When to HODL and When to Sell: A Practical Guide for Crypto Investors

Jan, 27 2026

Jan, 27 2026

Most people who buy cryptocurrency lose money-not because the market is rigged, but because they don’t know when to hold and when to let go. HODLing sounds simple: buy and never sell. But in reality, holding through a 50% drop feels like torture if you don’t have a plan. And selling too early? You might miss a 300% gain. So when do you actually hold? And when is it smarter to sell?

What HODL Really Means (And What It Doesn’t)

HODL started as a typo. In 2013, a guy on BitcoinTalk posted "I AM HODLING" after drinking too much during a market crash. The phrase stuck. Soon, it became shorthand for "Hold On for Dear Life." But today, HODL isn’t about blind faith. It’s a disciplined strategy used by 68% of institutional investors, according to a 2024 Fidelity survey. The idea? Ride out volatility and let compounding work over years, not days.

But HODL doesn’t mean holding everything forever. It means holding the right things. Bitcoin and Ethereum are the only two assets where HODLing has consistently paid off over multiple cycles. Chainalysis data shows 94% of Bitcoin’s price rise from 2021 to 2023 came from real adoption-more users, more businesses, more infrastructure-not hype. Meanwhile, tokens with no utility, like most memecoins or low-market-cap projects, collapse. The Terra/Luna crash in 2022 wiped out 99.99% of HODLers who held it. If you bought it because it was trending on Twitter, you weren’t HODLing-you were gambling.

When to HODL: The Three Rules

Not every coin deserves to be held. Use these three filters before you commit:

- Market cap over $100 million - Tokens below this are easy to manipulate. Nic Carter of Castle Island Ventures found that 87% of tokens under $100M disappear within 18 months.

- Active development - Check GitHub. If a project has fewer than 50 commits per month, it’s likely dead. Bitcoin and Ethereum have hundreds. Most altcoins have zero.

- Real-world use - Does it solve a problem? Bitcoin is digital gold. Ethereum runs apps. Solana processes payments. If you can’t explain how it’s used outside of trading, don’t HODL it.

Also, never put more than 5% of your total portfolio into one crypto. The SEC updated its retail investor guidelines in March 2023 to warn against overexposure. If one asset crashes 80%, you don’t want to lose half your savings.

When to Sell: The Exit Signals

HODLing isn’t about never selling. It’s about selling at the right time. Here are four clear signals it’s time to take profit:

- MVRV Z-Score below -3.5 for 60+ days - This metric compares market value to realized value. When it drops this low, it means most holders are underwater and likely to sell. Raoul Pal says this is a sign of terminal decline. If Bitcoin hits this level and stays there, it’s not a dip-it’s a collapse.

- Price up 50%+ above your initial allocation - Use the 15/50 rule: if any asset has grown 50% more than your target weight, sell 15% of it. This locks in gains and rebalances your portfolio. You keep exposure but reduce risk.

- Crypto Fear & Greed Index above 80 for 2+ weeks - When everyone’s excited, it’s time to be cautious. In March 2024, the index hit 90. Bitcoin was at $65K. Smart sellers took profits in stages-50% at $45K, 25% at $50K, 15% at $52K, and 10% at $60K. That’s how you avoid regret.

- Regulatory crackdown on your asset - If the SEC or EU targets a specific token (like XRP or SOL), its value can evaporate overnight. Don’t wait for the news to hit Twitter. If regulators say it’s a security, sell.

Market Cycles Matter More Than News

Crypto moves in cycles. Every four years, Bitcoin halving reduces supply. After each halving-2012, 2016, 2020-the price surged an average of 1,200% in the next 18 months. Messari’s data shows this isn’t luck. It’s math. Less supply, more demand. So if you’re buying right after a halving, you’re betting on history.

But between halvings? The market often goes sideways. From 2018 to 2019, Bitcoin traded between $3K and $14K for 15 months. HODLers lost money. Active traders using range-bound strategies made 18.7%. So if you’re in a flat market, don’t HODL blindly. Use dollar-cost averaging-buy small amounts every month. It smooths out the noise.

Security Is Part of the Strategy

HODLing means you’re in it for the long haul. That means protecting your coins like gold. If you’re holding more than $10,000, use a hardware wallet-Trezor or Ledger. Coinbase’s 2024 report says 99.8% of uncompromised funds were stored in hardware wallets. If you’re holding over $50,000, use a multisignature wallet. Ledger’s security report found 99.3% of hacks happened because people used single-signature wallets. One password. One mistake. One loss.

