State-Controlled Crypto Mining in Iran: How the Regime Uses Bitcoin to Bypass Sanctions

Feb, 1 2026

Feb, 1 2026

Iran’s Crypto Mining Machine: Power, Politics, and Profit

When the lights go out in Tehran during a 45°C summer heatwave, thousands of families sweat through blackouts. Meanwhile, just miles away, a hidden facility buried beneath a sports complex is running 24/7-thousands of Bitcoin miners humming, consuming electricity at a rate that could power a small city. This isn’t illegal activity in the usual sense. It’s state-sanctioned. And it’s one of the most striking examples of how a government turns digital currency into a tool of survival.

How It All Started: A Legal Loophole for Survival

In 2018, Iran’s government did something unexpected: it made cryptocurrency mining legal. Not because it believed in decentralization, but because it had no choice. U.S. sanctions had frozen Iran out of global banking. Foreign currency was nearly impossible to access. Imports of medicine, spare parts, even food were getting harder. The Central Bank of Iran saw crypto mining as a way to generate hard currency without touching the international financial system.

By 2020, Iranians were trading between $16 million and $20 million in crypto daily. Bitcoin mining alone was worth about $1 billion a year. The government didn’t stop it-they watched it, then took control.

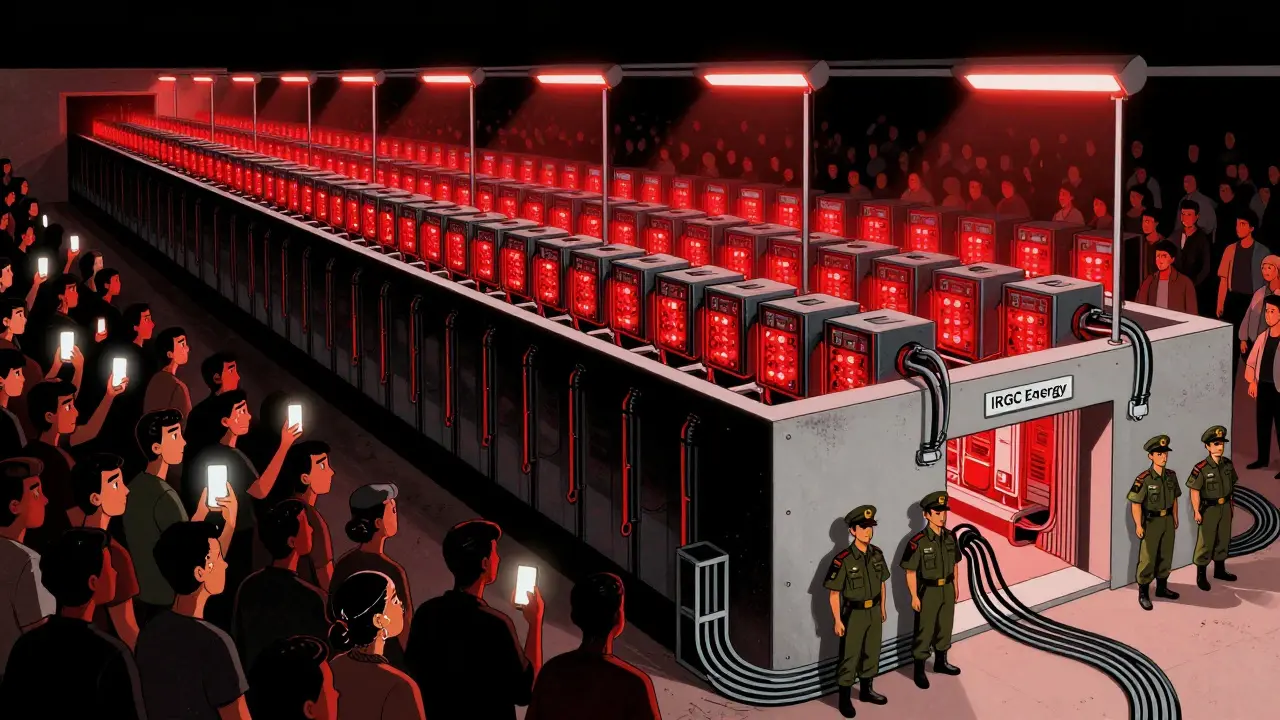

The IRGC’s Hidden Mines: Electricity as a Weapon

The real power behind Iran’s crypto boom isn’t tech startups or individual miners. It’s the Islamic Revolutionary Guard Corps (IRGC). With direct access to military-grade infrastructure and subsidized electricity, the IRGC built massive mining farms across the country. One of the most notorious is the 175-megawatt facility in Rafsanjan, built with Chinese equipment and running on electricity that costs just 0.004 cents per kilowatt-hour. That’s less than 1/50th of what businesses pay in the U.S. or Europe.

These aren’t just data centers. They’re energy theft operations disguised as national projects. Mining rigs are installed in tunnels under sports complexes, inside abandoned factories, and even on military bases with dedicated power lines. In Ahvaz, a 16-hectare cycling arena was found to house thousands of ASIC miners hidden beneath the track and in electrical rooms-operating undetected for over two years.

