How Slashing Reduces Your Staking Returns and How to Protect Yourself

Aug, 31 2025

Aug, 31 2025

Slashing Impact Calculator

Calculate Your Potential Loss

Enter your staked amount and select your blockchain to see how much you could lose from slashing events.

Potential Loss Analysis

When you stake your cryptocurrency, you’re not just earning rewards-you’re also betting your capital on the network’s security. And if things go wrong, you could lose a chunk of it. That’s where slashing comes in. It’s not a bug. It’s a feature. But for most people, it’s the scariest part of staking they never talk about until it happens.

Slashing means your staked tokens get taken away-partially or completely-because the blockchain thinks you broke the rules. Maybe your validator node went offline too long. Maybe you signed two conflicting blocks by accident. These aren’t hypothetical risks. They’re real, documented, and they’ve cost people tens of thousands of dollars.

What Slashing Actually Does to Your Returns

Let’s say you stake 32 ETH on Ethereum. Your annual reward might be around 4%, so you earn roughly 1.28 ETH per year. Sounds good. But if you get slashed for a minor error-like 1% downtime-you lose 0.32 ETH. That’s a quarter of your yearly earnings gone in one hit. If you double-sign? You lose the whole 32 ETH. No warning. No appeal. Just gone.

It’s not just about losing tokens. It’s about compounding loss. Less stake means less future rewards. If you start with 32 ETH and lose 5%, you’re now earning rewards on only 30.4 ETH. That gap never closes unless you add more capital. And if you’re running multiple validators? One mistake can trigger correlated slashing, where multiple nodes get hit at once. Ethereum’s protocol actually punishes clusters of failures harder-because coordinated attacks are the real threat.

On other chains, the numbers vary. Cosmos slashes 0.1% to 5% for downtime and up to 10% for double-signing. Solana can slash 100% for critical failures but rarely penalizes downtime. Avalanche keeps it tight at 0.5%-3%. But here’s the catch: networks with higher APY (like 8-12%) often have looser slashing rules, meaning your risk goes up as your reward does. You can’t have high returns without high risk.

Why Slashing Exists (And Why You Can’t Avoid It)

Slashing isn’t punishment for being bad. It’s a security tool. Blockchains like Ethereum, Cosmos, and Solana use Proof-of-Stake because it’s more energy-efficient than Bitcoin’s mining. But PoS needs a way to stop validators from cheating. If you can break the rules and get away with it, the whole system collapses.

