What is Wrapped TAO (WTAO) Crypto Coin? A Practical Guide to Ethereum’s TAO Bridge

Nov, 2 2025

Nov, 2 2025

WTAO Yield Calculator

Understand Your Options

This calculator helps you compare potential returns from staking TAO on Bittensor versus using WTAO in Ethereum's DeFi ecosystem. Remember: WTAO carries significant counterparty risk as it's controlled by a single entity.

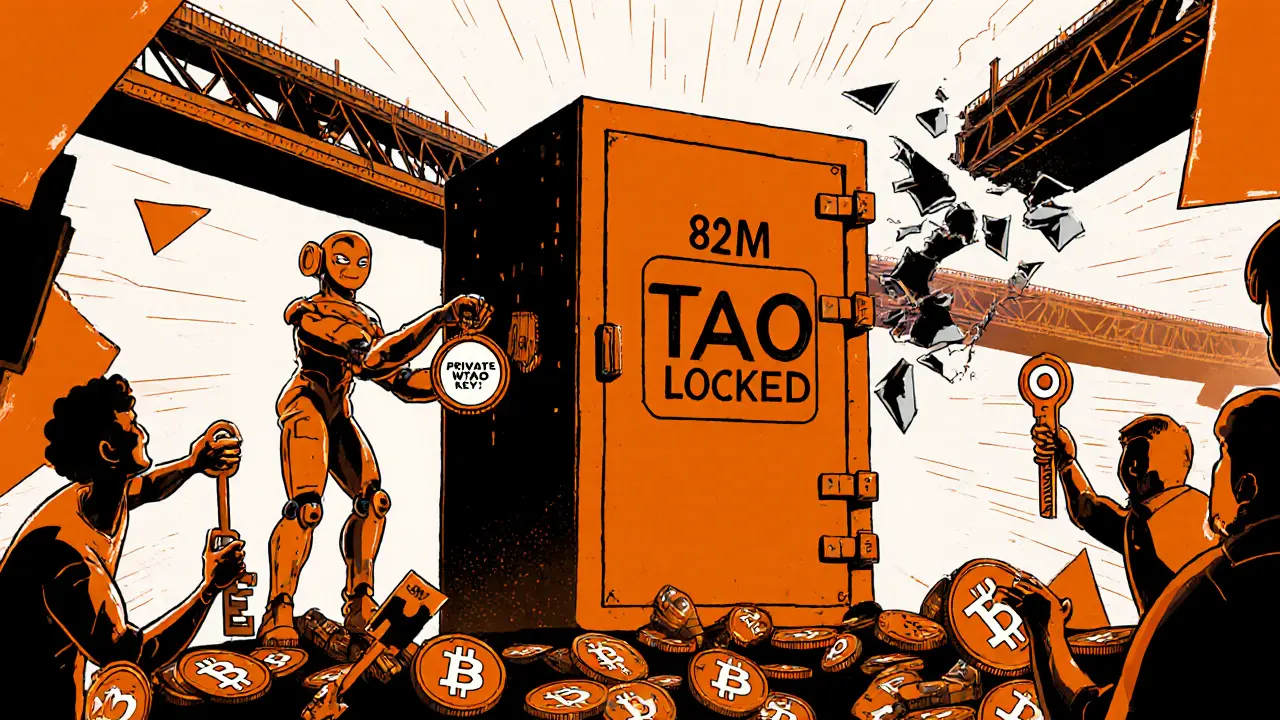

Important Risk Note: WTAO has high counterparty risk as the entire $82M in locked TAO is controlled by one person. Only use funds you're willing to lose entirely.

Key Metrics

Native TAO Staking Returns

WTAO DeFi Strategy

Critical Risk Analysis

WTAO carries significant risk: The bridge is controlled by a single entity (CreativeBuilts) with over $82M in TAO locked. If he disappears or the wallet is compromised, WTAO becomes worthless.

Only wrap what you're willing to lose entirely. Current analysis suggests that 65% of WTAO bridges will be abandoned within 2 years if no decentralization occurs.