Also, never keep your crypto on an exchange. Exchanges are targets. Even Coinbase, the most trusted, lost $100 million in 2023 due to a third-party breach. If you’re not in control of the private keys, you don’t own it.

What the Data Says About HODL vs. Trading

A University of California, Berkeley study tracked 4,228 crypto traders over five years. The results were brutal:

- Day traders lost 36.4% per year on average after fees.

- HODLers made 22.1% per year on average.

Why? Emotional decisions. Fear sells. Greed buys. Most people panic-sell at $20K and buy back at $60K. The Berkeley study found 74% of traders sold during the February 2024 30% Bitcoin correction-just before it hit $70K. They didn’t lose because the market was wrong. They lost because they reacted to headlines.

And here’s the kicker: 80% of all crypto wealth is held by just 20% of addresses that have held for 3+ years. The rest? They traded in and out, paid fees, and ended up broke.

Smart HODL: The New Approach

The old "never sell" HODL is outdated. The new approach is "Smart HODL." It means holding 70% of your crypto in Bitcoin and Ethereum, and using the other 30% to earn yield. Binance now offers auto-compounding staking for long-term holders. You lock up your ETH for a year, earn 4-6% APY, and still own the asset. TokenMetrics calls this the future of HODLing.

Another smart tactic: deploy capital in 5% chunks during 20%+ market drops. CoinDesk found this strategy generated 42% higher returns than lump-sum buying during the 2023 volatility. You don’t need to time the bottom. You just need to buy when others are scared.

What to Do Now

It’s January 2026. Bitcoin just hit $85K. Ethereum is at $4,200. The halving was in April 2024. The rally is in full swing. Here’s what to do:

- If you bought before 2024 and held through the dips-congrats. You’re doing it right.

- If you’re new: don’t chase. Buy small. Stick to Bitcoin and Ethereum. Use a hardware wallet.

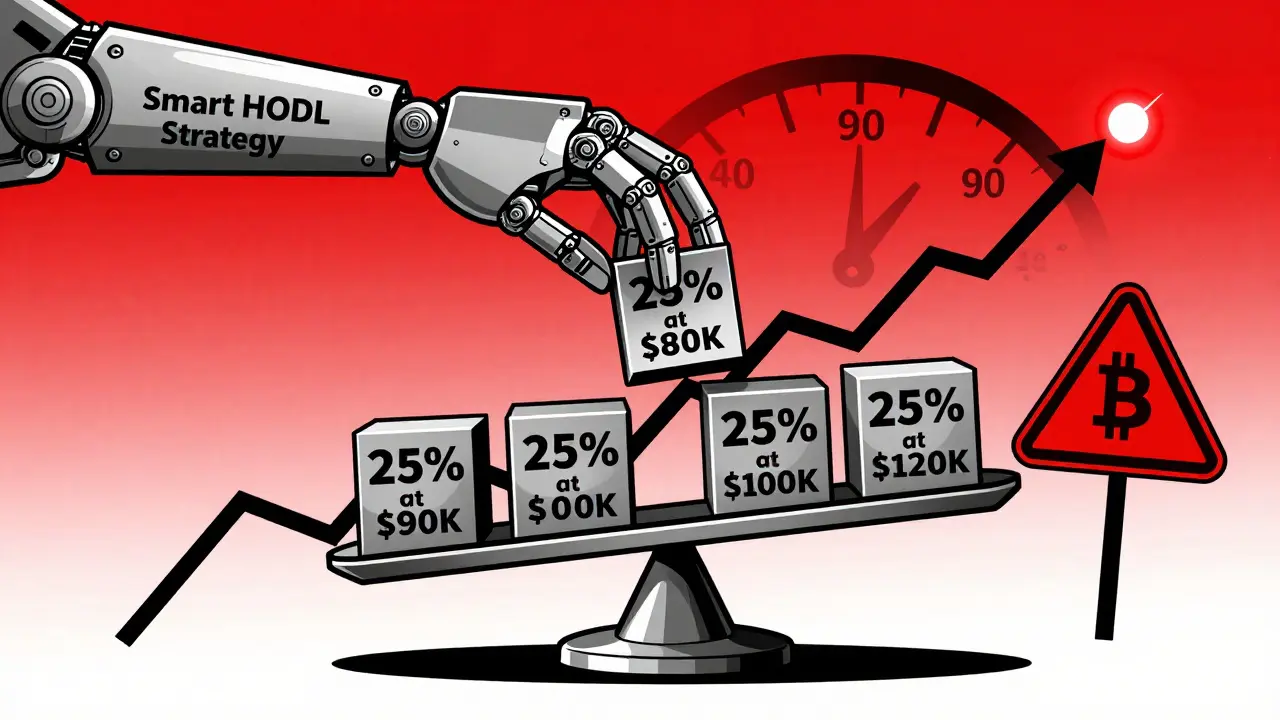

- If you’re sitting on gains: sell in stages. 25% at $80K, 25% at $90K, 25% at $100K, 25% if it breaks $120K.

