How to Get a Crypto Exchange License in 2025: Step-by-Step Guide for U.S. Operators

Feb, 14 2025

Feb, 14 2025

Crypto Exchange License Calculator

License Requirements Calculator

Calculate your estimated costs, timeline, and requirements for a U.S. crypto exchange license based on the state you're targeting.

Your License Requirements

Getting a crypto exchange license isn’t just about setting up a website and starting to trade. It’s a multi-year, multi-million-dollar legal and operational marathon. If you think you can launch a crypto exchange like you would a Shopify store, you’re already behind. In 2025, regulators in the U.S. are more aggressive than ever. Fines for unlicensed operations hit $100 million last year. The SEC and FinCEN aren’t just watching-they’re actively shutting down platforms that skip the paperwork.

Understand What Type of License You Need

Not all crypto businesses need the same license. Your exact requirements depend on what you’re doing. If you’re letting people trade Bitcoin for U.S. dollars, you need a Money Transmitter License (MTL). That’s state-level, and you’ll need one for every state you serve. New York? You need a BitLicense. California? You need an MTL plus $250,000 in capital. Texas? Different rules again. If you’re only trading crypto-to-crypto-say, BTC for ETH-then you’re still required to register as a Money Service Business (MSB) with FinCEN. That’s federal. But don’t assume that’s enough. FinCEN registration is the floor, not the ceiling. Most states still demand their own licenses on top of it. And if you’re handling security tokens (like tokens that act like stocks), the SEC steps in. If you’re offering crypto futures or options, the CFTC takes over. Stablecoin issuers? The OCC or state banking departments need to approve you. Each layer adds complexity. You’re not just applying for one license-you’re building a compliance stack.Start with FinCEN Registration (MSB)

Before you touch state applications, you must register with FinCEN as an MSB. This is non-negotiable. Even if you’re based in Wyoming and plan to serve only U.S. customers, FinCEN still requires it. The process takes 60 to 90 days, and you can’t proceed to state applications until this is done. You’ll need to submit:- Business structure details (LLC, corporation, etc.)

- Names and backgrounds of all owners with 10% or more stake

- Proof of AML/CFT policies

- Banking relationship details

- Sample KYC procedures

Choose Your States Wisely

You don’t need to get licensed in all 50 states. But you can’t operate in a state without a license if you’re targeting customers there. That means if someone in Florida signs up on your platform, you need a Florida MTL. Some states are easier than others. Wyoming, for example, has a clear regulatory sandbox and accepts applications faster. Delaware offers favorable corporate laws. New York’s BitLicense is the gold standard-but also the hardest. It takes 12 to 18 months, costs $50,000 just in application fees, and requires $500,000 in net capital. Here’s what you’re up against in key states:| State | License Type | Minimum Capital | Processing Time | Special Requirements |

|---|---|---|---|---|

| New York | BitLicense | $500,000 | 12-18 months | On-site audits, cybersecurity plan, cold storage rules |

| California | MTL | $250,000 | 6-9 months | Proof of insurance, biannual audits |

| Texas | MTL | $100,000 | 4-6 months | Resident agent, no foreign ownership restrictions |

| Wyoming | MTL + Special Crypto Charter | $100,000 | 3-5 months | Blockchain-friendly laws, custody rules simplified |

| Illinois | Exempt | $0 | N/A | Only if no fiat conversions; crypto-to-crypto only |

Build Your Compliance Infrastructure

Regulators don’t care how fancy your website is. They care about your controls. You must have:- Know Your Customer (KYC): Identity verification for every user. This isn’t just asking for a driver’s license. You need facial recognition, liveness detection, and document authenticity checks. In 2025, even basic KYC tools cost $15,000-$50,000 per year.

- Anti-Money Laundering (AML): Transaction monitoring software that flags suspicious activity. Tools like Chainalysis or Elliptic are standard. You must report suspicious activity to FinCEN within 30 days.

- Recordkeeping: All user data, transaction logs, and communications must be stored for at least five years. Encryption and access logs are mandatory.

- Insurance: Cyber liability and crime insurance. Most states require at least $1 million in coverage. Some demand $5 million.

