Social Send (SEND) Crypto Exchange Review: A Red Flag Project with Zero Circulating Supply

Apr, 7 2025

Apr, 7 2025

Crypto Scam Checker

This tool helps you identify potential crypto scams by checking key indicators mentioned in the Social Send review. Enter project metrics to see if they match scam patterns.

Project Metrics

Scam Indicators Analysis

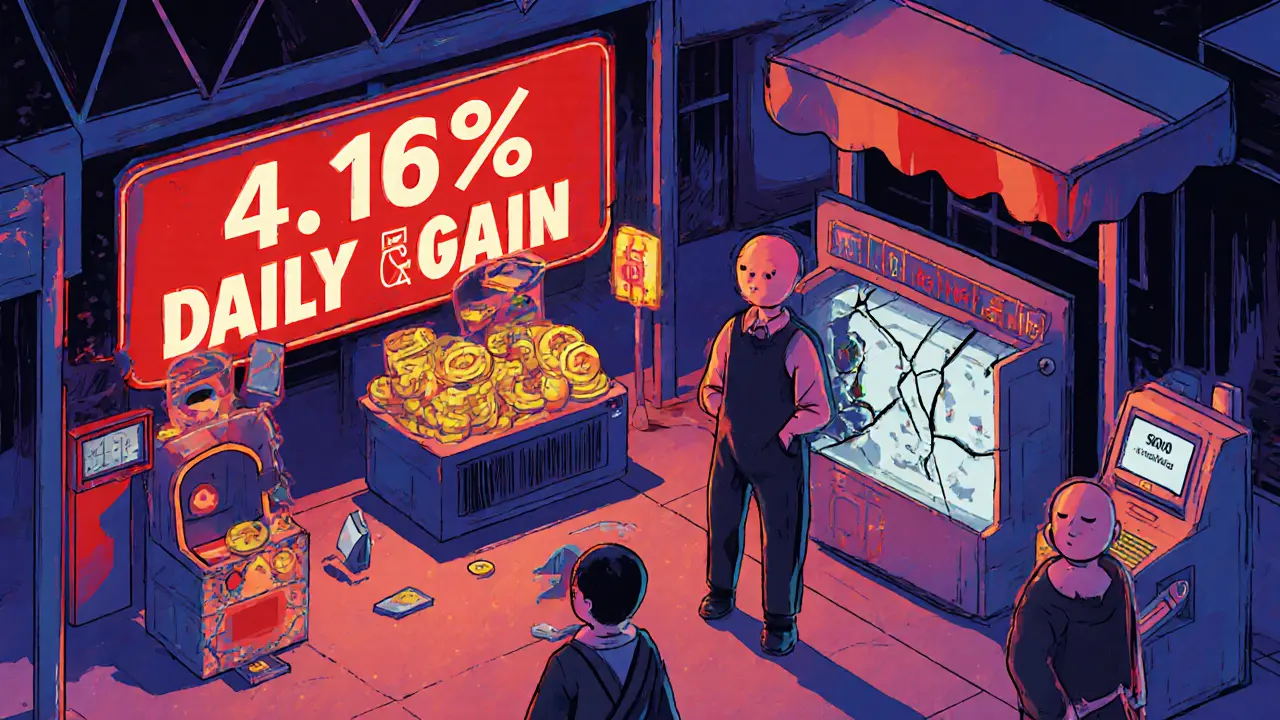

When you see a cryptocurrency promising big returns with no trading volume, no users, and a circulating supply of zero, you’re not looking at an investment opportunity-you’re looking at a warning sign. Social Send (SEND) is one of those projects. It shows up on CoinMarketCap with a price of $0.00042401 and a 4.16% daily gain. Sounds promising, right? Except there’s been $0 in trading volume for over 17 days straight. How can a coin go up in price if nobody’s buying or selling it? The answer: it can’t. And that’s just the start of the problems.

