How Turkish Citizens Trade Crypto Despite Payment Ban

Feb, 10 2026

Feb, 10 2026

When Turkey banned using cryptocurrency for payments in April 2021, many assumed it would kill the market. Instead, it sparked a wave of innovation. Today, nearly 20 million Turkish adults - over 45% of the adult population - actively trade crypto, even though they can’t use it to buy coffee, pay bills, or shop online. The government didn’t ban holding or trading crypto. It only banned using it as a payment method. That tiny loophole became the foundation for one of the most active crypto markets in the world.

Why the Ban Happened - And Why It Didn’t Work

The Central Bank of Turkey (CBRT) said the ban was meant to protect consumers from wild price swings and prevent money laundering. At the time, crypto prices were swinging 20% in a single day, and many people were borrowing money to buy Bitcoin. The bank feared a financial crisis if things went south. But here’s the catch: banning payments didn’t stop people from buying and selling crypto. It just made them find new ways to do it. Turkish lira has lost over 70% of its value against the dollar since 2020. People aren’t trading crypto because it’s trendy - they’re trading it to protect their savings. A single Bitcoin bought in 2021 for 500,000 Turkish lira (TRY) was worth over 12 million TRY by early 2025. That’s not speculation. That’s survival.The Two Sides of the Market: Licensed vs. Shadow

