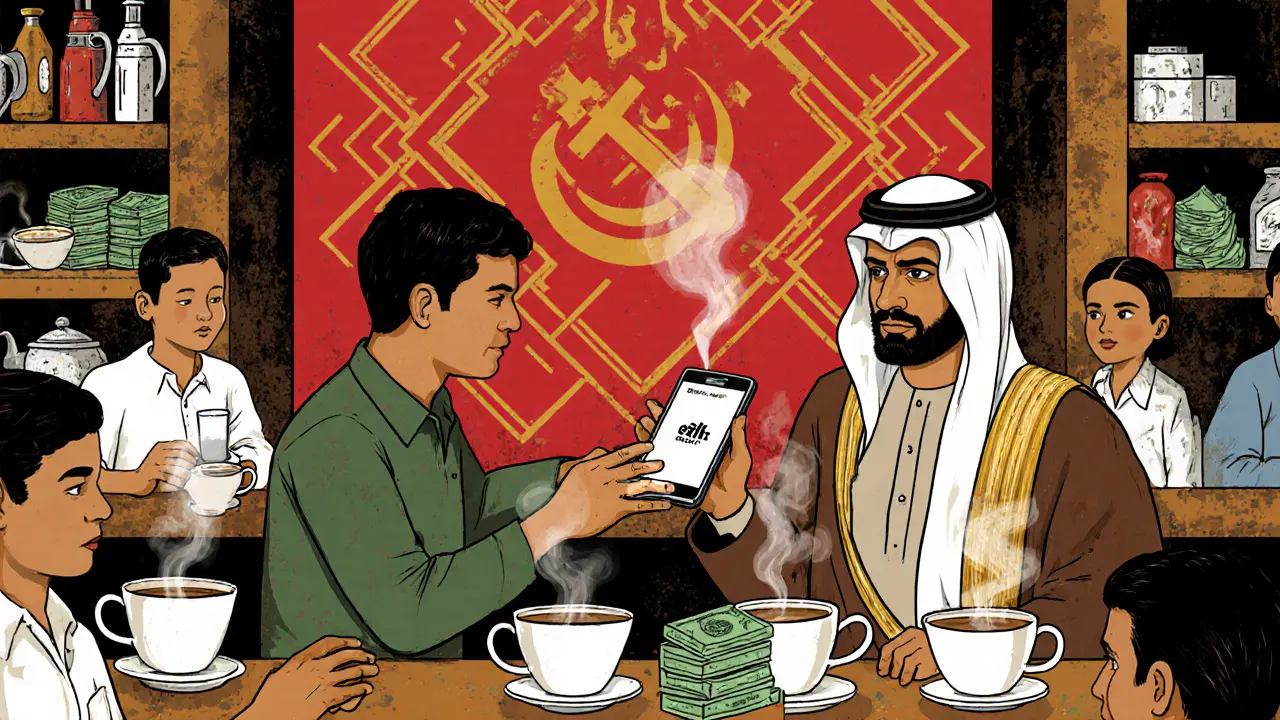

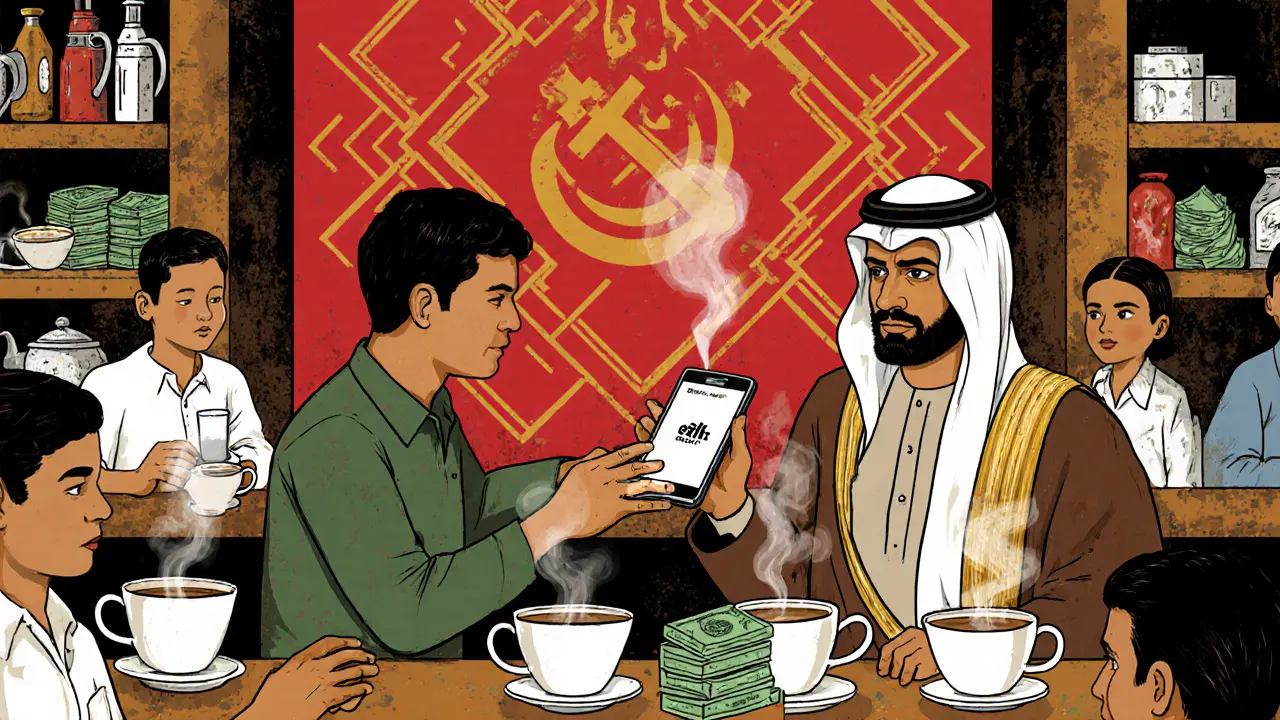

Despite a complete government ban, Bangladesh ranks 35th globally in crypto adoption with over 3.1 million users using stablecoins to send remittances. This underground system bypasses broken banking and high fees.

When people send money across borders, they usually pay high fees, wait days, and deal with banks that don’t care about their needs. But stablecoin remittances, digital currencies pegged to stable assets like the U.S. dollar that enable fast, low-cost cross-border transfers. Also known as crypto remittances, they let workers in the U.S., Europe, or the Middle East send money home in minutes—not weeks—with fees under 1%. This isn’t theory. In Nigeria, where over $59 billion in crypto was traded in 2024, people use USDT to send money to family in Ghana or Kenya without touching a bank. In Bangladesh, where Bitcoin trading is risky but stablecoins aren’t explicitly banned, millions rely on them to bypass financial restrictions.

Stablecoin remittances work because they skip the middlemen. Instead of routing money through SWIFT, correspondent banks, and currency exchanges, a sender buys USDT on a local exchange, sends the token to a recipient’s wallet, and the recipient cashes out locally—often through a trusted neighbor or shop. No wire fees. No exchange rate markups. No frozen accounts. It’s why countries with strict capital controls, like Iraq and Tunisia, still see thriving underground stablecoin networks. Even where crypto is banned, stablecoins like USDC and USDT keep flowing because they’re harder to trace than Bitcoin and behave like digital cash.

But it’s not perfect. Some platforms require KYC, and cash-out points can be unreliable. In places like Nigeria and Brazil, tax rules are catching up—gains from converting stablecoins to local currency may be taxable. And while stablecoins are supposed to be stable, not all are equally trusted. Tether (USDT) has faced scrutiny over its reserves, while USDC is backed by regulated U.S. firms. That’s why users in Iran use ARzPaya to trade Tether with local banks, while others in Latin America prefer USDC for its transparency.

What you’ll find below are real stories from people using stablecoin remittances to survive economic chaos, avoid banking bans, and send money home without paying 10% in fees. Some posts show how governments are reacting—like Nigeria shifting from banning crypto to regulating it. Others reveal how scams hide behind fake airdrops pretending to be payment tools. There’s no fluff here. Just what’s working, what’s failing, and who’s really benefiting.

Despite a complete government ban, Bangladesh ranks 35th globally in crypto adoption with over 3.1 million users using stablecoins to send remittances. This underground system bypasses broken banking and high fees.