Kine Protocol (BSC) Crypto Exchange Review: Leverage, Liquidity, and Real-World Performance

Jan, 23 2026

Jan, 23 2026

Kine Protocol (BSC) Crypto Exchange Review: Leverage, Liquidity, and Real-World Performance

If you're looking for a decentralized exchange that lets you trade crypto derivatives with 200x leverage and zero gas fees, Kine Protocol on BNB Smart Chain might seem like the perfect fit. But does it deliver? Or is it just another DeFi project with flashy numbers and hidden risks?

Unlike centralized exchanges like Binance or Coinbase, Kine Protocol doesn’t match buyers and sellers. Instead, it uses a peer-to-pool model - meaning every trade happens against a liquidity pool, not another trader. This sounds simple, but it changes everything about how you trade. No more worrying about order book depth. No more slippage from thin markets. But it also means you’re trusting a pool of collateral, not a counterparty. And that’s where things get tricky.

How Kine Protocol Works on BNB Smart Chain

Kine Protocol runs on BNB Smart Chain (BSC), Ethereum, Polygon, and Avalanche. But BSC is where most users go - it’s faster, cheaper, and has the highest trading volume. You connect your MetaMask wallet, deposit collateral (USDT, USDC, or BNB), and start trading perpetual contracts. No KYC. No account setup. Just wallet connection and trade.

The key innovation? Guaranteed liquidity. Traditional DEXs like Uniswap struggle with low liquidity for derivatives. Kine solves this by over-collateralizing its pools. Every trade is backed by real assets locked in smart contracts. This allows for up to 200x leverage on Bitcoin, Ethereum, Solana, and five other major tokens. You can go long or short with cross-margin, meaning your entire account balance acts as collateral.

But here’s the catch: higher leverage doesn’t mean higher profits. It means higher risk. A 1% move against you can wipe out your position. And unlike centralized exchanges, there’s no human support team to help you recover from a bad trade.

Trading Fees and Costs - Zero Gas, But Not Zero Cost

Kine Protocol boasts zero gas fees. That’s true. All transactions happen on-chain but are processed through Layer 2 technology, so you don’t pay Ethereum-style gas. You only pay a trading fee: 0.05% per trade. That’s lower than most DEXs. But there’s a twist.

If you use HT, OKB, or WOO tokens as your trading pair, the fee jumps to 0.8%. That’s 16x higher. Why? Because those tokens are used to incentivize liquidity providers. If you’re trading BTC or ETH, you’re fine. But if you’re trying to trade one of those tokens, you’re paying a premium.

Also, while there’s no gas fee, you still need to pay for the initial deposit and withdrawal. Those are on-chain transactions. So if you’re moving USDT from BSC to Kine, you’ll pay a small BNB fee. It’s not zero cost - it’s just not a trading fee.

Liquidity and Slippage - The Hidden Gap

Kine claims “lower slippage.” But data from DeFi Llama tells a different story. As of November 2025, Kine’s total liquidity across all chains is $211 million. That’s up 143% from the year before. Impressive growth. But compare that to dYdX, which holds over $3.5 billion in liquidity. Kine has less than 6% of dYdX’s depth.

For small trades under $5,000, slippage is minimal. You’ll get filled at the price you see. But for larger trades - say $10,000 or more - you’ll notice price movement. The pool isn’t deep enough to absorb big orders without shifting the price. That’s not a bug. It’s a design limit.

