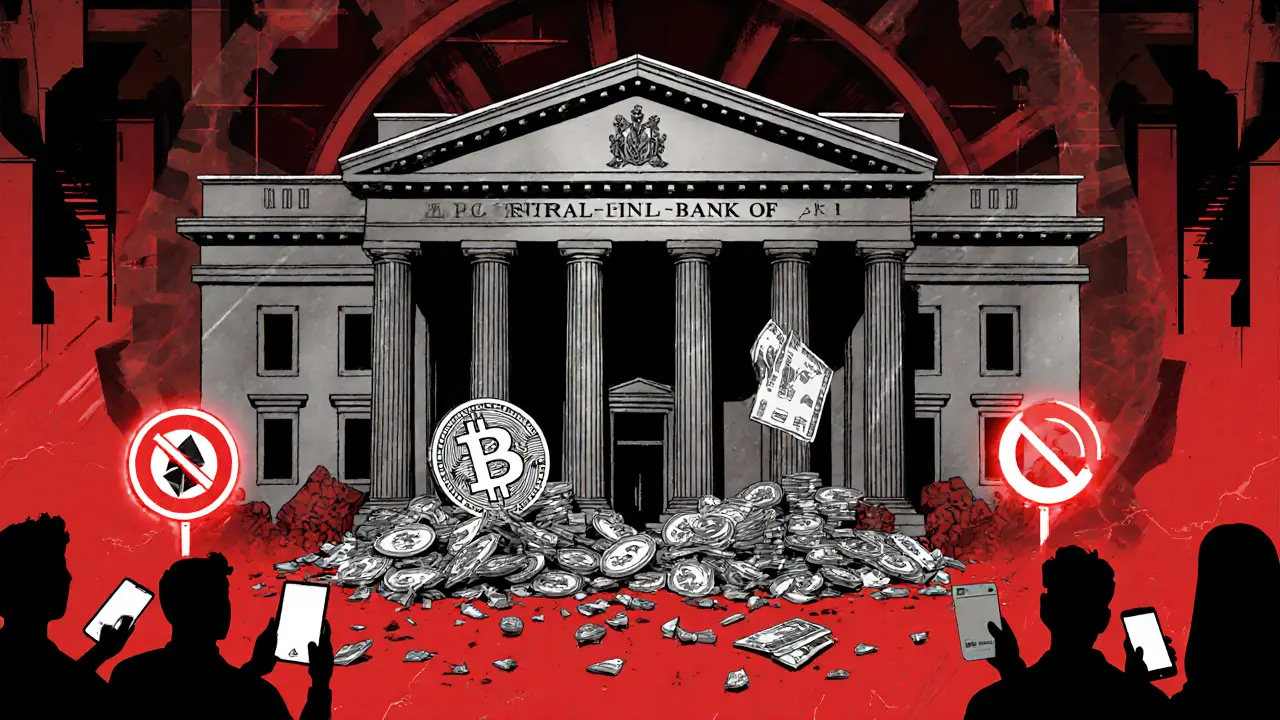

Iraq's Central Bank bans all cryptocurrency transactions, citing financial risks, while developing a state-controlled digital currency. Despite the ban, informal crypto trading persists, creating a legal gray zone for users.

When you hear Central Bank of Iraq, the government body that controls the Iraqi dinar and sets monetary policy for the country. Also known as CBI, it has never approved cryptocurrencies as legal tender and actively warns citizens against using them. That doesn’t mean Iraqis aren’t trading crypto — they are. Just not through banks. Instead, they use peer-to-peer platforms and local exchanges like ARzPaya, Iran’s top crypto exchange that also serves Iraqi users with Tether and Bitcoin trading via local bank transfers. The gap between official policy and real-world behavior is wide, and it’s created a thriving underground crypto economy.

The Iraqi dinar, the national currency controlled by the Central Bank of Iraq has struggled with inflation and low global confidence. That’s why many Iraqis turn to Tether, a stablecoin pegged to the US dollar that offers a more reliable store of value. Unlike banks, which freeze accounts for crypto activity, apps like ARzPaya let users deposit dinars and instantly convert them to USDT — no questions asked. This isn’t legal, but it’s practical. And it’s exactly why the Central Bank of Iraq keeps issuing warnings: they can’t control what happens outside their system.

There’s no official crypto license in Iraq, and no exchange is registered with the CBI. But that doesn’t stop new platforms from popping up. Some, like Domitai, a fake exchange with no team, no license, and copied website text, are outright scams. Others, like COINBIG or NovaEx, offer crypto-to-crypto trading without fiat support — perfect for users who already hold Bitcoin or Ethereum and want to trade without touching the dinar. The Central Bank of Iraq doesn’t regulate these, so users bear all the risk. That’s why guides on spotting fake airdrops, avoiding wallet scams, and understanding exchange security (like cold storage and KYC policies) are so vital.

Meanwhile, global trends are creeping in. The Malta Blockchain Island strategy, a clear regulatory framework that attracts crypto businesses with low taxes and legal clarity shows what’s possible when governments engage with blockchain. Iraq hasn’t taken that path. Instead, it’s stuck in denial. But the people? They’re already using crypto to protect savings, send remittances, and trade globally. The real story isn’t what the Central Bank of Iraq says — it’s what ordinary Iraqis are doing anyway.

Below, you’ll find real reviews of exchanges used by Iraqi and Iranian traders, breakdowns of stablecoin usage, and warnings about scams pretending to be official. No fluff. Just what works, what doesn’t, and how to stay safe when the banks won’t help you.

Iraq's Central Bank bans all cryptocurrency transactions, citing financial risks, while developing a state-controlled digital currency. Despite the ban, informal crypto trading persists, creating a legal gray zone for users.

Iraq's Central Bank has banned all cryptocurrency transactions since 2017, with strict rules on banks and payment providers. In 2025, it's pushing a state-controlled digital currency instead - raising privacy and surveillance concerns.