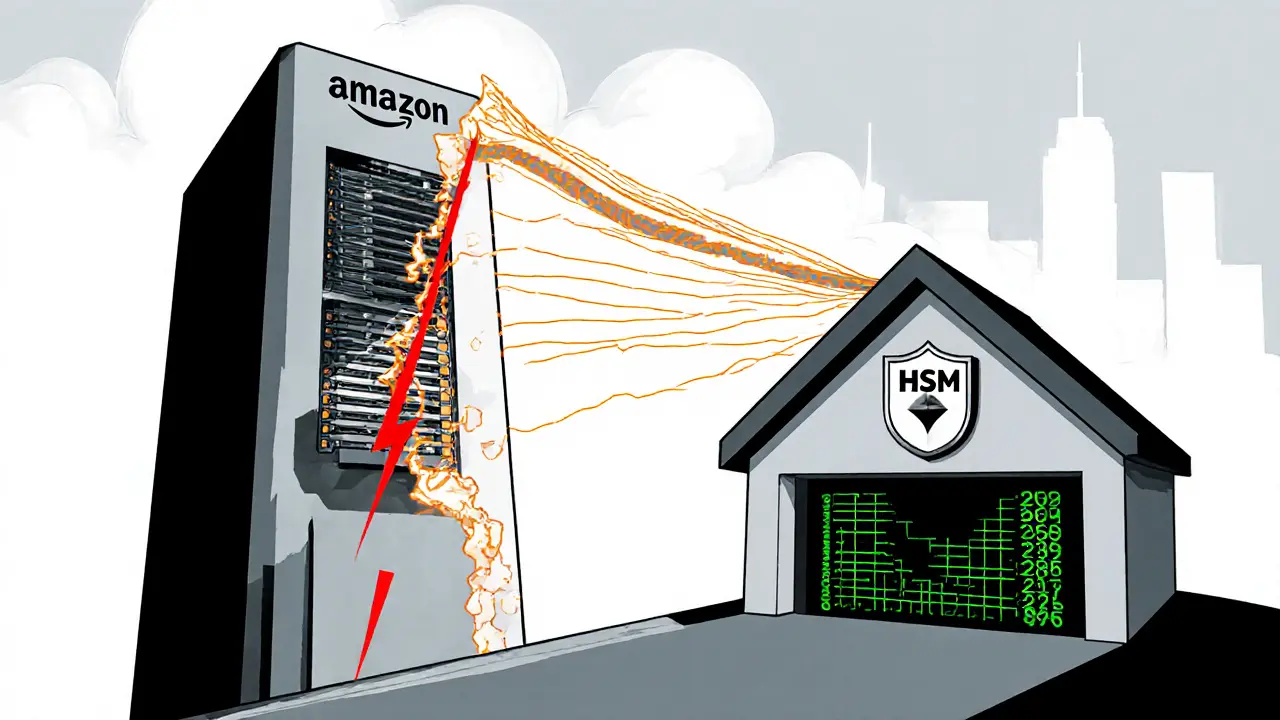

Slashing forces validators to have “skin in the game.” You don’t just run a server-you put your own money at risk. That’s why institutions take it seriously. They spend $15,000-$50,000 a year on redundant systems, geographically distributed nodes, and hardware security modules (HSMs). Retail stakers? Most run a single machine in their garage. That’s a recipe for disaster.

According to KPMG’s 2023 analysis, institutional validators have slashing rates below 0.1% per year. Retail operators? 1.2% to 2.5%. That’s a 12x difference. And when slashing hits, 37% of retail stakers quit entirely. Institutions? Only 8% walk away. The math doesn’t lie: if you’re not treating slashing like a business risk, you’re gambling.

The Top Three Ways You Get Slashed

Most slashing events aren’t caused by hackers or hacks. They’re caused by simple mistakes. Here are the three most common triggers:

- Double-signing: This happens when your validator signs two different blocks at the same height. It’s usually caused by running duplicate nodes, misconfigured backup systems, or a failed failover. Ethereum treats this as a critical offense-up to 100% slashing.

- Downtime: If your validator is offline for more than 12 hours on Ethereum, you start losing rewards. If it’s offline for days, you get slashed. Most retail stakers don’t monitor uptime closely. They assume “it’s running” means “it’s working.” It doesn’t.

- Invalid block proposals: This is rarer but deadly. If your node proposes a block that violates protocol rules (wrong signatures, malformed data), you get penalized. Often caused by outdated software or bad client configurations.

According to Reddit’s r/ethstaker community, 42% of slashing incidents were due to inadequate infrastructure, 31% to software misconfiguration, and 27% to failure to monitor node health. None of these are “acts of God.” They’re preventable.

How to Avoid Slashing (The Real Ways)

You can’t eliminate slashing risk entirely. But you can reduce it to near-zero levels. Here’s how:

- Use HSMs: Hardware Security Modules store your signing keys offline. Stakin’s 2023 study showed HSMs reduce slashing risk by 83%. You don’t need a military-grade system-just a Ledger Nano X or a YubiKey configured for Ethereum signing.

- Monitor everything: Set up Prometheus and Grafana. They’re free. They tell you if your node is lagging, if your internet drops, or if your clock drifts. Most slashing events happen because someone didn’t check their dashboard for weeks.

- Run redundant nodes: One server? Risky. Two servers in different data centers? Safer. Use different cloud providers (AWS + Hetzner) or run one on-prem. If one fails, the other keeps going.

- Keep software updated: Ethereum’s client software (Lighthouse, Prysm, Teku) updates monthly. Miss one update? You’re running outdated code. That’s how the May 2023 slashing event happened-27 validators lost everything because they didn’t upgrade after a bug fix.

- Use a trusted staking provider: If you don’t want to manage this yourself, use Coinbase, Kraken, or Lido. Their slashing rate is under 0.05%. Why? They spend millions on infrastructure. You’re paying a small fee for peace of mind.

People think self-staking is cheaper. It’s not. When you factor in time, electricity, hardware, and the chance of losing $50,000 in one go, the cost of DIY skyrockets. Professional monitoring services cost $8,500-$12,000 a year. That’s less than the average loss from a single slashing event.

Slashing Insurance? It’s Not What You Think

Companies like Nexus Mutual offer slashing insurance. You pay 0.5%-2.5% of your stake annually. Sounds good, right? Here’s the catch: their policies exclude 78% of common slashing scenarios. If your node goes offline because your ISP had an outage? Not covered. If you misconfigured your client? Not covered. If your HSM failed? Not covered.

