Understanding Bitcoin Block Reward: How Miners Get Paid and Why It Matters

Apr, 27 2025

Apr, 27 2025

Bitcoin Block Reward Calculator

Next Halving

Expected Block:

1,050,000

Expected Date:

2028

Reward After:

1.5625 BTC

Last Halving

Block:

840,000

Date:

April 2024

Reward Before:

6.25 BTC

Future Timeline

2140:

Last Bitcoin Minted

2100:

Fees Estimated at $15-$25/tx

2050:

Subsidy < 0.5 BTC/block

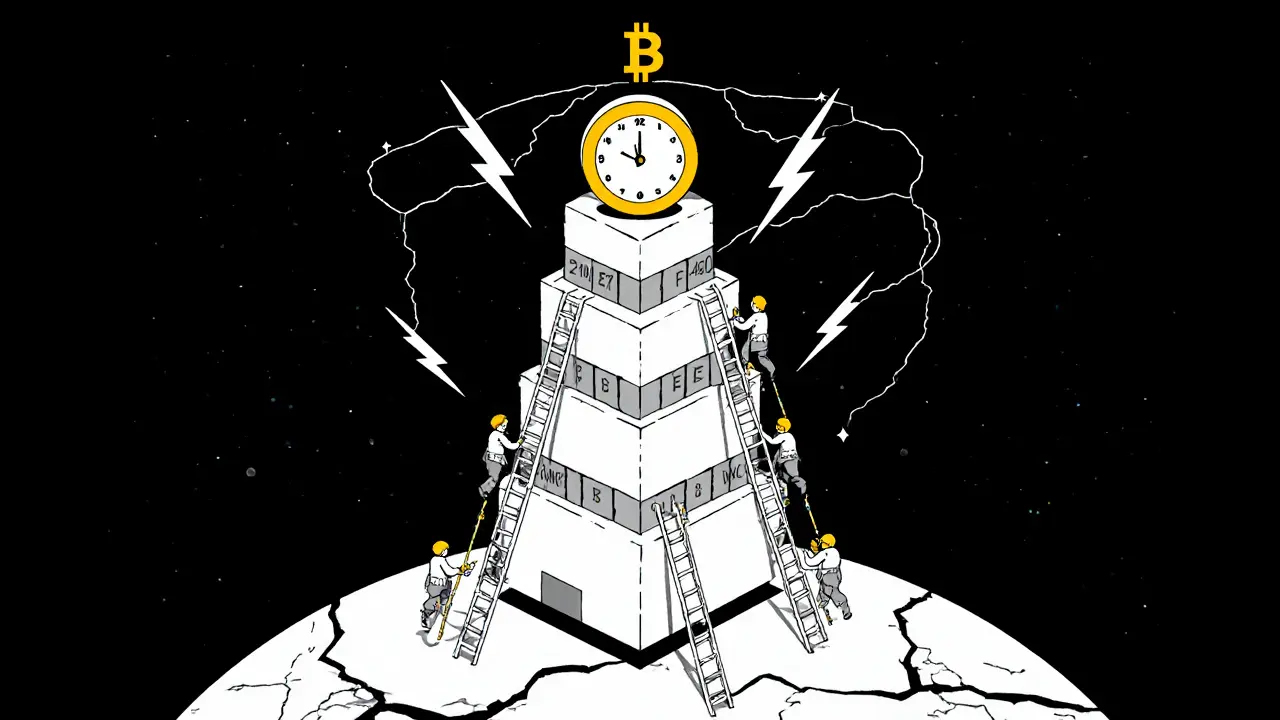

When you hear about Bitcoin’s price going up or down, it’s easy to think it’s all about speculation. But behind every new Bitcoin that enters circulation is a mechanical, predictable system designed to keep the network alive. That system is the Bitcoin block reward.

What Exactly Is the Bitcoin Block Reward?

The Bitcoin block reward is what miners get paid for verifying transactions and adding a new block to the blockchain. It’s not a bonus-it’s the core incentive that keeps the whole network running. Without it, no one would spend money on expensive hardware and electricity to secure Bitcoin.

