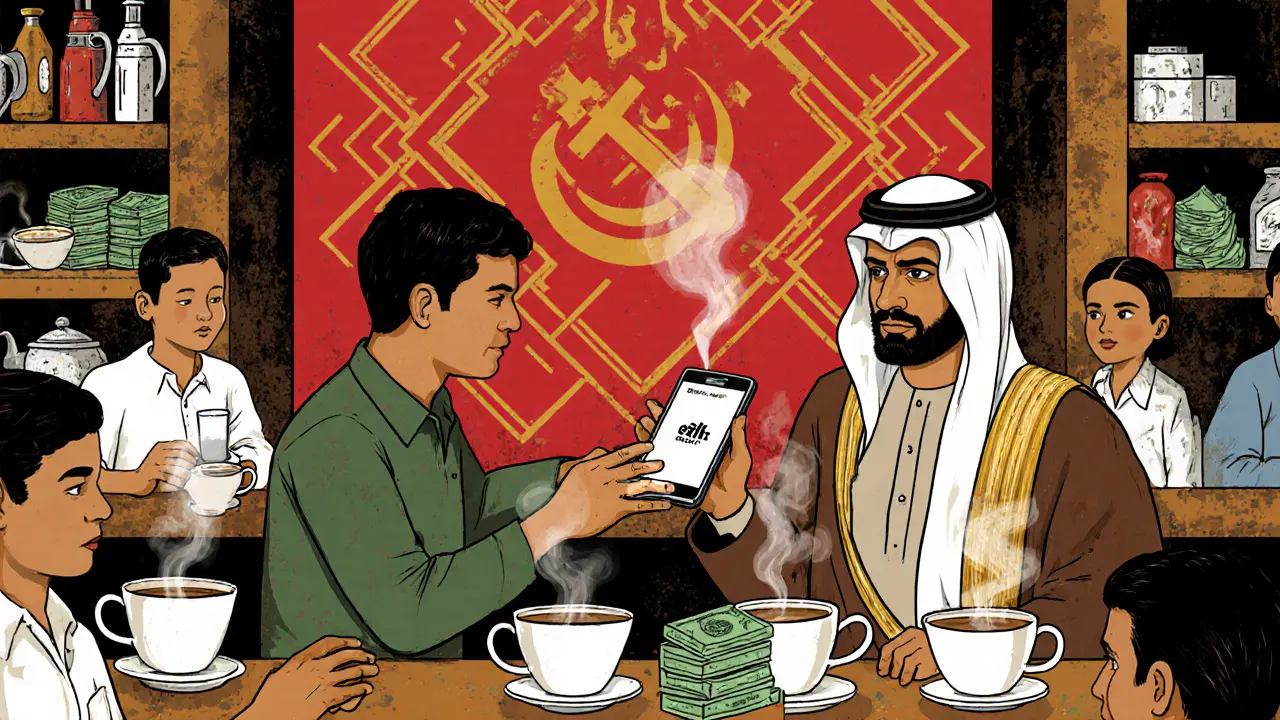

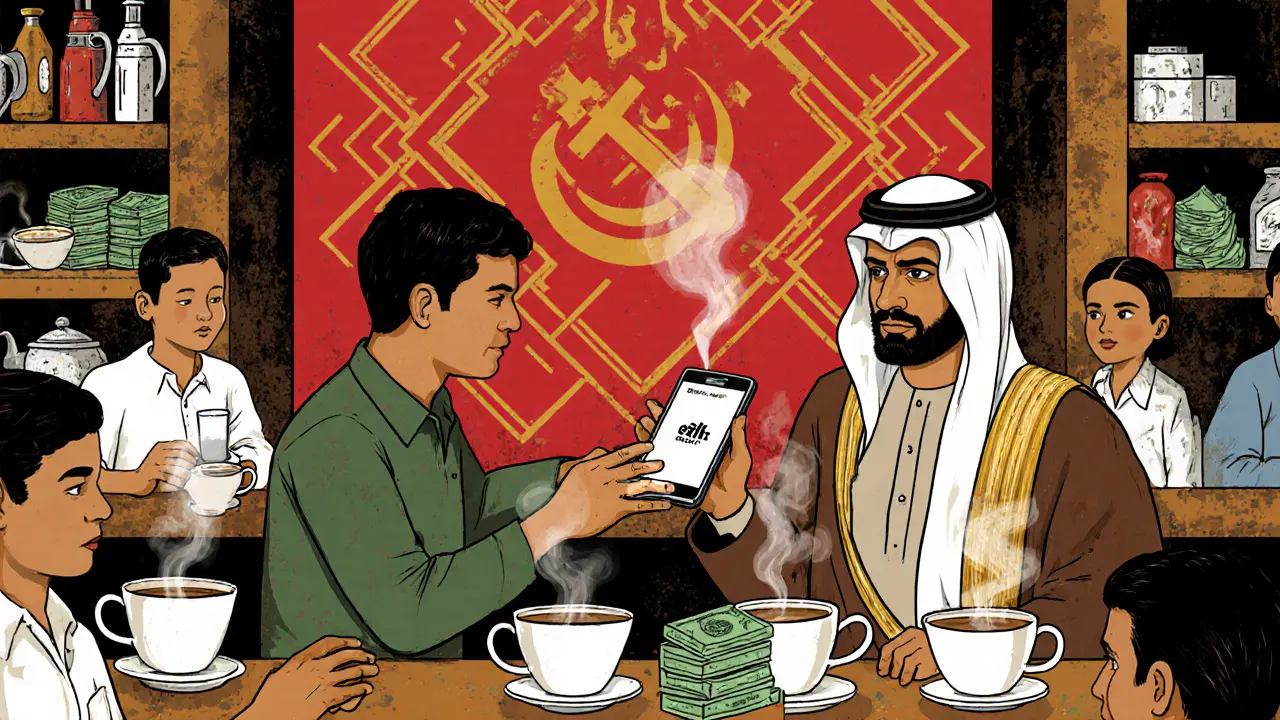

Despite a complete government ban, Bangladesh ranks 35th globally in crypto adoption with over 3.1 million users using stablecoins to send remittances. This underground system bypasses broken banking and high fees.

When you hear about Bangladesh crypto adoption, the widespread use of cryptocurrency despite government bans. Also known as crypto resistance in South Asia, it's not about innovation—it's about survival. In a country where inflation eats away at savings and banks deny access to foreign currency, people turned to Bitcoin not because it’s trendy, but because it’s one of the few ways to protect their money.

The Bangladesh Bank, the central bank that enforces strict financial controls banned cryptocurrency transactions in 2017, calling it illegal under money laundering laws. But the ban never stopped trading—it just pushed it underground. Today, traders use peer-to-peer platforms, mobile wallets, and cash-based deals to buy and sell Bitcoin. The crypto ban Bangladesh, a legal framework that criminalizes crypto use without offering alternatives means anyone caught can face prison time, frozen bank accounts, or seized assets. Yet enforcement is patchy. Many traders operate openly in cities like Dhaka and Chittagong, relying on trusted networks and cash-in-hand deals to avoid detection.

What makes Bangladesh’s case unique is how ordinary people turned crypto into a lifeline. A student in Sylhet sends money to family abroad using USDT via local traders. A garment worker saves earnings in Bitcoin because her bank won’t let her hold dollars. These aren’t investors—they’re people using crypto to bypass broken systems. The Bitcoin trading Bangladesh, the informal, high-risk market that thrives despite legal threats is now one of the most active in the region, even though it’s technically illegal. And while regulators crack down on high-profile cases, most small-time traders fly under the radar.

There’s no official data on how many people trade crypto in Bangladesh, but estimates suggest over a million active users. That’s more than the population of many small countries. The real story isn’t about regulation—it’s about resilience. People aren’t waiting for permission to use money that works. They’re using what’s available, even if it’s risky. And as long as inflation stays high and banking access stays limited, this underground market won’t disappear.

What follows is a collection of real stories, legal warnings, and market insights from inside Bangladesh’s crypto underground. You’ll find what happens when you trade Bitcoin here, how the law targets traders, and why no one talks about this openly—even though everyone knows someone who does it.

Despite a complete government ban, Bangladesh ranks 35th globally in crypto adoption with over 3.1 million users using stablecoins to send remittances. This underground system bypasses broken banking and high fees.