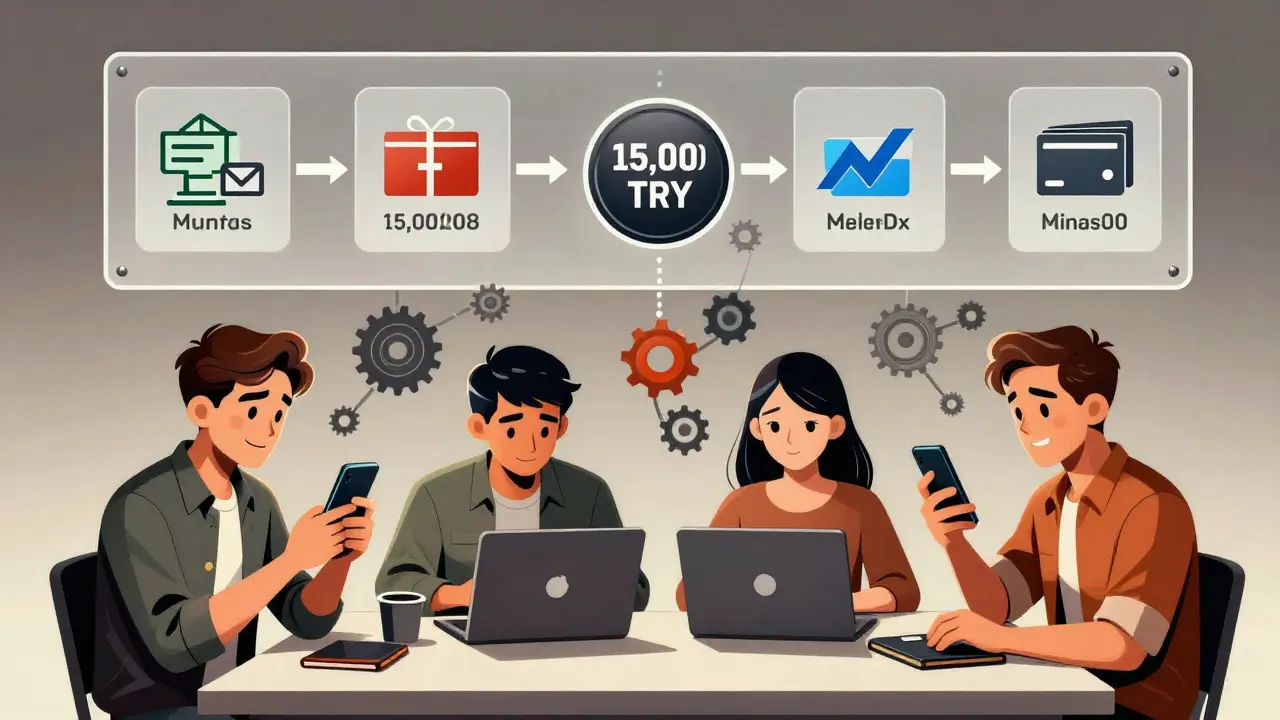

Turkey now has a split crypto market. On one side, there are the licensed exchanges: Binance Turkey, Paribu, and Bitlo. These platforms are registered with the Capital Markets Board (CMB), require full ID checks, and follow strict rules. You can’t trade more than 15,000 TRY (about $425) in a month without submitting your passport and proof of income. For many, this is a dealbreaker. On the other side is the shadow market - the unregulated, anonymous, and fast-moving world of P2P trading, VPNs, and DeFi wallets. Here’s how it works:- Telegram and WhatsApp groups connect buyers and sellers directly. No middleman. No KYC. You pay in cash, bank transfer, or even gift cards. Premiums range from 0.5% to 2% above market price, but users say it’s worth it for privacy.

- VPNs let users access global exchanges like Coinbase and Kraken. A December 2024 study by TÜBİTAK found 68% of Turkish crypto users use a VPN regularly. Some even set up automatic connections so their wallet never drops off.

- MetaMask and Trust Wallet connect directly to international blockchains. Users manually add non-Turkish RPC endpoints (like those from Ethereum nodes in Germany or the U.S.) to bypass local restrictions. After a few minutes of setup, they can trade tokens like UNI, AAVE, or SOL without ever touching a Turkish exchange.

How People Are Circumventing the 15,000 TRY Limit

The 15,000 TRY monthly threshold is the biggest pain point. It’s not a total block - it’s a speed bump. And Turkish traders have turned it into an art form.- Family splitting: Over 68% of users in a March 2025 survey said they use multiple family members’ accounts to stay under the limit. One person might buy 14,500 TRY worth of BTC on Paribu, then send it to a sibling’s wallet who does the same. No one triggers the ID check.

- Transaction splitting: Tools like the open-source TurkWallet project on GitHub automate this. It lets users create multiple wallets and distribute purchases so each stays below 15,000 TRY. It’s not illegal - it’s just clever.

- Stablecoin arbitrage: USDT is the most traded crypto in Turkey. People buy it cheap on licensed exchanges, then sell it at a premium on P2P platforms. One user reported earning 3-5% profit weekly by buying USDT on Paribu and selling it on LocalBitcoins.

The Rise of P2P and Why It’s Growing

LocalBitcoins, which was once a quiet platform, now processes over $1.2 billion in monthly trades from Turkish users. Telegram crypto groups have exploded. Some have over 50,000 members. Sellers post rates in real time. Buyers respond with screenshots of bank transfers. Deals close in minutes. Why does this work? Because Turkish banks don’t monitor peer-to-peer transfers the way they monitor crypto exchange deposits. A transfer from your account to your cousin’s account? No red flags. A transfer from your account to Binance? Triggered immediately. A May 2024 CMB report found that 78% of Turkish crypto users now use at least two different methods - usually a licensed exchange for small purchases and P2P for larger ones. This isn’t rebellion. It’s optimization.What Happens When You Get Caught?

MASAK - Turkey’s Financial Crimes Investigation Board - has started freezing accounts. If you deposit 200,000 TRY into a crypto exchange in one month, they’ll flag it. You’ll get a call. You’ll need to prove your income. If you can’t, your funds might be locked for 14 to 30 days. About 22% of users in a 5,000-person survey said they’ve had an account frozen at least once. But here’s the twist: most of them got their money back. MASAK doesn’t seize assets - it just investigates. The real risk isn’t losing your crypto. It’s the hassle. That’s why so many people avoid licensed platforms altogether.

The Future: Regulation vs. Innovation

In February 2025, Turkey banned 46 more crypto platforms, including PancakeSwap. In May, they added 17 more. That brings the total to 63 banned services. But instead of shrinking the market, it’s pushing innovation. GitHub activity for Turkish crypto tools jumped 189% in Q2 2025. YouTube has over 1,200 tutorial videos on bypassing restrictions - with 47 million total views. The CMB says it’s building a “Crypto Asset Gateway” for 2026 - a single portal for all on- and off-ramps. It sounds like control. But experts think it’s just a new layer of bureaucracy. As Dr. Hasan Yılmaz from Istanbul Finance Center said in June 2025: “As long as trading is allowed and the lira keeps falling, people will find ways to trade. Regulation doesn’t stop innovation. It just makes it more creative.”Who’s Using Crypto - And Why

Crypto adoption in Turkey isn’t random. It’s concentrated:- Age: 67% of users are between 25 and 44. They’ve seen inflation eat their savings. They know how to use tech.

