Iranian Energy Subsidies for Crypto Mining: How Cheap Power Fuels a National Grid Crisis

Feb, 13 2026

Feb, 13 2026

Iran is one of the few countries in the world where you can mine Bitcoin for less than $1,300 per coin. Meanwhile, in most places, the same task costs 10 to 100 times more. The reason? Heavily subsidized electricity. But this isn’t a success story. It’s a slow-motion collapse of the national power grid - and ordinary Iranians are paying the price.

How Cheap Electricity Made Iran a Crypto Mining Hub

In 2018, Iran legalized cryptocurrency mining. At the time, the government was already struggling with rolling blackouts, aging infrastructure, and international sanctions that cut off access to global financial systems. The solution? Let miners use cheap power to generate foreign currency. The logic was simple: sell mined Bitcoin abroad, earn dollars, and bypass sanctions. The cost? Electricity priced between $0.01 and $0.05 per kilowatt-hour - lower than in any other major economy. For comparison, in Italy, mining a single Bitcoin costs over $306,000. In Iran, it’s under $1,300. That’s a 235-fold difference. No wonder over 450,000 active miners now operate an estimated 3.5 to 4.2 million ASIC machines across the country. The Central Bank of Iran (CBI) officially permits licensed miners to sell their coins for cross-border trade. That’s how Iran gets around sanctions - not through smuggling, but through blockchain.The Hidden Cost: Power Consumption on a City-Wide Scale

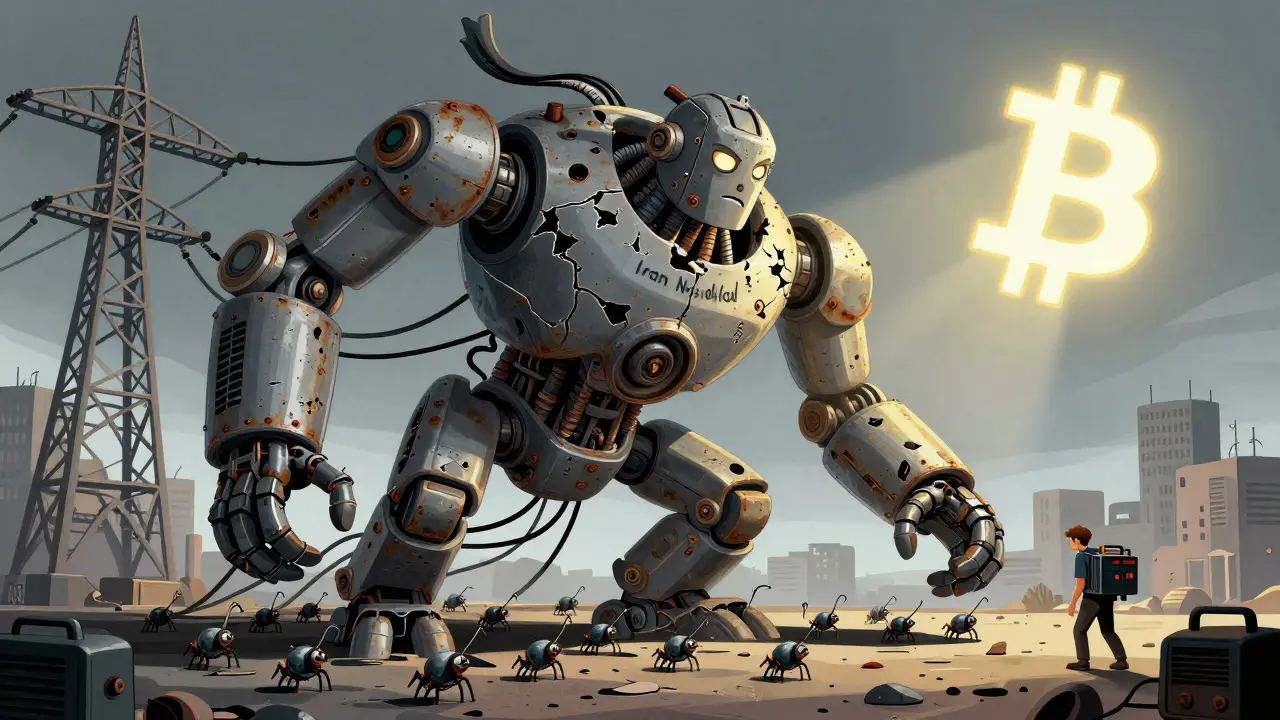

One Bitcoin requires over 300 megawatt-hours of electricity. That’s the same amount of power a typical Iranian household uses in a year. Multiply that by millions of devices, and you get a staggering number: cryptocurrency mining consumes nearly 2,000 megawatts of electricity daily. That’s 5% of Iran’s total power output. But here’s the kicker - it accounts for 15-20% of the country’s electricity imbalance. Think about that. For every 100 units of electricity Iran produces, 5 go to mining. But the grid is already stretched thin. When demand spikes - like during summer when air conditioning use jumps 30-40% - the system buckles. In mid-2025, during a nationwide internet outage linked to regional tensions, power use dropped by 2,400 MW overnight. Why? Because over 900,000 illegal mining devices were suddenly shut off. That’s not a glitch. That’s proof of scale. The energy ministry estimates illegal miners alone use up to two gigawatts - equivalent to the entire electricity demand of Tehran, a city of 9 million people. Former Energy Minister Reza Ardakanian warned in 2024 that mining operations were consuming up to 10% of Iran’s total generation capacity. The numbers don’t lie. The grid isn’t just stressed. It’s being drained.Blackouts, Rage, and a Public Breaking Point

