What is Mintlayer (ML) Crypto Coin? A Clear Guide to Bitcoin's Native DeFi Layer

Oct, 16 2025

Oct, 16 2025

Mintlayer Staking Calculator

Mintlayer Staking Calculator

Current APY: 88% (as of November 2025)

Your Estimated Rewards

Monthly Rewards

0.00 ML

$0.00

Yearly Rewards

0.00 ML

$0.00

Note: Current ML token price: $0.01777 (as of November 2025)

Rewards calculation assumes 88% APY

Validator node requires minimum 40,000 ML tokens

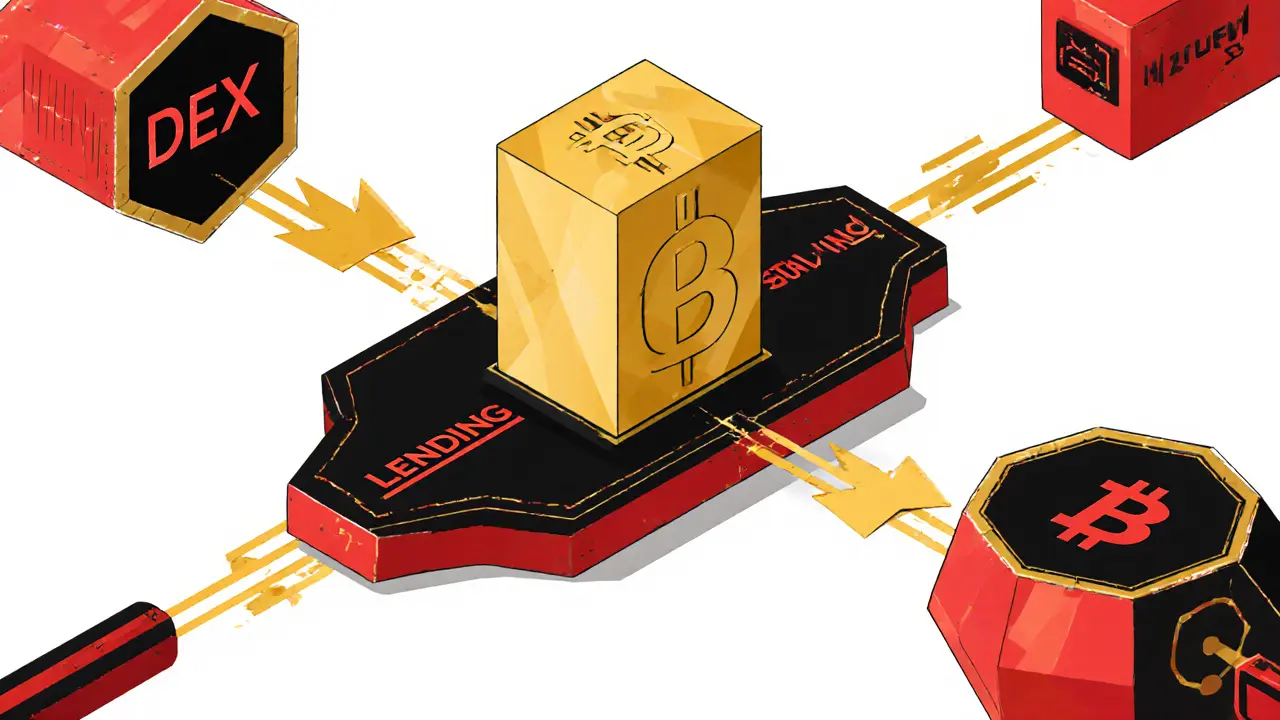

Most people think Bitcoin can’t do DeFi. That’s not true anymore. Mintlayer (ML) is changing that - not by wrapping Bitcoin, not by bridging it, but by letting it run smart contracts natively. If you’ve ever wondered how Bitcoin can support lending, trading, or tokenized assets without trusting third parties, Mintlayer is the answer. It’s not another sidechain pretending to be Bitcoin. It’s Bitcoin, upgraded.