Insurance is a marketing tool, not a solution. It doesn’t fix the root problem-it just gives you a false sense of security. The only real protection is good infrastructure, good habits, and constant monitoring.

The Future: Slashing Is Getting Smarter

Ethereum’s upcoming Prague upgrade (Q2 2024) will reduce the minimum slashing penalty from 1% to 0.5%. That’s a win. But it also increases penalties for coordinated attacks-because that’s where the real danger lies. The goal? A sweet spot: 0.5%-1.5% annual slashing rate. That’s what Delphi Digital predicts will become standard by 2026.

Networks that hit that range retain 92% of their validators. Those outside it? 67% lose operators within a year. The lesson? Slashing isn’t going away. But it’s getting more predictable. And as validator tools improve-better UIs, automated alerts, AI-driven anomaly detection-the risk will keep dropping.

For now, though, slashing is still the wild west for retail stakers. If you’re not treating it like a serious operational risk, you’re not staking-you’re speculating.

What Happens When Slashing Hits

Take the case of the May 2023 Ethereum event. 27 validators lost 100% of their 32 ETH each. That’s $56,000 per person. All because of a bug in a client update. They didn’t get hacked. They didn’t get lazy. They just didn’t update in time.

Or the Cosmos Hub incident in January 2022. A single validator, Figment, lost $1.2 million in stake across multiple chains. Their public report said the cause was a misconfigured monitoring system. They didn’t notice their node had been offline for 48 hours.

These aren’t outliers. They’re case studies. And they all point to the same truth: staking isn’t passive income. It’s a job. A high-stakes, 24/7 job.

If you’re still running a single Raspberry Pi to stake ETH, you’re not a validator. You’re a liability. And the network knows it.

What is slashing in crypto staking?

Slashing is when a blockchain protocol automatically removes part or all of your staked tokens as a penalty for violating network rules. Common reasons include going offline too long, signing conflicting blocks (double-signing), or proposing invalid data. It’s designed to punish bad behavior and keep the network secure.

How much can you lose from slashing?

It depends on the blockchain and the violation. On Ethereum, minor issues like downtime can cost 0.5%-1% of your stake. Double-signing can cost 100%. On Cosmos, penalties range from 0.1% to 10%. Solana can slash 100% for critical errors. Always check your chain’s specific rules before staking.

Can you get your tokens back after slashing?

No. Slashing is permanent and irreversible. Once your tokens are taken, they’re gone forever. There’s no appeal process, no customer support, and no refund. That’s why prevention is critical.

Do staking services like Coinbase or Lido get slashed?

Yes, but extremely rarely. Providers like Coinbase and Kraken use enterprise-grade infrastructure, redundant systems, and professional monitoring. Their slashing rate is under 0.05% per year-far lower than retail operators. That’s why they charge a fee: you’re paying for protection.

Is staking still worth it with slashing risk?

Yes-if you manage the risk. For most people, using a trusted staking provider is the smartest move. If you’re running your own validator, you need to invest in monitoring, redundancy, and security tools. Slashing isn’t a dealbreaker. It’s a cost of doing business. Treat it like insurance premiums: pay upfront to avoid catastrophic loss.

What’s the best way to reduce slashing risk?

Use a Hardware Security Module (HSM) to protect your signing keys, monitor your node 24/7 with tools like Prometheus, run at least two geographically separate validator instances, and keep all software updated. These steps can reduce your slashing risk by 80% or more.

If you’re serious about staking, stop thinking of it as a passive income stream. Start thinking of it as running a small financial infrastructure business. The returns are real. But so are the risks. And if you ignore slashing, you’re not earning yield-you’re just waiting to lose money.

sandeep honey

November 14, 2025 AT 10:18Slashing isn't scary if you treat it like a system failure, not a personal one. I run 3 validators on AWS and Hetzner with HSMs and Prometheus alerts. My uptime is 99.98%. The 0.02% downtime? I got penalized 0.12 ETH last year. That's less than my coffee budget. You don't need to be a genius, just consistent.

Mandy Hunt

November 16, 2025 AT 08:07they told us crypto was decentralized but now they want us to spend 50k on servers and hsm’s just to not get robbed by the protocol itself?? sounds like a scam to me. if the chain can take your money for a typo then it’s not trustless its just a bank with worse customer service

anthony silva

November 17, 2025 AT 04:54so let me get this straight… you’re telling me i have to pay more to not lose money than i’d make in interest? genius. next you’ll tell me i need a lawyer to stake eth. why don’t we just go back to mining with a gpu and call it a day

David Cameron

November 18, 2025 AT 11:20slashing is just capitalism with a blockchain overlay. you’re not earning yield-you’re renting out your hardware to a corporation that penalizes you for breathing wrong. the real question isn’t how to avoid slashing-it’s why we accept a system that turns participation into liability.