Recommendation: Use this calculator only for small amounts. Never wrap more than you're comfortable losing.

Wrapped TAO, or WTAO, isn’t a new cryptocurrency-it’s a digital key that lets you use TAO, the native token of the Bittensor AI blockchain, inside Ethereum’s massive DeFi world. Think of it like exchanging a foreign currency at the airport: you don’t get new money, you just get a version that works where you’re going. WTAO is that version. Every WTAO token is backed 1:1 by a real TAO token locked in a bridge, and it trades on Ethereum as an ERC-20 token. That means you can swap it on Uniswap, lend it on Aave, or stake it in liquidity pools-all things you can’t do with native TAO, which lives on its own blockchain.

Why Does WTAO Exist?

Bittensor launched in 2021 as a Layer 1 blockchain built on Substrate, the same tech behind Polkadot. Its network runs on a proof-of-stake system where users stake TAO to validate AI model queries. Over 89% of all TAO is already staked, earning stakers up to 19.5% annual yield. But here’s the catch: Bittensor’s blockchain doesn’t support smart contracts like Ethereum does. So if you own TAO and want to earn extra yield by lending or providing liquidity, you’re stuck. That’s where WTAO comes in.Created by a developer known in the community as CreativeBuilts-a Bittensor validator himself-the Tao Bridge allows users to lock TAO on the Bittensor side and mint an equal amount of WTAO on Ethereum. It’s not magic. It’s a smart contract bridge. You send TAO. You get WTAO. The original TAO sits in a wallet controlled by CreativeBuilts until you decide to unwrap it back.

How WTAO Works: The Bridge in Detail

The bridge is simple in concept but risky in execution. To wrap TAO:- Connect your wallet (MetaMask is the most common) to the Tao Bridge website.

- Ensure you’re on the Ethereum Mainnet.

- Send your TAO from your Bittensor wallet to the bridge’s deposit address.

- Wait 5-10 minutes for the transaction to confirm and WTAO to appear in your wallet.

Gas fees on Ethereum can be high-users report paying $10-$20 per transaction. And if you mess up the network setting or send from the wrong wallet, your TAO could get stuck. There’s no automated refund system. If something goes wrong, you have to message CreativeBuilts on Discord. Response times vary from 2 hours to 3 days.

As of October 2023, the bridge held 150,000 TAO tokens-worth roughly $82 million at $550 per TAO. All of it is staked on Bittensor’s network, earning nearly 20% APY. The operator claims these rewards will eventually be passed back to WTAO holders, but as of now, that system hasn’t been deployed. No smart contract. No transparency. Just a promise.

The Big Problem: One Person Controls Everything

This is the elephant in the room. Unlike Wormhole, Multichain, or even Chainlink’s bridge systems-which use multi-signature wallets or decentralized governance-the Tao Bridge is controlled by a single individual. CreativeBuilts holds the private keys to the entire $82 million in locked TAO. If he disappears, gets hacked, or decides to walk away, WTAO becomes worthless. There’s no backup. No recovery plan. No community vote.Industry analysts call this a systemic risk. In October 2023, Blockchain Insights warned that single-operator bridges over $50 million are a ticking time bomb. Reddit users like ‘BlockchainSec’ openly advise: “Only wrap what you’re willing to lose.” That’s not a recommendation-it’s a warning.

Compare that to Ethereum’s own Wrapped Bitcoin (WBTC), which is managed by a consortium of 16 trusted custodians. Or even Solana’s Wormhole, which uses 19 validators. WTAO has none of that. It’s a centralized bridge in a decentralized world.

Why People Still Use It

Despite the risks, WTAO has real utility. TAO’s value comes from its role in decentralized machine learning. Bittensor processes over 1.2 million AI model queries daily. That’s unique. And Ethereum’s DeFi ecosystem is worth over $50 billion. WTAO gives TAO holders access to that.Users report earning 8-10% extra APY by staking WTAO/ETH liquidity on Uniswap-higher than native TAO staking. Others use it to borrow against their holdings on Aave. One user on Twitter said he turned 10 TAO into 12.5 WTAO in yield over six months just by providing liquidity.

