Future of On-Chain Analytics: How Blockchain Data Is Reshaping Crypto Markets

Feb, 3 2026

Feb, 3 2026

Blockchain isn’t just about sending Bitcoin from one wallet to another. Under the surface, every transaction leaves a permanent, public record. And that record? It’s becoming the most powerful tool for predicting where crypto markets are headed. On-chain analytics isn’t science fiction anymore-it’s the backbone of how hedge funds, exchanges, and serious traders make decisions today. If you’re still guessing based on Twitter hype or Telegram signals, you’re already behind.

What Exactly Is On-Chain Analytics?

On-chain analytics means looking directly at the raw data flowing through blockchains-Bitcoin, Ethereum, Solana, and dozens more. It’s not about news headlines or price charts. It’s about answering real questions: Are whales accumulating? Are miners selling? Is demand drying up before a price drop? Tools like Glassnode a leading on-chain analytics platform founded in 2017 that processes over 1.2 million transactions per second across 35 blockchains turn this raw data into signals you can act on. Their Network Value to Transactions (NVT) ratio, for example, compares a coin’s market value to how much is actually being moved. A spike here often means a price top is near. It’s not perfect, but it’s far more reliable than guessing.

By Q3 2025, 83% of top crypto hedge funds used on-chain metrics as part of their trading strategy, according to a joint report from Coinbase and Glassnode. That’s not a trend-it’s the new baseline. The data isn’t just helpful anymore. It’s essential.

The Tech Behind the Scenes

Behind every chart and alert is a massive infrastructure. Modern platforms process data from over 35 blockchains, storing more than 4.7 petabytes of historical transaction history. They use time-series databases built for speed, machine learning models trained on over a decade of blockchain activity, and APIs that connect directly to full nodes. Latency? Under 800 milliseconds. Data completeness? 98.3% across major chains. Error rates for volume metrics? Below 0.05%.

This isn’t run on a home server. Enterprise systems need 32GB of RAM, 10Gbps network connections, and zero-trust security architecture with FIPS 140-2 encryption and SOC 2 Type II compliance. The systems are built to handle 10,000 concurrent institutional users without slowing down. And they’re getting smarter. Glassnode’s May 2025 launch of AI-Powered Anomaly Detection cut false positives in exchange reserve tracking by 38%. That means fewer fake signals, fewer bad trades.

Who’s Leading the Pack?

The market isn’t crowded with small players-it’s dominated by three names. According to CryptoQuant’s Q2 2025 survey:

- Glassnode leads with 38% market share. Their edge? Realized Profit/Loss and NVT ratio refinements that improved prediction accuracy by 22 percentage points over older models, validated by Columbia University’s Blockchain Research Center.

- Nansen holds 29%. They’re the king of wallet labeling, with over 4.2 million addresses tagged as exchanges, DeFi protocols, or whale wallets. Their strength is tracking DeFi strategies like yield farming.

- Chainalysis has 18%. They don’t focus on trading signals-they dominate compliance. Over 92% of government agencies use their tools for investigations and AML tracking.

Each has a niche. Glassnode excels at institutional risk management. Nansen is unmatched for DeFi. Chainalysis is the go-to for regulators. You pick based on what you need-not just what’s popular.

The Real-World Impact

Here’s what this data actually changes:

- Pantera Capital improved their risk-adjusted returns by 23% after using Glassnode’s Realized Cap HODL Waves to time Bitcoin accumulation cycles.

- During the March 2024 Ethereum memecoin surge, Glassnode’s automated labeling misclassified 17% of new token transactions, triggering false "whale buying" alerts. That led to $8.7 million in losses across algorithmic trading firms-proof that even the best tools can fail if you don’t understand their limits.