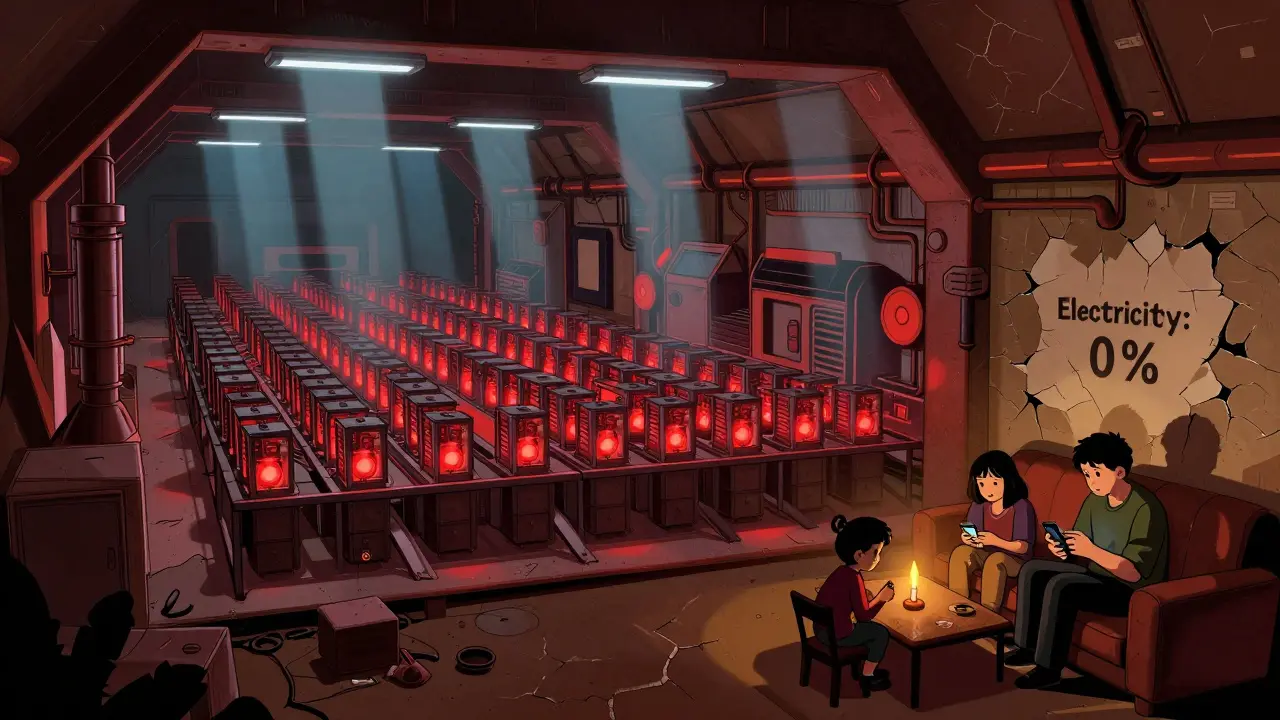

Most Iranians don’t have access to reliable power. In summer, 8 to 12 hours of blackouts per day are common. Families in cities like Ahvaz and Shiraz wait for hours just to charge a phone or run a fridge. Meanwhile, mining farms run 24/7 - often hidden in industrial zones, warehouses, or even inside the tunnels of Ahvaz Stadium. Social media is flooded with anger. On Twitter, @IranEnergyCrisis posted: “21 hours of blackouts this week while the IRGC’s mining farms in Ahvaz Stadium tunnels run 24/7 - this is economic terrorism against ordinary Iranians.” Reddit’s r/Iran had over 1,450 comments in June 2025. Ninety-two percent blamed crypto mining for the outages. Telegram channels like “Iran Electricity Crisis” now share real-time maps showing blackout patterns tied to known mining locations. One admin wrote: “Every time Bitcoin’s price surges, blackouts increase by 30-40% within 48 hours.” It’s not just frustration. It’s survival. People are choosing between turning on a fan or charging a medical device. Students study by candlelight. Hospitals rely on backup generators that cost more than they can afford. And yet, the government continues to protect the miners.