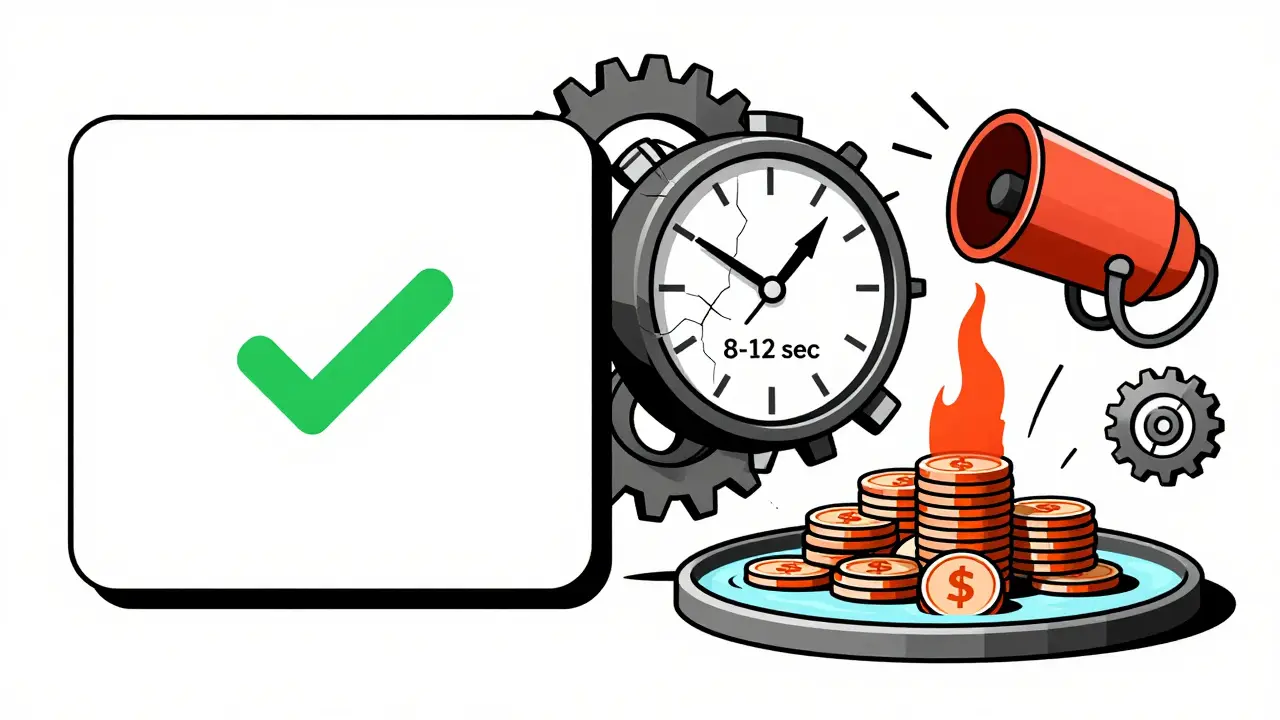

During the March 2025 market crash, Kine’s price oracles took 8-12 seconds to update. dYdX did it in under 5 seconds. That delay caused liquidations to trigger at wrong prices. Users reported being liquidated at prices that didn’t match the actual market. That’s not just bad luck - it’s a systemic risk.

Compared to dYdX, GMX, and ApeX

Who else is in this space? dYdX, GMX, and ApeX are the big players. Here’s how Kine stacks up:

| Feature | Kine Protocol | dYdX | GMX | ApeX |

|---|---|---|---|---|

| Max Leverage | 200x | 200x | 50x | 100x |

| Supported Chains | 4 (BSC, Ethereum, Polygon, Avalanche) | 1 (Ethereum) | 2 (Arbitrum, BSC) | 1 (Ethereum) |

| Total Liquidity | $211M | $3.5B | $2.4B | $740M |

| Trading Fee | 0.05% (0.8% for HT/OKB/WOO) | 0.02%-0.05% | 0.05% | 0.02% |

| Gas Fees | Zero on trades | Ethereum gas only | Arbitrum/BSC gas | Ethereum gas |

| Oracle Latency (Volatility) | 8-12 seconds | <5 seconds | 6-8 seconds | 7-10 seconds |

Kine wins on multi-chain support and leverage. But it loses on liquidity depth and speed during crashes. If you’re a small trader making quick moves under $5,000, Kine is fine. If you’re trading larger sums or need reliability during volatility, dYdX or GMX are safer.