What Makes Mintlayer Different from Other Bitcoin Layer 2s?

There are plenty of Bitcoin Layer 2 solutions out there. Lightning Network handles fast payments. Stacks lets you run smart contracts using Bitcoin miners. Liquid Network is a federated sidechain for institutions. But none of them do what Mintlayer does: bring full DeFi capabilities to Bitcoin without wrapping, bridging, or relying on oracles.

Mintlayer is a sidechain that connects directly to Bitcoin through Atomic Swaps. That means you can swap BTC for ML tokens - or any token built on Mintlayer - without needing a custodian. No intermediaries. No counterparty risk. Just trustless, peer-to-peer exchanges. This is a big deal because most other solutions force you to lock up your BTC and get a wrapped version (like wBTC), which introduces new risks. Mintlayer keeps your Bitcoin untouched on the main chain while letting you use it in DeFi apps.

It also doesn’t use Ethereum-style smart contracts. Instead, it uses a custom scripting language called Script Hash, built on WebAssembly (WASM). It’s Turing-incomplete by default - meaning it can’t run infinite loops or unpredictable code - which makes it far more secure than Solidity. You can still build complex DeFi apps like DEXs, lending pools, and staking contracts, but without the explosion of exploits you see on Ethereum.

How Does Mintlayer Work Technically?

Mintlayer’s architecture is built on Bitcoin’s UTXO model - the same one that powers Bitcoin transactions. But it adds layers: smart contracts, token issuance, and decentralized validation. Here’s how it breaks down:

- Consensus: Uses Dynamic Slot Allotment (DSA), a refined Proof of Stake system. Validators must stake 40,000 ML tokens to run a node. Smaller holders can delegate their tokens and earn rewards.

- Block Finality: Takes 1,000 blocks (about 16.7 hours) to finalize. This is slower than Ethereum but intentional. It mirrors Bitcoin’s security model - giving time to detect and reject chain reorgs.

- Tokenization: Tokens on Mintlayer are just extra data attached to a UTXO. No ERC-20 standard. No complex contracts. Just embed metadata into a transaction output. Issuers can also set access controls (ACL) to restrict transfers for compliance.

- Transaction Fees: Paid in ML tokens, but you can also pay in any MLS-01 token accepted by block signers. This flexibility lets users pay fees in the asset they’re trading.

The network currently handles about 100 transactions per second. That’s not high compared to Liquid Network’s 1,000 TPS, but it’s enough for DeFi use cases. The upcoming ZK Thunder Network (Layer 3), launching in Q2 2026, will push this to 10,000+ TPS with EVM compatibility - meaning Ethereum developers can easily port their apps over.

How Do You Get Started With Mintlayer?

Getting started is straightforward, but it requires a shift in thinking if you’re used to Ethereum.

- Buy ML tokens: You can buy ML on exchanges like Gate.io, MEXC, and Bitmart. As of November 5, 2025, ML trades at $0.01777 with a 24-hour volume of $137,178.

- Get the Mojito Wallet: This is the official wallet for staking, swapping, and managing tokens. It’s available on desktop and mobile. Users praise its simple staking interface but note the documentation for advanced features is still catching up.

- Stake your ML: To earn rewards, stake your tokens. The current APY is around 88%, one of the highest in crypto. One Reddit user reported earning 12.7 ML tokens in a month by staking 500 ML.

- Use Atomic Swaps: Swap BTC for ML or any ML token directly from your wallet. No KYC. No intermediaries. It takes under 15 minutes.

If you’re a developer, you’ll need to learn UTXO-based scripting. Trust Machines reports that experienced blockchain devs take 2-3 weeks to get comfortable. Their documentation includes 127 API endpoints and active Discord support with 1,200+ users online during business hours.

