Curve (Avalanche) Crypto Exchange Review: Fact Check and Real Alternatives

Nov, 15 2025

Nov, 15 2025

Stablecoin Swap Cost Calculator

Why This Matters

Curve (Ethereum) has lower slippage but much higher gas fees. Avalanche DEXs like Trader Joe offer faster transactions at near-zero fees, though with slightly higher slippage. This calculator helps you see the real cost trade-off.

Cost Comparison

Enter an amount to see the cost difference.

There’s no such thing as Curve (Avalanche) - at least not yet. If you’re searching for a Curve exchange running on Avalanche, you’re not alone. Many users assume Curve Finance, the popular stablecoin DEX, is available on Avalanche because both are big names in DeFi. But here’s the truth: Curve Finance is built on Ethereum. It was never launched on Avalanche. What you’re seeing online are either misunderstandings, misleading ads, or third-party bridges trying to mimic the experience.

What Curve Finance Actually Is

Curve Finance is a decentralized exchange designed for one thing: swapping stablecoins with almost no slippage. Launched in January 2020 by Michael Egorov, it uses a special algorithm that works best when trading assets that are meant to have the same value - like USDT, USDC, DAI, and BUSD. On Ethereum, Curve can execute a USDC to DAI swap with as little as 0.04% slippage. Compare that to Uniswap, where the same trade might cost you 0.3% or more. That’s a 75% reduction in price impact.

How does it do this? Curve doesn’t use the standard constant product AMM model (like Uniswap). Instead, it uses a stableswap formula that keeps prices stable even when large trades happen. It’s why institutions and retail traders alike use Curve for moving between stablecoins without losing value. The trade-off? Curve isn’t good for trading volatile assets like ETH to SOL. For that, you need a different kind of DEX.

Curve’s native token, CRV, gives users voting power and a share of trading fees. But you can’t stake CRV directly on Avalanche. It’s locked on Ethereum. And yes - Ethereum gas fees can spike. During peak times, a single swap can cost $15 or more. That’s why people look elsewhere.

What Avalanche Actually Offers

Avalanche is a completely different blockchain. Launched in September 2020 by Ava Labs, it’s built for speed and low cost. It doesn’t compete with Ethereum on popularity - it competes on performance. Avalanche handles 4,500 transactions per second. Ethereum manages 15-30. Avalanche finalizes trades in under one second. Ethereum takes 12-15 seconds. Transaction fees on Avalanche? Around $0.00025. On Ethereum during congestion? $10-$50.

Avalanche has three blockchains working together: the X-Chain for creating assets, the P-Chain for managing validators, and the C-Chain for smart contracts. The C-Chain is EVM-compatible, meaning Ethereum tools like MetaMask and Solidity contracts work on it. That’s why people think Curve could run here - and they’re not wrong technically. But no official version exists.

Avalanche’s native token, AVAX, is used for fees, staking, and securing the network. As of late 2024, about 42.4% of the 720 million AVAX supply is in circulation. JPMorgan’s Onyx division even uses Avalanche subnets for stablecoin settlement, processing nearly half a billion dollars in transactions with 99.998% uptime.

Why People Think Curve Is on Avalanche

The confusion comes from three places:

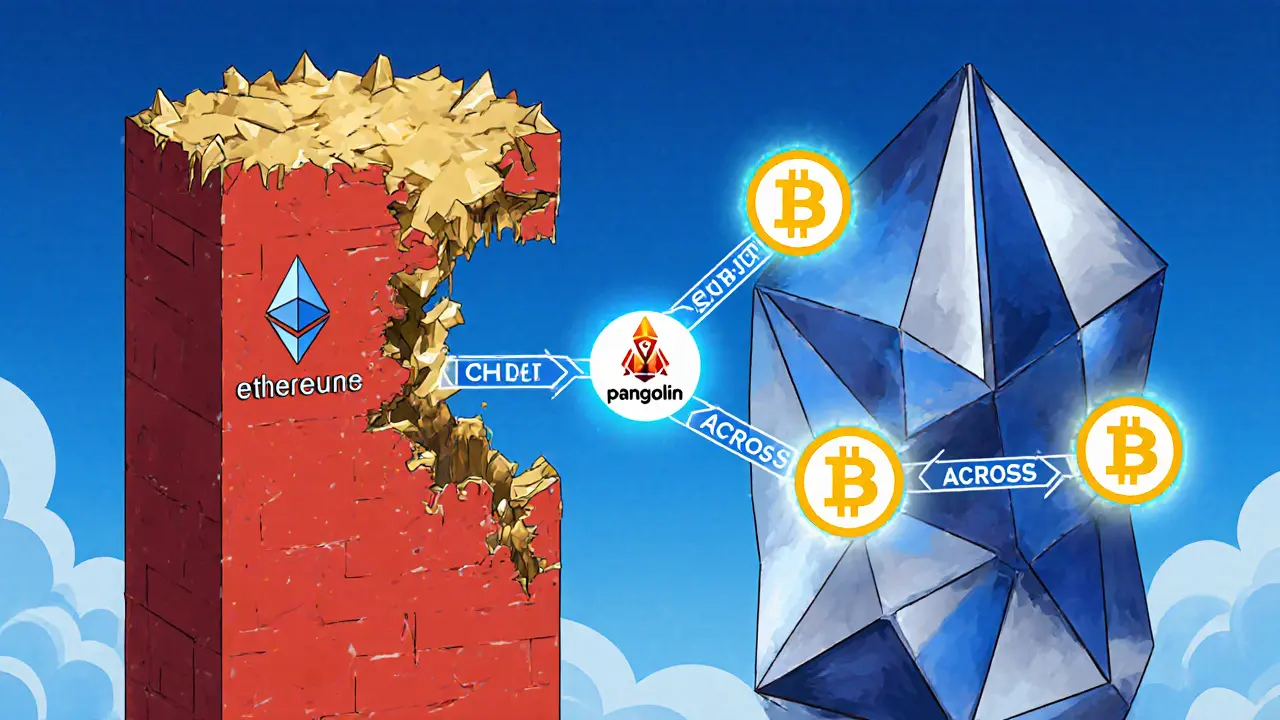

- Bridge services: Platforms like Synapse, Across, or LayerZero let you move stablecoins from Ethereum to Avalanche. Once there, you can swap them on Avalanche DEXs - but not on Curve. You’re just using Curve’s assets, not Curve’s engine.

- Marketing copy: Some crypto sites and YouTube videos say “Curve on Avalanche” to attract traffic. They’re not lying - they’re just being misleading. You’re not using Curve’s protocol. You’re using a bridge and a different DEX.

- Future speculation: Curve’s GitHub shows experimental code for EVM-compatible chains. Some developers are testing Curve’s algorithm on Avalanche’s C-Chain. But this is still in early research. No live product exists.

Don’t trust any website that says “Join Curve on Avalanche.” If it’s asking you to deposit funds directly to a contract labeled “Curve Avalanche,” it’s likely a scam.

Real Alternatives on Avalanche

If you want Curve-like performance on Avalanche, you need to use the DEXs that actually run there. Here are the top three:

- Trader Joe: The biggest DEX on Avalanche with 58.7% of the chain’s total DeFi value locked (TVL). It offers low-slippage swaps on stablecoin pairs and has a built-in yield aggregator. Its Joe token rewards liquidity providers.

- Pangolin: A fast, simple interface built for beginners. It supports over 100 tokens and has a strong community. Its AVAX-based liquidity pools often offer higher APYs than Ethereum equivalents.

- Benqi: Not a DEX, but a lending protocol that also offers swap functionality. It’s great if you want to borrow against your stablecoins or earn interest while swapping.

Trader Joe’s USDC/DAI pair has slippage around 0.06% - close to Curve’s 0.04%. It’s not perfect, but it’s fast, cheap, and real. And unlike Curve, you don’t need to bridge from Ethereum to use it.

Performance Comparison: Curve vs. Avalanche DEXs

| Feature | Curve Finance (Ethereum) | Trader Joe (Avalanche) | Pangolin (Avalanche) |

|---|---|---|---|

| Slippage on USDC/DAI | 0.038% - 0.04% | 0.05% - 0.07% | 0.06% - 0.09% |

| Transaction Fee | $1.50 - $15+ | $0.0002 - $0.001 | $0.0002 - $0.001 |

| Finality Time | 12-15 seconds | <1 second | <1 second |

| Stablecoin Pairs Available | 22+ (USDT, USDC, DAI, FRAX, etc.) | 12+ (USDC, DAI, USDT, mimUSD) | 10+ (USDC, DAI, USDT) |

| Native Token | CRV | JOE | PNG |

| Best For | Large stablecoin swaps, low slippage | Speed, yield farming, ease of use | Beginners, low fees, simple UI |

Bottom line: Curve still wins on slippage. But Avalanche DEXs win on cost, speed, and accessibility. If you’re swapping $10,000 in USDC to DAI, Curve saves you $3-$4. But if you’re swapping $500 every day, Avalanche saves you $500+ in fees per month.