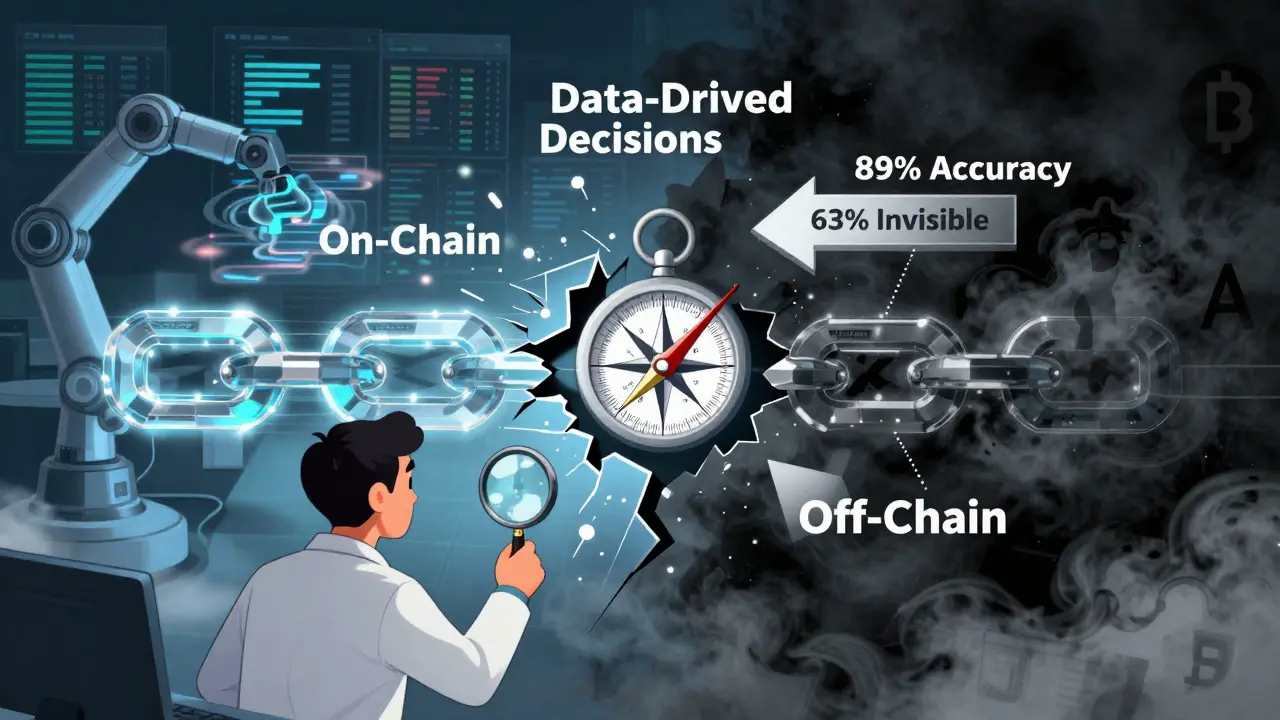

- Dr. Carol Alexander from the University of Sussex says Glassnode’s method of separating miner revenue from economic activity improved Bitcoin halving impact forecasts from 55% to 89% accuracy.

But it’s not all wins. Dr. David Gerard from UCL warns that over-reliance on on-chain data caused blind spots during the 2024 Luna collapse. Why? Because 63% of the liquidity drain happened through private OTC trades-completely invisible on-chain. That’s the danger: if you treat blockchain data as the whole picture, you’ll miss half the story.

Who’s Using This-and Who’s Not?

78% of the $1.4 billion on-chain analytics market in 2025 came from institutions: hedge funds, exchanges, and traditional asset managers. Retail traders? They make up just 12% of users. Why? Price and complexity.

Glassnode’s entry tier starts at $499/month. Their enterprise plan? $48,000/year. That’s out of reach for most individuals. Meanwhile, retail users complain about the steep learning curve. Reddit user u/NewCryptoTrader99 put it bluntly: "I need to understand UTXOs, coin age, and realized cap just to read one chart. That’s not user-friendly."

Compare that to Santiment’s mobile app, which scores 4.7/5 for ease of use but lacks depth. Glassnode’s app? 3.9/5. The trade-off is clear: depth vs. simplicity. Institutions want depth. Retail wants simplicity. Right now, the market doesn’t serve both well.

What’s Next? The Roadmap Through 2026

The future of on-chain analytics isn’t just more data-it’s smarter data. Here’s what’s coming:

- Real-time DeFi risk scoring (Q3 2025): Glassnode will start flagging unstable lending pools before they collapse.