Tokenomics and KINE Price Risks

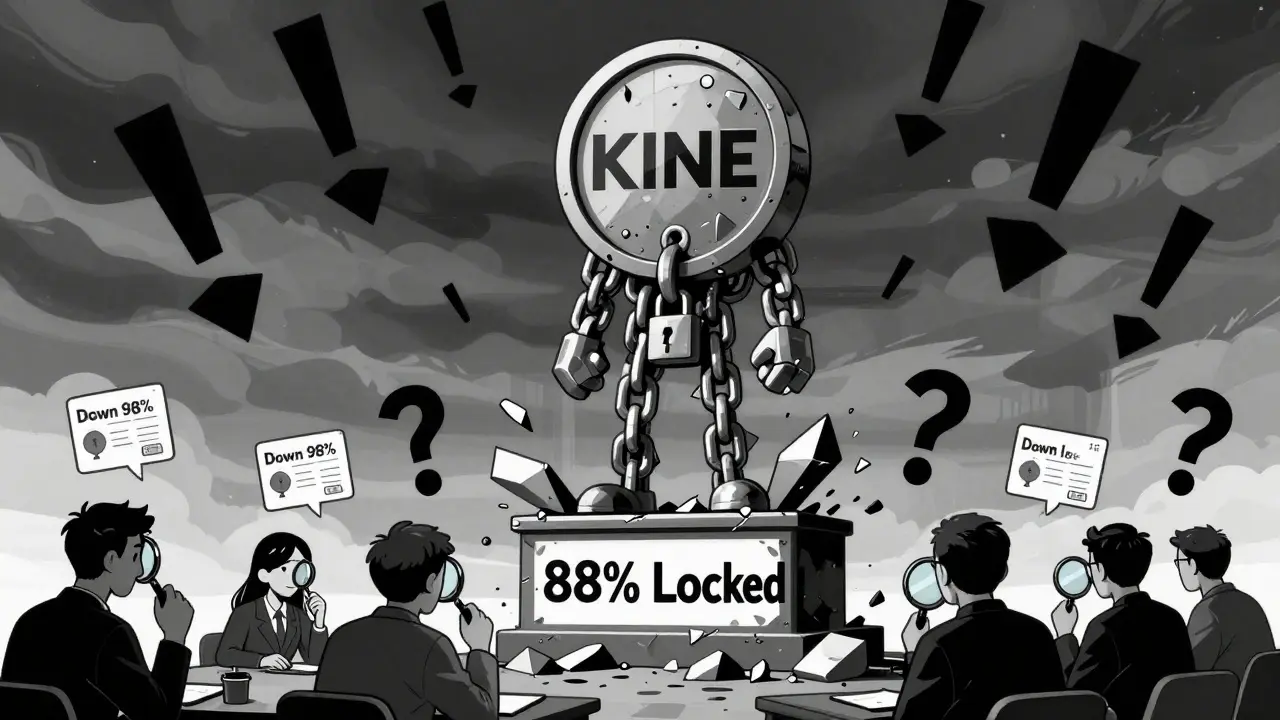

Kine Protocol has its own token: KINE. It’s used for governance (in theory), fee discounts, and staking rewards. But here’s the problem: only 12.7% of the total supply is circulating. The rest is locked for years.

That’s a red flag. When those tokens unlock - likely in 2026 - there will be massive selling pressure. CoinLore’s models conflict wildly: one says KINE hits $3.61 by year-end. Another says $5.18. Both assume massive adoption. But with 88% of tokens still locked, the real price is driven by speculation, not utility.

Technical indicators show 11 sell signals versus 3 buy signals. The token is down 98% year-over-year. Even if the platform grows, the token could keep falling. Don’t confuse platform success with token value. They’re not the same thing.

User Experience and Support

On paper, Kine is easy. Connect MetaMask, deposit USDT, trade. The interface is clean. No clutter. No confusing menus. SourceForge users give it a 4.2/5 for ease of use.

But support? That’s where it breaks down. User reports show average response times of 58 hours. During a market crash, you need help fast. You won’t get it. Discord and Telegram are active, but devs respond in 14 hours - even during crises.

Also, the documentation is thin on advanced strategies. It explains how to open a position, but not how to hedge against oracle delays or manage margin calls across chains. New users often lose money not because they’re bad traders - but because they didn’t understand the system’s quirks.

What’s Coming: V3 Upgrade in Q1 2026

Kine’s team announced a V3 upgrade for early 2026. It includes:

- Isolated margin (so you can trade one asset without risking your whole account)

- Improved oracle system to reduce latency during volatility

- Enhanced risk controls to prevent liquidation errors

If they deliver, Kine could close the gap with dYdX and GMX. But DeFi projects often miss deadlines. The last major upgrade took 9 months longer than promised.

Right now, Kine is a high-risk, high-reward tool for experienced DeFi traders. It’s not for beginners. Not for long-term holders. Not for anyone who expects customer service.

Who Should Use Kine Protocol (BSC)?

You should consider Kine Protocol if:

- You trade small to medium-sized positions ($500-$5,000)

- You want zero gas fees and multi-chain access

- You understand leverage and can handle 200x risk

- You’re okay with no support during crashes

You should avoid it if:

- You’re new to DeFi or derivatives

- You trade large sums ($10,000+)

- You need fast support during market crashes

- You’re holding KINE tokens as an investment

The platform works. But it’s not safe. It’s not stable. It’s not for everyone. It’s a tool for those who know exactly what they’re doing - and are willing to accept the consequences.

Final Verdict: High Leverage, High Risk

Kine Protocol on BSC delivers on its core promise: zero gas fees, 200x leverage, and always-available liquidity. For skilled traders who move quickly and keep positions small, it’s one of the best options available.

But the risks are real. Oracle delays can trigger wrong liquidations. Tokenomics are toxic. Support is slow. And the market is crowded with better-funded rivals.

If you’re looking for a reliable, long-term DeFi platform - look elsewhere. But if you want to take aggressive, short-term leveraged positions on BSC with minimal fees? Kine Protocol is one of the few places that lets you do it.

Just don’t bet more than you can afford to lose. And never trust the token price. The platform’s value isn’t in KINE - it’s in the trading engine. And that engine is still being tested under fire.