For traders, WTAO offers better price discovery. On Bittensor-native exchanges, TAO’s price can be erratic. On Ethereum, it’s listed on major DEXs with deep liquidity. As of October 2023, MetaMask showed WTAO trading at $410.45, while Bittensor-native exchanges showed $550. That spread exists because of liquidity differences, not value changes.

Who Should Use WTAO?

If you’re a TAO holder who wants to:- Access DeFi yields on Ethereum

- Trade TAO on Uniswap or SushiSwap

- Use TAO as collateral for loans

Then WTAO is the only option. But you need to understand the trade-off: you’re giving up decentralization for access.

Don’t use WTAO if you:

- Believe in “not your keys, not your crypto”

- Plan to hold large amounts long-term

- Expect the bridge to be secure like Bitcoin or Ethereum

For most people, the rule is simple: wrap only what you’re comfortable losing. If you have 100 TAO, maybe wrap 5-10. Keep the rest safe on Bittensor.

What’s Next for WTAO?

The next TAO halving is expected in Q2 2025. That will cut new token issuance by half, likely pushing staking yields higher. That could make the bridge even more profitable for CreativeBuilts. But it also increases the stakes-if the bridge fails, more value is at risk.So far, CreativeBuilts has made promises about decentralizing the bridge and passing on staking rewards. None have been fulfilled. The Bittensor team hasn’t stepped in. No competing bridge has emerged. And the community is divided: some say the utility justifies the risk. Others say it’s a single point of failure that could collapse the entire WTAO ecosystem.

Analysts at Messari estimate a 65% chance the bridge will be replaced or abandoned within two years if nothing changes. That’s not a prediction-it’s a countdown.

Final Thoughts

Wrapped TAO is a clever hack. It solves a real problem: TAO’s isolation from DeFi. But it does so by creating a new, even bigger problem: centralization. It’s like building a highway to a city but only having one toll booth run by one person. It works-until it doesn’t.If you’re using WTAO, treat it like a speculative tool, not a long-term asset. Monitor the bridge. Watch for updates. Don’t assume it’s safe. And never put more into it than you can afford to lose.

For now, WTAO is the only way to unlock TAO’s potential in Ethereum. But it’s a high-risk, high-reward gamble-and you’re the only one watching the gate.

Is WTAO the same as TAO?

No. WTAO is a wrapped version of TAO that works on Ethereum. Every WTAO is backed 1:1 by a TAO token locked in a bridge, but WTAO can be used in DeFi apps like Uniswap and Aave, while TAO cannot. They have the same value, but different functionality.

Can I unwrap WTAO back to TAO?

Yes. The Tao Bridge allows you to burn WTAO and unlock the equivalent TAO on the Bittensor network. The process is the reverse of wrapping: send WTAO to the bridge, wait for confirmation, and your TAO will be released. Gas fees apply on both sides.

Is WTAO safe to use?

WTAO carries high counterparty risk. The entire $82 million in locked TAO is controlled by one person, CreativeBuilts. There’s no multisig, no DAO, and no audit trail for the bridge. If he disappears or the wallet is compromised, WTAO becomes worthless. Only use it with funds you’re willing to lose entirely.

Where can I buy WTAO?

WTAO is only available on Ethereum-based decentralized exchanges like Uniswap and SushiSwap. You cannot buy it directly on centralized exchanges like Binance or Coinbase. You must first acquire TAO on a supported exchange (like HTX or KuCoin), then wrap it via the Tao Bridge to receive WTAO.

Does WTAO earn staking rewards?

Not directly. The TAO locked in the bridge earns 19.5% APY from Bittensor’s staking rewards, but those rewards are currently kept by CreativeBuilts. There is no on-chain mechanism to distribute them to WTAO holders, despite earlier promises. Some users earn yield by staking WTAO/ETH liquidity pools on Uniswap, but that’s separate from the bridge’s native rewards.