This reward has two parts:

- The block subsidy: New Bitcoin created out of thin air, according to the protocol’s rules.

- Transaction fees: The leftover Bitcoin from users’ payments that aren’t fully spent. Miners collect these as a bonus.

For example, if someone sends 1 BTC but only needs to pay 0.999 BTC in fees and change, the 0.001 BTC difference goes to the miner. It’s like the tip you leave at a restaurant-but in Bitcoin.

The first transaction in every block is called the coinbase transaction. It’s the only one that can create new Bitcoin. That’s where the subsidy gets added. No other transaction can do that.

How the Block Reward Has Changed Over Time

When Bitcoin launched in January 2009, the block reward was 50 BTC. That sounds like a lot-but it was never meant to last. Satoshi Nakamoto built in a built-in countdown: every 210,000 blocks, the reward cuts in half. This is called a halving.

Here’s how it’s played out:

- November 2012: 50 BTC → 25 BTC

- July 2016: 25 BTC → 12.5 BTC

- May 2020: 12.5 BTC → 6.25 BTC

- April 2024: 6.25 BTC → 3.125 BTC

That’s four halvings. The next one is expected around 2028. By then, the reward will drop to 1.5625 BTC per block.

Why does this matter? Because Bitcoin’s total supply is capped at 21 million coins. As of October 2025, about 19.9 million have been mined. That leaves less than 100,000 BTC left to issue. After that, no new Bitcoin will be created.

Why Halvings Exist: Scarcity as a Feature

Most money today gets printed by central banks. The U.S. dollar, the euro, even the British pound-none of them have hard limits. Bitcoin does. And that’s intentional.

The halving mechanism turns Bitcoin into a deflationary asset. It mimics how gold is mined: harder to find over time, rarer, more valuable. The predictable reduction in supply creates scarcity, which has helped Bitcoin earn its reputation as “digital gold.”

Compare that to Dogecoin, which has no supply cap, or Litecoin, which will eventually release 84 million coins. Bitcoin’s hard cap is unique. And it’s the reason institutional investors like MicroStrategy and Grayscale have bought billions in Bitcoin-they’re betting on scarcity, not speculation.

As of 2025, Bitcoin’s annual inflation rate is around 1.8%. That’s lower than the U.S. dollar’s inflation rate in most years. And it’s still falling.

Miners Are Becoming More Dependent on Fees

Right now, the block subsidy (new Bitcoin) still makes up most of the reward. But that’s changing.

Before the April 2024 halving, transaction fees made up about 15% of miner revenue. After the halving, that jumped to 28% during peak usage. Why? Because fewer new coins are being created, so miners need to make up the difference.

Some miners are already feeling the squeeze. In March 2024, a Reddit thread from Bitcoin miners showed that inefficient operations-those using older hardware or paying over $0.06 per kWh for electricity-shut down within weeks. Only those with cheap power and modern ASICs (like the Antminer S21 Hydro) are surviving.

Today, profitable mining requires electricity costs below $0.045 per kWh. That’s why so much mining has moved to places like Texas, Georgia, and Scandinavia, where energy is cheap and abundant.

The long-term question isn’t whether miners will disappear-it’s whether transaction fees will rise enough to keep them profitable. Right now, the average fee is around $2.50. By 2100, analysts estimate it may need to hit $15-$25 per transaction just to match today’s miner income.

That’s a problem. If fees go that high, Bitcoin becomes impractical for everyday payments. That’s why the Lightning Network exists-a second-layer solution that lets users send small payments off-chain, reducing pressure on the main blockchain.

How Bitcoin Compares to Other Blockchains

Not all blockchains pay miners the same way.

Bitcoin uses proof-of-work (PoW). Ethereum switched to proof-of-stake (PoS) in 2022. In PoS, validators don’t mine blocks-they stake their own ETH to be chosen. Their reward comes from transaction fees and newly minted ETH, but there’s no halving. Ethereum’s supply is inflationary, not capped.

Bitcoin’s model is more like mining gold than running a utility. It’s energy-heavy, but that’s the point. The cost of attacking Bitcoin’s network is astronomical because you’d need to control over 50% of the global hash rate. That’s nearly impossible.

