Crypto Asset Service Provider Licensing in EU: MiCA Requirements, Costs, and Real-World Challenges

May, 26 2025

May, 26 2025

CASP License Cost Calculator

Calculate Your CASP License Costs

Your Estimated CASP License Costs

Based on EU MiCA regulations (December 2024)

Starting a crypto business in the EU isn’t just about building a platform or writing smart contracts anymore. Since December 30, 2024, if you want to offer crypto services to customers anywhere in the European Union, you need a Crypto Asset Service Provider (CASPs) license under MiCA - the Markets in Crypto-Assets Regulation. This isn’t a suggestion. It’s the law. And if you’re still operating without one, you’re breaking it.

What Exactly Is a CASP?

A CASP is any company that provides one or more crypto services to clients on a professional basis. That includes custody services, trading platforms, exchanging crypto for euros or dollars, executing trades for customers, selling new crypto tokens, or even giving financial advice about crypto. It doesn’t matter if you’re a startup in Lisbon or a firm based in Singapore - if you serve EU customers, you need to be licensed.There’s no loophole for decentralized platforms. MiCA only covers legal entities with a physical presence and identifiable management. That means most DeFi protocols, DAOs, and anonymous smart contracts are effectively blocked from operating legally in the EU. A University of Zurich study found that 68% of DeFi projects have chosen to avoid the EU entirely because of this.

The One-Stop Passport System - And Why It Matters

Before MiCA, crypto firms had to get licensed in each EU country separately. That meant dealing with 27 different regulators, 27 sets of rules, and costs that could hit €350,000 per country. Now, you apply once. Get approved by one National Competent Authority (NCA) - like France’s AMF, Germany’s BaFin, or Lithuania’s Bank of Lithuania - and you can offer services across all 27 EU countries.This passporting system is the biggest reason why firms are applying. Kraken got licensed in France in March 2025 and expanded to 15 other EU markets within 30 days. Bitstamp got approved in the Czech Republic and went live across the bloc in weeks. No extra paperwork. No new applications. Just one license, one approval, full EU access.

But here’s the catch: the approval process is slow, uneven, and under-resourced. Germany’s BaFin takes an average of 6 months. Spain’s CNMV takes 9. Estonia’s processing time has stretched to 11 months. ESMA’s own data shows 42% of NCAs don’t even have enough staff to handle crypto applications properly. One founder on Reddit said they submitted to France’s AMF in January 2025 - and still had no decision six months later. MiCA says 6 months. Reality says otherwise.

