Curve Finance isn't on Avalanche - despite what you might see online. Learn the truth about stablecoin swaps, real alternatives like Trader Joe, and why Avalanche's DEXs are better for most users.

When you trade tokens on Curve Avalanche, a decentralized exchange built on the Avalanche blockchain that specializes in stablecoin and asset swaps with minimal slippage. It's a specialized version of Curve Finance, optimized for Avalanche’s fast, low-cost network. Unlike general DEXs like Uniswap, Curve Avalanche doesn’t try to handle every token under the sun. It focuses on one thing: making swaps between similar assets—like USDT, USDC, DAI, and wrapped BTC—smooth, cheap, and fast. This matters because when you’re moving large amounts of stablecoins or collateralized assets, even 0.1% slippage can cost you real money.

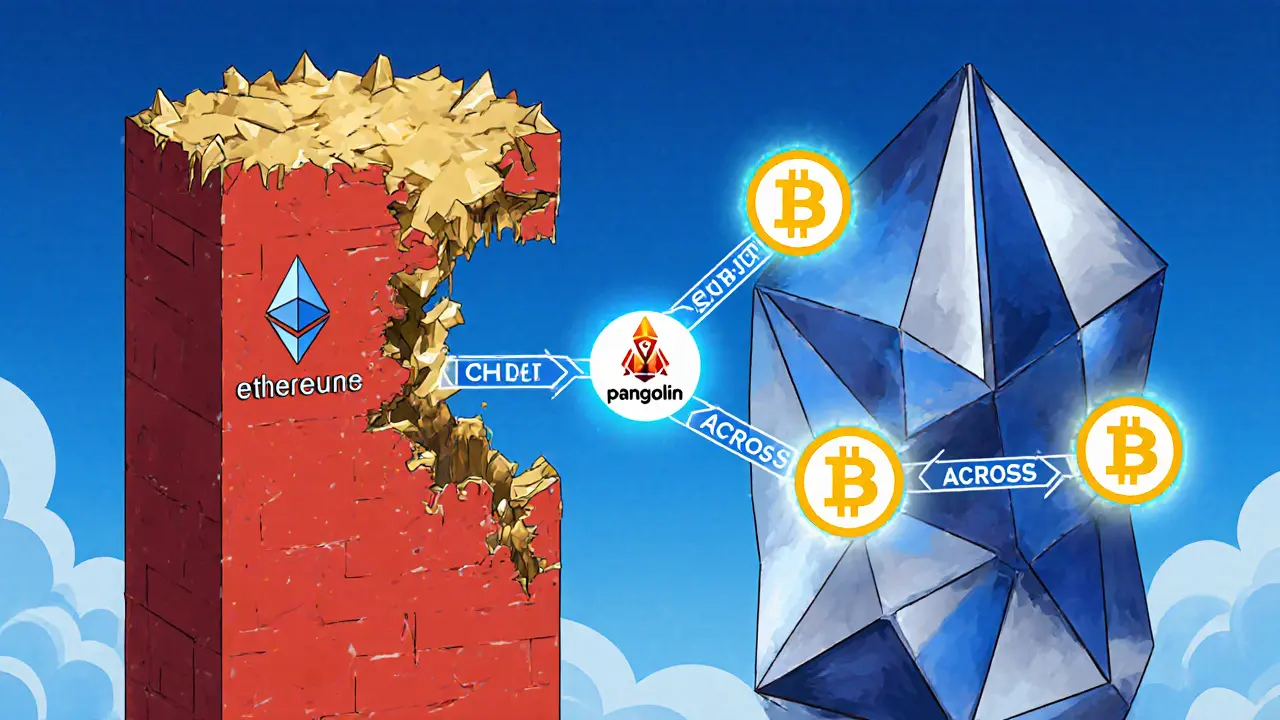

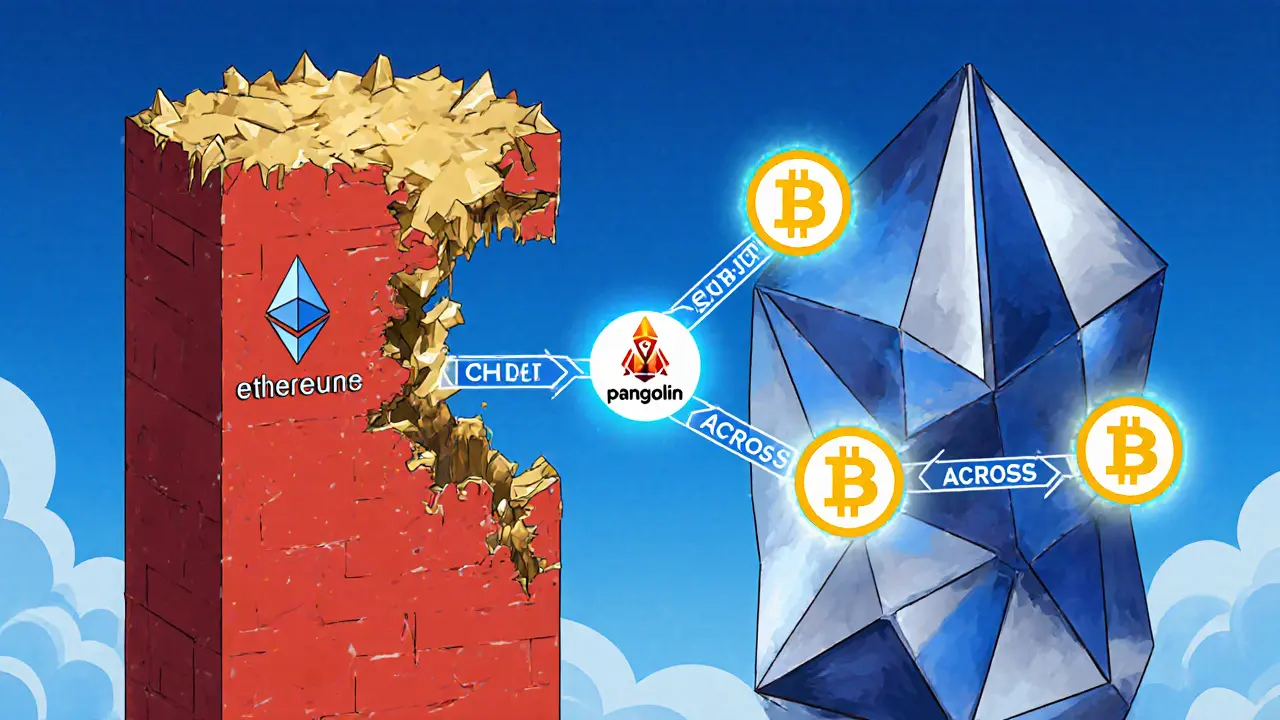

Curve Avalanche works by using liquidity pools, concentrated reserves of paired assets provided by users in exchange for trading fees and rewards. These pools are designed for assets that should stay close in value, like different USD-backed stablecoins. The math behind it—called the StableSwap algorithm—is engineered to keep prices stable during trades, so you don’t get ripped off when swapping $1,000 of USDC for USDT. And because it runs on Avalanche, transactions settle in under a second and cost pennies, not dollars. This makes it a favorite for yield farmers, traders who lock up tokens in pools to earn extra rewards, often in the form of governance tokens or boosted APYs. Many users deposit stablecoins into Curve Avalanche pools not just to trade, but to earn interest from trading fees and bonus incentives from projects like Triple A or Aura Finance that partner with Curve. You’ll also find it used by protocols that need to move assets between chains without high fees or long waits—like moving wrapped ETH from Ethereum to Avalanche for DeFi exposure.

But here’s the catch: Curve Avalanche isn’t for beginners chasing quick gains. If you’re looking for a simple way to buy Bitcoin or swap a random meme coin, this isn’t your spot. It’s a tool for people who understand liquidity, impermanent loss, and the difference between a stablecoin and a volatile asset. The posts below show you exactly how it’s being used—some right, some wrong. You’ll see real cases where users earned steady income, others who got trapped by low liquidity or fake reward campaigns. You’ll also find comparisons to other cross-chain tools like Elk Finance and Bancor, and learn why Curve Avalanche stands out—or doesn’t—when you’re trying to move money efficiently in DeFi.

Curve Finance isn't on Avalanche - despite what you might see online. Learn the truth about stablecoin swaps, real alternatives like Trader Joe, and why Avalanche's DEXs are better for most users.