ Same thing. Different flavor of oppression.

Bhavna Suri

November 16, 2025 AT 08:34This is very bad. People should not use crypto. It is dangerous. The government knows best. We must follow rules.