What is EthereumPoW (ETHW) Crypto Coin? The Full Story After The Merge

Oct, 15 2025

Oct, 15 2025

ETHW Mining Profitability Calculator

Mining Setup

Network Status

Calculation Results

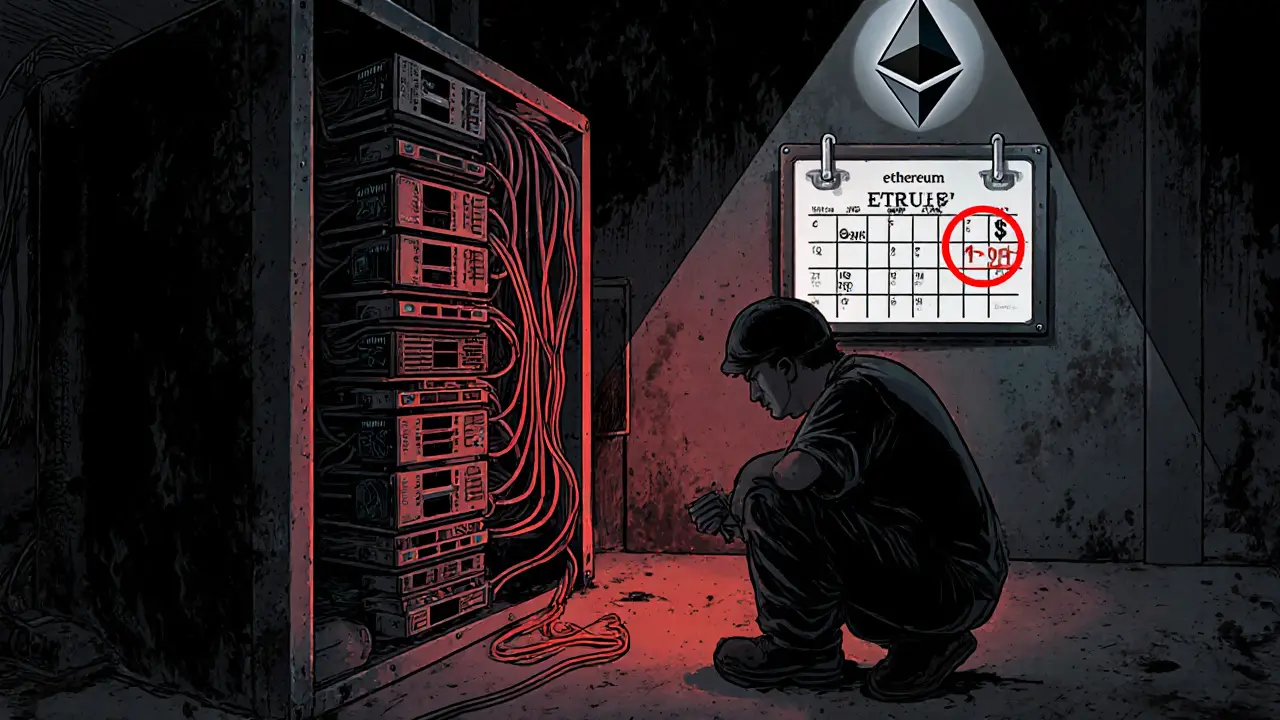

When Ethereum switched from mining to staking in September 2022, a big chunk of the crypto world didn’t go along with it. Thousands of miners, many who had spent thousands on GPUs and electricity bills, suddenly found their equipment useless. That’s when EthereumPoW (ETHW) was born - a direct fork of the old Ethereum chain, keeping proof-of-work alive for anyone who still believed in mining.

How ETHW Came to Be

EthereumPoW didn’t appear out of nowhere. It was created on September 15, 2022, the exact moment Ethereum completed its Merge. At block 15,537,393, the original Ethereum blockchain split. One side became Ethereum (ETH), running on staking. The other became ETHW, keeping the old mining rules.

This wasn’t some random group of devs. It was led by Chinese miner Chandler Guo and backed by major mining pools like Flexpool and 2Miners. These weren’t hobbyists - they were businesses with millions in hardware. Their goal? Keep the original Ethereum vision alive: anyone with a decent GPU could mine and help secure the network.

Before the Merge, Ethereum mining was worth over $18 billion a year. When it ended, so did the income for those miners. ETHW gave them a way to keep running their rigs. It wasn’t about changing Ethereum - it was about preserving it.