The result? Widespread blackouts. In 2024, citizens took to Twitter with #IranEnergyCrisis, posting videos of their homes without power while mining operations nearby ran uninterrupted. One verified account reported a 14-hour blackout in Tehran’s District 3 during peak heat-while the IRGC’s rigs kept mining.

Legal vs. Illegal: A Game of Two Rules

Iran’s government claims to regulate crypto mining. Since 2025, operators need a license from the Ministry of Industry, Mine and Trade. They’re supposed to use government-approved hardware, pay 7 cents per kWh, and report their profits. Sounds fair-until you realize the rules don’t apply to everyone.

IRGC-linked operations, religious foundations like Astan Quds Razavi, and state-owned enterprises operate with total immunity. They get electricity at 0.004 cents. They don’t pay taxes. They don’t need licenses. They’re protected by armed guards. Meanwhile, private miners face delays of 6-8 weeks just to get a license, and their machines are forced to use less efficient, government-approved hardware that cuts profits by 15-20%.

This isn’t regulation. It’s a cartel. The state controls the market by letting its allies take everything while squeezing everyone else.

Sanctions Evasion: Crypto as a Lifeline

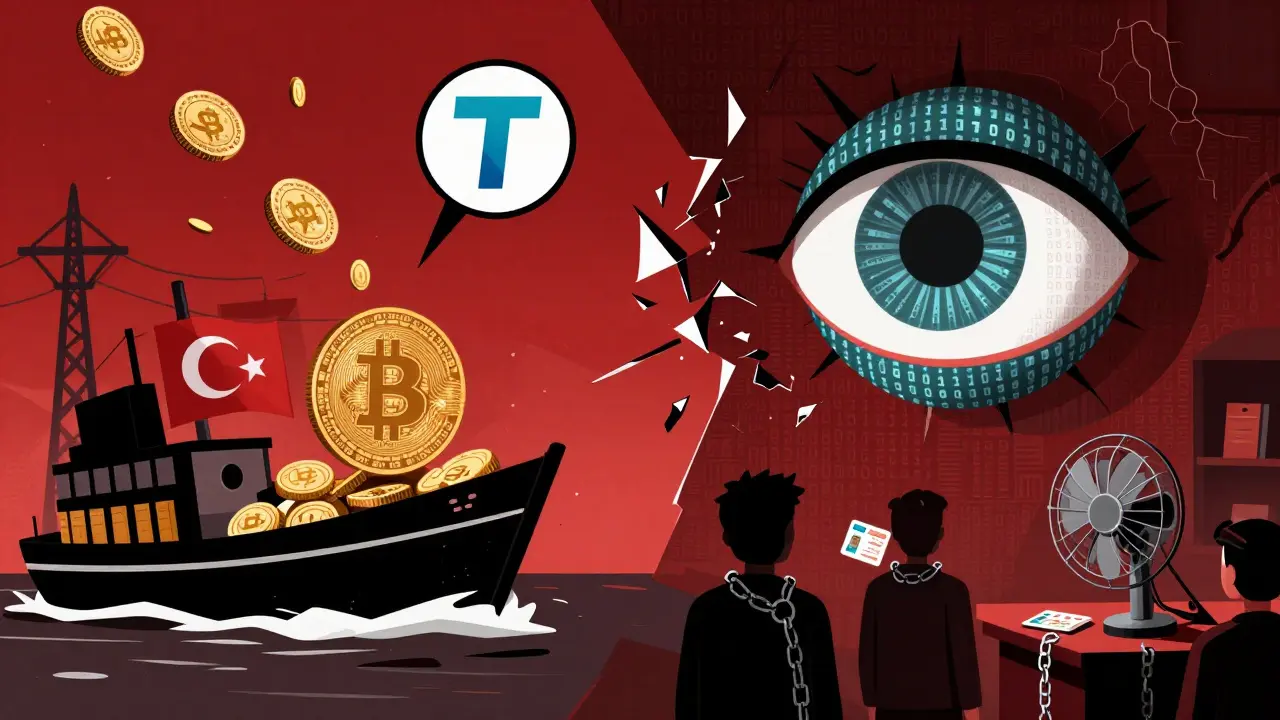

Iran’s real goal isn’t to become a crypto superpower. It’s to bypass sanctions. By mining Bitcoin and converting it to stablecoins like USDT, the regime can buy goods on the black market without touching banks. No SWIFT. No audits. No paper trail.

But the world is catching on. In July 2025, Tether-the company behind USDT-froze 42 Iranian-linked cryptocurrency addresses. It was the largest single freeze in Tether’s history. The wallets were tied to Nobitex, Iran’s biggest domestic exchange, and IRGC-affiliated wallets flagged by Israeli counterterrorism analysts.

The freeze didn’t stop Iran. It forced a shift. Within days, the government urged citizens and businesses to move their holdings from USDT to DAI, a decentralized stablecoin on the Polygon network. Why? Because DAI is harder to freeze. It’s not controlled by a single company. It’s code. And code, unlike banks, can’t be shut down by a U.S. executive order.