Who Should Use What?

If you’re trading large amounts of stablecoins and don’t mind paying Ethereum gas fees, Curve is still the best. It’s used by hedge funds and DeFi protocols because of its reliability.

If you’re a retail trader, yield farmer, or just want to swap tokens without waiting or paying $10 in fees, use Trader Joe or Pangolin on Avalanche. You’ll get 95% of Curve’s performance at 1/100th the cost.

And if you’re thinking about bridging your assets from Ethereum to Avalanche just to use Curve? Don’t. The bridge adds risk. There have been reports of 3.7% of bridged assets experiencing delays over 15 minutes. That’s not worth it for a swap you could do in 5 seconds on Avalanche anyway.

Future Outlook

Curve’s team is exploring EVM-compatible chains. GitHub commits from October 2024 show testing for Avalanche compatibility. But nothing is live. Even if Curve launches on Avalanche, it won’t be a copy-paste job. The team will need to rebuild liquidity pools, adjust fee structures, and onboard new users.

Avalanche’s Banff upgrade in November 2024 cut cross-subnet delays by 63%. That means future DEXs on Avalanche will get even faster. If Curve ever arrives, it’ll be on a much better platform than it is today.

For now, treat “Curve on Avalanche” as a myth. Use the real tools. Use Trader Joe. Use Pangolin. Use Avalanche’s native ecosystem. You’ll save money, time, and stress.

Frequently Asked Questions

Is there a Curve Finance app on Avalanche?

No. Curve Finance only operates on Ethereum. Any website or wallet claiming to offer Curve on Avalanche is either mistaken or running a scam. You can use bridges to move stablecoins to Avalanche, but you’ll be swapping them on Trader Joe or Pangolin - not Curve.

Why do people say Curve is on Avalanche?

It’s usually due to misleading marketing. Some crypto influencers and sites use “Curve on Avalanche” as a clickbait phrase because both names are popular. Others confuse the concept of bridging stablecoins (which is possible) with running Curve’s actual protocol (which isn’t).

Which is cheaper: Curve on Ethereum or Trader Joe on Avalanche?

Trader Joe on Avalanche is dramatically cheaper. A single swap on Curve can cost $1-$15 depending on Ethereum congestion. On Trader Joe, it costs less than $0.001. For frequent traders, Avalanche saves hundreds per month.

Can I stake CRV on Avalanche?

No. CRV is an Ethereum-native token. You can’t stake it on Avalanche. You can only hold it or use it for governance on Ethereum. Some bridges let you wrap CRV into a token on Avalanche, but that’s not the same as staking the real token or earning real governance rights.

Should I bridge my assets from Ethereum to use Avalanche DEXs?

Only if you already have assets on Ethereum and want to take advantage of Avalanche’s low fees. But don’t bridge just to chase a “Curve on Avalanche” myth. Use Avalanche-native tokens like USDC.e or mimUSD directly. They’re already on-chain and ready to trade on Trader Joe or Pangolin without bridging risk.

Final Takeaway

Curve Finance is a powerful tool - but only on Ethereum. Avalanche is a faster, cheaper blockchain - and it has its own top-tier DEXs. Don’t waste time looking for something that doesn’t exist. Use what’s real. Use Trader Joe. Use Pangolin. Save money. Trade faster. And skip the hype.

Mike Calwell

November 16, 2025 AT 01:17curve on avalanche? lol nope. just saw some youtuber say it and thought i was late to the party. turned out it was just a bridge scam. saved me $20 in gas tho.

Nidhi Gaur

November 16, 2025 AT 02:16you people still falling for this? curve’s on eth, avalanche’s got trader joe. if you’re bridging just to ‘use curve’ you’re paying 10x the fee for 90% of the performance. this isn’t rocket science.

