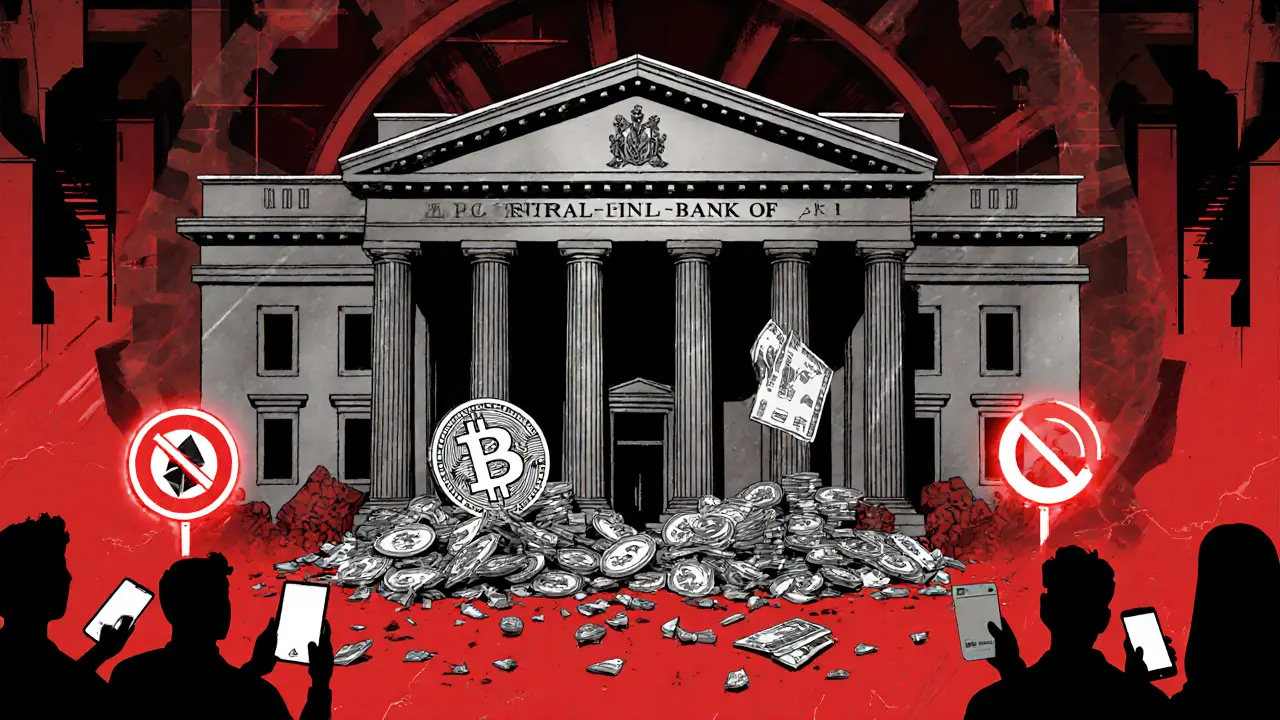

Iraq's Central Bank bans all cryptocurrency transactions, citing financial risks, while developing a state-controlled digital currency. Despite the ban, informal crypto trading persists, creating a legal gray zone for users.

When crypto ban in Iraq, a government decision to prohibit all cryptocurrency transactions and exchanges under central bank authority. Also known as cryptocurrency prohibition in Iraq, it was enforced in early 2024 to stop capital flight and protect the Iraqi dinar from volatility. The move wasn’t unique—countries like Egypt and Nigeria have taken similar steps—but Iraq’s case stands out because it didn’t shut down access. It just made it riskier.

People in Iraq still trade Bitcoin, Tether, and Ethereum through peer-to-peer platforms, local traders, and unofficial channels. The ban targeted banks and licensed exchanges, not individuals. So while you can’t open a Coinbase account linked to an Iraqi bank, you can still meet someone in Baghdad to swap cash for crypto. This gray zone created a thriving underground market. Meanwhile, neighboring Iran—with its own crypto restrictions—became a key bridge for Iraqi traders using ARzPaya and other regional platforms to move value across borders. The crypto exchange Iran, a network of local platforms enabling Tether trading and fiat-to-crypto swaps despite national controls became a lifeline.

What’s really happening isn’t just about bans—it’s about control. The Iraqi central bank fears losing monetary power, but users aren’t giving up. They’re adapting. Some use VPNs to access foreign exchanges. Others hold crypto in non-custodial wallets like Trust Wallet or Phantom, keeping keys offline. And while regulators push for compliance, the real story is in the quiet resilience of everyday people who need an alternative to a failing banking system. The blockchain legality, the uncertain legal status of decentralized networks in countries with strict financial oversight isn’t black and white—it’s messy, local, and constantly shifting.

Below, you’ll find real stories and breakdowns of what’s working for users in restricted regions. From fake airdrops pretending to be official Iraqi crypto projects, to exchanges like ARzPaya that quietly serve the region, this collection cuts through the noise. You’ll see how people are staying safe, spotting scams, and keeping their funds accessible—even when governments say they shouldn’t.

Iraq's Central Bank bans all cryptocurrency transactions, citing financial risks, while developing a state-controlled digital currency. Despite the ban, informal crypto trading persists, creating a legal gray zone for users.

Iraq's Central Bank has banned all cryptocurrency transactions since 2017, with strict rules on banks and payment providers. In 2025, it's pushing a state-controlled digital currency instead - raising privacy and surveillance concerns.