- Location: Istanbul has 42% crypto penetration. Rural areas? Just 18%. Access to tech and banking infrastructure makes a huge difference.

- Stablecoins: 38.7% of all crypto transactions in Turkey involve USDT. It’s not about speculation. It’s about stability. When the lira drops 5% in a week, USDT holds its value.

What This Means for the Rest of the World

Turkey’s crypto market is a real-world experiment. It shows what happens when a government tries to control money without controlling access. You can ban payments. You can’t ban necessity. You can’t ban a population that’s been burned by inflation. Other countries watching closely - Argentina, Nigeria, Lebanon - are seeing the same pattern. When people need a safe place to store value, they’ll find it. Even if the law says they can’t. The lesson? Regulation doesn’t kill markets. It just reshapes them. And in Turkey, the market didn’t die - it got smarter.Is it legal to trade crypto in Turkey?

Yes, buying, selling, and holding cryptocurrency is completely legal in Turkey. The 2021 ban only prohibits using crypto as a payment method for goods and services. You can’t use Bitcoin to pay your electric bill, but you can buy Bitcoin on an exchange and sell it later for Turkish lira.

Can I use Binance or Coinbase in Turkey?

You can use Binance Turkey - it’s licensed and regulated. But the global versions of Binance and Coinbase are blocked by Turkish internet providers. Many users access them through VPNs. Over 68% of Turkish crypto traders use a VPN to reach international platforms. It’s not illegal, but it’s technically against ISP rules.

Why do Turkish people use USDT instead of Bitcoin?

USDT (Tether) is a stablecoin pegged to the U.S. dollar. Because the Turkish lira has lost over 70% of its value since 2020, people use USDT as a digital savings account. It doesn’t swing wildly like Bitcoin. It holds its value. In 2024, 38.7% of all crypto transactions in Turkey involved USDT - more than any other coin.

What’s the 15,000 TRY limit for?

It’s an anti-money laundering rule. Any transaction over 15,000 TRY (about $425) on a licensed exchange triggers mandatory identity verification. This is meant to track large transfers. But many users avoid it by splitting transactions across multiple accounts - even family members’ - to stay under the limit.

Are Turkish crypto users at risk of losing their money?

If you use a licensed exchange, your funds are protected under CMB rules. If you use P2P or unregulated platforms, you have no legal recourse if the seller disappears. Scams do happen. But most users who trade on P2P platforms are experienced and use escrow services or meet in person with ID checks. The biggest risk isn’t theft - it’s account freezes by MASAK if you exceed limits without documentation.

How do people access DeFi in Turkey?

Users connect wallets like MetaMask or Trust Wallet to non-Turkish blockchain nodes (RPC endpoints). For example, instead of using a Turkish server, they switch to a node in Germany or the U.S. This bypasses local blocks. Once connected, they can trade tokens on Uniswap, SushiSwap, or Curve - even though those platforms are officially banned in Turkey.

Is the crypto market growing in Turkey despite the ban?

Yes. In 2024, Turkey recorded $85.3 billion in crypto transactions - up 21% from 2023. Chainalysis ranked Turkey 7th globally for crypto adoption. The payment ban didn’t stop demand - it just changed how people meet it. Experts predict volumes will hit $102 billion in 2025, even with new regulations.

What’s the easiest way for a beginner to start trading crypto in Turkey?

Start with Paribu or Binance Turkey. Sign up, complete the 15-45 minute ID verification, and deposit Turkish lira via bank transfer. Buy a small amount of USDT or BTC. Once you’re comfortable, explore P2P trading or VPN access to international platforms. Most users start compliant, then expand into shadow methods as they need more flexibility.

monique mannino

February 10, 2026 AT 19:09