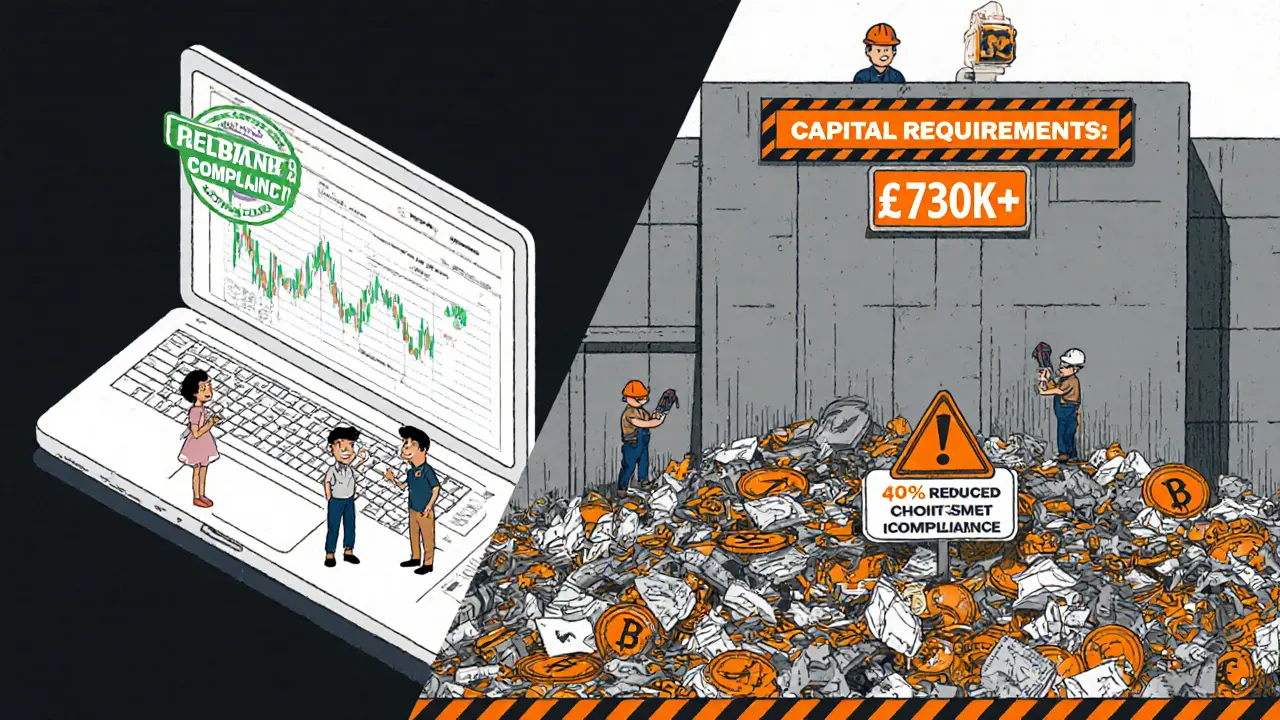

How Much Does It Cost to Get Licensed?

This isn’t a cheap process. The minimum capital requirements alone are steep:- €125,000 for custody services

- €150,000 for exchange services

- €730,000 for operating a trading platform

But capital is just the start. You’ll need:

- An EU-based legal entity with at least one director living in the country where you apply

- A full AML/KYC system compliant with the 6th Anti-Money Laundering Directive

- Data security systems that meet the NIS2 Directive standards

- Environmental impact reports detailing your energy use - yes, even if you use proof-of-stake

- Transaction monitoring tools costing up to €1.2 million to implement

- At least 5-7 full-time compliance staff dedicated to MiCA

PwC’s August 2025 report found the total cost of authorization ranges from €750,000 for basic custody to €2.5 million for a full trading platform. For smaller firms, that’s more than their entire annual revenue. And if you’re not based in the EU, you’re facing an even steeper hill: 68% of non-EU applicants underestimated how hard it is to set up local management.

Who Counts as a ‘Significant CASP’?

If your platform has more than 15 million active EU users, you’re automatically labeled a ‘significant CASP’ (sCASP). That brings extra rules:- Quarterly stress tests

- Annual third-party audits

- Real-time transaction monitoring

- Direct supervision by your NCA - not just paperwork, but active oversight

That’s why giants like Kraken, Bitstamp, and Coinbase are rushing to get licensed. They’re not just complying - they’re positioning themselves as the only safe, legal options for EU users. Meanwhile, smaller players are getting squeezed out. As of August 2025, 89 firms are authorized - but they control 62% of all EU crypto trading volume. The market is becoming a two-tier system: big players with deep pockets, and everyone else trying to survive.

The Environmental Reporting Trap

One of MiCA’s most controversial rules is the requirement to report energy consumption. Even if your platform runs on proof-of-stake - which uses 99.9% less energy than Bitcoin mining - you still have to calculate and publish your environmental impact using the EU’s Blockchain Observatory methodology.Industry groups like Blockchain for Europe call this a joke. They say it ignores technological progress and adds €200,000-€500,000 in annual compliance costs for mid-sized exchanges. Professor Angela Walch from the University of Luxembourg called it ‘the green mirage’ - a regulatory box-ticking exercise that doesn’t reduce emissions but stifles innovation.

Still, it’s mandatory. And if you don’t report, you don’t get licensed. Even firms that use zero-energy consensus mechanisms have to submit reports. It’s not about reality - it’s about perception.

Stablecoins and the Reserve Problem

MiCA requires asset-referenced tokens (like USDC or EURC) to hold 1:1 reserves in cash or cash equivalents. Sounds simple. But the European Banking Authority warned in March 2025 that this might not be enough during a crisis. Remember the USDC depeg in March 2023? That happened even though it was supposedly fully backed.Now, regulators are asking: What if a bank holding those reserves fails? What if there’s a run on stablecoins? MiCA doesn’t require those reserves to be held in liquid, immediately accessible assets - just ‘equivalent value.’ That’s a gap. And experts say it could trigger another collapse.

What Happens After You Get Licensed?

Getting approved isn’t the end. It’s the beginning of ongoing compliance:- You must disclose all crypto assets you list - and only those that meet MiCA’s strict safety criteria. Many altcoins have been removed from EU platforms because they don’t qualify.

- You’re required to show users mandatory risk warnings before every trade. Users hate them. 41% of negative reviews on Trustpilot call them ‘excessive’ and ‘bad for UX’.

- You need to segregate client assets from your own. No mixing funds. Ever.

- You must prove you have enough reserves to cover all client holdings - proof-of-reserves is now mandatory.

These rules are working. Trustpilot ratings for MiCA-licensed exchanges average 4.1/5, with 63% of users praising improved security and transparency. But they’re also reducing choice. The number of available crypto assets on EU platforms has dropped by nearly 40% since MiCA launched.

