How Iran Uses Bitcoin Mining to Bypass International Sanctions

Aug, 8 2025

Aug, 8 2025

Bitcoin Mining Profit Calculator

Calculate how much Bitcoin you could mine based on your electricity costs and mining hardware efficiency. See how Iran's near-zero electricity costs give it an unprecedented advantage in Bitcoin mining operations.

At $0.01/kWh electricity cost, your mining operation would be highly profitable compared to global averages. This is exactly why Iran has been able to scale mining operations to 4.5% of the global network.

Power Grid Impact: Mining 1 BTC daily at Iran's electricity costs would consume approximately 1,500 kWh/day - enough to power over 100 homes in developed countries. In Iran, this energy is diverted from critical infrastructure like hospitals and schools, creating power shortages.

Iran’s Bitcoin mining isn’t just about making money-it’s about survival.

When the U.S. pulled out of the Iran nuclear deal in 2018, the world’s banking system slammed the door shut. SWIFT connections were cut. Dollar transactions became impossible. Foreign banks refused to touch Iranian money. For a country that depends on oil exports to feed its economy, this was a death sentence.

But Iran didn’t shut down. It turned on its lights.

Millions of kilowatts of electricity, once used to power homes and factories, started flowing into rows of humming Bitcoin miners. Not in hidden basements. Not in underground labs. But in massive, state-backed facilities in Rafsanjan, Khuzestan, and Bushehr-some run by the Islamic Revolutionary Guard Corps (IRGC), others by religious foundations with direct ties to the regime. These aren’t hobbyists. They’re industrial-scale operations, consuming the energy equivalent of 10 million barrels of oil per year just to generate Bitcoin.

By 2025, Iran accounted for 4.5% of the entire world’s Bitcoin mining power. That’s more than Russia. More than Canada. More than most European countries combined. And it’s all legal-on paper. The Iranian government issued over 10,000 mining licenses by 2022. It set up 90 domestic cryptocurrency exchanges. It even passed laws allowing crypto payments for imports. This wasn’t a loophole. It was policy.

How it works: Electricity, ASICs, and a parallel financial system

Iran doesn’t have cheap labor. It doesn’t have access to Western tech. But it has one thing no other sanctioned country can match: almost free electricity.

Natural gas is abundant. Power plants are old and inefficient. Instead of letting that wasted energy go to waste, the government redirected it to Bitcoin miners. In the U.S., electricity costs $0.05 per kWh. In Iran, miners pay next to nothing-sometimes less than $0.01-because the state absorbs the cost. For miners, this isn’t a business. It’s a subsidy program.

The hardware? Mostly Chinese-made ASIC miners. Smuggled in through Turkey, the UAE, and Pakistan. Even with sanctions, there’s always a way. Companies in Dubai and Hong Kong act as middlemen, rebranding shipments as "industrial equipment" or "server parts." Once inside Iran, these machines run 24/7, connected to power grids that prioritize mining over schools or hospitals.

The Bitcoin they produce doesn’t sit in wallets. It gets converted. Some is traded on Iranian exchanges for Iranian rials. Most is moved offshore-through Binance, TRON-based stablecoins, or shell companies in the UAE. By 2024, over $4.18 billion in cryptocurrency had left Iran. That’s not just a trickle. That’s a flood.

And here’s the real trick: once Bitcoin is in international hands, it becomes a currency. Iran buys medicine, food, and spare parts for its power plants using crypto. In August 2020, it made its first official import order using Bitcoin: $10 million worth of medical equipment. No banks. No intermediaries. No sanctions enforcement.

It’s not just mining-it’s a sanctions evasion machine

Bitcoin mining is only one part of Iran’s larger strategy. It’s paired with a shadow fleet of over 320 oil tankers that change flags, turn off transponders, and transfer cargo at sea. It’s paired with fake invoices, front companies in Bosnia and South Africa, and cryptocurrency wallets that change addresses daily.