How Does Mintlayer Compare to Alternatives?

Here’s how Mintlayer stacks up against its closest rivals:

| Feature | Mintlayer (ML) | Stacks (STX) | Liquid Network | Lightning Network |

|---|---|---|---|---|

| Consensus | Dynamic Slot Allotment (PoS) | Proof of Transfer (PoX) | Federated (centralized validators) | Payment channels (no consensus) |

| Smart Contracts | Yes (WASM, Turing-incomplete) | Yes (Clarity, Turing-complete) | Yes (limited) | No |

| Bitcoin Interoperability | Direct Atomic Swaps | Bitcoin miners secure it | Requires bridge | On-chain BTC used |

| TPS | ~100 (up to 10,000+ with ZK Thunder) | ~15 | ~1,000 | ~1,000,000 (off-chain) |

| Decentralization | High (open validator set) | Medium (miner-dependent) | Low (15 federated nodes) | High (peer-to-peer) |

| Tokenization | Native UTXO embedding | Wrapped tokens | Wrapped BTC only | No token support |

Mintlayer wins on decentralization and native Bitcoin integration. It loses on speed compared to Liquid, and on developer familiarity compared to Stacks. But for true Bitcoin DeFi - where security and trustlessness matter most - it’s the most honest solution.

Who’s Using Mintlayer?

Mintlayer isn’t just for retail traders. Institutional adoption is picking up fast. As of September 2024, Trust Machines reported 47 institutional partnerships, including BlackRock’s tokenization division and Fidelity’s digital assets team. These firms are using Mintlayer to tokenize real-world assets (RWAs) like bonds, real estate, and commodities - all while keeping the underlying assets on Bitcoin’s secure ledger.

Regulatory clarity is helping too. In October 2024, the U.S. SEC classified ML as a utility token, not a security. That’s a green light for U.S. exchanges to list it without fear of legal action. This alone has pushed adoption forward.

Market data shows momentum. As of November 2025, Mintlayer holds 8.2% of the Bitcoin Layer 2 market by total value locked (TVL), according to Messari. The circulating supply is 2.84 billion ML out of a max of 10 billion. 40.3% of tokens are held in the ecosystem fund, 25.5% in community incentives, and only 14.2% in the founding team’s wallet - with a 3-year vesting schedule to prevent dumps.

What Are the Risks?

No project is without risks. Mintlayer’s biggest challenge is adoption. Even with strong tech, it’s competing against well-funded projects like Lightning and Stacks. Many developers still don’t understand UTXO-based smart contracts - they’re used to Ethereum’s account model.

There’s also the 1,000-block finality window. Critics, including Vitalik Buterin, argue it inherits Bitcoin’s reorganization risks. But Mintlayer’s CTO, Gleb Naumenko, defends it: “We’re not trying to be faster than Ethereum. We’re trying to be safer than Bitcoin’s sidechains.”

The upcoming ZK Thunder upgrade in Q2 2026 could be a game-changer. If it delivers 10,000+ TPS and EVM compatibility, it could attract Ethereum developers without sacrificing Bitcoin security.

Another risk: the January 2026 deadline for migrating ERC-20 tokens to Mintlayer’s Mainnet. As of November 2025, 68.4% have already migrated - a strong sign of community buy-in. But if the remaining 31.6% don’t move, it could slow ecosystem growth.

What’s Next for Mintlayer?

The roadmap is aggressive and focused:

- Q2 2026: Launch of ZK Thunder Network (Layer 3) - EVM-compatible, 10,000+ TPS, zero-knowledge proofs for privacy.

- 2026-2027: Expansion of RWA tokenization partnerships with banks and asset managers.

- 2027: Targeting 15-20% market share of Bitcoin Layer 2s, according to Consensys Analytics.