Zero Circulating Supply? That’s Not How Crypto Works

Every legitimate cryptocurrency has a circulating supply-the number of tokens actually available to the public and being traded. That’s what gives a coin its price. If no one holds or trades the token, it has no market value. Social Send claims a total supply of over 54 million SEND tokens, but zero are in circulation. That’s not a glitch. It’s a violation of basic crypto principles. Coursera’s January 2024 guide on cryptocurrencies clearly states that “cryptocurrencies require circulating supply for market price determination through actual trading activity.” Social Send breaks that rule. No trading volume. No holders. No real users. Just numbers on a screen.No Website. No Tech. No Transparency

Legitimate blockchain projects publish whitepapers, smart contract addresses, and technical documentation. Minds.com, Peepeth, and Indorse.io all do. They explain how tokens are earned, how posts are stored on-chain, and how wallets connect. Social Send? Nothing. No whitepaper. No GitHub repo. No smart contract address you can verify on Etherscan. The official website, socialsend.io, doesn’t load properly in most browsers. Domain records show it was last updated in March 2024 with privacy protection enabled-common for scam sites trying to hide who owns them. There’s no developer activity, no updates, no community forums. Just a placeholder page that looks like it was built in a weekend.Trading Volume of $0? That’s a Red Flag #3

DataVisor’s September 2025 analysis of fake crypto projects ranked “zero circulating supply with reported price activity” as the third most common scam indicator. It appeared in 83% of verified fraudulent tokens that year. Social Send fits perfectly. The math doesn’t work. You can’t have a price change without trades. A 4.16% rise in 24 hours means someone bought and sold tokens. But CoinMarketCap shows $0 volume. That’s not a data error-it’s a lie. Even low-volume tokens like $LEO (LeoFinance) had $142,750 in daily volume across eight exchanges in September 2025. Social Send has none. It’s not a micro-cap. It’s a ghost.

Comparison: Social Send vs. Real Blockchain Social Platforms

| Feature | Social Send (SEND) | Minds.com | Indorse.io |

|---|---|---|---|

| Circulating Supply | 0 SEND | 1.2 billion MINDS | 450 million IND |

| 24-Hour Trading Volume | $0 | $187,000 | $21,500 |

| Active Users (Monthly) | 0 verified | 1.2 million | 12,350 |

| Blockchain | None verified | Ethereum (ERC-20) | Ethereum (ERC-20) |

| Exchange Listings | 1 (non-functional) | 5 | 5 (including Uniswap, Gate.io) |

| Technical Documentation | None | 47-page developer guide | Public API specs |

| Community Sentiment (Oct 2025) | 100% negative | 72% positive | 65% positive |

Scam Indicators: 4 Out of 7 Matched

TechForing’s October 2025 report listed seven red flags for crypto scams. Social Send hits four of them:- Impossible trading metrics: Price movement with $0 volume

- Zero circulating supply: No tokens available for trading

- Non-functional website: No real platform, no user access

- Automated promotions: Twitter and Telegram bots pushing “200% returns in 7 days”

No User Reviews. No Support. Just Scam Reports

Check Trustpilot. Zero reviews for socialsend.io. ScamAdviser gives the domain a 12/100 risk score. Reddit’s r/CryptoScams has 17 user reports from September 2025 alone. One user, u/CryptoWatcher2025, wrote: “Contacted CoinMarketCap about SEND-they confirmed it meets their Tier 3 listing criteria, which requires minimal verification. That’s why scam tokens show up.” That’s the truth. CoinMarketCap doesn’t verify projects. It just lists them if they meet basic technical formatting rules. It’s not a stamp of approval. It’s a catalog. No one’s posting about earning rewards. No one’s sharing success stories. Only warnings. Bitcointalk threads about SEND are 100% scam alerts. The same “200% returns” pitch used in the Alpha2Iota scam-where victims lost an average of $26,000-is now being pushed through WhatsApp groups targeting new crypto users.

Why This Matters: The Bigger Picture

The blockchain social media sector did $417 million in transaction volume in Q3 2025. Real projects have users, revenue, and transparency. Social Send has none of that. It’s not a failed startup. It’s a fraud designed to lure money from people who don’t know how to read the numbers. The SEC’s February 2025 enforcement actions specifically called out “inconsistent supply metrics” as evidence of fraud. Social Send has that in spades. Chainalysis’ October 2025 study of 1,247 similar tokens found a 99.3% failure rate. DataVisor rates Social Send 98/100 for “extreme scam likelihood.” CoinGecko has it on their delisting watchlist with a note: “near-certain removal within 30 days.” That’s not a prediction. That’s a death sentence.What to Do If You’ve Encountered Social Send

- Don’t buy SEND. There’s no exchange where you can actually trade it. Even if you send crypto to a “SEND wallet,” you’ll lose it.