The IRGC doesn’t just mine Bitcoin. It uses it to fund Hezbollah, the Houthis, and missile programs. Chainalysis and Elliptic have traced $8 billion in Bitcoin transactions since 2018 back to IRGC-linked wallets. These aren’t random hackers. These are state-directed financial operations.

Unlike North Korea, which steals crypto through hacks, Iran plays by the rules of the Bitcoin network. It doesn’t break the blockchain. It breaks the rules of the global financial system. And because Bitcoin is decentralized, there’s no central bank to freeze. No SWIFT code to cut. No correspondent bank to pressure.

Even when the U.S. Treasury names Iranian mining farms as sanctioned entities, it doesn’t matter. The miners keep running. The electricity keeps flowing. The Bitcoin keeps being mined. The system is designed to be resilient.

Why other sanctioned countries failed-while Iran succeeded

Venezuela tried. It created the Petro, a state-backed cryptocurrency backed by oil reserves. No one trusted it. No one used it. It was a propaganda tool, not a payment system.

North Korea stole crypto. It hacked exchanges, ran phishing scams, and laundered funds through mixers. But theft isn’t sustainable. It invites retaliation. And it doesn’t generate steady income.

Russia started mining after its own sanctions in 2022. It’s now the third-largest miner. But its operations are fragmented. No central coordination. No licensing system. No state-backed electricity subsidies. It’s reactive. Iran’s is strategic.

Iran’s model works because it’s integrated. Mining licenses. Domestic exchanges. Crypto import laws. Military-backed infrastructure. All of it connected. It’s not just a workaround. It’s a new financial layer built on top of the old one.