Who’s Winning? Who’s Losing?

The winners are clear:- Large exchanges with global reach (Kraken, Bitstamp, Coinbase)

- Traditional financial firms (J.P. Morgan found 78% of banks won’t enter crypto unless it’s MiCA-compliant)

- EU countries with strong regulators (France, Germany, Lithuania)

The losers:

- Small crypto startups without deep pockets

- DeFi protocols that can’t identify a legal entity

- Users who want access to niche tokens or lower fees

- Non-EU firms that thought they could operate remotely

And then there’s the gray area: firms still operating under old national licenses. As of May 2025, 34% of crypto businesses in the EU are still under pre-MiCA rules. But that ends on July 1, 2026. After that, no exceptions. No grace period. No warnings.

What’s Next? MiCA 2.0 and the Future

The European Commission is already working on MiCA 2.0, expected in late 2025 or early 2026. This version aims to tackle DeFi, NFTs, and algorithmic stablecoins using a ‘functional approach’ - meaning regulation based on what a service does, not what it’s called.Real-time transaction monitoring starts January 2026. The new Anti-Money Laundering Authority (AMLA) will take over cross-border AML supervision in June 2026. And while the Digital Euro is still speculative, regulators are quietly preparing for integration.

For now, the message is clear: if you want to operate in the EU crypto market, you need to be licensed, compliant, and ready for long-term oversight. There’s no shortcut. No workaround. Just one path - and it’s expensive, slow, and unforgiving.

Do I need a CASP license if I’m based outside the EU?

Yes. If you serve EU customers - even one - you need a CASP license. MiCA applies based on where your users are, not where your company is registered. Non-EU firms must set up a legal entity within the EU and appoint a local director. You can’t operate remotely under MiCA.

How long does it take to get a CASP license?

MiCA says 6 months, but in practice, it takes 6-11 months depending on the country. Germany takes around 6 months, Spain 9, and Estonia has hit 11. Delays are common due to understaffed regulators. Start early and prepare for a longer wait.

Can DeFi platforms get licensed under MiCA?

No. MiCA only applies to legal entities with identifiable management and a registered office. DeFi protocols, DAOs, and anonymous smart contracts don’t qualify. That’s why 68% of DeFi projects have chosen to avoid the EU market entirely.

What happens if I don’t get licensed by July 2026?

After July 1, 2026, operating without a CASP license in the EU is illegal. You could face fines, asset freezes, or criminal charges. EU regulators will block your services, and payment processors will cut you off. There will be no grace period.

Is MiCA better than U.S. crypto regulation?

It’s more predictable. The U.S. has no unified crypto framework - firms must comply with the SEC, CFTC, and 50 state regulators. MiCA gives you one rulebook for 27 countries. But MiCA is stricter on capital, environment, and disclosure. The U.S. is looser but riskier. For pan-European operations, MiCA wins. For global reach, U.S. rules may be easier to navigate - if you can survive the legal chaos.

Vanshika Bahiya

November 14, 2025 AT 23:33Just finished setting up our CASP license in Lithuania-took 8 months, but worth it. The passport system really saves time if you pick the right NCA. We’re now live in 12 countries without extra paperwork. For small teams, the compliance burden is brutal, but if you’re serious about EU growth, there’s no alternative. Start early, hire a local legal rep, and don’t trust the 6-month timeline. Reality is slower, but it’s doable.

Albert Melkonian

November 15, 2025 AT 01:20While MiCA's regulatory framework is undeniably rigorous, its structural integrity offers an unprecedented level of legal certainty for institutional participants. The harmonization of capital requirements, AML/KYC protocols, and environmental reporting standards across 27 jurisdictions represents a monumental step toward the maturation of digital asset markets. Although compliance costs are substantial, they serve as a necessary filter to eliminate speculative actors and promote fiduciary responsibility. The long-term outcome may well be a more resilient, transparent, and trustworthy crypto ecosystem.

Kelly McSwiggan

November 15, 2025 AT 17:52So let me get this straight-we’re forcing startups to spend $2.5M to prove they’re not a scam, while the regulators who approved this are still using Excel sheets to track applications? Classic. The environmental reports for PoS? Hilarious. Next they’ll want us to submit carbon footprints for our coffee mugs. This isn’t regulation. It’s bureaucratic theater with a side of market consolidation.

Byron Kelleher

November 17, 2025 AT 10:03Big picture: MiCA is like putting seatbelts in a race car. It slows you down, sure-but now you can actually finish the race without ending up in the hospital. Small teams are getting crushed, no doubt. But if you’re building something real, not just flipping tokens, this is the price of legitimacy. The users who care about safety? They’re grateful. The ones who just want to gamble? They’ll find another playground. And honestly? Good riddance.