Is Kine Protocol safe to use on BSC?

Kine Protocol is technically secure - its smart contracts have been audited and run on BSC, a well-established chain. But safety isn’t just about code. The platform has shown oracle delays during volatility, leading to incorrect liquidations. There’s also no customer support team to reverse errors. Use it only if you understand DeFi risks and can afford to lose your funds.

Can I trade Kine Protocol without KYC?

Yes. Kine Protocol is fully non-custodial and requires no KYC. You only need a Web3 wallet like MetaMask. This makes it popular in regions with strict crypto regulations. But it also means there’s no recovery option if you lose your private key or get hacked.

What’s the difference between Kine Protocol and dYdX?

Kine runs on multiple chains including BSC, while dYdX is only on Ethereum. Kine offers 200x leverage like dYdX, but with lower liquidity and slower price updates during crashes. dYdX has deeper pools and faster oracles, making it more reliable for larger trades. Kine wins on accessibility; dYdX wins on reliability.

Does Kine Protocol have a mobile app?

No. Kine Protocol has no official mobile app. You must use a desktop browser with MetaMask or another Web3 wallet. Some users access it via mobile browsers, but the interface isn’t optimized for small screens. Avoid unofficial apps - they’re scams.

Is KINE token a good investment?

No, not based on current data. Only 12.7% of KINE tokens are circulating. The rest are locked and will flood the market in 2026. The token is down 98% year-over-year, and technical indicators show strong sell pressure. KINE has no real utility beyond governance (which is unused). Don’t invest in KINE expecting price growth.

What happens if Kine Protocol’s liquidity pool gets drained?

The protocol is over-collateralized, meaning the pool holds more assets than are actively traded. If withdrawals exceed deposits, the system slows down and temporarily halts new trades until liquidity is restored. This has never happened at scale, but it’s a theoretical risk. Users could face delays in withdrawing funds during extreme market stress.

Linda Prehn

January 24, 2026 AT 07:28200x leverage is just gambling with extra steps. I've seen people lose their entire portfolio on a 1% dip. No support, no safety net. Just a cold smart contract laughing at your tears.

Brenda Platt

January 25, 2026 AT 08:36Still, for small trades under $2k? It’s the fastest way to get in and out. Just don’t sleep with your position open. Ever.

steven sun

January 25, 2026 AT 21:44Adam Lewkovitz

January 27, 2026 AT 14:51And don't get me started on KINE token. 88% locked? That's not innovation-that's a pump-and-dump waiting to happen. We need regulation, not more DeFi fantasyland.

Arnaud Landry

January 28, 2026 AT 16:16I’ve seen this movie before. Remember Terra? Luna? Same script. Different blockchain. They’re not building a platform-they’re building a time bomb with a clean UI.

And don’t tell me ‘it’s decentralized’-if you can’t withdraw your funds when you want, it’s not decentralized. It’s just locked up.

Paru Somashekar

January 29, 2026 AT 15:12For traders above $5k, slippage becomes non-trivial. I’ve seen 1.8% slippage on a $10k ETH long. That’s not negligible-it’s a 1.8% loss before the market moves.

Also, the 0.8% fee on HT/OKB/WOO is a trap. Most new users don’t read the fine print. They think they’re trading BTC and end up paying 16x more because they accidentally selected HT/USDT pair. This is predatory design.

Sara Delgado Rivero

January 30, 2026 AT 11:24And don’t tell me ‘the platform is good.’ If the token crashes, the liquidity dries up. It’s all connected. You’re not trading a platform-you’re trading a pyramid scheme with a nice frontend.

Melissa Contreras López

January 31, 2026 AT 07:52That’s not risk. That’s negligence.

But here’s the thing: I’m not mad. I learned. And now I only use it for under $1k trades. It’s like driving a race car without airbags-fun if you know the track, deadly if you don’t.

If you’re new? Walk away. Seriously. There’s no shame in not playing with fire.

Adam Fularz

January 31, 2026 AT 22:10Also, no support team? You think that’s a feature? That’s a death sentence. When the market crashes, you’re not getting a refund-you’re getting a blockchain receipt that says ‘you lost.’

David Zinger

February 2, 2026 AT 20:53And yes, the oracle delay happened. So did it on dYdX in 2022. They patched it. Kine will too. V3 is coming. Stop panicking over temporary flaws.

Athena Mantle

February 3, 2026 AT 01:55I used to be a KINE holder. Now I’m a former holder. I watched it drop from $0.80 to $0.016. I didn’t sell-I just… stopped caring. That’s the real lesson here: the token doesn’t care about you. The system doesn’t care about you. Only you care about you.

And that’s okay. But only if you accept it.