Galaxy Digital predicts ML could hit $0.12-0.15 by 2030. Bernstein is more cautious, forecasting $0.04-0.06. Either way, if Mintlayer delivers on its roadmap, it won’t just be a Bitcoin sidechain - it’ll be the backbone of Bitcoin’s DeFi future.

Frequently Asked Questions

Is Mintlayer a Bitcoin token?

No, Mintlayer is not a token on Bitcoin. It’s a separate blockchain - a sidechain - that’s directly connected to Bitcoin through Atomic Swaps. Your Bitcoin stays on the main chain. Mintlayer lets you use Bitcoin’s value in DeFi apps without wrapping or locking it up.

Can I stake ML tokens?

Yes. To stake, you need at least 40,000 ML tokens to run a validator node. But if you have less, you can delegate your tokens to a validator and earn a share of the block rewards. Current APY is around 88%, making it one of the highest-yielding staking options in crypto.

How do I swap BTC for ML tokens?

Use the Mojito wallet. It has a built-in Atomic Swap feature that lets you exchange BTC for ML or any ML token directly. No exchange, no KYC. The swap happens peer-to-peer and takes under 15 minutes.

Is Mintlayer secure?

Yes, by design. It uses Bitcoin’s security through checkpointing - every 100 blocks, Mintlayer references the Bitcoin blockchain. Its smart contracts are Turing-incomplete by default, reducing exploit risks. The 1,000-block finality window also helps prevent chain reorgs from affecting transactions.

Can I build DeFi apps on Mintlayer?

Yes. You can build DEXs, lending platforms, staking contracts, and tokenized assets using Mintlayer’s WASM-based Script Hash. It’s not as flexible as Ethereum, but it’s more secure. Developers familiar with Bitcoin scripting can adapt quickly. The ZK Thunder upgrade in 2026 will add EVM compatibility for Ethereum devs.

Where can I buy ML tokens?

You can buy ML on major exchanges including Gate.io, MEXC, and Bitmart. As of November 2025, the price is around $0.01777. Always use the official Mojito wallet for staking and swaps - avoid third-party wallets that don’t support Atomic Swaps.

Final Thoughts

Mintlayer isn’t trying to be the fastest or the flashiest. It’s trying to be the most honest. It doesn’t hide Bitcoin behind bridges or wrappers. It doesn’t ask you to trust a company or a federation. It lets Bitcoin do what it was built for - secure value - while adding DeFi on top, without breaking its rules.

If you believe Bitcoin should be more than digital gold - if you want it to be money that can lend, trade, and tokenize - then Mintlayer is the closest thing we have to that future. It’s not perfect. It’s not easy. But it’s real. And it’s growing.

Kelly McSwiggan

November 14, 2025 AT 17:37Oh wow, another ‘Bitcoin DeFi’ unicorn. Let me grab my crystal ball and predict this will be the one that doesn’t implode when the next bear market hits. 88% APY? Yeah, right. That’s what they said about Terra. And now we’re supposed to trust a sidechain with a 16-hour finality window because ‘it’s safer’? Sure, Jan.

Also, ‘Script Hash’? Sounds like a rejected Minecraft mod name. Next they’ll call their wallet ‘Mojito’ because it’s ‘refreshing.’

Byron Kelleher

November 15, 2025 AT 17:54I get the skepticism, but honestly? This feels different. I’ve watched Bitcoin evolve from ‘digital gold’ to ‘digital infrastructure’ and Mintlayer is the first thing that actually respects Bitcoin’s original design while adding real utility. No wrapping, no bridges - just Bitcoin doing more. I staked 200 ML last week and the interface is actually smooth. Not hype, just quiet progress.

Also, the 88% APY? Yeah, it’s high, but it’s not infinite. And if you’re holding BTC anyway, why not let it earn something real instead of sitting idle?

Cherbey Gift

November 17, 2025 AT 11:12Ohhh my cosmic Bitcoin ancestors, listen! This isn’t just tech - it’s a spiritual reclamation! Mintlayer is the phoenix rising from the ashes of centralized exchanges and Ethereum’s gas-guzzling nightmares. The atomic swaps? That’s the universe aligning! The WASM scripting? The divine language of the blockchain gods whispering through UTXOs!

