WaultSwap (BSC) Crypto Exchange Review: High Risk, Low Reward in 2025

Oct, 14 2025

Oct, 14 2025

WaultSwap Slippage Calculator

Calculate Your WaultSwap Trade Loss

WaultSwap has extremely low liquidity. This calculator shows how much you could lose due to slippage when trading on this platform.

Trade Results

WaultSwap (BSC) sounds like it could be the next big thing in decentralized finance - low fees, high APYs, a native token, and all built on Binance Smart Chain. But if you're thinking about swapping tokens on it right now, you need to know the truth: this isn't a platform you use to trade. It's a gamble with almost no safety net.

What WaultSwap Actually Is

WaultSwap is a decentralized exchange (DEX) that runs on Binance Smart Chain (BSC). It uses an automated market maker (AMM) model, meaning there’s no order book - trades happen directly between users and liquidity pools. Its native token, WEX, is meant to be used for governance and staking. The platform claims to be community-run through a DAO, but there’s no public record of active voting, proposals, or developer involvement in the last 90 days.WaultSwap’s biggest selling point? A 0.17% trading fee - slightly lower than PancakeSwap’s 0.25%. But here’s the catch: that tiny fee doesn’t matter if you can’t execute a trade without losing half your money to slippage.

The Liquidity Problem

Liquidity is the lifeblood of any DEX. Without it, prices swing wildly, trades fail, and your funds vanish. WaultSwap has almost none.As of November 2025, there are only three active trading pairs: WEX/BUSD, WEX/BNB, and WEX/ETH. Each has less than $5,000 in 24-hour volume. Compare that to PancakeSwap, which handles over $1.2 billion daily across 2,500+ pairs. On WaultSwap, even swapping $100 worth of BNB for WEX can trigger a 20% slippage. That means if you think you’re buying $100 of WEX, you might end up with $80 worth - because the pool is so thin, the price moves against you the moment you click confirm.

On-chain data from BscScan shows WaultSwap processes fewer than 130 transactions per day. PancakeSwap does over 3 million. That’s not a small difference - it’s a chasm.

Staking Yields Are a Trap

You’ll see ads claiming WEX staking farms offer up to 187% APY. That sounds insane - and it is. High yields on DEXes aren’t rewards. They’re warnings.When a token has almost no real demand, the only way to attract users is to pay them in new tokens. That’s called “yield farming.” But if no one wants to buy WEX, the price crashes as soon as farmers start cashing out. And they always do.

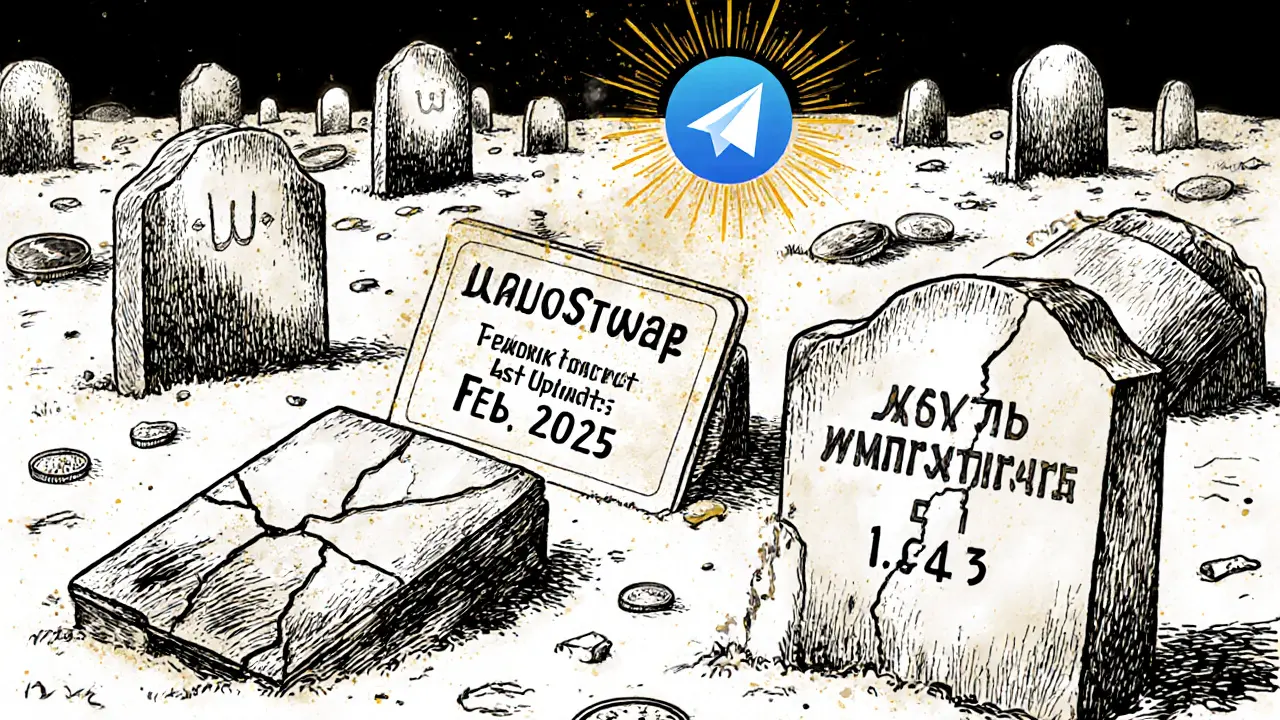

There are no locked liquidity pools or insurance mechanisms on WaultSwap. If the team pulls the plug - or just stops updating the site - your staked tokens become worthless. And there’s zero evidence they’re building anything new. The last update was in February 2025. The GitHub repo has been silent for over three months.