- Segregated Accounts: Customer funds must be kept separate from company funds. Mixing them is a felony in many states.

Secure Banking Relationships

This is where most crypto businesses die. Banks are terrified of crypto. Even with a license, getting a business bank account is hard. Major banks like Chase and Bank of America won’t touch crypto firms unless they’re already licensed in multiple states and have a clean compliance track record. Your best bet is to work with specialized crypto-friendly banks like Silvergate (now closed), Signature Bank (also closed), or newer players like Mercury, Cross River Bank, or Evolve Bank & Trust. These institutions understand the regulatory landscape and have systems built for crypto compliance. But even they require:- Proof of licensing (state and federal)

- Monthly compliance reports

- Quarterly audits

- Clear source-of-funds documentation

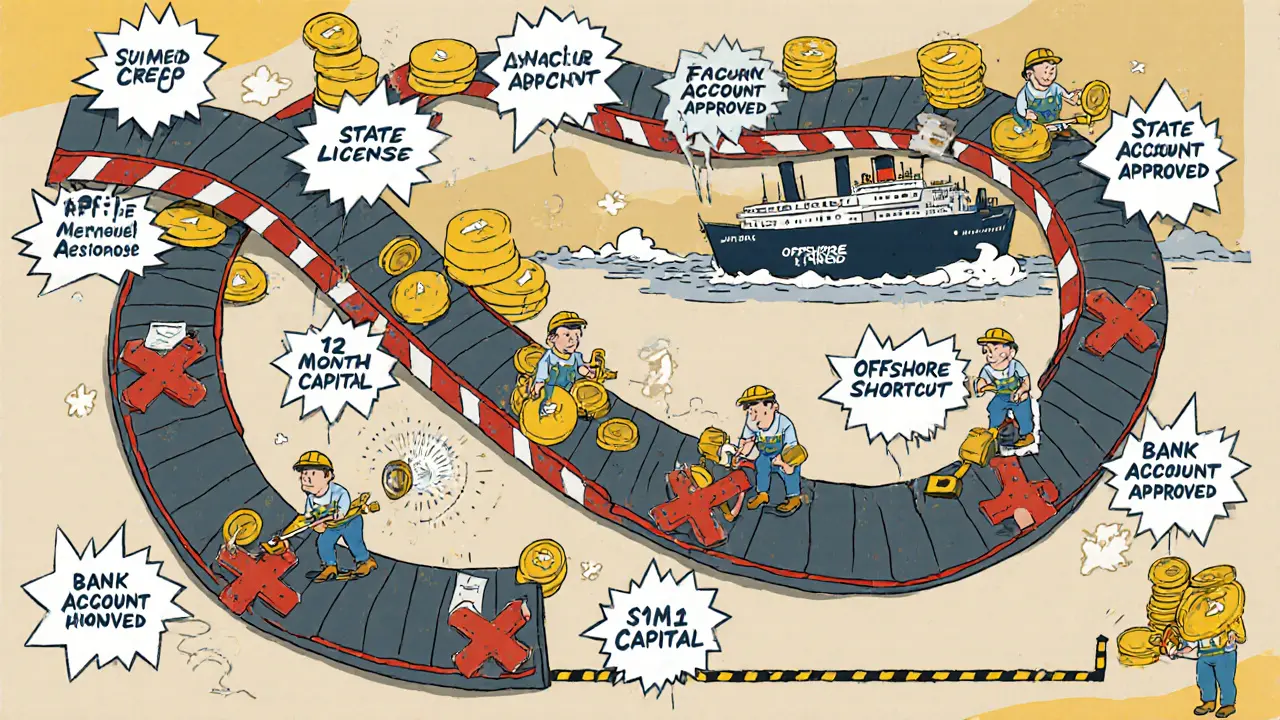

Expect a 12-24 Month Timeline and $500K-$2M in Costs

This isn’t a side hustle. The average cost to launch a compliant U.S. crypto exchange in 2025 is $1.2 million. Here’s the breakdown:- Legal fees (licensing, structuring, compliance docs): $200,000-$400,000