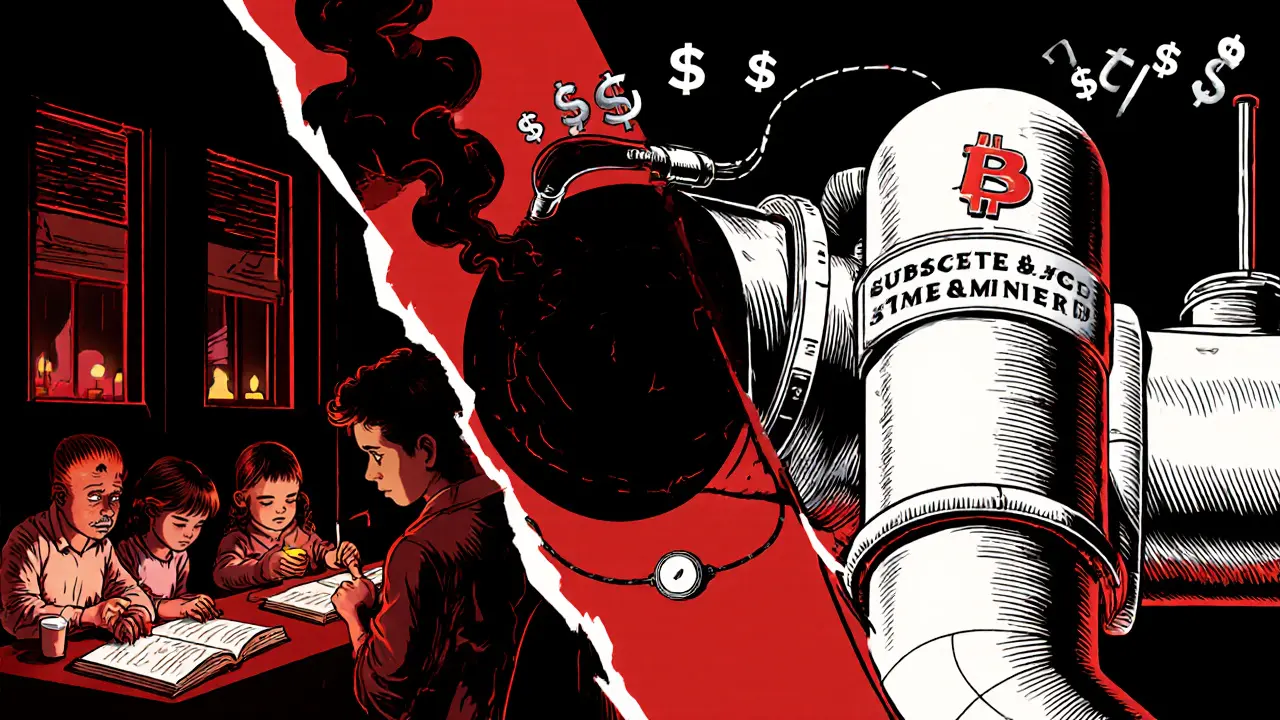

The hidden costs: Blackouts, inequality, and broken grids

But there’s a price.

Iran’s power grid is collapsing. In the summer of 2024, Tehran went dark for 14 hours straight. Factories shut down. Hospitals ran on generators. Students studied by candlelight.

Why? Because mining farms were sucking up 15% of the country’s total electricity. And they weren’t paying for it.

While ordinary Iranians struggle to afford heating in winter, the IRGC’s mining facilities run at full capacity. The government doesn’t cut power to them. It cuts power to homes.

And the money? It doesn’t reach the people. It goes to the Revolutionary Guard, religious foundations, and regime elites. The average Iranian citizen can’t access these crypto exchanges. They can’t get the licenses. They can’t get the subsidized power. The system is designed to benefit those in power-not those who need it most.

Can the world stop it?

International regulators are trying. FinCEN issued advisories in 2025 warning banks about Iranian-linked crypto flows. The EU is pressuring exchanges to block Iranian IPs. The U.S. has sanctioned over 40 mining entities.

But here’s the problem: Bitcoin doesn’t care about borders.

You can’t shut down a miner in Rafsanjan by blocking its IP. The miners use proxy servers, decentralized pools, and offshore wallets. Even if you ban one exchange, they move to another. If you freeze one wallet, they create ten more.

Blockchain analytics firms like TRM Labs can trace transactions-but they can’t stop them. The system is too distributed. Too resilient.

And the more the West tries to isolate Iran, the more it pushes Iran to innovate. Every sanction becomes a reason to build a better workaround.

What’s next for Iran’s crypto strategy?

Iran isn’t stopping. It’s scaling.

In 2025, new mining farms opened in Bushehr and Khuzestan, using surplus gas power and even solar panels. The government plans to increase mining capacity by 50% over the next two years. It’s developing its own digital currency, but not to replace Bitcoin-to complement it.

It’s also negotiating crypto cooperation deals with Russia, China, and even countries like Switzerland and Austria. Why? Because even Western nations are starting to see the value in bypassing the dollar system.

Iran’s goal isn’t to replace the global financial system. It’s to carve out a space where it doesn’t need it.

And right now, it’s working.

What this means for the rest of the world

Iran’s Bitcoin mining isn’t just a national story. It’s a warning.

Financial sanctions used to be a powerful tool. Now, they’re becoming outdated. When a country can turn its excess energy into a global currency, traditional sanctions lose their teeth.

Bitcoin doesn’t need banks. It doesn’t need the dollar. It doesn’t need permission.

And if Iran can do it, others will try. Venezuela, Syria, Cuba, even Belarus-they’re watching. They’re learning. They’re building their own versions.

The era of financial isolation is ending. The era of digital resilience is beginning.

Cory Munoz

October 28, 2025 AT 23:18Prateek Kumar Mondal

October 29, 2025 AT 04:28Alisa Rosner

October 29, 2025 AT 15:17Jasmine Neo

October 31, 2025 AT 08:24Ron Murphy

October 31, 2025 AT 23:18William P. Barrett

November 2, 2025 AT 06:50Clarice Coelho Marlière Arruda

November 2, 2025 AT 07:27Nick Cooney

November 3, 2025 AT 10:28Allison Andrews

November 3, 2025 AT 17:20Wayne Overton

November 5, 2025 AT 17:10MICHELLE SANTOYO

November 7, 2025 AT 15:00Brian Collett

November 9, 2025 AT 10:13