Cherbey Gift

November 19, 2025 AT 04:36Oh honey, this isn’t regulation-it’s a funeral for crypto’s soul. They took the wild, chaotic, beautiful mess of DeFi and stuffed it into a three-piece suit with a tie made of compliance forms. Now every smart contract has to file a tax return. Every DAO has to appoint a CEO who drinks espresso in Brussels. The blockchain was supposed to be free, baby-now it’s got HR policies and mandatory energy audits. We didn’t build a decentralized future-we built a regulated zoo where only the big cats get fed.

Anthony Forsythe

November 20, 2025 AT 00:20Think about it: MiCA isn’t just a law-it’s a philosophical statement about power. It says: ‘If you cannot be seen, if you cannot be named, if you cannot be held accountable by a human being in a government building-you do not exist in this economy.’ We are witnessing the death of anonymity as a value, the surrender of decentralization to the altar of bureaucratic control. The question isn’t whether MiCA works-it’s whether we want a crypto that is safe, or a crypto that is free. And the answer, for now, is clear: safety wins. But at what cost to the spirit of the movement?

Kandice Dondona

November 21, 2025 AT 17:23Y’all are stressing too much 😊 The license is a pain, but look at the upside-users actually trust these platforms now! No more ‘is this exchange legit?’ drama. And the risk warnings? Yeah, they’re annoying-but they’re saving people from stupid trades. I’ve seen friends get scammed before MiCA. Now? They’re safer. It’s not perfect, but it’s progress 🙌 Let’s not forget: crypto’s future isn’t about being wild-it’s about being trusted. And trust? It costs money. Worth it.

Becky Shea Cafouros

November 23, 2025 AT 01:22Interesting how the EU mandates energy reports for PoS but ignores the fact that the entire banking system uses more electricity than all crypto combined. The hypocrisy is almost poetic. Also, 730k minimum capital? That’s not a licensing fee-that’s a startup tax on ambition. And don’t get me started on the ‘local director’ requirement. So now I need to fly someone from Berlin to Lisbon just to sign papers? This isn’t innovation-it’s red tape with a blockchain sticker on it.

Drew Monrad

November 24, 2025 AT 06:57Let’s be real-MiCA was written by bankers who lost money on Bitcoin in 2017 and now want to control it. The ‘one-stop passport’? A trap. The first country to approve you? They’ll demand you hire their cousins. The regulators are drowning in applications because they don’t want to say yes. They’re scared. And the big exchanges? They’re laughing all the way to the bank because they bought off the lobbyists. This isn’t regulation-it’s a cartel setup. And you’re all just playing along.

Cody Leach

November 25, 2025 AT 08:32My team spent six months preparing the application. We hired a compliance officer, upgraded our systems, moved our legal entity to Lithuania. It was exhausting. But now we’re live across the EU, and our user retention has gone up 30%. People are actually staying because they feel safe. The cost was high, but the ROI isn’t just financial-it’s reputational. If you’re building for the long term, MiCA isn’t a wall. It’s a foundation.

sandeep honey

November 27, 2025 AT 06:49Why are people surprised? This is what happens when you try to regulate something that was designed to escape regulation. MiCA is like putting a leash on a tornado. The big players will adapt because they have lawyers. The rest? They’ll vanish. And the users? They’ll migrate to offshore platforms or just stop using crypto. The EU thinks it’s controlling the future-but it’s just making itself irrelevant to the next generation of builders.

Mandy Hunt

November 27, 2025 AT 18:18They’re watching you. Every click. Every trade. Every wallet. The digital euro is coming and MiCA is just the first step. They want to know what you bought, when you bought it, and how much energy it took. They’re not protecting you-they’re building a financial prison with compliance bars. And the worst part? You’re all volunteering to walk in. Just wait till they start taxing your private keys.

anthony silva

November 28, 2025 AT 17:27They spent 2 years writing this and still didn’t fix the reserve problem for stablecoins? LOL. So now we have a $2M license just to run a system that could collapse next Tuesday because someone’s bank failed? Classic EU. You spend millions to build a house… then forget to put in the roof

David Cameron

November 29, 2025 AT 05:50There’s a difference between control and order. MiCA tries to force order onto a system that thrives on chaos. The irony? The most decentralized parts of crypto-DeFi, DAOs, peer-to-peer swaps-are the ones most people actually use. The regulated platforms? They’re just banks with crypto buttons. We didn’t need more rules. We needed more freedom. But freedom scares people. So they made a rulebook instead.