- Technology (KYC, AML, trading engine, security): $300,000-$600,000

- Capital reserves (minimum state requirements): $250,000-$500,000

- Insurance: $50,000-$150,000

- Compliance staff (CFO, AML officer, legal team): $200,000-$300,000/year

- Banking setup and fees: $50,000

Offshore Licenses Aren’t a Shortcut

Many founders look to offshore jurisdictions like Malta, the Cayman Islands, or Singapore for faster, cheaper licenses. Yes, they’re faster. Yes, they cost less. But here’s the catch: if you’re targeting U.S. customers, those licenses don’t protect you. The SEC still comes after you. In 2024, the SEC sued three offshore-licensed exchanges for serving U.S. users without a U.S. license. All three were forced to shut down. Offshore licenses only make sense if you’re serving non-U.S. markets exclusively. If you’re building a global exchange, you’ll need both: a U.S. license for American users and an offshore license for international ones. That doubles your costs and complexity.What Happens If You Skip the License?

The risks aren’t theoretical. In 2023, a startup in Atlanta launched a crypto exchange without a license. They had 5,000 users. Within six months, the Georgia Department of Banking and Finance shut them down. The founders were fined $1.8 million. One was banned from the financial industry for life. The SEC doesn’t just fine you. They freeze your assets. They seize your servers. They issue cease-and-desist orders that get published on their website. Your reputation is destroyed before you even launch. There’s no such thing as a "regulatory gray zone" anymore. Regulators have tools to trace blockchain activity. They know who you are. They know where you’re operating from. And they’re not afraid to act.Next Steps: What to Do Right Now

If you’re serious about launching a crypto exchange:- Consult a crypto-specific law firm. Don’t use your general business attorney. Look for firms with experience in FinCEN and state MTL filings.

- Decide which states you’ll target first. Start with Wyoming or Texas if you want speed.

- Build your compliance team. Hire a Chief Compliance Officer before you write a single line of code.

- Apply for FinCEN MSB registration. Do this immediately-it’s the first domino.

- Start budgeting. Set aside at least $1 million before you even begin.

Do I need a license if I only trade crypto-to-crypto?

Yes. Even if you don’t handle fiat currency, you must register as a Money Service Business (MSB) with FinCEN. The U.S. classifies crypto exchanges as financial institutions under the Bank Secrecy Act, regardless of whether they convert to dollars. Most states also require a separate Money Transmitter License if you serve residents there.

Can I get a crypto license without being in the U.S.?

You can get a license in offshore jurisdictions like Malta or Singapore, but if you serve U.S. customers, you still need a U.S. license. The SEC enforces its rules globally. Foreign licenses offer no protection against U.S. enforcement. If you want to operate legally in the U.S., you must be licensed by U.S. regulators.

How long does a crypto exchange license take to get?

It varies. FinCEN MSB registration takes 2-3 months. State licenses like New York’s BitLicense can take 12-18 months. On average, expect 12-24 months total if you’re applying in multiple states. Rushing the process leads to rejections, delays, and higher costs.

What’s the cheapest state to get a crypto license?

Wyoming and Texas offer the lowest capital requirements-$100,000 minimum. Wyoming also has a special crypto charter that simplifies custody rules. But even in these states, legal, compliance, and technology costs push total expenses to $500,000+. There’s no truly cheap option-only less expensive ones.

Do I need to hire a compliance officer?

Yes. Every state and federal regulator requires a designated Chief Compliance Officer (CCO). This person must have direct authority over AML/KYC systems and report directly to the board. A part-time consultant won’t cut it. Regulators expect a full-time, dedicated compliance professional on staff.

Can I use a third-party KYC provider?

Yes, but you’re still responsible for compliance. If the third-party fails, you’re the one fined. You must audit their systems, monitor their performance, and document everything. Popular providers include Jumio, Onfido, and Trulioo. But you need internal controls to ensure they’re working correctly.

What happens if my license is denied?

You can appeal, but most denials are due to incomplete documentation, weak AML policies, or unqualified ownership. If you’re denied, get legal help immediately. Many applicants reapply after fixing their compliance framework. But if you’re denied twice, regulators may blacklist your team, making future applications nearly impossible.