The Rial Digital: The Government’s Countermove

While the IRGC mines Bitcoin, the Central Bank of Iran is quietly building its own digital currency: the Rial Digital. Officially, it’s described as “the electronic version of common banknotes.” In reality, it’s a surveillance tool. Every transaction is tracked. Every wallet is tied to your ID. Every purchase can be monitored.

The goal? Replace decentralized crypto with state-controlled crypto. If citizens can’t use Bitcoin to buy medicine from Turkey, maybe they’ll use the Rial Digital instead. And if they do, the government gets full visibility into their spending habits.

This is the ultimate contradiction: the same regime that protects mining for sanctions evasion is trying to ban its own people from using the same technology.

What’s Next? Tax, Control, or Collapse?

In August 2025, Iran passed the Law on Taxation of Speculation and Profiteering. For the first time, crypto profits are taxed-like gold, real estate, and forex. The government is now trying to collect billions in unpaid taxes from exchanges that operated in the shadows for years.

But here’s the problem: the people who made the money-the IRGC and its allies-still don’t pay taxes. The tax law targets small traders and legal operators, not the ones who stole the power.

Energy experts warn that Iran’s grid can’t handle this much demand. Mining consumes over 1,000 megawatts of electricity nationwide. That’s enough to power millions of homes. The country already imports electricity from neighbors like Iraq and Azerbaijan. If the grid collapses, it won’t be because of drought or mismanagement. It’ll be because a handful of state-linked entities turned electricity into a cash machine.

Public Outrage and the Cost of Silence

Iranians know what’s happening. Reddit threads in r/Iran have thousands of comments from people describing factories shutting down because of power cuts, while mining farms in the same city kept running. Social media is full of anger: “They take our electricity to buy weapons. We can’t even run a fan.”

But speaking out is dangerous. The government has banned all crypto advertising-online and offline. Journalists who investigate mining operations disappear. Whistleblowers are silenced.

The real cost of state-controlled crypto mining isn’t just in kilowatts. It’s in trust. It’s in the dignity of a population forced to choose between staying warm and staying connected.

Final Reality: A System Built to Break

Iran’s state-controlled crypto mining isn’t a success story. It’s a desperate gamble. The regime uses it to survive sanctions, but it’s killing its own economy in the process. The energy grid is crumbling. Public anger is rising. International pressure is tightening. Even the stablecoins they rely on are being frozen.

There’s no long-term win here. Either the government shuts down the IRGC’s mines-and risks losing its main source of hard currency-or it lets them keep running, and the country burns out from the inside.

Right now, it’s choosing the burn.

Is cryptocurrency mining legal in Iran?

Yes, but only under strict conditions. Legal mining requires a license from the Ministry of Industry, Mine and Trade, payment of specific electricity tariffs (7 cents per kWh), and use of government-approved hardware. However, state-affiliated entities like the IRGC operate outside these rules with free power and no oversight, creating a two-tier system where the rules apply to citizens but not the regime.

Why does Iran allow crypto mining if it causes blackouts?

Because it’s a lifeline for sanctions evasion. By mining Bitcoin and converting it to stablecoins like USDT, Iran can buy goods internationally without using banks. The electricity used for mining is heavily subsidized, making it extremely profitable. The government tolerates the blackouts because the financial benefit outweighs the domestic cost-especially for the elite who control the mines.

Who controls Iran’s crypto mining operations?

The Islamic Revolutionary Guard Corps (IRGC) and entities tied to Supreme Leader Ali Khamenei control the largest and most profitable mining operations. These include joint ventures with Chinese firms and facilities built on military land. Private miners are heavily regulated and taxed, while state-linked operations enjoy free electricity, no licensing requirements, and armed protection.

How much electricity does Iran’s crypto mining use?

Iran’s total crypto mining consumption exceeds 1,000 megawatts as of early 2023, enough to power a city of 1 million people. The largest single facility, in Rafsanjan, uses 175 megawatts. This has directly contributed to nationwide blackouts, especially during peak demand periods in summer and winter.

Why did Tether freeze Iranian crypto addresses in 2025?

Tether froze 42 Iranian-linked addresses tied to Nobitex and IRGC-affiliated wallets after being flagged by Israeli counterterrorism analysts. This was the largest single freeze in Tether’s history. The move was part of growing international pressure to cut off Iran’s access to global crypto liquidity, forcing Tehran to shift to harder-to-freeze stablecoins like DAI on decentralized networks.

Is Iran developing its own cryptocurrency?

Yes. The Central Bank of Iran is developing the Rial Digital, a state-controlled digital currency pegged to the traditional rial. Unlike Bitcoin, it’s fully centralized and allows the government to track every transaction. The goal is to replace decentralized crypto with a tool of financial surveillance and control, while still maintaining access to digital payments under sanctions.

Will Pimblett

February 2, 2026 AT 17:41Rico Romano

February 3, 2026 AT 03:46