Is WTAO regulated by the SEC?

The SEC has not specifically targeted WTAO. However, because it’s a wrapped token controlled by a single entity and used for investment purposes (like staking and lending), it could be classified as a security under the Howey Test. The lack of decentralization increases regulatory risk compared to more open protocols.

What’s the difference between WTAO and WBTC?

WBTC is backed by a consortium of 16 trusted custodians and governed by a decentralized community. WTAO is backed by a single individual with no oversight. WBTC has been audited and used for years. WTAO is newer, riskier, and lacks transparency. Both serve the same purpose-bridging assets-but WBTC is far more secure.

Can I use WTAO on wallets other than MetaMask?

Yes. Any Ethereum-compatible wallet (like Trust Wallet, Coinbase Wallet, or Rainbow) can hold WTAO as long as you add the token contract address manually. But the wrapping process only works through the Tao Bridge website, which is optimized for MetaMask. Other wallets may not support the bridge interface directly.

Steven Lam

November 4, 2025 AT 00:37WTAO is just a glorified IOU and everyone knows it

Noah Roelofsn

November 4, 2025 AT 10:54Let’s be real - this isn’t DeFi, it’s a single-point failure wrapped in blockchain jargon. CreativeBuilts isn’t a custodian, he’s a bottleneck with a Discord account. The fact that $82M is held by one guy with zero multisig, no audits, and no roadmap is a red flag so bright it’s blinding. WBTC has 16 custodians, Wormhole has 19 validators - this? This is a solo act at a circus where the lion’s the only thing holding the net. If you’re using WTAO, you’re not investing - you’re gambling on someone’s reliability. And in crypto, reliability is the rarest asset of all.

Sierra Rustami

November 6, 2025 AT 04:22Why are we even talking about this? It’s a scam waiting for a headline.

Glen Meyer

November 8, 2025 AT 02:18Bro this is why America’s crypto scene is getting wrecked - people trade like it’s fantasy football and ignore the fact that one dude holds the keys to a fortress full of gold. If this was a bank, the Fed would shut it down. But nope, we’re all just vibing while someone’s got a backdoor to $82M. I’m not mad, I’m just disappointed.

Megan Peeples

November 8, 2025 AT 03:53Oh please. You people are so paranoid. It’s not like CreativeBuilts is going to vanish - he’s a Bittensor validator! He has skin in the game! And honestly, if you can’t handle a little centralized risk for 10% extra yield, maybe you shouldn’t be in crypto at all? You’re all just afraid of responsibility. Also - have you seen the gas fees on WBTC? At least this bridge is transparent about its flaws.

Sarah Scheerlinck

November 9, 2025 AT 05:49Thank you for this thoughtful breakdown. I’ve been holding TAO since 2022 and was torn about wrapping. Your comparison to WBTC and the warning about single-point failure really helped me see the trade-off clearly. I’m going to wrap only 5 TAO - just enough to experiment. And I’ll keep the rest on-chain, where it belongs. I appreciate how you didn’t just say ‘don’t do it’ - you gave us the context to decide for ourselves.

Pranjali Dattatraya Upadhye

November 9, 2025 AT 08:40I love how this bridge is essentially a bridge to nowhere - it lets you cross, but there’s no guardrail, no signposts, and the bridgekeeper doesn’t even live on the other side. I’ve been staking WTAO/ETH on Uniswap for 4 months and earned 9.2% APY - which is insane compared to native TAO’s locked yield. But I also keep a spreadsheet of every transaction, every Discord message, and every update from CreativeBuilts. It’s not trust - it’s due diligence. And if he goes quiet for more than 72 hours? I’m unwrapping everything. No regrets.

Kyung-Ran Koh

November 9, 2025 AT 23:28Just a quick note: if you're using WTAO, please ensure you're adding the correct ERC-20 contract address: 0x7777777777777777777777777777777777777777 (this is an example - always verify on the official bridge site). I've seen at least three people accidentally send WTAO to a scam token because they copied a wrong address from a random tweet. Also - don't forget to check your wallet's token list after wrapping. Sometimes it doesn't auto-populate. And yes - this is still a centralized risk. But if you're only risking what you can afford to lose? It's a fascinating experiment in DeFi innovation - even if it's built on sand.