Lena Novikova

October 29, 2025 AT 02:14Let me cut through the noise - you don’t need a $2M budget to start. You need a lawyer who’s actually done this before and a CCO who doesn’t outsource their job to a freelancer. I’ve seen too many founders waste six months on legal templates from Upwork only to get flagged by FinCEN. The real cost isn’t the license - it’s the delay. Start with Wyoming, skip New York unless you’re already flush, and get that MSB registration done yesterday. No excuses.

Olav Hans-Ols

October 29, 2025 AT 08:42Man, I read this whole thing and just felt like I got punched in the face by reality 😅 I thought crypto was supposed to be the wild west - turns out it’s more like tax season with blockchain. But hey, if you’re serious, this is the map. No sugarcoating. Kudos to whoever wrote this - it’s brutal but fair.

Kevin Johnston

October 29, 2025 AT 10:39THIS. 👏👏👏

Dr. Monica Ellis-Blied

October 31, 2025 AT 09:00While the above commentary is technically accurate, it fails to address the ethical imperative: financial inclusion cannot be achieved through exclusionary, capital-intensive regulatory gatekeeping. The system is designed to protect incumbents, not innovation. The fact that a startup must raise $1.2 million just to comply - while hedge funds operate with zero oversight - is not regulation, it’s institutionalized discrimination. We must demand structural reform, not just procedural compliance.

Herbert Ruiz

November 1, 2025 AT 15:00Wyoming? That’s a joke. They don’t even require a physical office. You’re just paying for a PO box and a name on paper. Don’t fool yourself.

Saurav Deshpande

November 2, 2025 AT 11:18They’re all lying. The SEC doesn’t care about licenses - they care about control. Every ‘compliance requirement’ is just a way to funnel money to their cronies in law firms and audit firms. You think they want you to succeed? No. They want you to fail quietly so they can buy your IP for pennies later. This whole guide? It’s a trap. The real license is silence - don’t launch, don’t advertise, don’t exist. Then you’re invisible.

Paul Lyman

November 3, 2025 AT 09:31Yo if you're reading this and thinking 'I can do this' - you're either rich or dumb. I tried. Got halfway through the MSB paperwork, then my bank froze my account. No warning. No explanation. Just gone. Took me 4 months to get another one. And I'm not even a full exchange - just a P2P thing. Don't do it unless you're ready to lose your savings. And your sanity.

Frech Patz

November 3, 2025 AT 21:43Given the regulatory fragmentation across state jurisdictions, is there any empirical data on the success rate of applicants who pursue multi-state licensing versus those who concentrate on a single state? Furthermore, what is the average attrition rate during the 12–24 month application window, and what are the most common points of failure?

Derajanique Mckinney

November 5, 2025 AT 15:19bro why is everything so expensive?? like i just wanna trade eth for btc and now i need a $500k bank account and a lawyer named ‘Reginald’?? 😭

Rosanna Gulisano

November 6, 2025 AT 17:44If you’re doing crypto without a license you’re a criminal. Period. End of story. No one cares how ‘decentralized’ you think you are. You broke the law. Pay the price.

Sheetal Tolambe

November 6, 2025 AT 22:21This is actually really helpful. I’m from India and was wondering if I could help a friend set up something stateside. The breakdown of costs and timelines made it so much clearer. Even if I’m not doing it myself, I’m glad someone laid it all out like this. Thanks for the clarity.

gurmukh bhambra

November 8, 2025 AT 11:57They’re tracking everything. Every IP. Every wallet. Every transaction. Even if you’re offshore. Even if you use mixers. The government has AI that reads blockchain like a book. You think you’re hidden? You’re not. They’ve been watching you since you bought your first Bitcoin. This isn’t finance - it’s surveillance with a license.

Sunny Kashyap

November 9, 2025 AT 22:30USA always make things hard. In India we just open a bank and start. No papers. No lawyers. No $1 million. Why do you need so much? You just want to control people.

james mason

November 11, 2025 AT 20:55How quaint. You’ve reduced the entire architecture of modern financial compliance to a cost-benefit spreadsheet. I suppose you also believe that the SEC’s mandate is merely bureaucratic overhead rather than a necessary bulwark against systemic moral hazard. Your tone suggests a profound ignorance of fiduciary duty - and worse, a glorification of regulatory arbitrage as innovation. How pedestrian.