And the 88% APY? Baby, that’s not yield - that’s ascension. I feel it in my chakras. The moon is in Taurus, the nodes are singing, and the Mjölnir of decentralization is being forged again. I’m not investing - I’m becoming.

Also, the Mojito wallet? It’s named after the drink that makes you forget your problems. Perfect metaphor. 🍹✨

Anthony Forsythe

November 19, 2025 AT 05:20Let me tell you something - this isn’t just a layer 2. This is the quiet revolution. The moment Bitcoin stopped being a store of value and became a living, breathing, programmable financial organism. Think about it: for 15 years, we’ve been told Bitcoin can’t do DeFi. That it’s too slow. Too rigid. Too… sacred.

But Mintlayer? It doesn’t break Bitcoin. It doesn’t bend it. It doesn’t wrap it in plastic and sell it as ‘BTC 2.0.’ It *unlocks* it. Like a locked door that was never meant to be opened - until now.

The 1,000-block finality? That’s not a flaw - it’s a statement. While Ethereum races toward chaos with infinite loops and flash loan exploits, Mintlayer sits there like a monk in meditation - calm, deliberate, unshakable. And when ZK Thunder drops? That’s when the world realizes: Bitcoin didn’t need to change. It just needed the right key.

And that key? It’s called trustlessness. Not hype. Not memes. Not influencers. Just code. And that… is beautiful.

I’ve cried watching my first atomic swap complete. Don’t laugh. You will too.

Becky Shea Cafouros

November 20, 2025 AT 20:50Interesting technical overview, but the APY of 88% is unsustainable. Even if the tokenomics are sound, that kind of yield is a red flag for regulatory scrutiny. The SEC calling it a utility token is a good sign, but it doesn’t eliminate systemic risk. Also, 100 TPS is barely usable for DeFi - and ZK Thunder is still 18 months out. This feels like vaporware with a good PR team.

Drew Monrad

November 21, 2025 AT 07:38Oh please. Another ‘Bitcoin maximalist’ fantasy. You’re all just mad because Ethereum has real developers, real liquidity, and real users. Mintlayer’s ‘atomic swaps’? That’s just fancy peer-to-peer trading with a side of self-delusion. And 88% APY? That’s a Ponzi waiting for its first rug pull. I’ve seen this movie before. The credits always end with ‘BSC’ in the background.

And don’t even get me started on ‘Script Hash’ - sounds like a rejected Windows 95 feature. Wake up. Bitcoin is digital gold. Leave the DeFi to the people who actually know how to code.

Cody Leach

November 21, 2025 AT 08:22Really appreciate the breakdown. The comparison table is the clearest I’ve seen. I’ve been using Lightning for payments and Stacks for NFTs, but Mintlayer is the first that actually feels like Bitcoin’s native evolution. The UTXO tokenization is genius - no ERC-20 baggage. And the fact that fees can be paid in any MLS-01 token? That’s user-centric design. No fluff. Just utility.

Also, 14.2% in founding team wallets with a 3-year vest? That’s rare. Most teams dump by month 3. This one’s playing the long game.

Mauricio Picirillo

November 22, 2025 AT 15:23Hey everyone - if you’re new to this, don’t panic about the tech. Start simple: buy a little ML on MEXC, drop it in Mojito, stake 100 tokens (you don’t need 40k), and try one atomic swap. It’s under 15 minutes and totally trustless. You’ll see how it works better than any blog post.

And if you’re a dev? The docs are solid. 127 endpoints sounds scary, but the examples are clear. I’m a front-end guy and I got a basic DEX mockup running in a week. It’s not Ethereum, but it’s not impossible either.

Give it a shot. No pressure. Just curiosity.