Other PoW coins like Bitcoin Cash or Litecoin follow similar halving schedules, but none have the same market dominance. As of 2024, Bitcoin controls 86.7% of all PoW cryptocurrency market value. That’s because its block reward system is tied to trust, scarcity, and predictability.

The Big Debate: Is Bitcoin’s Model Sustainable?

Some experts think Bitcoin’s block reward system is brilliant. Others think it’s a ticking time bomb.

Dr. Garrick Hileman from Blockchain.com says: “The block reward is Bitcoin’s lifeblood.” He argues that the economic incentive to secure the network is what makes Bitcoin the most secure digital asset ever created.

But economist Nouriel Roubini disagrees. He claims that once subsidies disappear, miners won’t have enough incentive to keep the network safe. The result? A less secure Bitcoin.

And it’s not just theoretical. The IMF warned in 2024 that Bitcoin’s security model faces “existential risk” after 2050, when block subsidies fall below 0.5 BTC per block. At that point, fees need to be high enough to compensate-or the network becomes vulnerable.

Meanwhile, the Bitcoin community is working on solutions. BIP-300, a proposed upgrade, aims to create more stable fee markets by encouraging users to pay higher fees during low-usage periods. It’s a long-term fix, but it’s still in early discussion.

What This Means for You

If you’re holding Bitcoin, the block reward doesn’t directly affect your wallet. But it affects Bitcoin’s value, security, and long-term viability.

Every halving reduces the supply of new Bitcoin. Historically, that’s preceded bull markets-but not always immediately. After the 2020 halving, prices didn’t surge until 12 months later. The 2024 halving followed a similar pattern.

If you’re thinking about mining Bitcoin, understand this: it’s no longer a hobby. It’s a capital-intensive business. You need specialized hardware, access to cheap power, and the ability to handle sudden difficulty spikes. Most individual miners now join mining pools to share rewards.

And if you’re using Bitcoin to send money? The block reward system is why your transaction might cost more during busy times. The network prioritizes higher-fee transactions. That’s how miners decide which blocks to include.

Bitcoin’s block reward isn’t just a technical detail. It’s the engine behind its entire economic model. It’s what makes Bitcoin different from every other currency ever created.

What Comes Next?

By 2140, the last Bitcoin will be mined. After that, miners will rely entirely on transaction fees. The network will still work-but only if users are willing to pay for it.

The Lightning Network, sidechains, and future protocol upgrades are all attempts to make that future possible. But none of them change the core rule: Bitcoin’s supply is finite. Its scarcity is programmed. And its block reward is the reason that rule matters.

Understanding the block reward isn’t about mining. It’s about understanding why Bitcoin has value-and why it might keep it for the next century.

What is the current Bitcoin block reward?

As of October 2025, the Bitcoin block reward is 3.125 BTC per block. This includes newly minted Bitcoin (the subsidy) and transaction fees from transactions in that block. The subsidy was last reduced in April 2024 during the fourth halving event.

How often does the Bitcoin block reward halve?

The Bitcoin block reward halves every 210,000 blocks, which happens approximately every four years. This is hardcoded into Bitcoin’s protocol. The last halving occurred in April 2024, and the next one is expected in 2028.

Do miners only get paid in new Bitcoin?

No. Miners earn two things: the block subsidy (new Bitcoin created with each block) and transaction fees from users. As the subsidy decreases over time, transaction fees are becoming a larger portion of miner income. In 2025, fees account for nearly 30% of total miner revenue during peak network usage.

Why is the Bitcoin block reward important for security?

The block reward gives miners a financial incentive to invest in powerful hardware and electricity to validate transactions. This competition makes it extremely expensive for anyone to attack the network. The higher the reward, the more secure Bitcoin becomes. Without it, there would be no reason for miners to participate.

Will Bitcoin mining stop after all coins are mined?

No. Mining will continue even after the last Bitcoin is mined around 2140. Miners will still earn income from transaction fees. The network will remain secure as long as users are willing to pay fees to get their transactions confirmed. The challenge is making those fees high enough to replace the lost subsidy.

