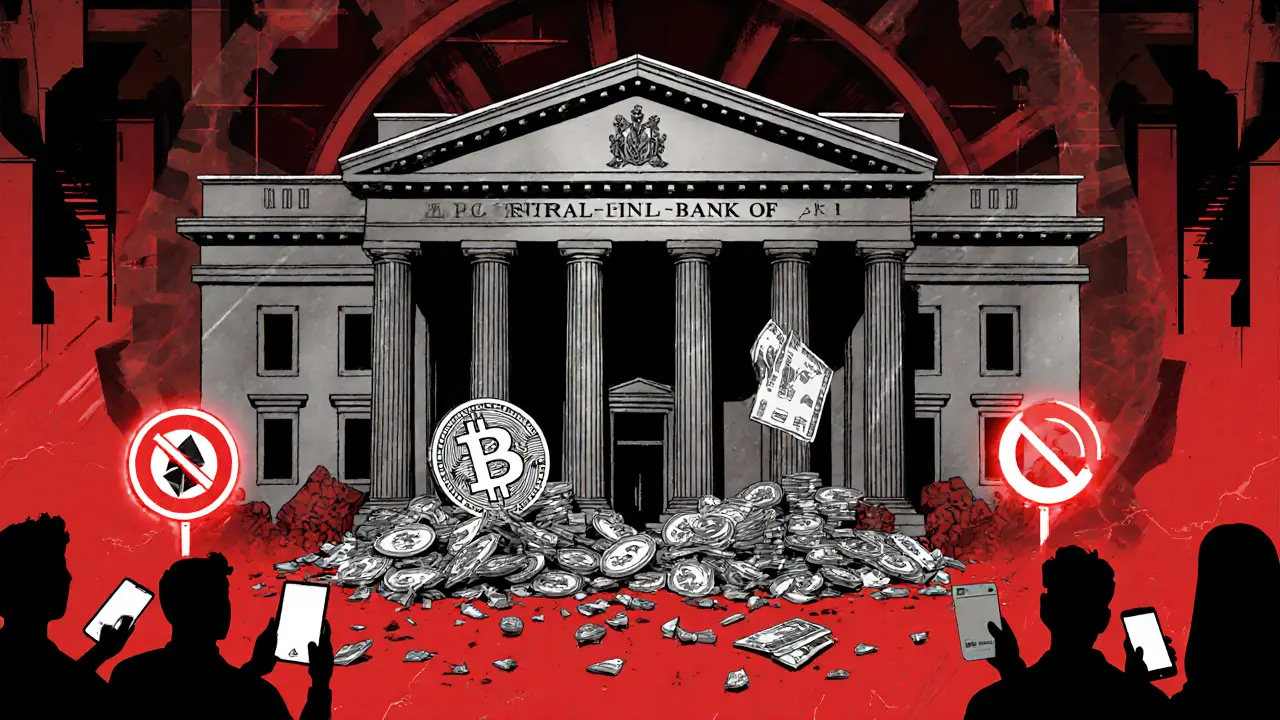

Iraq's Central Bank bans all cryptocurrency transactions, citing financial risks, while developing a state-controlled digital currency. Despite the ban, informal crypto trading persists, creating a legal gray zone for users.

When it comes to crypto regulations Middle East, the evolving legal and tax frameworks governing cryptocurrency use across nations like the UAE, Saudi Arabia, and Bahrain. Also known as blockchain regulation in the Gulf, these rules are no longer optional—they’re the foundation for any crypto business or trader operating in the region. Unlike the U.S. or EU, where rules are often fragmented or slow to adapt, countries in the Middle East have moved fast to build clear, business-friendly systems. This isn’t about banning crypto—it’s about controlling it.

One major player is the United Arab Emirates, a hub for crypto exchanges, NFT marketplaces, and blockchain startups with a well-defined licensing system. Also known as UAE crypto framework, it requires all exchanges to register with the Virtual Assets Regulatory Authority (VARA) and follow strict AML and KYC rules. If you’re trading on an exchange based in Dubai, you’re likely covered by a license that’s been reviewed by regulators—not just some random website. Meanwhile, Saudi Arabia, has taken a more cautious but structured path, allowing crypto trading under the SAMA regulatory sandbox while banning unlicensed platforms. Also known as SAMA crypto rules, it demands full transparency from any firm handling digital assets. Both countries tax crypto profits, but only if they’re converted to fiat or used for purchases—holding long-term often means no tax. That’s a big difference from places like the U.S., where every trade triggers a taxable event.

What’s missing? Consistency. While the UAE and Saudi Arabia are clear, countries like Egypt and Jordan still have murky or restrictive rules. Some banks block crypto deposits. Others don’t recognize it as legal property. And while Malta or Singapore have entire legal codes built around crypto, the Middle East is still building its playbook—piece by piece. That’s why you’ll find posts here about exchanges like ARzPaya in Iran, which operate under local banking laws, or why Malta’s model is studied by Gulf regulators trying to copy what works.

What you’ll find in this collection are real-world breakdowns of how these rules affect you: which exchanges are licensed, which tokens are banned, how to avoid scams in unregulated zones, and what happens when regulators crack down. No theory. No fluff. Just what’s happening now—and what you need to do to stay safe and compliant.

Iraq's Central Bank bans all cryptocurrency transactions, citing financial risks, while developing a state-controlled digital currency. Despite the ban, informal crypto trading persists, creating a legal gray zone for users.

Iraq's Central Bank has banned all cryptocurrency transactions since 2017, with strict rules on banks and payment providers. In 2025, it's pushing a state-controlled digital currency instead - raising privacy and surveillance concerns.