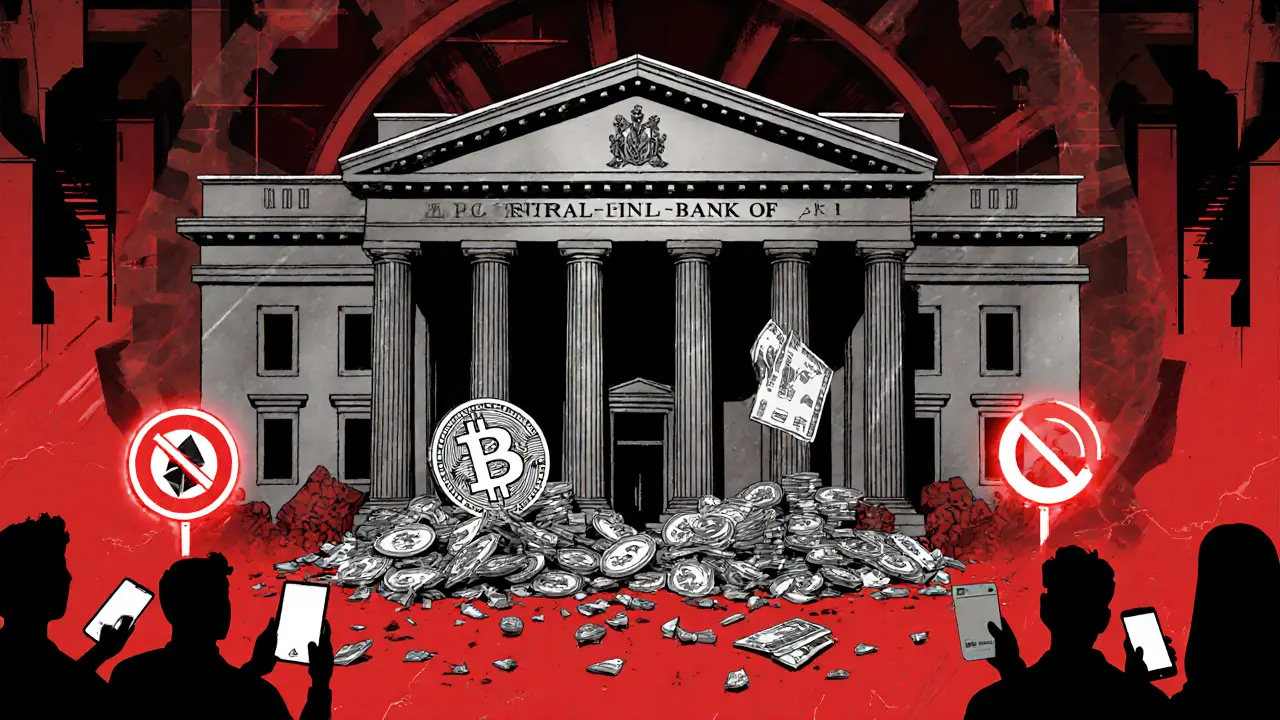

Iraq's Central Bank bans all cryptocurrency transactions, citing financial risks, while developing a state-controlled digital currency. Despite the ban, informal crypto trading persists, creating a legal gray zone for users.

When people talk about CBDC Iraq, a potential digital version of the Iraqi dinar issued and controlled by the Central Bank of Iraq. It's not just a tech experiment—it’s a move that could reshape how ordinary Iraqis pay, save, and receive government aid. Unlike Bitcoin or Ethereum, a CBDC isn’t decentralized. It’s a government-backed digital dollar, but in this case, a digital dinar. And while many countries are testing their own versions, Iraq’s plan is unique because it’s trying to do this in a country still recovering from conflict, high inflation, and cash dependence.

What makes CBDC Iraq, a potential digital version of the Iraqi dinar issued and controlled by the Central Bank of Iraq. It's not just a tech experiment—it’s a move that could reshape how ordinary Iraqis pay, save, and receive government aid. different is the scale of need. In rural areas, people still rely on cash because banks are scarce. A digital currency could let farmers get paid directly, students receive scholarships without middlemen, and families get subsidies without corruption. But it also raises questions: Who controls the data? Can the government freeze your money? And if internet goes down, do you lose access to your cash? These aren’t theoretical. They’re real risks seen in other CBDC pilots, like Nigeria’s eNaira or Jamaica’s Jam-Dex.

Then there’s the blockchain government, the use of distributed ledger technology by state institutions to manage public services, payments, and records. While Iraq hasn’t confirmed it’s using blockchain for its CBDC, many experts suspect it’s part of the plan. Why? Because blockchain offers transparency—something Iraq’s financial system desperately needs. But here’s the catch: even if blockchain is involved, the Central Bank of Iraq would still be the sole operator. That means it’s not truly decentralized. It’s more like a digital ledger under one lock. This isn’t about freedom or anonymity. It’s about control, efficiency, and survival. And that’s why it matters to anyone following how money evolves in unstable economies.

What you’ll find below are real posts about digital currencies, government-backed tokens, and the hidden risks behind shiny new crypto projects. Some talk about how CBDCs could replace cash. Others warn about surveillance and control. A few even compare Iraq’s path to other nations. There’s no hype here—just facts, warnings, and what’s actually happening on the ground. If you’re trying to understand if Iraq’s digital dinar is a step forward or a trap, these posts will show you the full picture.

Iraq's Central Bank bans all cryptocurrency transactions, citing financial risks, while developing a state-controlled digital currency. Despite the ban, informal crypto trading persists, creating a legal gray zone for users.

Iraq's Central Bank has banned all cryptocurrency transactions since 2017, with strict rules on banks and payment providers. In 2025, it's pushing a state-controlled digital currency instead - raising privacy and surveillance concerns.