How ETHW Works

ETHW runs on the same Ethash algorithm as pre-Merge Ethereum. That means you still need a powerful GPU - not an ASIC - to mine it. The block time is 13-15 seconds, just like old Ethereum. Every time a miner finds a new block, they get 2 ETHW plus whatever transaction fees are in that block.

Unlike Ethereum, there’s no staking. You can’t lock up ETHW to earn rewards. You mine it. That’s the whole point.

It’s fully compatible with Ethereum’s old tools. If you used MetaMask for Ethereum before, you can use it for ETHW too. Just add the RPC endpoint https://mainnet.ethereumpow.org and you’re connected. Smart contracts, dApps, wallets - they all work the same way. You don’t need to learn anything new.

Gas fees are low. As of mid-2024, the average gas price hovers around 5 Gwei. That’s less than 10% of what you’d pay on Ethereum. Transactions are cheap, but they’re slower. Confirmations take about 45 seconds on average, compared to 15 seconds on Ethereum.

How Much ETHW Is Out There?

There are 107.8 million ETHW coins in circulation as of early 2024. That’s less than the original Ethereum supply because some ETH was staked and couldn’t be moved to the PoW chain. The total supply is capped at 107.8 million - no more will ever be created.

Miners earn new ETHW with every block, but the rewards have dropped over time. In late 2022, miners made $1.2 million a month. By mid-2024, that number fell to just $187,000. Why? ETHW’s price crashed. It peaked at $34.50 right after the fork. Today, it trades around $0.96. When mining rewards drop below electricity costs, miners shut down.

ETHW vs Ethereum - The Big Difference

Ethereum and ETHW share the same history, but they’ve gone in opposite directions.

- Ethereum: Uses staking. You need 32 ETH to become a validator. No mining. Higher security, higher fees, faster transactions, more developers.

- ETHW: Uses mining. Anyone with a GPU can participate. Lower fees, slower transactions, no staking, almost no new development.

Ethereum processes 15-30 transactions per second. ETHW manages about 0.11. That’s not a typo - it’s barely functional for real-world use. There are only 12 active dApps on ETHW. Ethereum has over 5,800.

Security is another big gap. Ethereum’s hashrate is over 1,000 TH/s. ETHW’s is just 1.2 TH/s. That means a single mining pool could theoretically take over the network. It’s not likely, but the risk is real.

ETHW vs Ethereum Classic (ETC)

Some people compare ETHW to Ethereum Classic (ETC). Both are PoW forks of Ethereum. But ETC has been around since 2016, after the DAO hack. It has its own community, its own roadmap, and its own development team.

ETC has a fixed supply of 210 million coins. ETHW’s supply is capped at 107.8 million. ETC’s market cap is over $5 billion. ETHW’s is around $105 million. ETC has 10 times more dApps. It has 12 times more mining power. It’s not even close.

ETHW is essentially a one-time replay of Ethereum’s past. ETC is a different blockchain with its own future.

Who Uses ETHW Today?

Most ETHW holders are miners. According to Nansen analytics, 82% of ETHW wallets belong to mining operations or mining pools. Regular users? Almost none.

There are no big companies using ETHW. No DeFi protocols. No NFT marketplaces. No institutional adoption. It’s a miner’s coin. That’s it.

On Reddit, you’ll find two kinds of posts:

- “ETHW saved my mining rig” - from people who bought RTX 3080s in 2021 and kept them running.

- “Why I quit ETHW mining” - from people who realized electricity costs more than what they earn.

One miner in Texas said he was making $45 a day in late 2022. By early 2024, he was losing $3 a day after paying for power. He sold his GPUs.

Can You Still Mine ETHW?

Technically, yes. But is it worth it?

To break even, you need:

- A modern GPU (RTX 3060 or better)

- Electricity under $0.07 per kWh

- No hardware depreciation

Most home miners don’t meet those conditions. Even with cheap power, the returns are tiny. ASICMINER’s 2024 analysis showed that even the best setups only make $0.50-$1.50 per day after costs.

And the hashrate keeps dropping. In late 2022, ETHW had 1.8 TH/s. Today, it’s 1.2 TH/s. Miners are leaving. The network is shrinking.

Where to Buy ETHW

ETHW is listed on only 18 major exchanges. The most active is BingX, with $1.2 million in daily volume. Bitfinex and MEXC are next, but volumes are low.

Big exchanges like Coinbase and Binance don’t list it. That’s a red flag. If no major exchange supports it, liquidity is weak. You might not be able to sell when you want to.

There have been reports of exchanges delisting ETHW without warning. One user on Trustpilot said BingX removed it overnight. No notice. No refund. Just gone.

