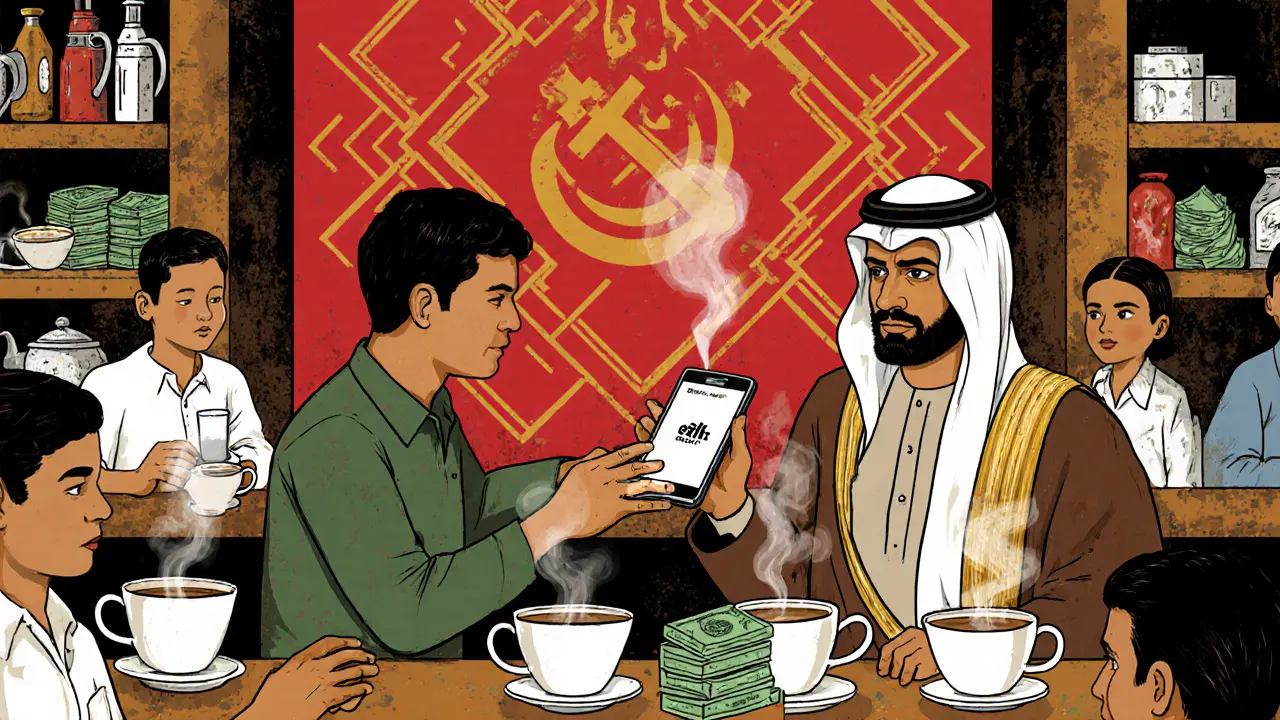

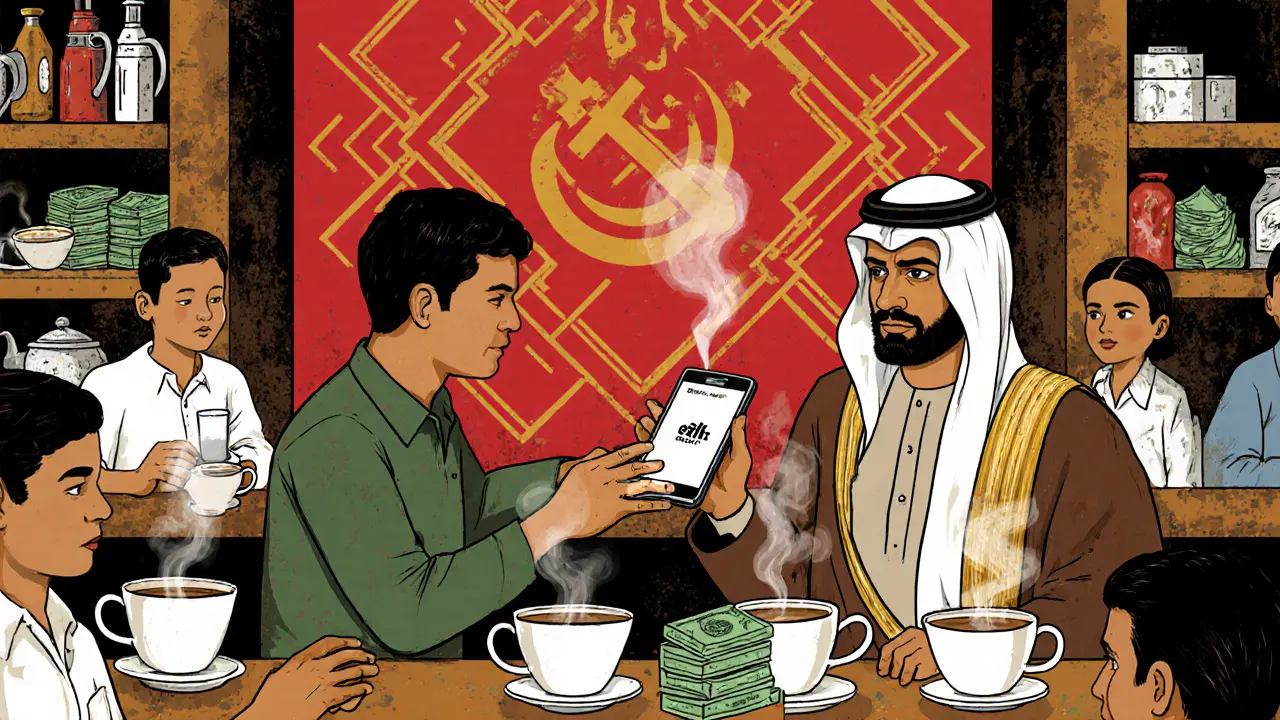

Despite a complete government ban, Bangladesh ranks 35th globally in crypto adoption with over 3.1 million users using stablecoins to send remittances. This underground system bypasses broken banking and high fees.

When the Crypto Ban in Bangladesh, a government-enforced prohibition on cryptocurrency transactions and exchanges since 2021. Also known as cryptocurrency prohibition in Bangladesh, it was issued by the Central Bank of Bangladesh, the nation’s monetary authority responsible for financial stability and currency control to prevent capital flight and protect the taka from volatility. But the ban didn’t stop people—it just pushed them underground.

Unlike countries that slowly regulate crypto, Bangladesh took a hardline approach: banks were ordered to cut off services to crypto exchanges, and users faced legal risk for buying or selling Bitcoin, Ethereum, or any other digital asset. Yet, peer-to-peer trading exploded. People started using WhatsApp groups, local cash meetups, and foreign wallets to trade. The Bangladesh cryptocurrency regulation, a strict, unyielding policy that treats crypto as illegal under the Foreign Exchange Regulation Act hasn’t changed, but enforcement is patchy. Many young professionals, freelancers, and remittance recipients rely on crypto to send money abroad faster and cheaper than traditional banks allow.

Meanwhile, the government is quietly exploring its own digital currency—a digital currency Bangladesh, a state-controlled electronic version of the taka that could replace cash and monitor every transaction. This creates a strange contradiction: while private crypto is banned, the state is building its own surveillance-friendly version. It’s not about stopping technology—it’s about controlling it. Users are caught in the middle. Some risk fines or jail time to keep using crypto. Others wait for a policy shift. And a growing number are looking to neighboring countries with clearer rules, like India or Thailand, for legal workarounds.

What you’ll find below are real stories and analyses from people affected by this ban—how they adapted, what tools they use, and whether the crackdown is working. You’ll see how Bangladesh fits into a global pattern of crypto repression, where bans often backfire. There are no easy answers here, but there are real experiences—and that’s what matters when your money is on the line.

Despite a complete government ban, Bangladesh ranks 35th globally in crypto adoption with over 3.1 million users using stablecoins to send remittances. This underground system bypasses broken banking and high fees.

Bitcoin trading in Bangladesh is not explicitly illegal, but it carries severe legal risks including prison time, asset seizures, and bank account freezes under money laundering laws. Despite a thriving underground market, authorities actively prosecute traders.