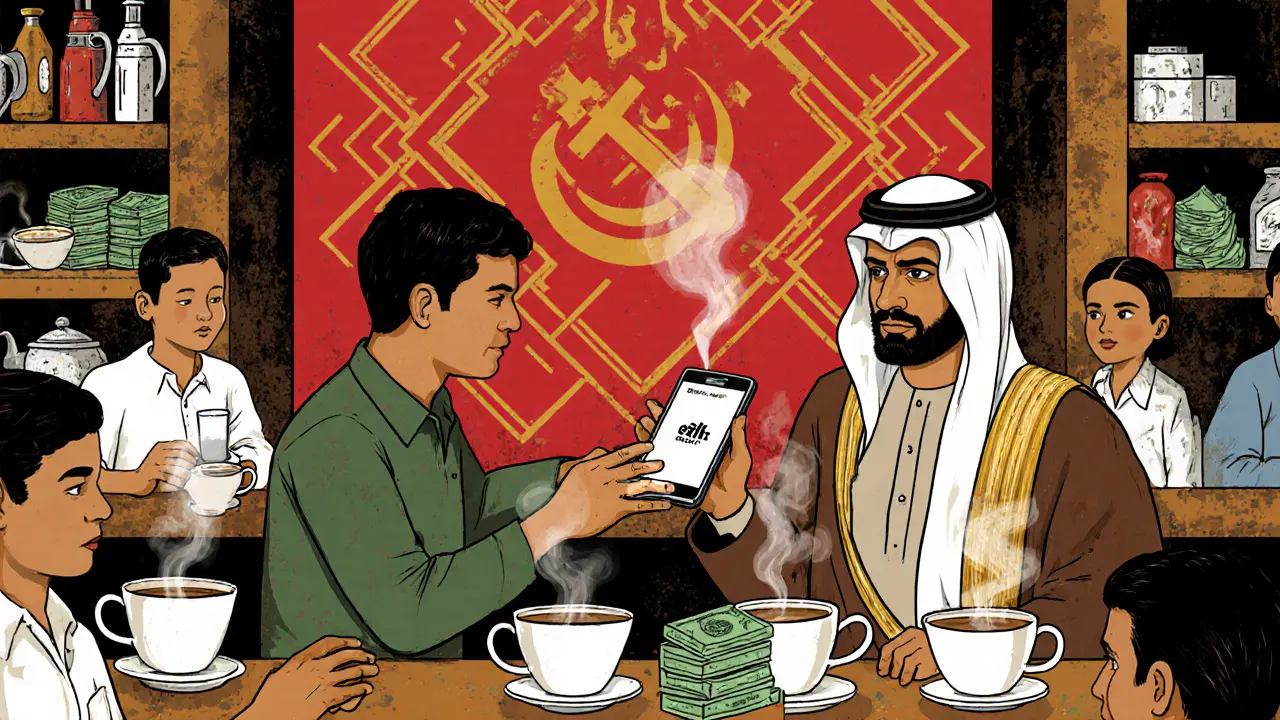

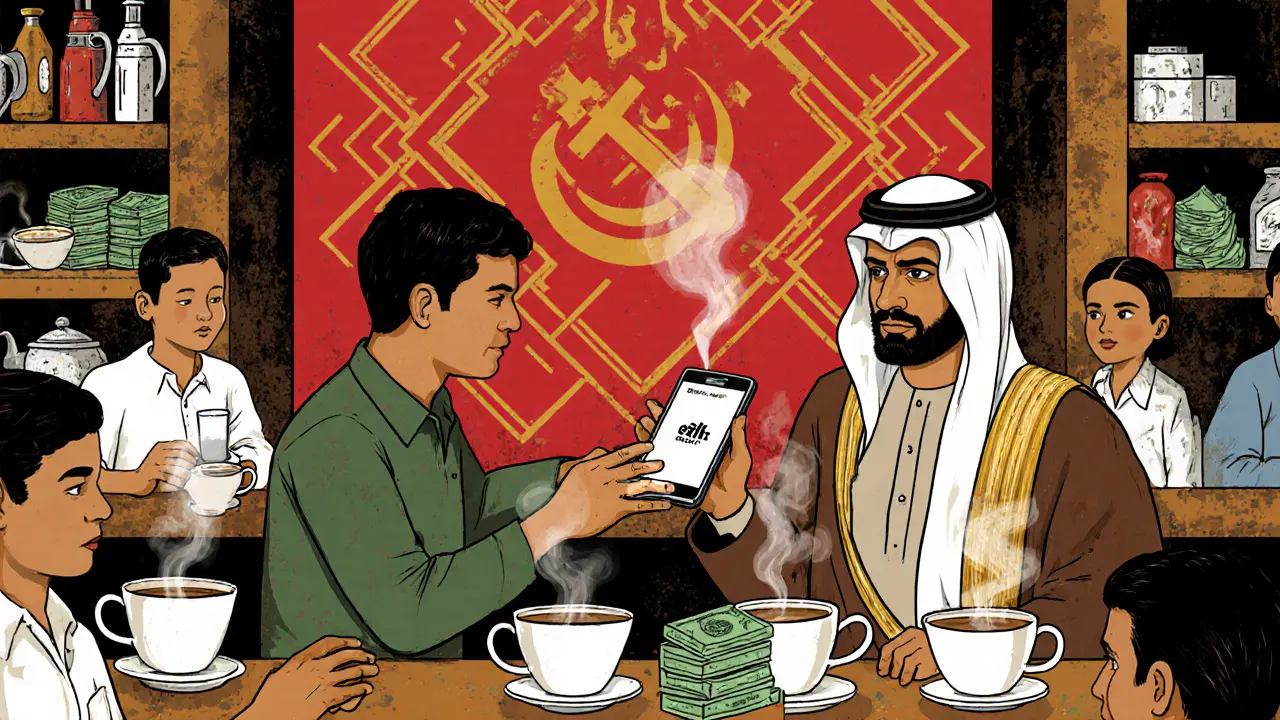

Despite a complete government ban, Bangladesh ranks 35th globally in crypto adoption with over 3.1 million users using stablecoins to send remittances. This underground system bypasses broken banking and high fees.

When we talk about cryptocurrency regulation, the rules governments set to control how digital currencies are used, traded, and taxed. Also known as crypto law, it’s not about stopping innovation—it’s about deciding who gets to play, under what rules, and who pays the price when things go wrong. Some countries treat crypto like cash. Others treat it like a weapon. And a few are quietly building their own digital currencies while banning the rest.

Central bank crypto policy, how national banks decide whether to allow, restrict, or monitor crypto use. Also known as monetary control over digital assets, it’s the real power behind most crypto rules. Nigeria flipped from banning crypto in 2021 to regulating it by 2025, turning into Africa’s biggest crypto market overnight. Tunisia banned all trading but quietly tests blockchain for government records. Iraq shut down crypto completely in 2017 and now pushes its own state-controlled digital money. These aren’t random decisions—they’re responses to inflation, capital flight, or fear of losing control.

Crypto tax, how governments collect money from crypto gains, trades, and mining. Also known as digital asset taxation, it’s where regulation hits your wallet. Brazil now hits every crypto profit with a flat 17.5% tax—no exemptions, no loopholes. Meanwhile, Bangladesh doesn’t have a formal tax law for crypto, but if you trade Bitcoin, you could end up in prison under money laundering charges. Tax isn’t just about revenue—it’s about signaling what’s legal and what’s not.