Sara Lindsey

November 19, 2025 AT 17:29you got this!!! don’t let fear stop you from earning! yes slashing is real but so is the 4-12% apy. just set up alerts, use a ledger, and boom-you’re already ahead of 90% of people. i started with a pi and upgraded after i lost 0.5 eth to downtime. now i’m running 2 nodes and sleeping like a baby. you can too!!

alex piner

November 20, 2025 AT 15:14im still a little confused but i think i get it? like if your node goes down you lose money? thats wild. i just use coinbase but now im wondering if i should try running my own… maybe i’ll start with a small amount and see how it goes. thanks for the tips

Gavin Jones

November 20, 2025 AT 16:14While I appreciate the technical depth of this post, I must emphasize the importance of institutional-grade infrastructure in mitigating slashing risk. The disparity between retail and institutional slashing rates is not merely anecdotal-it is statistically significant and reflects a fundamental asymmetry in risk management capability. One cannot reasonably expect an individual operating from a residential broadband connection to achieve the same reliability as a firm with geographically distributed data centers and redundant power systems.

Kevin Hayes

November 22, 2025 AT 11:25Slashing is the price of decentralization. If you want a system that doesn’t require vigilance, use a centralized exchange. If you want control, you accept responsibility. The math is simple: 32 ETH at 4% = 1.28 ETH annual return. One slashing event at 1% = 0.32 ETH loss. That’s 25% of your yield gone. You don’t need to be an engineer-you need to be disciplined. Set up alerts. Update software. Monitor uptime. Do it like your money depends on it-because it does.

Katherine Wagner

November 23, 2025 AT 09:23so… insurance doesn’t cover the actual reasons you get slashed?? then why even exist?? like if i buy car insurance and they say ‘we dont cover if you forget to check your oil’ then its not insurance its a joke. and why do they even make these rules if they’re just gonna take your money for dumb mistakes??

ratheesh chandran

November 23, 2025 AT 22:56you think this is bad wait till the gov starts tracking your validator ip and taxing your rewards like income… they already know everything… your node is a backdoor… they use slashing to control who participates… this is not crypto its a surveillance tool disguised as finance… you’re being played

Hannah Kleyn

November 25, 2025 AT 09:36i’ve been staking for two years and honestly i didn’t even know what slashing was until i lost 0.7 eth last year because my router had a firmware update and my node went offline for 18 hours. i thought it was just ‘waiting for rewards’ and then boom-my balance dropped. i didn’t cry, i just bought a yubikey and set up prometheus. now i get text alerts if my node is lagging. it’s not hard, it’s just… not passive. i used to think staking was like a savings account. now i know it’s like owning a small business that never sleeps. i’m still in. but i’m way more careful now.

gary buena

November 27, 2025 AT 03:50honestly the biggest thing people miss is clock drift. it’s not the internet, not the power, not the hsm-it’s the time on your server being off by 2 seconds. that’s enough to get you slashed on eth. i learned that the hard way. now i run ntp on every node and monitor it daily. no fancy gear, just free tools. if you’re not checking your time sync, you’re gambling.

Vanshika Bahiya

November 28, 2025 AT 20:15if you're from india and want to start staking, here's what i did: bought a used dell server for $200, installed ubuntu, used ledger nano x for keys, and set up grafana with free cloud monitoring. my first month i got slashed 0.1 eth because i forgot to update lighthouse. second month? zero. now i help 5 friends set up their nodes. you don't need to be rich. you just need to care enough to check your dashboard once a week. it's not hard, just not 'set and forget'.

Albert Melkonian

November 29, 2025 AT 19:26It is imperative to recognize that the economic model of Proof-of-Stake fundamentally redefines the nature of participation in decentralized networks. The notion of ‘passive income’ is a misnomer; staking is a fiduciary responsibility requiring operational excellence. The institutional slashing rate of 0.1% versus the retail rate of 2.5% is not indicative of technological superiority-it is a reflection of systemic discipline. To equate staking with traditional interest-bearing instruments is to misunderstand the architecture of trustless systems. The cost of failure is not merely financial-it is epistemic. One must learn to operate as a node operator, not merely a stakeholder.