Is ETHW a Good Investment?

Let’s be blunt: ETHW is not a good investment.

It has no growth plan. No new features. No developer activity. GitHub shows only 12 active contributors. Ethereum has over 350.

Its value is based entirely on nostalgia - the idea that mining is “fairer” than staking. But fairness doesn’t pay bills. Profitability does.

Galaxy Digital predicts ETHW has only a 35% chance of surviving past 2026. Outlier Ventures called its future “insurmountable.” Even the EthereumPoW Foundation admits mining is unsustainable - they’ve started using community funds to subsidize miners just to keep the chain alive.

If you’re holding ETHW, you’re betting that someone else will pay more for it tomorrow. That’s not investing. That’s gambling.

Final Thoughts

EthereumPoW is a digital museum piece. It’s Ethereum as it was - not as it is. It’s a snapshot of a moment in crypto history. For miners who lost everything in 2022, it was a lifeline. For everyone else, it’s a relic.

There’s no future in ETHW. No innovation. No adoption. No growth. Just a shrinking network of miners trying to keep an old machine running.

If you want to mine cryptocurrency, there are better options - Bitcoin, Litecoin, or even Monero. If you want to use Ethereum, use Ethereum. ETHW doesn’t offer anything new. It just repeats the past, and the past is fading fast.

Is ETHW the same as Ethereum?

No. ETHW is a fork of Ethereum that kept proof-of-work mining after Ethereum switched to proof-of-stake in September 2022. ETHW uses GPUs to mine new coins, while Ethereum now relies on staking. They share the same history up to block 15,537,393, but they’ve diverged completely since then.

Can I still mine ETHW profitably?

It’s extremely difficult. Mining ETHW today requires cheap electricity (under $0.07/kWh), modern GPUs, and no hardware depreciation. Most home miners lose money after paying for power. Mining rewards have dropped from $1.2 million per month in late 2022 to under $200,000 in mid-2024. The network’s hashrate is shrinking, and the price is down 92% from its peak.

Is ETHW compatible with MetaMask?

Yes. You can add ETHW to MetaMask by entering the RPC URL: https://mainnet.ethereumpow.org. The network ID is 10001, the symbol is ETHW, and the block explorer is https://ethwscan.com. Once added, you can send, receive, and interact with ETHW dApps just like you would on Ethereum.

Why is ETHW’s price so low?

ETHW’s price crashed because its mining economics collapsed. After the fork, it briefly spiked to $34.50, but as miners realized they couldn’t cover electricity costs, they sold off their coins. With low demand, no new development, and no institutional interest, the price has dropped over 90%. Today, it trades around $0.96.

Should I buy ETHW as an investment?

No. ETHW has no growth potential. It doesn’t have new features, a strong developer team, or real adoption. Its only purpose is to keep old mining rigs running. The network is shrinking, exchanges are dropping it, and experts predict it may not survive past 2026. Buying ETHW is betting on nostalgia, not value.

What’s the difference between ETHW and Ethereum Classic?

ETHW is a direct copy of Ethereum’s pre-Merge chain, created in 2022. Ethereum Classic (ETC) is a separate blockchain that forked from Ethereum in 2016 after the DAO hack. ETC has its own development team, longer history, higher hashrate, more dApps, and a larger market cap. ETHW is essentially a one-time replay; ETC is a living, evolving chain.

Derajanique Mckinney

October 28, 2025 AT 18:12Sheetal Tolambe

October 30, 2025 AT 02:02Pranav Shimpi

October 31, 2025 AT 04:28Saurav Deshpande

November 1, 2025 AT 20:52Henry Gómez Lascarro

November 3, 2025 AT 12:07Will Barnwell

November 4, 2025 AT 14:06Jean Manel

November 4, 2025 AT 17:26Cory Munoz

November 6, 2025 AT 14:01jummy santh

November 8, 2025 AT 10:43Kirsten McCallum

November 8, 2025 AT 13:21Rosanna Gulisano

November 8, 2025 AT 15:21Lawrence rajini

November 9, 2025 AT 02:23gurmukh bhambra

November 9, 2025 AT 05:07Frech Patz

November 10, 2025 AT 05:35William P. Barrett

November 11, 2025 AT 22:00Matt Zara

November 12, 2025 AT 08:07Sunny Kashyap

November 13, 2025 AT 02:09Jasmine Neo

November 14, 2025 AT 21:40james mason

November 15, 2025 AT 11:06Paul Lyman

November 17, 2025 AT 01:27