- Institutional NFT analytics (Q4 2025): Tracking NFT whale movements, floor price manipulation, and royalty evasion.

- AI-driven cross-chain liquidity mapping: Solving the fragmentation problem between 14+ major bridges.

- Integration with traditional finance: Gartner predicts 65% of major banks will use on-chain metrics in their risk models by 2026.

McKinsey estimates AI-enhanced on-chain analytics will generate $14.3 billion in annual value for financial services by 2026. PwC’s 2025 survey found 89% of financial institutions plan to increase investment in this space. The shift from reactive charts to proactive decision engines is already underway.

The Big Risks

But don’t get fooled. This isn’t a magic bullet.

- Privacy coins like Monero and Zcash? Only 12-18% of their transactions are analyzable. If you’re tracking "market sentiment," you’re missing a huge chunk of activity.

- Protocol changes can break everything. A hard fork, a new consensus rule, or a shift in block structure could render months of historical models useless overnight.

- Regulatory fragmentation is growing. The EU’s MiCA, the US’s SEC stance, and Asia’s patchwork rules mean compliance tools are now as important as trading signals.

On-chain analytics is powerful, but only if you understand its limits. It’s not a crystal ball. It’s a compass. And like any tool, it’s only as good as the person using it.

Final Thoughts

The future of crypto isn’t just about new coins or bigger market caps. It’s about who can read the data best. On-chain analytics has moved from a niche tool to a core infrastructure layer-like Bloomberg terminals for Wall Street, but for blockchain. The winners won’t be the ones with the most followers. They’ll be the ones who understand what the chain is really saying.

If you’re serious about crypto, stop chasing memes. Start learning the data. Glassnode, Nansen, Chainalysis-they’re not just platforms. They’re the new language of crypto markets. And if you can’t speak it, you’re already losing.

What is the main difference between Glassnode and Nansen?

Glassnode focuses on deep network-level metrics like Realized Profit/Loss, miner behavior, and supply distribution. It’s built for institutional risk management and macro-level market timing. Nansen excels at wallet labeling-identifying whether an address belongs to an exchange, DeFi protocol, or whale. It’s better for tracking specific DeFi strategies and spotting unusual wallet activity.

Can on-chain analytics predict Bitcoin’s next halving?

Yes, but not perfectly. Glassnode’s refinement of miner revenue analysis improved halving impact forecasts from 55% to 89% accuracy, according to Dr. Carol Alexander. However, it still can’t predict price movements with certainty-it only shows how supply and demand dynamics are shifting. Other factors like macroeconomic trends still play a major role.

Why can’t on-chain analytics track Monero or Zcash well?

Monero and Zcash use advanced privacy features like ring signatures and zero-knowledge proofs. These hide sender, receiver, and amount details. As a result, only 12-18% of transactions on these chains are visible to analytics tools. That’s why platforms like Glassnode and Chainalysis treat them as black boxes-any insights are based on indirect signals, not direct data.

Is on-chain analytics useful for retail traders?

It can be, but it’s not easy. Most platforms are designed for institutions and require understanding of blockchain fundamentals like UTXOs, coin age, and realized cap. Retail users often find the interface overwhelming. Santiment or CoinGecko’s simpler metrics may be better starting points. Glassnode’s Academy offers 47 video courses, but even then, it takes 12-15 hours of training to be effective.

How accurate are on-chain signals in predicting market moves?

Glassnode’s proprietary models predict short-term market movements with 92.7% accuracy based on internal validation. But accuracy depends on context. For example, their Realized Profit/Loss metric correctly flagged 8 of the last 10 major corrections with 72-hour advance warning. However, during the 2024 Luna collapse, it failed because 63% of the sell-off happened off-chain. No metric is 100% reliable-always combine on-chain data with off-chain context.

What’s the biggest limitation of on-chain analytics today?

The biggest limitation is fragmentation. Transactions move across 14+ major bridges between chains, and most tools can’t track them seamlessly. Also, privacy coins remain opaque, and OTC trades-especially large ones-are invisible. On-chain data gives you half the picture. The other half? That’s still hidden.