Security Claims Don’t Match Reality

WaultSwap says its smart contracts are “fully audited.” But no public audit report from firms like CertiK, PeckShield, or SlowMist is available. No date. No firm name. Just a vague statement on their website - last updated in March 2024.Meanwhile, users on Reddit and CoinGecko are reporting consistent issues: transactions confirmed but tokens never arrive. Wallets show zero balance after a “successful” swap. Support emails go unanswered for days. One user reported trying to swap 0.5 BNB for WEX - the transaction went through, but the tokens never showed up. They waited 14 days. No reply.

WaultSwap’s Telegram group has shrunk from nearly 5,000 members in January 2025 to just over 1,200. That’s not a community. That’s a graveyard.

Who Should Even Try This?

The only people who might benefit from WaultSwap are those who bought WEX in 2023 or early 2024 at pennies per token. One Reddit user said they bought 10 million WEX for $50 - and now it’s worth $582. That’s a 1,064% return. But that’s luck, not strategy.For everyone else? Don’t touch it.

If you’re a beginner, you won’t understand how to set slippage tolerance or verify contract addresses. If you’re experienced, you know this is a dead project with no roadmap, no development, and no liquidity. Even if you think you’re “just testing,” you’re risking your capital on a platform that doesn’t care if you lose.

How It Compares to the Competition

| Feature | WaultSwap (BSC) | PancakeSwap | Biswap |

|---|---|---|---|

| Trading Fee | 0.17% | 0.25% | 0.20% |

| Active Trading Pairs | 3 | 2,500+ | 1,200+ |

| 24h Volume | <$10,000 | $1.2B+ | $180M+ |

| APY (LP Farms) | Up to 187% | 30-60% | 40-80% |

| Developer Activity | None (90+ days) | Regular updates | Regular updates |

| Community Size (Telegram) | 1,247 | 2.1M | 890K |

| Market Cap (WEX / CAKE / BSW) | $3,750 | $412M | $89M |

| Support Response Time | 72+ hours | Under 12 hours | Under 24 hours |

WaultSwap doesn’t compete with these platforms. It’s barely on the same planet.

Real-World Risks You Can’t Ignore

This isn’t just about losing money. It’s about violating regulations. WaultSwap has no KYC or AML checks. That means if you’re in the EU, using it after December 30, 2024, could technically put you in violation of MiCA rules - even as a retail user. Enforcement is still new, but regulators are watching. Your wallet address could be flagged.There’s also no insurance. No FDIC. No recourse. If the contract has a bug, if the team disappears, if someone exploits the pool - you lose everything. And no one will help you.

Getting Started? Don’t.

Even if you ignore all the red flags, the setup is a hassle. You need:- A Web3 wallet (MetaMask or Trust Wallet)

- BSC network manually added (RPC: https://bsc-dataseed.binance.org/, Chain ID: 56)

- BNB for gas (average $0.05-$0.15 per transaction)

- Slippage tolerance set to 15-25% just to make a trade go through

- Contract address verification - and even then, you’re gambling

It takes 15 minutes just to get to the point where you can fail a trade. And that’s assuming the site loads. Users report frequent downtime.

Final Verdict

WaultSwap (BSC) is not a crypto exchange you use. It’s a speculative token with a broken interface, zero liquidity, and no future. The high yields are bait. The low fees are irrelevant. The audits are unverified. The community is gone.There are hundreds of better DEXes on BSC - PancakeSwap, Biswap, ApeSwap, and even newer ones like ThunderCore Swap. All have real volume, active teams, and transparent audits. WaultSwap doesn’t deserve a spot on your radar unless you’re trying to lose money fast.

If you already hold WEX? Consider it a loss. Don’t add more. Don’t stake more. Just wait and see if it dies quietly - or gets wiped out in a rug pull.

There’s no upside here. Only risk.

Is WaultSwap safe to use?

No. WaultSwap has no verified audits, no active development, and extremely low liquidity. Users report failed transactions, missing tokens, and unresponsive support. The platform lacks basic security features and regulatory compliance. It’s not safe for any kind of trading or staking.

Can I make money staking WEX?

Technically, yes - if you bought WEX years ago at near-zero prices. But the 187% APYs are unsustainable. They exist because no one wants to buy WEX, so the platform pays users in more WEX. When those users cash out, the price crashes. Staking now is like betting the token won’t collapse before you can withdraw.

Why is WaultSwap’s trading volume so low?

Because no one uses it. With only three trading pairs and less than $10,000 in daily volume, there’s no reason for traders to choose it over PancakeSwap or Biswap, which offer hundreds of pairs, deep liquidity, and reliable execution. WaultSwap’s low volume is a symptom of its irrelevance, not a problem that can be fixed.

Does WaultSwap have a roadmap or future updates?

No. The last update was in February 2025, fixing minor UI bugs. The 2024 roadmap promised cross-chain support and institutional security - neither has been delivered. There have been zero code commits in the last 90 days. This is a stagnant project with no signs of revival.

Should I buy WEX as an investment?

Absolutely not. WEX has a market cap of just $3,750 and is traded on no major exchanges. Its price is manipulated by tiny liquidity pools. Analysts predict up to a 90% price drop. Even the most bullish forecasts show only short-term speculative swings - not sustainable growth. Treat WEX like a lottery ticket, not an asset.