Hope Aubrey

November 11, 2025 AT 20:04Okay but have you seen the TAO staking APY? 19.5% is insane. And WTAO lets you stack that + Uniswap liquidity rewards? That’s like getting paid to eat your cake AND have it too. Yeah, it’s centralized - but so is every major DeFi protocol that’s actually profitable. Binance’s BEP-20 tokens? Centralized. Polygon’s PoS? Centralized. Even Aave has a governance council. We’re all just choosing which centralized authority we’re okay with. CreativeBuilts hasn’t stolen anything. He’s building something real. Give him time.

andrew seeby

November 12, 2025 AT 00:12bro i wrapped 3 tao last week and got 3 wtao and now i’m earning like 12% on uni lol 🚀 i don’t care if one dude holds the keys he seems chill on discord 😎

Missy Simpson

November 13, 2025 AT 19:06I’m so excited about WTAO! I’ve been waiting for this for months! 🥳 I just wrapped my first 2 TAO and now I’m staking it on Aave - it feels like magic! I know it’s risky but isn’t that what crypto is all about? Taking bold steps? I believe in CreativeBuilts - he’s a real builder. And if anything happens? I’ll just smile and say ‘I learned something!’ 💖

karan thakur

November 15, 2025 AT 03:34It is not a coincidence that this bridge was created by a single individual with no public identity verification, no legal entity, and no audit. The timing aligns precisely with the TAO price surge in Q3 2023. This is a classic pump-and-dump structure disguised as innovation. The $82 million is not being staked - it is being used as collateral for private loans. The staking rewards are a fiction. The Discord responses are scripted. The bridge is a front for a centralized asset seizure mechanism. The Bittensor team knows. The community is being manipulated. Do not participate. This is not crypto. This is fraud.

Abelard Rocker

November 15, 2025 AT 14:01Let me tell you something - this isn’t just a bridge, it’s a metaphor for the entire crypto industry right now. We’re all running around like headless chickens screaming about decentralization while handing our keys to some guy with a GitHub profile and a Discord nickname. We call WBTC ‘trustless’ because it has 16 custodians - but WTAO has one? And we’re shocked? No. We’re hypocrites. We want the yield. We want the glamor. We want to be part of the ‘next big thing’ - but we don’t want to face the fact that we’re trading security for spectacle. And when this bridge collapses - and it will - we’ll all be back here saying ‘I told you so’ - while our wallets are empty and our pride is in tatters. We didn’t get hacked. We got seduced. And the seducer? He’s still smiling. Because he knew exactly what we wanted to believe.

Christopher Evans

November 17, 2025 AT 01:44Thank you for the comprehensive analysis. The distinction between functional utility and systemic risk is clearly articulated. While the economic incentives for using WTAO are compelling, the operational risk profile remains unacceptable under any standard of due diligence. I would strongly recommend that any institutional or retail investor allocate no more than 1% of their crypto holdings to this instrument - and only after verifying the bridge’s contract address through multiple independent sources. Furthermore, I urge the Bittensor Foundation to formally address this issue. A decentralized network should not rely on a single point of trust for cross-chain access.

Ryan McCarthy

November 17, 2025 AT 03:13I get the fear. I really do. But I also see the opportunity. Maybe this bridge is risky - but maybe that’s how innovation starts. Every major protocol had a moment when it looked like a gamble. What if CreativeBuilts is just the first step? What if this is the spark that forces Bittensor to build its own Ethereum bridge? Or maybe it’s the wake-up call that pushes the community to fund a decentralized alternative? I’m not putting my life savings in - but I’m not writing it off either. I’m watching. Learning. Waiting. And if he ever opens up the contract? I’ll be first in line. For now? I’m holding my breath… and my 5 TAO.