- Report it. File a report with your local financial regulator. In the UK, that’s the FCA. In the US, report it to the FTC and the DFPI.

- Warn others. If you saw it on Telegram, Reddit, or YouTube, leave a comment. Someone else might be about to lose money.

- Check before you invest. Always verify: Is there real trading volume? Is there a working website? Are there real users? Is the circulating supply above zero? If any answer is “no,” walk away.

Final Verdict: Avoid Social Send at All Costs

Social Send isn’t a crypto exchange. It’s not even a real cryptocurrency. It’s a digital ghost-price tags with no buyers, tokens with no owners, and promises with no substance. It uses the same playbook as every other exit scam: fake numbers, fake hype, and a quick exit before anyone realizes it’s gone. The data doesn’t lie. The market doesn’t lie. And the people who lost money to this project? They’re not dumb. They just didn’t know how to read the signs.If you’re looking for a blockchain social platform with real utility, check out Minds.com or Indorse.io. They have users, transparency, and actual trading. Social Send? It has nothing but red flags.

Is Social Send (SEND) a real cryptocurrency?

No. Social Send is not a real cryptocurrency. It has zero circulating supply, no trading volume, no technical documentation, and no verifiable blockchain infrastructure. It meets multiple criteria for a crypto scam, including impossible price movements and a non-functional website.

Why does CoinMarketCap list Social Send if it’s a scam?

CoinMarketCap lists tokens based on technical formatting, not legitimacy. It doesn’t verify if a project is real or if its data is accurate. Many scam tokens appear on CoinMarketCap because they meet basic submission rules, not because they’re trustworthy. Always check volume, supply, and community feedback-not just the price.

Can I trade Social Send on any exchange?

No. Social Send is listed on only one exchange, and it has $0 trading volume. That means no one is buying or selling it. Even if you find a wallet address, you cannot trade SEND tokens because they don’t exist in circulation. Any site claiming to let you trade SEND is either a scam or a fake interface.

What are the signs that a crypto project is a scam?

Signs include: zero or near-zero trading volume, zero circulating supply, no whitepaper or technical docs, no real community or user reviews, promises of guaranteed high returns, and automated social media promotion. If a project checks three or more of these boxes, treat it as a scam until proven otherwise.

Has Social Send been flagged by regulators?

Yes. The California Department of Financial Protection and Innovation (DFPI) listed Social Send as a high-risk token in October 2025, citing inconsistent supply metrics and non-verifiable trading activity. It’s also on CoinGecko’s delisting watchlist and has been flagged by DataVisor and Chainalysis as an extreme scam risk.

What should I do if I already sent money to Social Send?

If you sent crypto to a Social Send wallet or paid for access to a fake platform, the funds are likely gone. Crypto transactions are irreversible. Report the incident to your local financial authority (like the FCA in the UK or the FTC in the US). Do not pay anyone claiming they can recover your funds-that’s a second scam. Learn from the experience and always verify projects before investing.

mark Hayes

November 1, 2025 AT 18:03Eliane Karp Toledo

November 1, 2025 AT 21:28Derek Hardman

November 2, 2025 AT 01:57Malinda Black

November 3, 2025 AT 07:49Mehak Sharma

November 5, 2025 AT 03:17Shaunn Graves

November 5, 2025 AT 16:51Chris Strife

November 6, 2025 AT 18:01Eric Redman

November 8, 2025 AT 14:37Edgerton Trowbridge

November 10, 2025 AT 14:35Hanna Kruizinga

November 12, 2025 AT 14:21Ron Cassel

November 14, 2025 AT 05:16Nadiya Edwards

November 15, 2025 AT 00:17Vicki Fletcher

November 15, 2025 AT 19:20Josh Serum

November 16, 2025 AT 22:33ISAH Isah

November 17, 2025 AT 22:45bob marley

November 19, 2025 AT 12:36Phyllis Nordquist

November 19, 2025 AT 22:15