Who Really Benefits? The IRGC and the Black Market

The government claims licensed mining brings in $800 million annually in foreign exchange. But the real power lies elsewhere. According to multiple reports, the Islamic Revolutionary Guard Corps (IRGC) controls between 55% and 65% of all mining operations - either directly or through front companies. These aren’t small-time hobbyists. These are state-backed operations with access to subsidized power, imported equipment, and direct export channels. The CBI bans domestic cryptocurrency payments. So, Bitcoin can’t be used to pay for groceries or gas. But it can be used to buy medicine, machinery, and fuel from countries that ignore sanctions. That’s the real goal: bypassing the global financial system. The IRGC doesn’t care if a family in Kerman has no power. They care about the dollars they’re earning. This isn’t just corruption. It’s a parallel economy - one where the state controls both the energy supply and the output. Dr. Saeed Laylaz, economic advisor to former President Khatami, put it bluntly: “The government has created a system where the IRGC profits from stolen electricity, while ordinary citizens pay with their daily lives.”The Regulatory Maze: Licenses, Fees, and Fakes

To mine legally, you need four permits: from the Ministry of Industry (for equipment), Tavanir (for electricity), the CBI (for export), and the Iran Blockchain Council (for registration). The process takes 3 to 6 months. Approval rates? Below 40%. And even if you get approved, you pay $0.04 to $0.07 per kWh - still far below global prices. Meanwhile, illegal miners pay nothing. They tap into household lines, use stolen transformers, or install hidden rigs in public buildings. The government’s response? A reward program. Citizens who report illegal mining get 10% of the recovered electricity cost as cash. In the first half of 2025, 8,432 reports led to 2,157 shutdowns. But for every one they catch, ten more pop up. The real problem? The grid wasn’t built for this. Iran’s infrastructure is 60-70% below what it needs to function reliably. Transformers overheat. Power lines sag. Substations fail. And when they do, it’s not the miners who suffer. It’s the people.

Why This Can’t Last

The International Energy Agency predicts that without major upgrades, Iran’s power shortages could increase by 25-30% by 2027. The Carnegie Endowment calls this situation “a microcosm of Iran’s broader energy policy challenges - short-term gains versus long-term collapse.” Kazakhstan, once Iran’s main competitor, now mines Bitcoin at $5,000 per coin. It’s more expensive, but its grid is stable. Iran’s advantage isn’t technology. It’s theft. Theft of public resources. Theft of electricity. Theft of dignity. The government keeps tweaking the rules - new smart meters, industrial zoning, real-time monitoring. But none of it fixes the core issue: why should a nation with 80 million people let a few thousand machines drain its power so a handful of elites can profit?What Comes Next?

There’s no easy answer. Cutting subsidies would crash the mining industry - and with it, the foreign currency flow the regime depends on. But keeping them means more blackouts, more anger, and a grid that will eventually fail. For now, Iran walks a razor’s edge. Miners still get cheap power. Citizens still lose electricity. And the world watches as one of the largest crypto mining operations on Earth runs on the backs of its own people.Why does Iran subsidize electricity for crypto mining?

Iran subsidizes electricity for crypto mining because it allows the government to generate foreign currency without using traditional banking systems. With international sanctions blocking access to dollars and euros, mining Bitcoin and selling it abroad became a way to bypass those restrictions. The state profits indirectly - mostly through the IRGC, which controls most large-scale operations - while the public pays with rolling blackouts and grid instability.

How much electricity does crypto mining use in Iran?

Cryptocurrency mining consumes an estimated 2,000 megawatts (MW) of electricity daily, which is about 5% of Iran’s total power generation. Illegal operations alone are estimated to use up to 2 gigawatts - equivalent to the entire electricity demand of Tehran. During peak summer months, mining accounts for 15-20% of the country’s electricity imbalance, meaning the grid struggles to meet basic household needs.

Is crypto mining legal in Iran?

Yes, but only under strict conditions. Licensed miners can operate if they get permits from multiple agencies, pay industrial electricity rates ($0.04-$0.07/kWh), and export their mined coins for trade. However, over 90% of mining is done illegally - using household power, stolen transformers, or hidden facilities. The government tolerates this because it still generates foreign currency, even if it’s not officially tracked.

Why do Iranians blame crypto mining for blackouts?

Because the timing matches. During summer, when air conditioning demand spikes, blackouts worsen. When Bitcoin prices surge, mining activity increases, and power consumption jumps. Social media data and blackout maps show clear correlations: when mining ramps up, households lose power. In July 2025, a nationwide internet outage caused a 2,400 MW drop in power use - directly linked to the shutdown of 900,000 illegal mining devices. For many Iranians, it’s not speculation - it’s lived experience.

Who controls most of Iran’s crypto mining?

The Islamic Revolutionary Guard Corps (IRGC) controls between 55% and 65% of all mining operations, either directly or through front companies. These aren’t small farms - they’re industrial-scale operations with access to subsidized power, imported equipment, and direct export channels. The IRGC uses the profits to fund operations outside the official economy, bypassing central bank oversight and international sanctions.

Can Iran stop crypto mining without crashing its economy?

Not easily. Cutting subsidies would collapse the mining industry overnight - and with it, the $1.5 billion in annual foreign exchange earnings the regime relies on. But continuing it means accelerating grid collapse. The government’s current strategy - periodic bans during summer, fines for illegal miners, and rewards for informants - is a temporary fix. Without major investment in power infrastructure, the system will eventually fail. The real choice isn’t between mining and no mining. It’s between saving the grid or saving the profits.