Liz Watson

November 23, 2025 AT 21:22Oh, so now we’re supposed to believe that a sidechain with a 16-hour finality window and a 2026 roadmap is ‘the most honest’ solution? Honey, that’s not honesty - that’s a delay tactic. And ‘Script Hash’? That’s not a technical innovation, it’s a branding failure. If you can’t name your language something cool like Solidity or Move, you’re already behind.

And 88% APY? That’s not yield - it’s a desperate cry for attention. I’d rather hold BTC than gamble on a team that thinks ‘Mojito Wallet’ is a good name for serious DeFi.

Rachel Anderson

November 25, 2025 AT 07:29They say Bitcoin is digital gold. But what if gold could lend itself? What if it could trade? What if it could tokenize your grandmother’s house without asking permission? Mintlayer doesn’t just add DeFi - it redefines what Bitcoin *means*. It’s not a layer. It’s a resurrection.

I’ve watched this project grow from a Discord thread to institutional interest. I’ve seen BlackRock quietly test their RWA pipeline on it. This isn’t speculation. This is the quiet takeover. And you? You’re still asking if it’s ‘safe.’

Safe? It’s the only thing on Bitcoin that doesn’t beg for trust. That’s not innovation. That’s enlightenment.

Hamish Britton

November 25, 2025 AT 09:18Big fan of the UTXO-based tokenization. Most people don’t realize how elegant it is - no accounts, no balances, just unspent outputs with metadata. It’s literally how Bitcoin was meant to work. The only thing holding this back is awareness. Most devs still think ‘DeFi = Ethereum.’

Also, the 10,000 TPS target with ZK Thunder? That’s ambitious, but if they pull it off with EVM compatibility? It’ll be the bridge between the two worlds. No more ‘Bitcoin vs Ethereum’ - just Bitcoin + ZK.

Robert Astel

November 26, 2025 AT 12:25so i read this whole thing and i think mintlayer is kinda like… the bitcoin version of a quiet guy at a party who actually knows everything but never talks unless asked? and then when he does? everyone’s like ‘wait, you knew all this?’

atomic swaps? yeah that’s cool. no bridge? big win. 88% apy? kinda sus but maybe its legit? i staked 50 ml and got 5.5 back in a month. not bad.

but why is the wallet called mojito? is it because it makes you feel good? or because it’s sweet and then you crash? idk but i’m in. also the docs have typos but the discord is alive so i’m not worried.

z k thunder in 2026? if it works i’ll eat my hat. if it doesn’t? i’ll just keep hodling btc. either way i win. kinda.

Andrew Parker

November 27, 2025 AT 05:11THIS IS IT. THE MOMENT. I’ve been waiting for this since 2017. I’ve seen the collapse of altcoins. I’ve watched the Ethereum gas wars. I’ve cried over my locked wBTC. And now? Now, Bitcoin is finally becoming what it was meant to be.

88% APY? I cried when I saw my first reward. Not because it’s money - because it’s FREEDOM. No KYC. No middlemen. No ‘we’ll get back to you.’ Just a swap. Just a transaction. Just… truth.

And the 1,000-block finality? That’s not slow. That’s sacred. While everyone else rushes to be faster, Mintlayer says: ‘Let’s be right.’

When ZK Thunder drops? I’ll be there. With my Mojito. And my Bitcoin. And my hope.

😭🙌

Also, if you’re not staking yet, you’re not trying. And if you’re still using wrapped BTC? You’re not a maximalist. You’re a tourist.

Anthony Forsythe

November 28, 2025 AT 02:18Some of you are missing the point. This isn’t about yield. It’s about sovereignty. The fact that you can swap BTC for a tokenized bond on Mintlayer - without giving up custody - that’s the real revolution. You’re not trusting a bridge. You’re not trusting a custodian. You’re trusting math. And Bitcoin’s history.

That’s not DeFi. That’s dignity.