Then there’s the crypto ban, when a country outright forbids buying, selling, or holding digital currencies. Also known as crypto prohibition, it’s the most extreme form of regulation. Bangladesh, Tunisia, Iraq, and others don’t just discourage crypto—they punish it. Bank accounts get frozen. Assets get seized. People get jailed. Yet underground markets keep running. Why? Because when people can’t access banks or fight inflation, they find other ways. Regulation doesn’t kill demand—it just pushes it into the shadows.

And behind all of this is the silent war between privacy and surveillance. Privacy coins like Monero fight to stay hidden. Companies like Chainalysis use AI to track every transaction. Exchanges get pressured to delist coins. Users get caught in the middle. This isn’t science fiction—it’s happening right now, in real time, across every country with crypto activity.

What you’ll find below isn’t theory. It’s real cases. Real laws. Real consequences. From Nigeria’s booming peer-to-peer market to Brazil’s tax receipts, from Tunisia’s secret blockchain tests to Bangladesh’s prison sentences—you’ll see how regulation isn’t one-size-fits-all. It’s messy, uneven, and often brutal. But it’s also the biggest force shaping crypto’s future. Whether you’re trading, holding, or just watching, you need to know where the rules stand—and where they’re headed next.

Despite a complete government ban, Bangladesh ranks 35th globally in crypto adoption with over 3.1 million users using stablecoins to send remittances. This underground system bypasses broken banking and high fees.