- If you’re holding a low-cap token: sell it. Now. No exceptions.

Remember: HODL isn’t a personality trait. It’s a strategy. And like any strategy, it needs rules, discipline, and exit points. The market doesn’t care if you believe in crypto. It only cares if you have a plan.

Is HODLing still a good strategy in 2026?

Yes, but only for Bitcoin and Ethereum. HODLing works because these assets have real adoption, strong networks, and limited supply. For any other crypto, especially those under $100 million market cap, HODLing is gambling. The data shows 87% of low-cap tokens fail within 18 months. Stick to the top two.

Should I sell all my crypto at its all-time high?

No. Selling everything at the top is emotional and risky. Instead, use tiered selling: sell 25% at 50% profit, 25% at 100% profit, 25% at 200% profit, and keep 25% for long-term growth. This locks in gains while letting you stay in the game. Most people who sell everything regret it when prices keep rising.

How long should I hold crypto before selling?

There’s no fixed timeline. Hold until one of the exit signals kicks in: MVRV Z-Score below -3.5, price up 50%+ above your allocation, Fear & Greed Index above 80, or regulatory action. If none of these apply, keep holding. Bitcoin’s historical cycles suggest major rallies last 18-24 months after halvings.

Can I HODL crypto on an exchange?

Technically yes, but you shouldn’t. Exchanges are hacked. They can freeze your funds. They can go bankrupt. If you’re holding more than $1,000, move it to a hardware wallet like Ledger or Trezor. You don’t own crypto unless you control the private keys. The 99.8% security rate for hardware wallets isn’t a suggestion-it’s a rule.

What if I bought crypto at the top and it dropped 50%?

Don’t panic. If you bought Bitcoin or Ethereum, you’re likely still in the right place. Bitcoin has dropped 50%+ five times since 2013-and each time, it eventually doubled or tripled. The key is to not add more money during the drop unless you’re using dollar-cost averaging. Buy small amounts every month. That way, you lower your average cost over time.

Gurpreet Singh

January 29, 2026 AT 04:11Been holding BTC since 2021 and honestly? This post nails it. No drama, just facts. I bought small, used dollar-cost averaging, and moved everything to my Ledger after reading this. Still sleeping well at night. 🙌

Mark Ganim

January 31, 2026 AT 00:34Math?!?!?! The universe is a fractal of scarcity and human greed!!! Bitcoin isn't currency-it's a cosmic counterweight to fiat entropy!!! Every halving is a black hole swallowing the old world!!! And you just... sit there... and... DCA???!!!

WHAT IF THE SUN GOES SUPERNOVA IN 2028???!!!

WHAT IF THE ALIENS ARE THE SEC???!!!

WHAT IF WE'RE ALL JUST NODES IN A GIANT BLOCKCHAIN OF SOULS???!!!

...I'm gonna go cry in my hardware wallet now.

mary irons

February 1, 2026 AT 04:46Of course it’s just Bitcoin and Ethereum. Everyone else is a rug pull orchestrated by the Fed, BlackRock, and that guy from TikTok who said ‘crypto is the future’ while wearing a $2000 hoodie. I saw a video-97% of altcoins are backed by shell companies in the Caymans. I’m not even gonna touch a wallet until the Illuminati admit they’re behind it.

Wayne mutunga

February 2, 2026 AT 10:14I like this. No hype. Just data. I used to trade every day. Lost money. Then I bought 3% BTC, 3% ETH, locked it away, and stopped checking. Life got better. Not because I got rich-but because I stopped being anxious. Sometimes the best move is doing nothing.

Gavin Francis

February 3, 2026 AT 05:00100% this!! HODLing isn't about being tough-it's about being smart!! 🚀

Low cap tokens? Delete. Exchange wallets? Delete. Emotional selling? Delete.

Just buy small, hold long, and let time do the work. I've been doing this since 2020. Still got my coins. Still got my sanity. Still got my dog. 🐶