Usnish Guha

November 17, 2025 AT 10:46if you’re using any dex that isn’t curve, you’re just gambling with your stablecoins. slippage isn’t a suggestion, it’s a law. anyone who says ‘trader joe is close enough’ hasn’t moved $50k yet. i’ve lost $12k to fake curve scams. don’t be next.

satish gedam

November 18, 2025 AT 08:12hey newbies, chill! 😊 curve ain’t on avalanche, but trader joe is *literally* the same vibe-low slippage, cheap fees, and you don’t need to bridge anything. just use usdc.e or mimusd on avax and you’re golden. you’re not missing out, you’re winning. trust me, i’ve been in this since 2021. 🙌

Grace Craig

November 19, 2025 AT 08:32It is profoundly disingenuous to conflate the functional architecture of a decentralized exchange with the mere transportation of asset liquidity across heterogeneous layer-1 ecosystems. Curve Finance, as a protocol, is not merely a UI or a liquidity pool-it is a mathematical construct grounded in the stableswap invariant, implemented exclusively on Ethereum’s EVM. To suggest that Trader Joe constitutes a functional equivalent is not merely inaccurate-it is epistemologically negligent.

rahul saha

November 20, 2025 AT 04:19curve on avax? more like curve on delusion 😅. we’re all just trying to find the holy grail of zero slippage… but maybe the real truth is we’re all just addicted to the chase. zen and the art of defi maintenance, bro.

Ninad Mulay

November 21, 2025 AT 10:04in india, we call this ‘jugaad’-using a bridge to fake curve on avax. but honestly? i’ve been using trader joe for 8 months. 0.06% slippage, $0.0003 fee, and my grandma can use it. curve’s cool, but it’s like driving a ferrari to buy milk. why not use the scooter that doesn’t cost $15 to start?

also, if you’re still paying $10 in gas to swap usdc to dai in 2024, you’re either rich or confused. and if you’re rich, why are you even here? 😏

avax isn’t trying to be ethereum. it’s trying to be better for the people who actually use it. curve’s for hedge funds. trader joe’s for the rest of us. no shame in that.

ps: if you see ‘curve avalanche’ on telegram, block it. i got phished once. lost 3k. never again.

Marcia Birgen

November 21, 2025 AT 18:33thank you for this breakdown!! 🙏 i was so confused by all the ‘curve on avax’ ads. i thought i was late to the party 😅 now i know i just avoided a scam. trader joe is my new bestie. just swapped 2k usdc to dai in 2 seconds for $0.0008. i’m crying happy tears. 💖

Jerrad Kyle

November 22, 2025 AT 00:59the real win here isn’t just that avalanche’s cheaper-it’s that you don’t need to be a blockchain engineer to use it. curve’s amazing, but its gas fees make it feel like a members-only club. trader joe? anyone with a phone can use it. that’s not just innovation-that’s inclusion.

also, the banff upgrade? genius. avax’s speed isn’t a feature, it’s a culture shift. we’re moving from ‘wait for the blockchain’ to ‘just do it.’

and if you’re still bridging? just stop. you’re not saving money. you’re just moving your risk from one place to another. use native tokens. it’s easier. safer. smarter.

Nathan Ross

November 22, 2025 AT 16:46curve is eth only. trader joe is avax native. no bridge needed. no confusion. just facts. stop letting marketing cloud your judgment. the numbers are clear. the data is public. use what works.

Jess Zafarris

November 24, 2025 AT 12:17so… curve on avalanche is a myth… but somehow 70% of the crypto influencers still say it’s real? interesting. i guess the algorithm rewards ‘clickbait truth’ over actual truth. who knew?

Jay Davies

November 25, 2025 AT 13:06the table is accurate, but you missed one critical point: Curve’s liquidity depth is still 5x greater than Trader Joe’s on major pairs. For swaps over $50k, Curve still wins on price impact. So yes, Trader Joe is better for retail-but institutional traders still need Curve. That’s not a flaw in Avalanche; it’s just market structure.

Usama Ahmad

November 26, 2025 AT 20:51yeah i was confused too but this post cleared it up. trader joe is fine for me. no bridge, no stress. just swap and go. thanks for the real talk.

Bill Henry

November 27, 2025 AT 10:47so curve’s not on avax… but i just saw a tweet from a ‘curve team’ account saying they’re launching soon? is that legit or just bots?

satish gedam

November 28, 2025 AT 08:09that tweet’s fake. 🚫 curve’s official twitter hasn’t posted about avax since 2022. if they were launching, they’d announce it on their blog + github + discord. not some random tweet with a link to a wallet. i checked. it’s a phishing site. don’t click.