Can Bitcoin’s block reward be changed?

Technically, yes-but only if over 90% of the network agrees to a hard fork. Bitcoin’s block reward schedule is hardcoded into its protocol and has never been altered since 2009. Any attempt to change it would likely split the network and lose the trust of users who value its predictable monetary policy.

Clarice Coelho Marlière Arruda

October 30, 2025 AT 06:17so like... miners are basically just crypto janitors getting paid in digital confetti? weird but kinda cool i guess.

Brian Collett

October 31, 2025 AT 11:56bro the fact that we’re down to 3.125 BTC per block and fees are already hitting 28% of revenue is wild. this isn’t just tech-it’s economics in real time. i’ve seen mining rigs go dark in Texas because power prices spiked. it’s a survival of the fittest now.

Allison Andrews

November 1, 2025 AT 21:55It’s fascinating how the block reward isn’t just a technical feature but a philosophical statement about scarcity, time, and human value systems. The design enforces discipline where central banks enforce flexibility. One is a clock; the other is a sponge.

Wayne Overton

November 1, 2025 AT 22:45miners gonna mine fees gonna rise bitcoin gonna die

Alisa Rosner

November 2, 2025 AT 10:05Okay, let me break this down for you like you’re five 🧒: Miners get paid in two ways-new Bitcoin (like printing money) + little tips from users (like leaving a dollar on the table). Right now, the printing is slowing down, so they’re relying more on tips. If tips don’t grow, miners quit → network gets slower → Bitcoin gets less secure. That’s why Lightning Network is like a secret backdoor for tiny payments 💸⚡

MICHELLE SANTOYO

November 4, 2025 AT 06:22you people act like scarcity is magic. gold doesn’t run on electricity. bitcoin is just a glorified spreadsheet held together by hope and coal. the ‘digital gold’ narrative is marketing nonsense wrapped in a whitepaper. if you think this isn’t a pyramid scheme with extra steps, you’re not paying attention

Lena Novikova

November 5, 2025 AT 19:23everyone’s freaking out about fees but no one talks about how the network is already optimized for whales. if you’re sending $5 you’re getting ignored. this isn’t money it’s a luxury asset for the rich. the lightning network is just a bandaid on a bullet wound

Olav Hans-Ols

November 7, 2025 AT 10:18Love how this whole thing is basically a slow-motion countdown to something beautiful. It’s not broken-it’s evolving. The fact that we’ve gone from 50 BTC to 3.125 and the network’s still standing? That’s resilience. And the Lightning Network? That’s the next chapter. Keep building, keep mining, keep believing. 🙌

Kevin Johnston

November 8, 2025 AT 14:27Bitcoin’s gonna be fine 🚀🔥

Nick Cooney

November 10, 2025 AT 04:10you say ‘Bitcoin’s gonna be fine’ like it’s a pep rally. nice try. the math doesn’t lie: by 2050, block subsidies drop below 0.5 BTC. if fees don’t hit $20 per tx, the network’s hash rate plummets. and guess what? nobody’s building a viable fee market. we’re just hoping the next generation of users will pay more because… reasons. this isn’t optimism-it’s denial with a whitepaper.

also, ‘miners gonna mine’ is not a strategy. it’s a prayer. and we all know how well prayers work when the power bill’s due.

Dr. Monica Ellis-Blied

November 12, 2025 AT 00:23While the block reward mechanism is elegantly designed, it is imperative to recognize that economic incentives must evolve in tandem with technological adoption. The current trajectory, wherein transaction fees are projected to increase exponentially, may undermine Bitcoin’s utility as a medium of exchange. Furthermore, the concentration of mining power in low-cost energy regions introduces systemic centralization risks. Without proactive, community-driven fee-market reforms, Bitcoin risks becoming a store of value only-deprived of its original peer-to-peer vision.

Herbert Ruiz

November 13, 2025 AT 17:01Post is 90% fluff. Block reward halves every 210k blocks. That’s it. Everything else is speculation. Stop writing essays.